The Jetson’s and Rosey the Robot – source

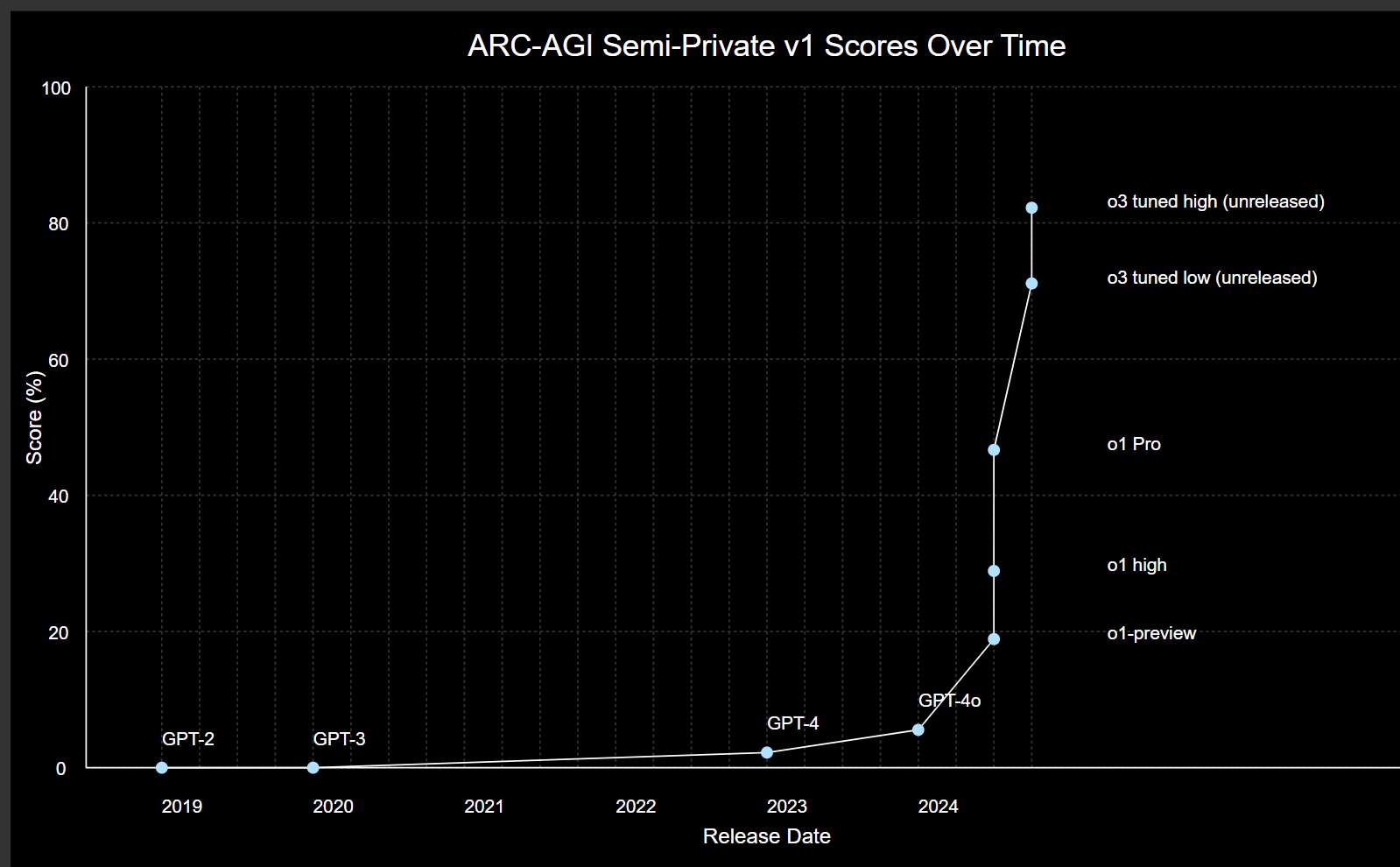

Some people think the most important chart in the world is the chart of oil. Others, the U.S. dollar. Still others the U.S. 10 year bond. I think they’re all wrong. Increasingly, I think the most important chart in the world is the test scores of artificial intelligence (AI) over time.

