Uri and Irene’s Debt Struggles

Meet Uri and Irene, a young couple wrestling with a mountain of debt. They owe $308,000 on their home, with $60,000 needing urgent refinancing at an alarmingly higher interest rate than they are currently paying. Add a hefty $20,000 for essential home repairs that will have to be added to their debt, and their financial picture, unlike their portrait, is daunting.

Uri, Irene and Leo the Lion

This couple, despite earning $104,000 a year, find themselves in a dilemma. Higher interest payments will eat away 3% more of their income. In layman’s terms, unless their income grows by at least 3%, they’ll have less and less to live on and may have to borrow just to make the interest payments. They’re stuck in a debt spiral of endless borrowing just to keep up with their debt. There’s a term for people in the situation Uri and Irene find themselves – broke!

The Global Debt Crisis

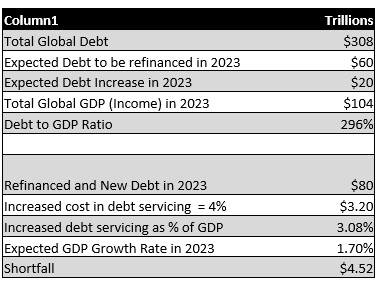

Here’s the surprising twist: Uri and Irene aren’t just two people. “U” and “I” stand for all of us, I’ve used them to illustrate the global debt crisis. If we replace “thousand” with “trillion” and “annual income” with “GDP,” the total value of goods and services produced in a year, you’ll understand the global debt situation the world faces. Here’s the breakdown:

The global economy needs to grow by more than 3% just to keep up with the increased interest costs on the debt. But the forecast is gloomy: growth of a mere 1.7% next year. The shortfall will have to be borrowed – just to pay the interest!

Countries could be sucked into a debt spiral, forced to borrow more just to meet interest payments. This isn’t just a problem for developing countries. Canada has a massive combined government and household debt. We were recently ranked number one for household debt per capita among G7countries – source. Even more worrying is that Canada’s income growth rate is the slowest among the 39 nations of the OECD – source.

Liquidity and Investment Opportunities

Economic reality is as relentless as a lion and harder to tame. If interest rates climb or even just stay high, interest costs on global debt will swell faster than our economy can grow, and we’re headed for a debt spiral. The warning signs are there, like the recent banking crisis in the U.S. Our central bankers, having been complicit in creating this mess, now have to try to act as lion tamers to get us out of it.

Jerome Powell – Lion Whisperer

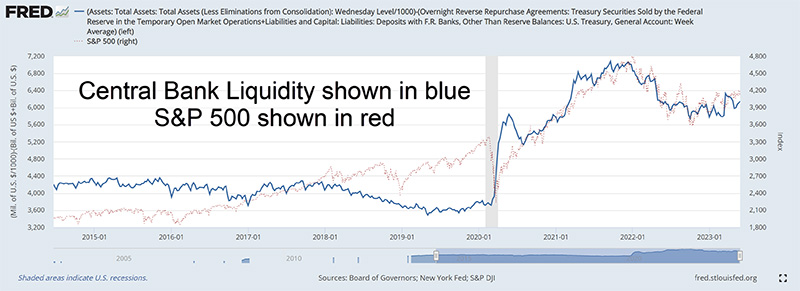

Yet, there’s hope for investors. That battle with inflation may be ending (if not the war). After raising rates and tightening liquidity in recent years, central banks are reopening the liquidity tap. In economic terms, ‘liquidity’ refers to the extent to which assets can be quickly bought or sold in the market without affecting the asset’s price. Essentially, it’s the lifeblood of the economy, ensuring money flows smoothly and since 2022 liquidity has been drained to combat inflation. Less liquidity has generally resulted in lower stock prices as the chart below shows. So this renewed provision of liquidity could signal the end of the rising interest rate cycle and provide a boost to markets.

The world needs to refinance – or restructure – a staggering $60 trillion in debt and increase it by $20 trillion. If there is insufficient liquidity to handle this, we’re looking at serious trouble. A lifeline comes from central banks pumping in liquidity, or easily accessible funds.

Recent signals show an uptick in liquidity, a ray of hope for investors. With the Federal Reserve moving to boost liquidity, technology stocks are shining. Veteran economist Michael Howell, an expert on liquidity and author of “Capital Wars: The Rise of Global Liquidity”, pinpoints three potential hotspots for investment: Gold (and gold stocks), stocks (especially tech), and surprisingly, cryptocurrencies like Bitcoin. (source: https://investresolve.com/podcasts/resolve-riffs-with-michael-howell-on-liquidity-its-multi-dimensional-impacts-on-markets-and-the-economy/) I’m not sure I agree with all of his conclusions, but his analysis seems spot-on.

The Good News is that even in the face of banking crises and potential recession, hope remains. The tech, gold, and crypto sectors are showing signs of resilience, buoyed by shifting liquidity conditions.

If this positive trend persists, we might soon witness the end of this challenging interest rate cycle. Like our fictional friends Uri and Irene, we’re all on a financial journey, it’s like a road trip across Canada. We’ve been driving through thunderstorms on the prairies, soon we’ll see the Rockies on the horizon. Yes, there are still risks ahead – chiefly recession risk – but the increase in liquidity is an encouraging indicator and the performance of some sectors are a strong reminder that there are always opportunities.

Glen

ps Sharp-eyed readers may be wondering how increased liquidity solves the debt crisis? Sadly doesn’t, but it allows the debts to be rolled and funded and maintains orderly markets. We’ll discuss the ways the debt might be resolved another time.