Supersonic flight involves a great irony – in order to go faster, engineers have to slow down the air entering the engines. Counter-intuitive right? Take my favourite plane of all time, the venerable SR-71 Blackbird. See the huge spikes in front of the air-intakes? The mighty J-58 engine relies on a movable spike at the air intake that incrementally moves backwards above Mach 1.6. At maximum speed, it retracts fully 26″!

As the spikes retract they create shockwaves in front of the air intake – these shockwaves literally slow the incoming air, compressing it, allowing the J-58 to act like ramjet at supersonic speeds and a conventional jet engine at subsonic. Without the cones? The engine would burn up and catastrophically stall as the compressors struggled with supersonic incoming air. Want to fly at Mach 3.3? You need to slow down to go fast.

Image: Dall-E

Skunk Work Engineers Have a Lesson For Policy Makers

The engineers at the Skunk Works division of Lockheed could teach our central banks and governments a few lessons about achieving top speed without risking a stall. Currently, both the Canadian and US governments are running massive deficits during a period of high inflation. If the economy was the SR-71, we’re flying at Mach 3 with the inlet spikes in the advanced position – the engine of the economy is burning up. Worse, our monetary policy and fiscal policy are moving in opposite directions.

One Foot on the Gas, One on the Brake

Allow me another illustration. Tiff Macklem, the Governor of the Bank of Canada has both feet on the brakes, panic-braking to slow down the economy (and inflation). Meanwhile, his passenger, (our Prime Minister) has reached over from the passenger seat to mash the accelerator! The risk for the economy is the same as for jet engines flying supersonic – stall!

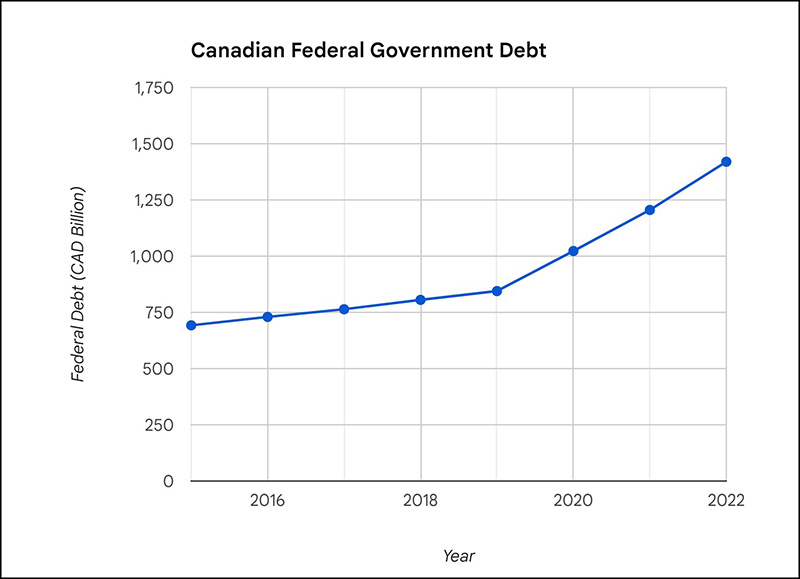

Let’s be honest, we shouldn’t be surprised. What did we think would happen when our government more than doubles the debt during its tenure and whose fiscal policy is permanent deficits? This isn’t a political critique, Canadians are hardly victims, collectively we voted for this. Now there is a flashing red light in the cockpit and an audible alarm: “Warning Stall, Stall, Stall!”

source: Google Bard

The Costs of Overspending

Economists at Scotia Bank recently calculated nearly half of the interest rate hikes inflicted on the economy are a direct consequence of the profligate spending of our government. Imagine the pain that an extra 2% rate rise is causing young financially strapped homeowners. source https://www.bloomberg.com/news/articles/2023-11-17/scotiabank-says-canada-s-profligate-spending-forced-rates-higher#xj4y7vzkg

Put another way, the recent Fall Economic Update confirms that the cost of servicing this doubled-debt is expected to exceed $52 billion dollars in 2024 – more than Canada Health Care Transfers to the provinces. That pain will worsen if the reality of a recession intrudes on the hopes of Ms. Freeland.

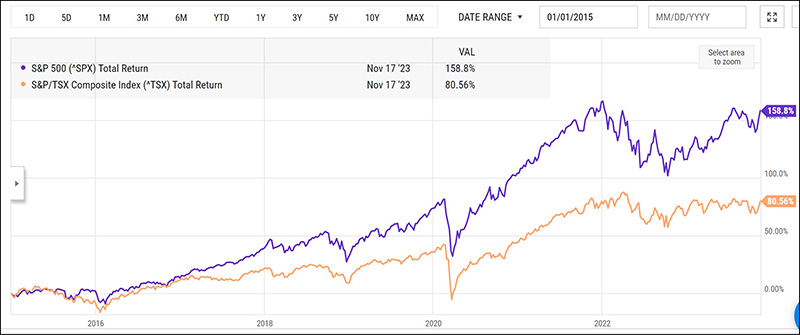

Financial Markets Vote with Their Feet

Eventually, voters will decide whether to stay on this path. Financial markets get a vote too – often with their feet. We see the consequences of our choices in both the value of the Loonie and our stock market compared to the US.