Why AI Test Scores Are the Most Important Chart in the World

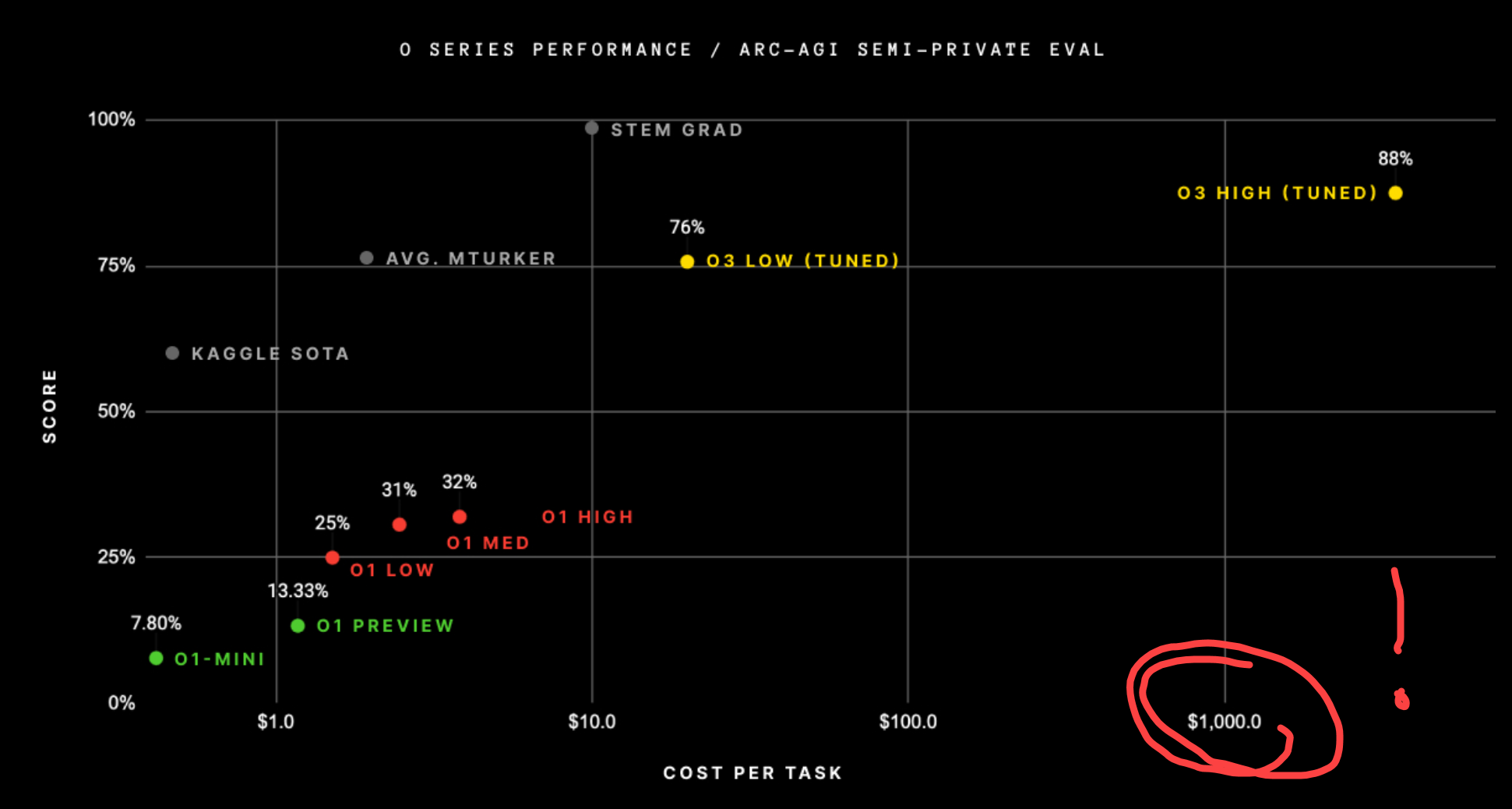

The chart above shows the “IQ test” results of AI models. Created in 2019, the ARC-AGI Test is designed to measure how successful models were at solving human-like problems. Until recently, the progress was minimal. The last six months have changed the narrative. In late December, OpenAI announced their new o3 model attained scores of 87% on the test–this result surpasses average human ability.

OpenAI o3 Model: A Leap Beyond Human Intelligence

Consider another datapoint. A competitive bunch, software developers often test their coding ability on a competitive programming test called Codeforces. OpenAI’s o3 model achieved a rating that ranks it 175th in the world. Ironically, o3 outranks OpenAI’s Chief Scientist, Jakub Pachocki.

