Rumble and Piper have a complicated relationship—well not from Piper’s point of view. Piper is the undisputed Queen—the sun Goddess around whom the house rotates. Rumble is a serf in his own house, tolerated by her Majesty (mostly for his body heat). You can learn a lot about what makes good neighbours by watching our dogs.

Sadly, that’s not actually true—what you learn is that the bully generally rules. Check out the ‘side-eye’ Rumble is giving the Queen:

The Trade Tariff Threat: Canada’s Bully in the Backyard

So too in trade, you can’t open a newspaper today without reading about president-elect Donald Trump’s tariff threats and the dire risk they pose to Canada. Following the election conventional wisdom was that he was blustering. He has since demonstrated his prowess at the “art of the deal” by convincing Canadian leaders that he will follow-through with 25% tariffs. Maybe.

Market Reaction: Canadian Stock Market’s Surprising Calm

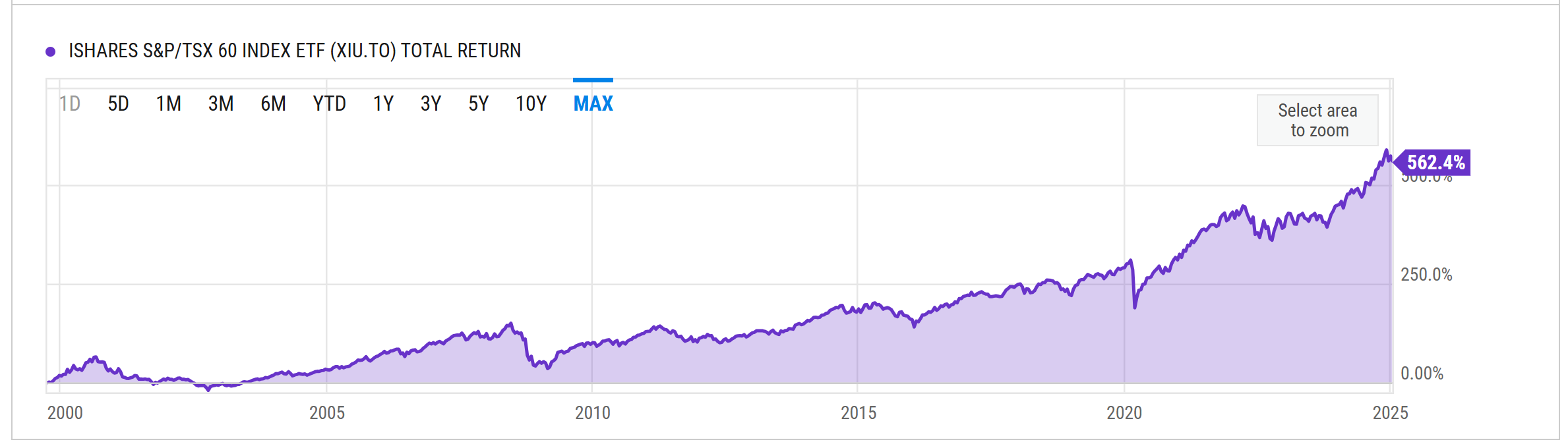

It remains the case that tariffing Canadian oil imports would disadvantage the U.S. (and that their refiners need our heavy crude). Perhaps that’s why the Canadian stock market is strangely unphased by the risk. Take a look at the TSX 60:

YCharts.com © 2025 YCharts, Inc. All rights reserved

The Canadian Dollar: Already Discounting the Tariff Risk?

Look, I’m not downplaying the tariff threat to Canada (though I think Trump and Canadian politicians have done a masterful job of anchoring everyone around 25%). It is widely accepted that the stock market discounts future news in advance. If this is true, the TSX 60 seems remarkably unconcerned. Maybe that’s because the Canadian dollar has already fallen (which would cushion the cost of tariffs).

Is Canada’s Dollar at the Bottom? The Path Forward for the Loonie

The Canadian dollar has fallen to $0.69 on Trump’s election, but it has actually rallied since Trudeau resigned. That’s how a bottom is formed. The reversals in 2016 and 2020 were also “V” shaped. Yes, the loonie could revisit the 2002 lows, but I think it is equally plausible that it is bottoming and that new leadership which begins to attract foreign investment back into Canada will push the dollar higher once again. Remember that Trump doesn’t want an overly strong U.S. dollar.

source: StockCharts.com

Stock Market Signals: A Contrarian Take on Tariffs

I’m not an economist and things can always change, but at present, it seems to me that the tariff news isn’t having the impact one might have expected on the TSX 60. The loonie appears to have already discounted the risk. News reporting has it that Canada will acquiesce to the U.S. demand to secure the border—evidence that Trump’s bullying and tariff threats are having the intended result (and also that fences really do make for good neighbours). Speaking of good neighbours, Rumble has found a way to live with her Majesty. We probably can too!

A Different Approach: Removing Canada’s Internal Trade Barriers

To be clear, I’m not minimizing the risk of tariffs, just pointing out that the stock market seems unconcerned. Let me go one step further, since our premiers have apparently become ambassadors with some recommending appeasement and others threatening critical electricity supplies. They might be better off focusing on being good neighbours to the other provinces.

