Notre Dame on fire (image courtesy of FranceToday.com)

Notre Dame on Fire — And the Lessons Begin

The Queen of Cathedrals has lessons for investors today. She has stood on an island in the Seine largely completed since 1260. Desecrated first by Robespierre’s French Revolutionaries when her treasures were plundered and she was renamed the Temple of Reason and then in 2019 by the roof fire which threatened to completely engulf her, still she stands. She has, in a real sense, been twice resurrected. In December 2024, it is hoped that the repairs underway to repair her roof will be complete and she will reopen. Investors know a little about trial by fire too.

Wikipedia: Spire on Fire.jpeg

Investors Are Feeling the Heat, Too

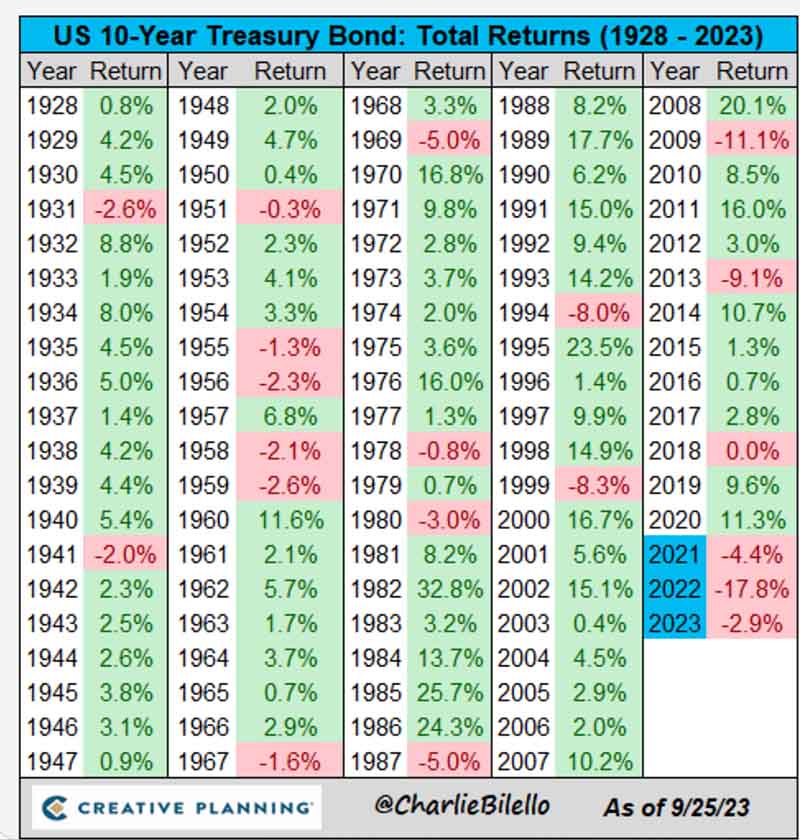

Just as the world awoke in horror to images of the Lady of Paris in flames in April 2019 watching transfixed as her spire burnt and then collapsed into the ruins, bond, bank and utility investors have watched their investments get torched by continued interest rate hikes in 2023. At the time of writing, US bonds (and by inference Canadian bonds) are on pace to record three consecutive negative years. This would be unprecedented.

source: https://twitter.com/charliebilello/status/1706739358605201644

Traditional Safe Havens Aren’t So Safe

The losses in the bond market (caused by central banks raising interest rates) has led to large price drops in bonds and interest sensitive securities like Utilities and Banks. Let’s look at the US 10 year bond to see the damage. The chart below shows that interest rates have now broken above a 40 year down trend. For the past 40 years buying bonds when the downtrend has been touched has been a profitable strategy. Now it appears that we may be in a new uptrend rather than a downtrend – that has important implications for investors like you and I.

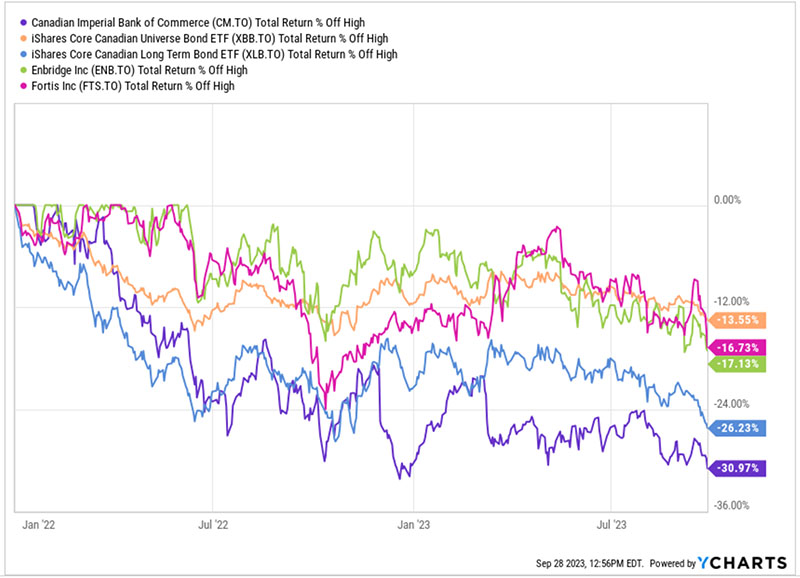

It’s not just bonds that are impacted. The chart below shows the percent below highs of the Canadian Bond Universe, Canadian Long Bonds, and a handful of representative “blue-chip” companies. Notice that all appear to be moving in the same direction? That’s a problem.