source: Stockcharts.com

source: YCharts.com

The Case for Investing Outside of Canada Has Never Looked Better

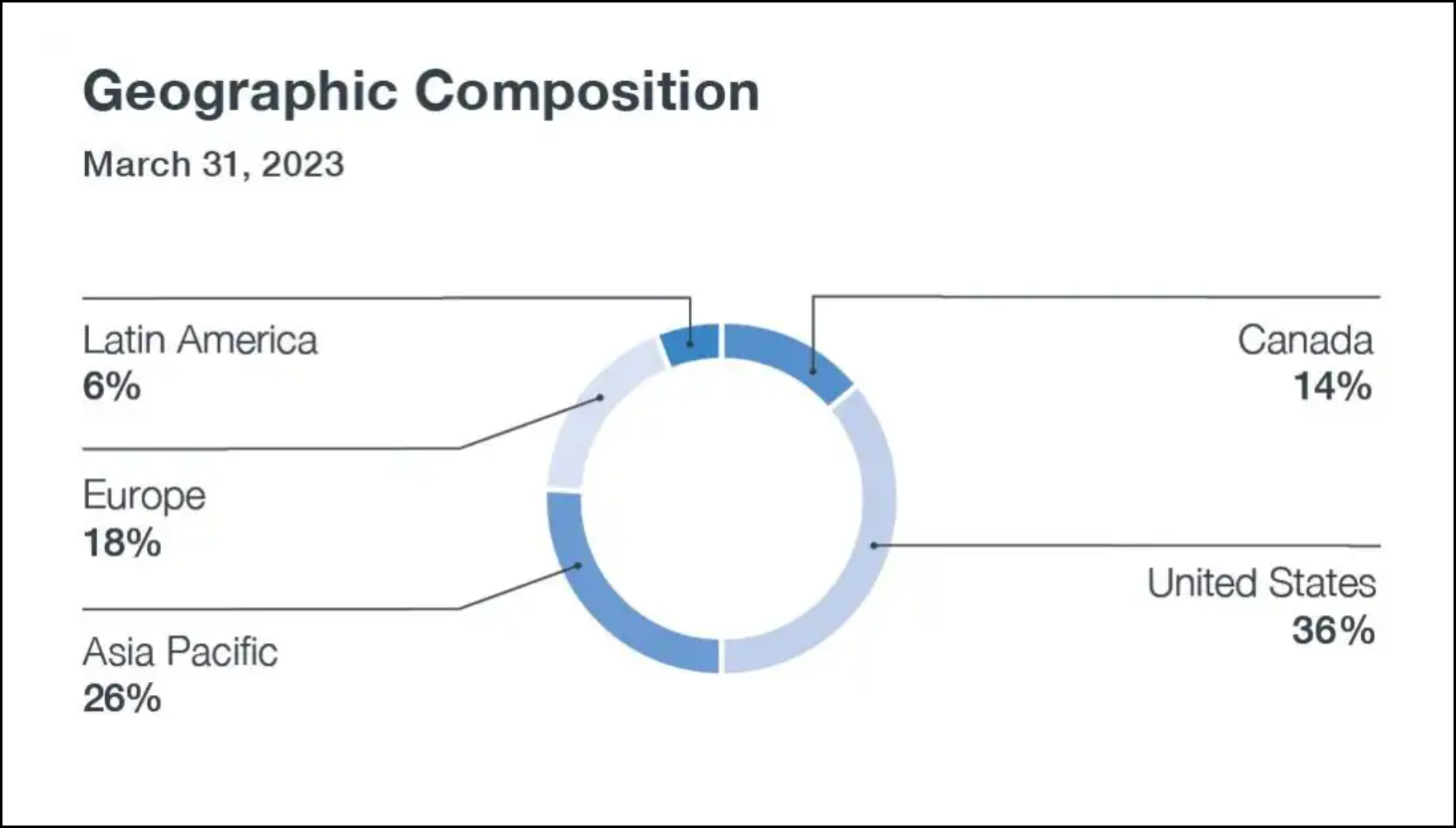

Not only has the US stock market doubled the performance of the Canadian stock market since 2015, but our currency has fallen by over 16% to boot! Canadian investors need to protect their capital by diversifying away from Canada. Unconvinced? Take a look at the current asset allocation of the Canada Pension Plan – they have a mere 14% allocation to Canada:

Plot Twist – Why I’m Bullish Canada in the Medium Term

While our government always seems ready to light the afterburners of deficit spending, the likelihood that the Canadian stock market is about to go supersonic seems low. Few prognosticators would take that bet – at least on a long term basis. Indeed, the consensus view is that Canada will continue to underperform. I’m not so sure I agree – at least in the medium term. Hear me out.

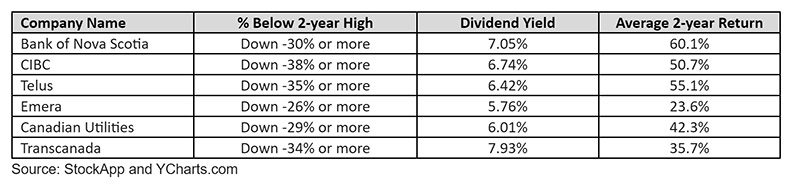

As investors we have to remember that betting with the consensus is a good way to achieve below average results – real outperformance comes from betting against the consensus (and being right). It’s true that the Canadian stock market trended lower than the US stock market, but trends change. Given the poor relative performance of the Canadian stock market compared to the US we should expect a reversal at some point.

I’ve illustrated in previous issues how the Canadian blue chips have bounced back after periods of underperformance. Remember this table?

Two things can be true at the same time – Canadian investors should diversify away from Canada due to poor fiscal and monetary management – and Canadians might see a substantial bounce in performance of down and out Canadian blue chip stocks as recession fears abate next year.

We can help you find the right balance.

Glen