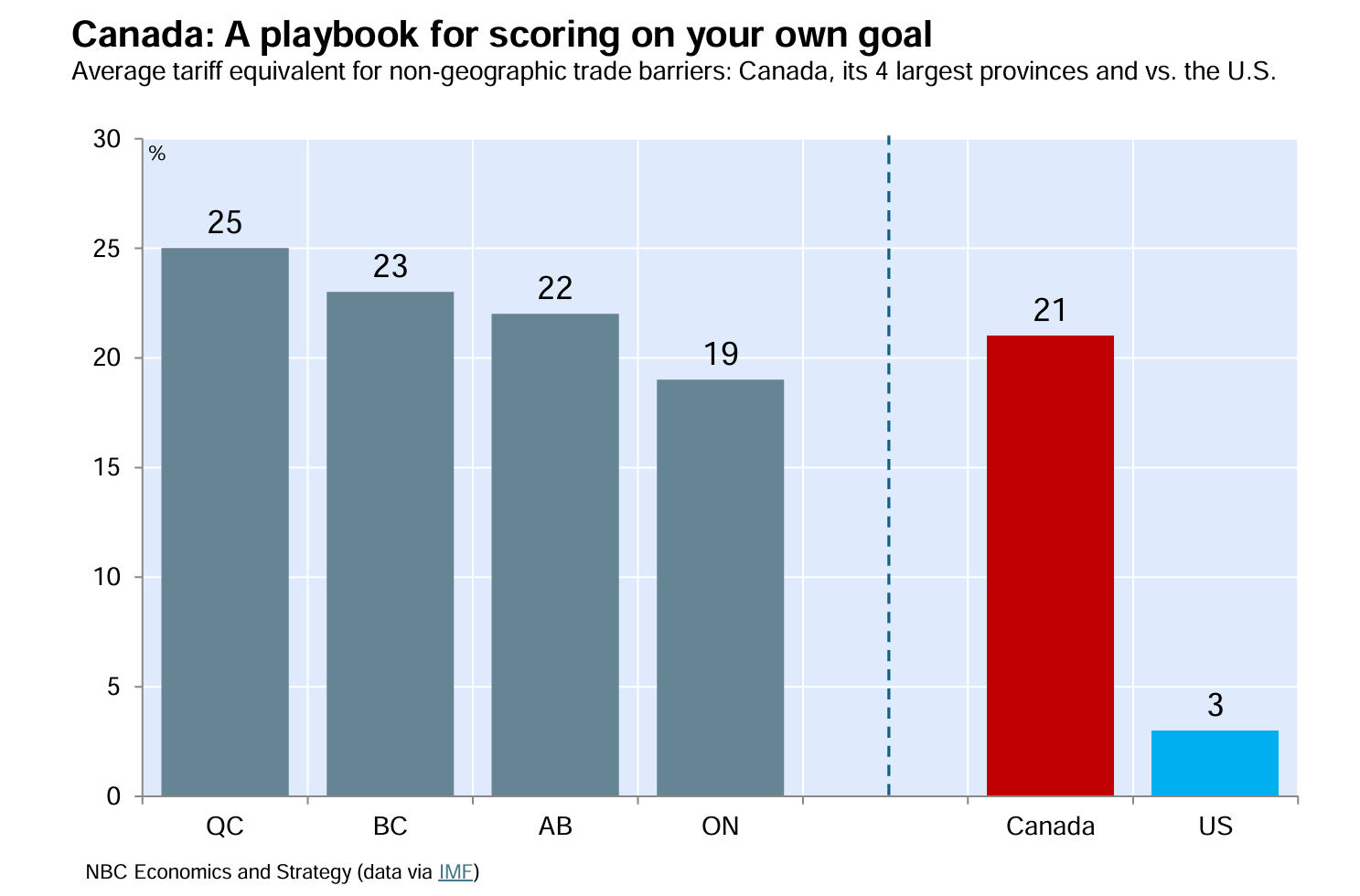

Given the uniformly anti-tariff sentiment of Canadians premiers and elected leaders and the overwhelmingly negative sentiment that Canadians have towards tariffs, it’s more than a little puzzling to read that interprovincial ‘tariffs’ amount to nearly 21% in Canada.

Unlocking Canada’s Economic Potential

According to National Bank “…the removal of internal trade barriers could raise Canada’s standard of living and increase GDP per capita by an estimated 3.8% across the country. It’s time to stop scoring own goals and start unlocking our full economic potential.” — source.

If we are to respond to tariffs, maybe we should start there?

The Path Forward: Turning the Tariff Threat into Opportunity

I’m optimistic—and I think the signal the Canadian stock market is sending is more important than the hysteria in the press. It’s true that Canada is dealing with a bully. This wake-up call could bring material benefits to Canada—diversifying our trading partners could bring long-term benefits. Canada is serious about mounting a response to the tariff threat, we could start with dismantling our own interprovincial trade barriers and removing irritants that have stymied other foreign trade agreements (i.e. the dairy control board). Let’s hope that we’re serious!

Glen

PS: Don’t feel too bad for Rumble—he’s got a pretty good life!