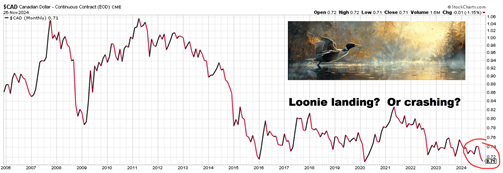

source: StockCharts.com

The Loonie is tanking. Again. Canadian politicians will be quick to blame Trump’s Tariff threats. Don’t buy it. Even a casual look at this chart shows our problems predate Trump. There are myriad reasons for this—most of our own making. What if the Loonie is landing rather than crashing?

A Technical Analyst’s Take on the Loonie

I’m a Chartered Market Technician so I know a little bit about charts. I know just about everyway to present a chart to tell a story. Notice the only chart here is a simple long term price chart of monthly closing prices? No tricks. No tea leaves. Just price.

So what does this chart tell me—you might be surprised.

Different this time?

Let’s put on our trading-hat to look at the Loonie. What do we see? A security in a secular downtrend starting in 2011 that has bounced strongly at this level in 2016 and 2020. For the past 8 years the Loonie has been consolidating, bouncing between $0.71 and $0.80.

From a trader’s perspective, this is a buy zone—a level where the Loonie has historically rebounded. But, like any seasoned trader, I’d cut my losses if it fell below this support. Why? Because that would signal that it really is different this time.

Bad Company?

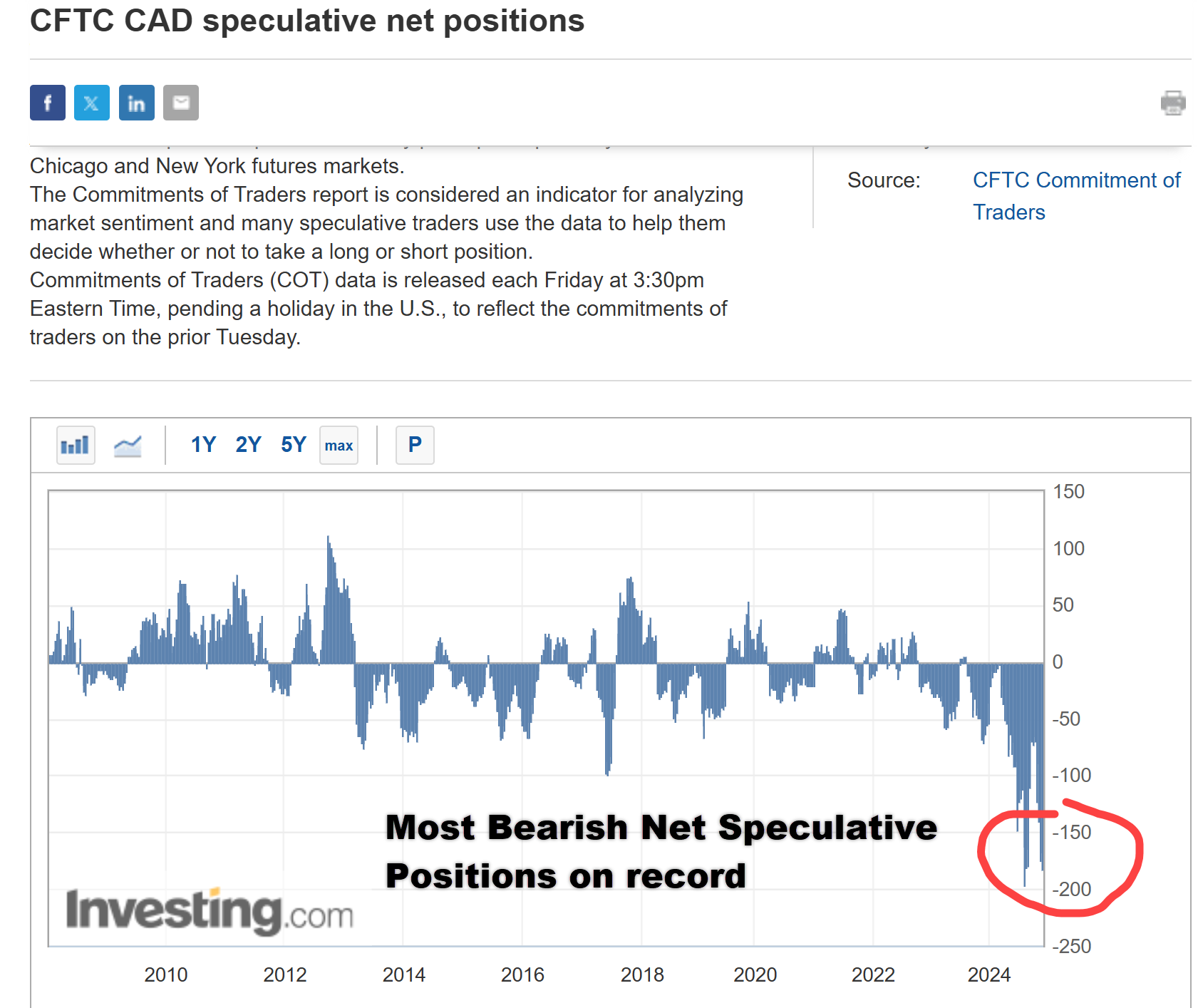

Traders often think alike, and the chart below suggests many professionals are betting heavily against the Loonie. You don’t need to grasp every detail to see that traders are “all in” on the belief that the Loonie will break historic support.

What happens if it doesn’t? If the Loonie lands instead of crashes, these speculators will need to unwind their bets—fast. To do that, they’ll have to buy the Loonie, potentially sparking an unexpected rally. That would be the big surprise.

What Investors Should Do About the Loonie

We’re investors, not traders. Currency speculation is best left to the pros. Our portfolios already include significant US and global exposure, providing some protection against the Loonie’s decline.

But here’s the question: what could change the consensus view?

What about the Greenback?

source: StockCharts.com

To understand the Loonie’s weakness, we must look at the US dollar’s strength. The two currencies are essentially mirror images. Since the election, the US dollar has surged. But can this strength continue?

Consider this: a strong dollar makes US-manufactured goods more expensive in global markets—hardly the formula for “Making America Great Again.” Trump’s nominee for Treasury Secretary, Scott Bessent, addressed this back in January 2024:

“Trump will pursue a weak dollar policy rather than implementing tariffs. Tariffs are inflationary and would strengthen the dollar—hardly a good starting point for a US industrial renaissance. Weakening the dollar early in his second administration would make U.S. manufacturing competitive. A weak dollar and plentiful, cheap energy could power a boom. The current Wall Street consensus is for a strong dollar based on the tariffs. We strongly disagree…” – source.

Bessent might be singing a slightly different tune now, but I suspect his original take is the accurate one. Simply put, I’m not convinced that Trump can afford a strong dollar. If the dollar weakens, the Loonie will likely strengthen.

The Bottom Line

Technical analysts can’t predict the future; we can only identify potential turning points. Right now, we’re approaching one. With the consensus heavily tilted against the Loonie, any shift in sentiment could trigger an unexpected recovery.

Whether the Loonie moves up or down, our focus remains the same: making the necessary adjustments to stay disciplined and protect your savings.

Glen