As a December baby, I was always the smallest among my school friends. Nobody picked me first for hockey or for football. I’m not complaining though, my size motivated me to work harder – and that trait has stuck. Sharing a home with older siblings often builds hardiness as well – maybe you can relate. Strangely, sharing a continent with a larger sibling hasn’t had the same salutary effect on Canada.

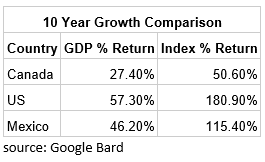

Within the free trade family of the United States, and Mexico, Canada is the runt. Our GDP has grown by less than half of America’s and slightly more than half of Mexico’s over the last decade. That is reflected in the returns of the stock markets of each country as you can see in the table below.

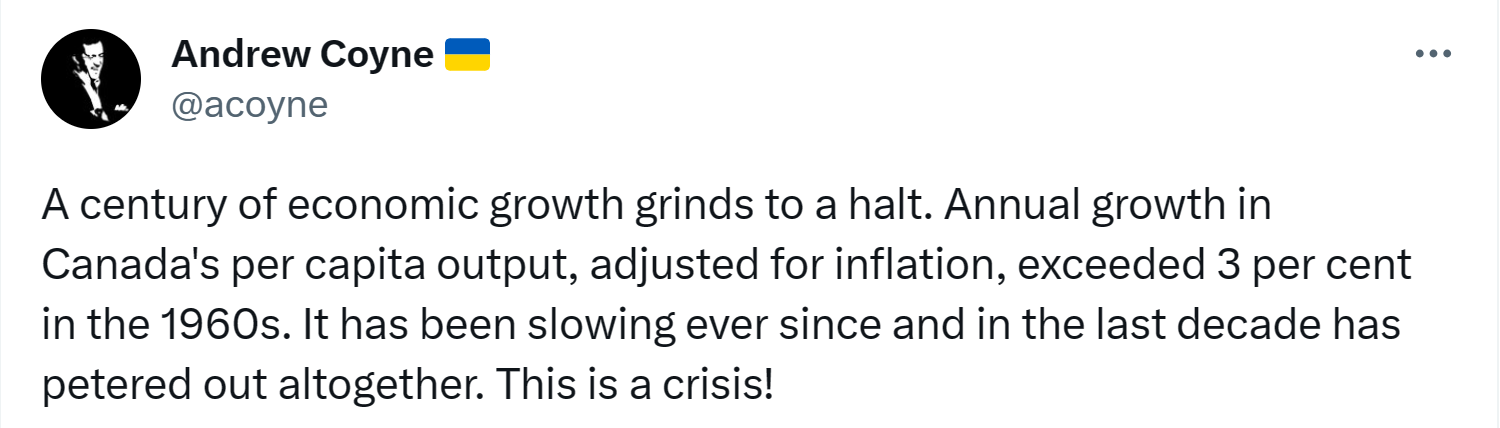

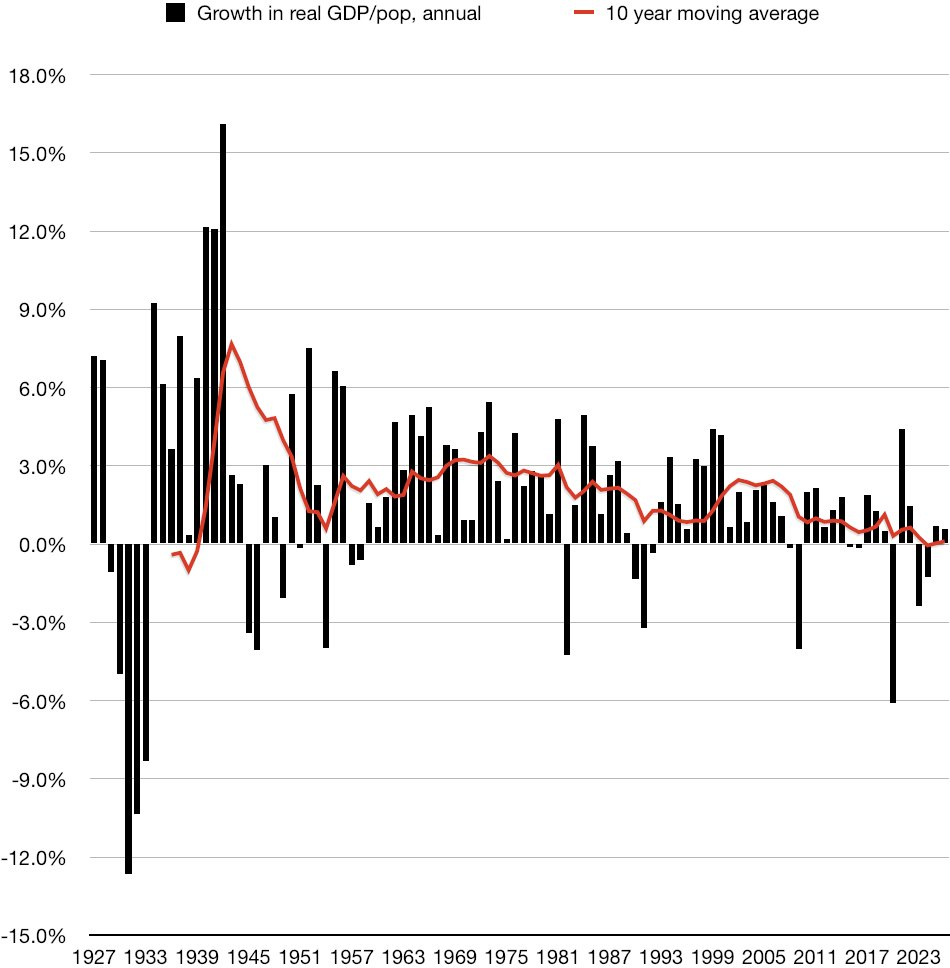

I’ve commented before about Canada’s lack of real GDP growth per capita, a theme that journalist Andrew Coyne has tweeted about:

https://twitter.com/acoyne/status/1679045943226671106

As Canadian investors, (not to mention tax payers) we ought to be concerned. Clearly we are not keeping pace with our major trading partners. Since economic growth and index returns are so closely related, Canadians need to look outside of Canada for better growth prospects. Investing is a game of balance.

My middle child Katelyn, recently enjoyed rock climbing near Mont Tremblant. She sent me this photo of a swaying bridge, framed by two waterfalls. It seems to me to capture the challenge Canadian investors face. Tax advantages make holding Canadian securities preferable for income generating Canadian investors – but we have to be aware of the risks of falling behind.

It can be a little intimidating stepping up to invest more globally. Fortunately, it’s never been easier for investors to increase their exposure to other markets. That’s this week’s Good News!

Cheers,

Glen