“Every blade of grass has its own angel bending over it, whispering, “Grow, grow.”

― the Talmud

Enclosed, insulated and protected, the dormant material receives a long anticipated signal from the outside world – “warmth”. First a trickle, then a rush of nutrients, water and carbohydrates prime the ancient machine. As the cells absorb the elixir of life they swell, creating pressure and tension on the protective walls that once protected but now imprison the new life. Pressure builds until one spring day, the bud walls rupture and the flower bursts into view expanding as much as 16 times by weight in a single day. Repeated billions of times over, spring arrives in the nation’s capital.

It’s not just flowers that respond to the imperative to grow. Economies, countries, communities, and yes, individuals all have a primordial voice whispering “Grow, grow”. Can you hear it?

The Market Cycle: From Deep Freeze to Blooming

Recently, financial markets have responded to the call. In 2022, interest rates spiked, blanketing global stock markets in deep snow and freezing investments. In 2023, a thaw occurred as rates peaked creating a warming trend. Now in 2024, spring has returned once again as many markets have blossomed to record new all-time highs. North American, European and many emerging markets have now fully recovered and are making new all-time highs (or close to). Gold and Bitcoin have also joined in the party.

Policy-makers, CEO’s and governments aren’t whispering – they’re shouting, “Grow, Grow!” Investors once again have the sun on their face and the wind at their back. All of this is good news, but many investors are confused. Like the Looney Tunes cartoon character, Marvin the Martian, they were expecting “an earth shattering ka-boom!”

Marvin the Martian – surprised. Dall-E

The Resilience of “Il Gigantes”

Recession worries, layoff notices and deficits were supposed to create an “earth shattering ka-boom!” Instead, these risks have been digested by financial markets and used to fuel the new bull markets. Who could have foreseen this? We did! Recall that in October we wrote about Il Gigantes (the marble stone that David was carved from), when stocks had their final tumble in October, I wrote this:

Portfolio Managers and Investors Have to See What Others Miss

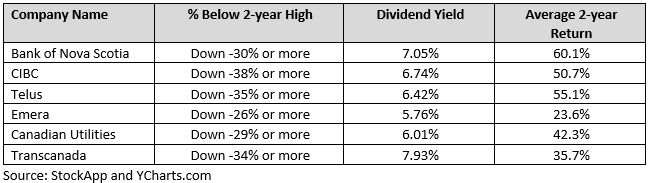

It’s no secret that rising interest rates have negatively impacted utilities, banks and telecom companies in Canada. We’ve catalogued in prior issues just how far some of these giants have fallen. Instead of recounting the losses, let’s consider how these Il Gigantes have responded to prior periods of steep losses. To do that, I used software that I’ve had custom built to examine how the share prices have performed in the two years following prior periods of weakness. These Average 2-year Returns exclude the high current dividends these securities are paying. To be clear, we can’t be certain that history will repeat – but we can hope it rhymes.

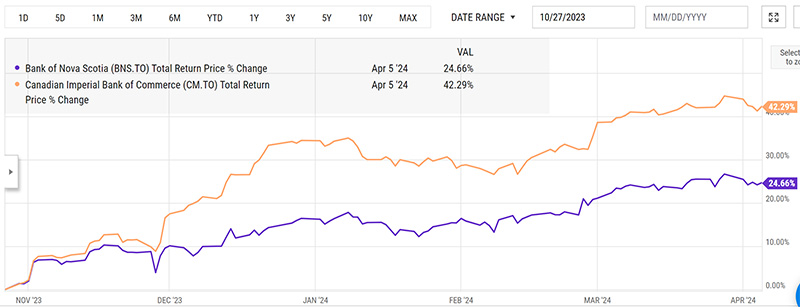

Since then the Banks have begun to flower while utilities and telecoms continue to develop in their buds.

A Personal Note: Embracing Growth and Change

Progress. It always surprises us even though it should be our default assumption! Sometimes though we need a voice of encouragement – the Talmud’s vision of “Every blade of grass has its own angel bending over it, whispering, “Grow, grow.” seems apropo for investors too. I aim to be that voice for you – amplifying the signal when the noise of the day overwhelms it.

This spring, Briana and I joined Wellington Altus. We’ve bloomed. I’ve been building to this moment for more than 25 years. Learning and growing, compounding my skills and knowledge while helping you grow your wealth – we’ve been quietly mastering our craft and strengthening our voice. Most importantly, we’ve been getting to know you better – I hope you feel that level of commitment. Now we turn our words into personal action – Grow, Grow. That’s what this change means.

Wellington Altus represents the next step in our evolution together. They embrace the growth vision while ensuring the stability and safety of our assets.

Thank you for growing with us!

Glen