The Battle of Gettysburg: No True Winners

Even those who hadn’t been shot could barely walk. The summer sun baked the battlefield with 87 degree temperatures. Dressed in thick wool uniforms, 12,000 exhausted and dehydrated infantry troops advanced in Pickett’s Charge only to be cut down by the accurate rifle and artillery fire of the other side.

Over three days in July 1863, the bloodiest battle of America’s Civil War raged. While the North emerged victorious, the numbers suggest there were no true winners. The ground at Gettysburg was soaked with the blood of as many as 51,000 casualties – more than one in four. You won’t read this in history books, but I think the real winner of the Battle of Gettysburg wasn’t a general, nor a regiment, but a weapon – the Enfield Pattern 1853 rifle-musket.

British Pattern 1853 Rifle transparent – Pattern 1853 Enfield – Wikipedia

Manufactured in Enfield England by the Royal Small Arms Factory, it featured a rifled bore which provided accuracy out to 800 yards – a massive improvement over the smooth bore muskets of the time. Even if General Lee hadn’t marched his Confederate army into the jaws of the North’s withering rifle and artillery fire, the Enfield would have reigned supreme. You see, both sides were armed with this British technological marvel. Both sides paid the Royal Small Arms Factory, first in money and then in blood.

The F-16 Fighting Falcon in the News

Weapons manufacturers seem to be the one true winner of wars. The Fighting Falcon is in the news these days. Manufactured by General Dynamics, the F-16 multirole fighter jet is used by many air forces around the world and has long been sought after by the Ukrainian air force. Throughout this war, many red lines have been crossed, given recent comments by President Biden, supplying F-16’s might be the next one.

F-16 June 2008 – General Dynamics F-16 Fighting Falcon – Wikipedia

Not everyone shares the President’s enthusiasm. Indeed, unity among the allies seems to be fracturing. The Wall Street Journal highlights the reluctance of some countries to echo America’s increasing commitment to this path. A year after political posturing and photo-ops, the solemn vows of a new world order and promises of increased defense spending are proving hollow. Canada, in a surprising turn, is reportedly reducing its defense spending, while Germany wavers on its pledge to raise defense spending to 2% of GDP.

Lessons from History

Indeed, history provides us invaluable lessons about the complexities of international support in times of conflict. I did a little reading up on the Lend-Lease Act during World War II. This U.S. policy, established in 1941, aimed to support Allied nations with military aid while maintaining official neutrality. Supporting the allies made US ships targets for the German wolf-pack U-boats. In the end it stoked tensions and drew America into the war.

Similarly, I also read about the Non-Intervention Act of 1936, it was signed by 27 European nations, in the hope of preventing the Spanish Civil War from escalating into a larger European conflict. Instead, it fostered mistrust among countries due to covert support for warring factions. That distrust is thought to be a contributing factor to the onset of World War II.

Defense Contractors: The Real Winners

In light of these historical lessons, investors have to ask themselves: could arming Ukraine with the F-16 Fighting Falcon inadvertently lead us towards a wider conflict? It’s my hope that we won’t have to find out.