Investors have been burned by bonds and traditional low risk investments.

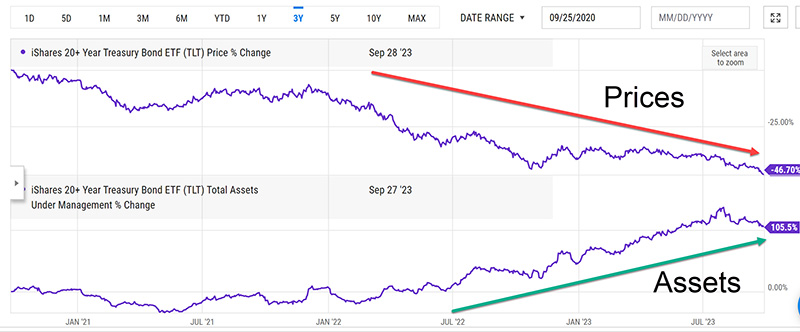

Are you feeling the heat? If so, you’re in good company. Expecting an imminent bounce, investors have been piling into bond ETFs even as prices have fallen like Notre Dame’s spire. Below you can see that assets in the iShares 20+ Year Bond ETF have nearly doubled even as the share price has fallen over -46%!

What to Do When the Old Rules No Longer Apply

Why are investors piling in even as prices fall? Hope. Hope that prices will recover as interest rates moderate next year. Hope that inflation will fall. Hope that buying long bonds when interest rates are approaching 4.5% will outperform. Sadly, hope isn’t a plan. The trouble with this knee-jerk reaction is that the long-term trend appears to have changed for interest rates.

Investors need a better plan to contend with the possibility that interest rates may stay higher than expected for longer than expected. With oil prices testing $95/barrell inflation seems to be having another bump – frustrating the hopes of our central bankers and causing further losses in bond and interest sensitive stocks. So what should investors do? Let the fireman extinguish the blaze before starting repairs.

Before Notre Dames’ spire can be reinstalled, preparations had to be made. A whole new roof structure (designed to perfectly match the original) had to be fabricated and installed. A team of over one thousand workers have been working for years to restore her to her former beauty. Visitors to Notre Dame, like today’s investors will need to have patience – and a plan.

My 3-Step Plan to Rebuild Without Getting Burned

Interest rates are still grinding higher and look to have at least a little further to rise. My advice? Go slow and keep three facts in mind:

- Banks, Utilities and Telcos are trading at dividend yields we haven’t seen for years. They likely represent good value and will be early recovery candidates.

- We may be in a new regime for bonds – a period when bonds may not offer the same negative correlation to stocks that they have for the past 40 years. This will change the script for investors.

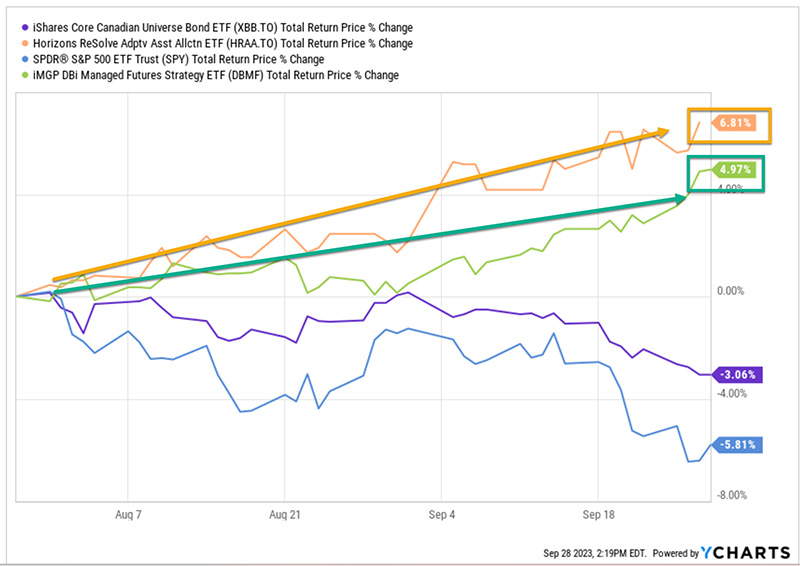

- Commodities, (particularly managed futures strategies), may replace bonds as a source for low correlated returns in investment portfolios. Since the S&P 500 peaked on July 28, managed futures strategies (like those shown in orange and green below) have been the only safe place to hide.

source YCharts.com

I continue to expect that we are close to the top of this interest rate cycle. That makes me keen to add to my financials, utilities and interest rate sensitive stocks. Bonds will represent good value soon – but they may not see as substantial a bounce as we have seen in prior downturns. Long-term investors may have to incorporate other strategies to protect their equity portfolios.

Notre Dame 2019 photo courtesy of World Monuments Fund

Restoration Takes Time — So Does Wealth-Building

Notre Dame is rising again. In time the Queen of Cathedrals will shed her scaffolding and shine once again. I love the story of Notre Dame because of the craftsmen, artists and sculptures who are once again leaving their mark on the world. Cathedrals don’t build themselves and neither does wealth. Building portfolios isn’t the high art of cathedral building – but it takes skill, it takes patience and planning and most of all it takes dedication to the craft.

Glen