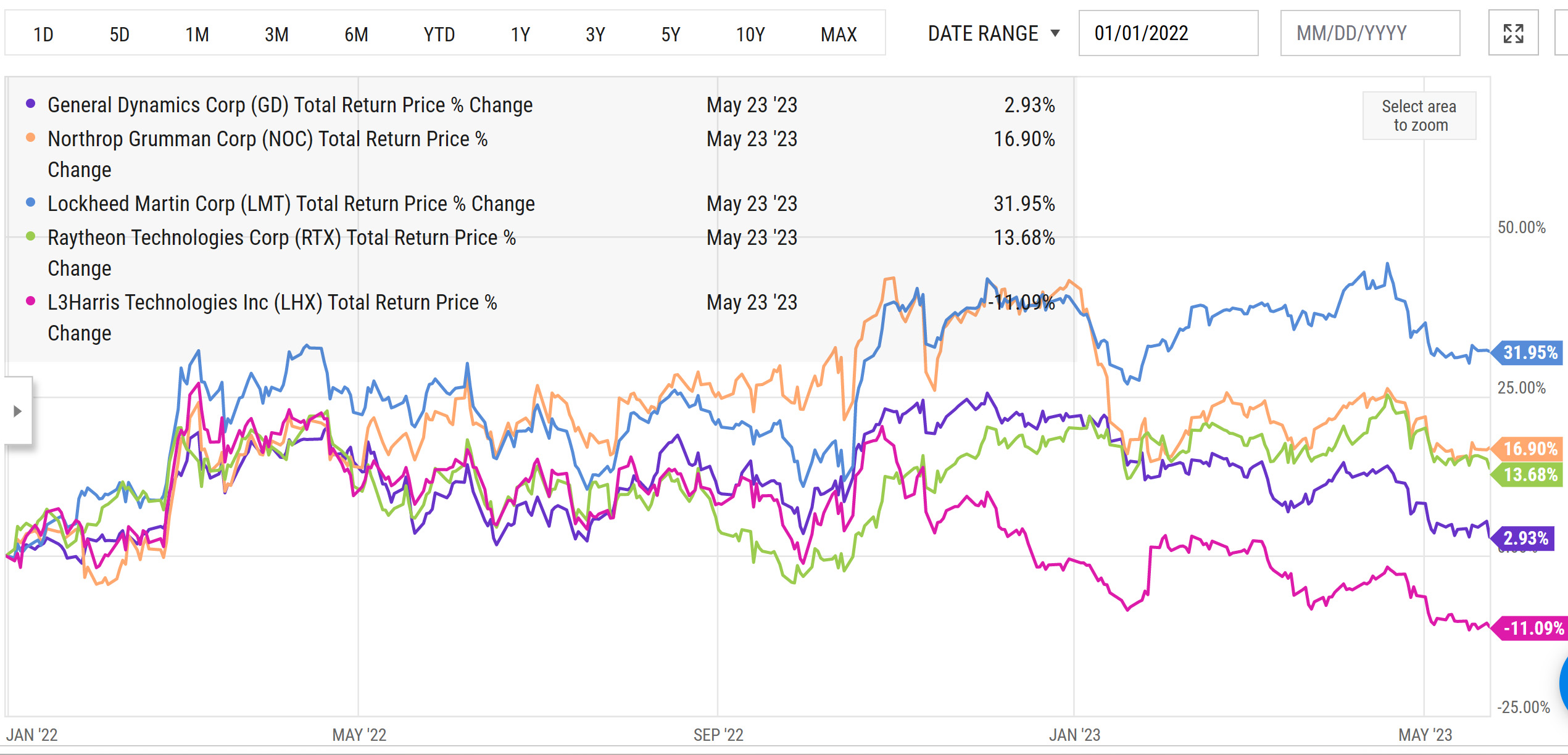

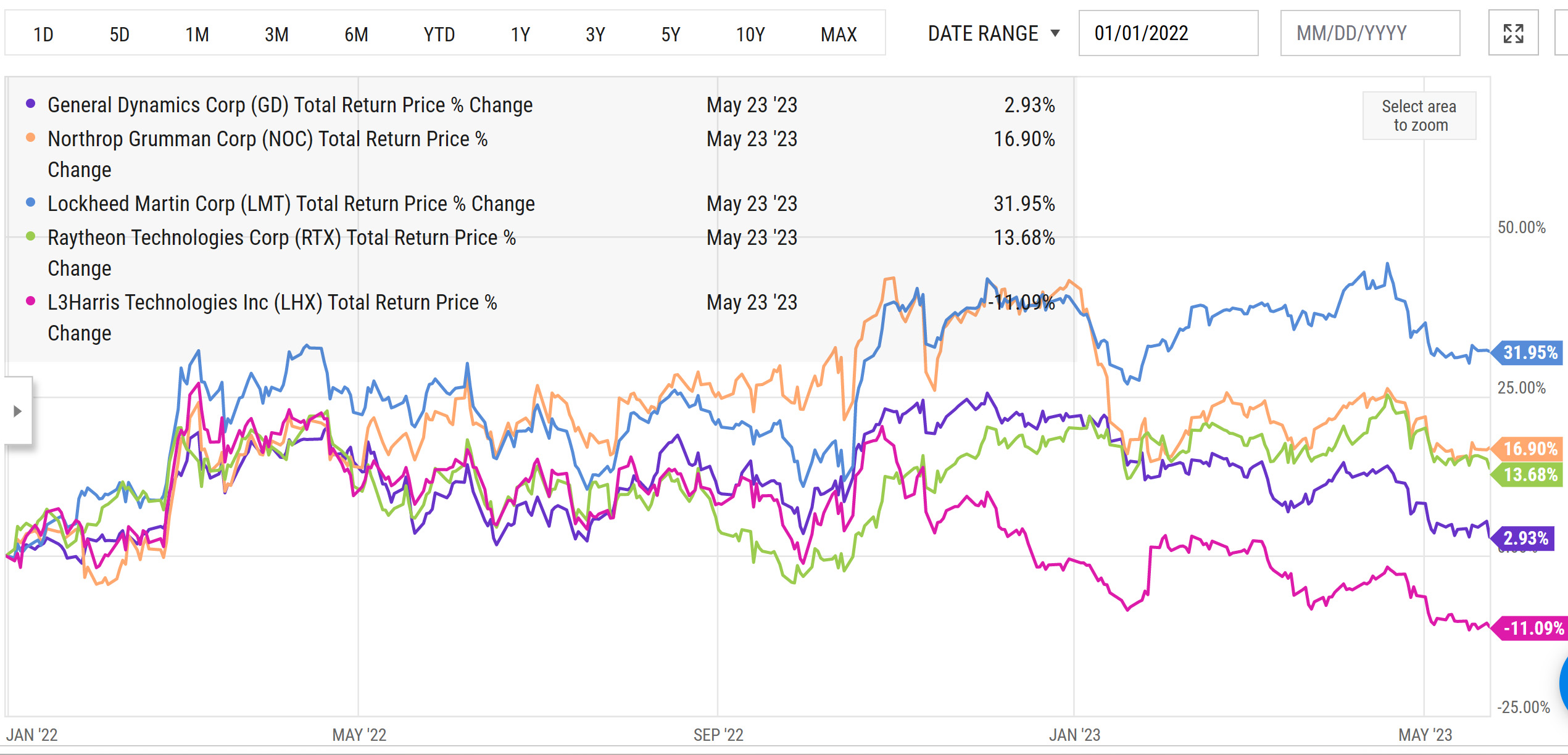

If it’s true that defense contractors and arms manufacturers are the only winners of war, let’s check in on how the large defense contractors are performing. Interestingly, most popped when Russia invaded and have slowly fallen back down to pre-war levels.

Before you feel too bad for them, remember that their 10 year performance seems to confirm that war is a good business.

source: YCharts.com

The Risk-Reward of Geopolitics

Look, I’m not here to make a moral statement about defense contractors – the world is a dangerous place – and there are no participation medals handed out on the battlefield. If we have to fight, we should fight to win. I just think there are better investment hedges to balance the risk of war (like energy for example).

We’re living in a dangerous world. And no, it doesn’t always feel like our leaders are on top of things. But if risks have risen, so too have opportunities. The two go hand in hand. The defense contractors are just one example – every geopolitical event has winners and losers. Distinguishing between the two is part of the riddle of investment management.

We look at history to be ready for what’s next, and keep an eye on the news so nothing catches us off guard. We game plan for different situations, just so we’re ready for anything that comes our way. We don’t have a crystal ball, but we try to be prepared for what may come. This is how we protect your investments and keep them growing, no matter what happens next.

Patience.

Glen