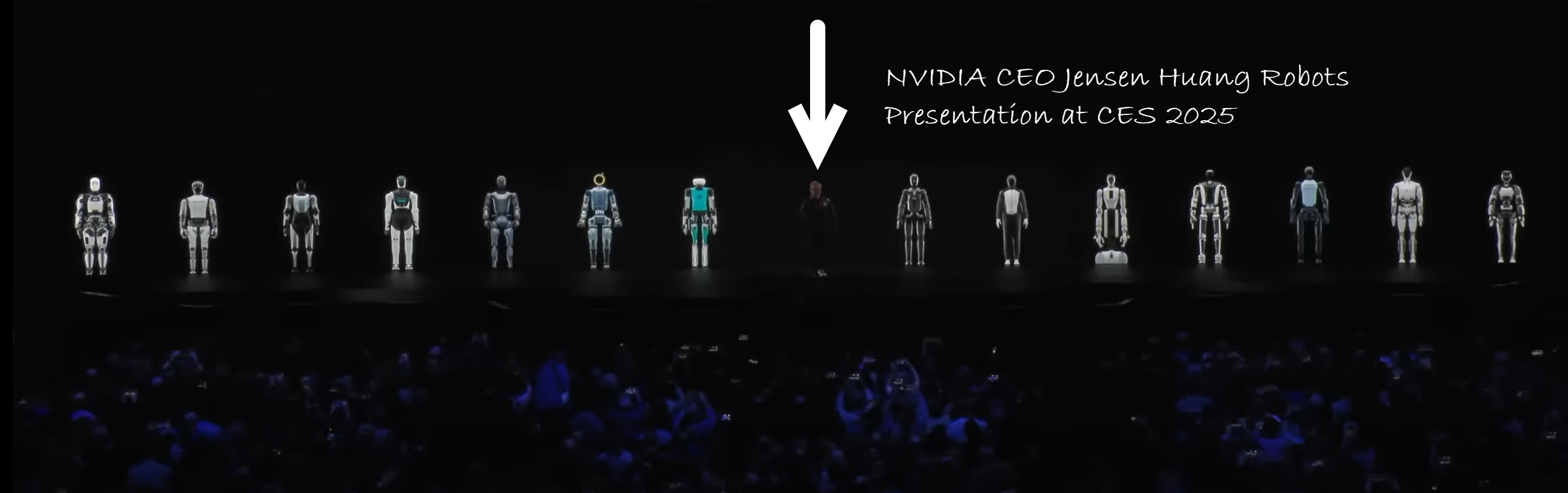

We’re not there yet, but the Singularity is near. Remember Rosey the Robot on the Jetson’s? She’s on her way to a home near you! Embody this intelligence in robots (cars and humanoids) and the possibilities are both endless and unnerving! Ready or not, 2025 will see humanoid robots begin to proliferate. You can already buy a 4′-3″ tall Chinese humanoid for just $16,000 (U.S. dollars) or a robot dog for less than $3,000 (not a recommendation 😉).

Screenshot from Nvidia’s Robots Presentation at CES 2025

The Rise of Humanoid Robots and AI-Powered Tools

Many of us are nervous about the societal implications of the AGI. I get it, it’s both fascinating and unsettling. I’m more interested in what comes after AGI–Superintelligence. Take note that the pace of development here has been exponential. There is no reason to believe that it won’t continue or accelerate.

AI in Action: A Personal Story of Enhanced Productivity

A personal story. I spent a lot of time with Anthropic’s Claude Sonnet writing the code to generate monthly performance summaries for my Advisor Managed Accounts. I’ll admit that the process was slower than I’d hoped, but the output was over 640 lines of code that creates great visuals and commentary on my models with only minimal input from me. Something that I can run in minutes every month now–saving me two to three days of work per month. That’s more time for client reviews and research.

I recently tasked Google’s Gemini 1.5 Deep Research with assessing the likelihood that a change in government might lead to surprising strength in the Canadian dollar. Gemini thought about the problem for over 10 minutes, researched over 50 different websites and returned a thoughtful scenario. That’s like having an economist and a seasoned software developer at my fingertips. You bet my productivity is increasing! o3 will make Gemini and Claude Sonnet look silly.

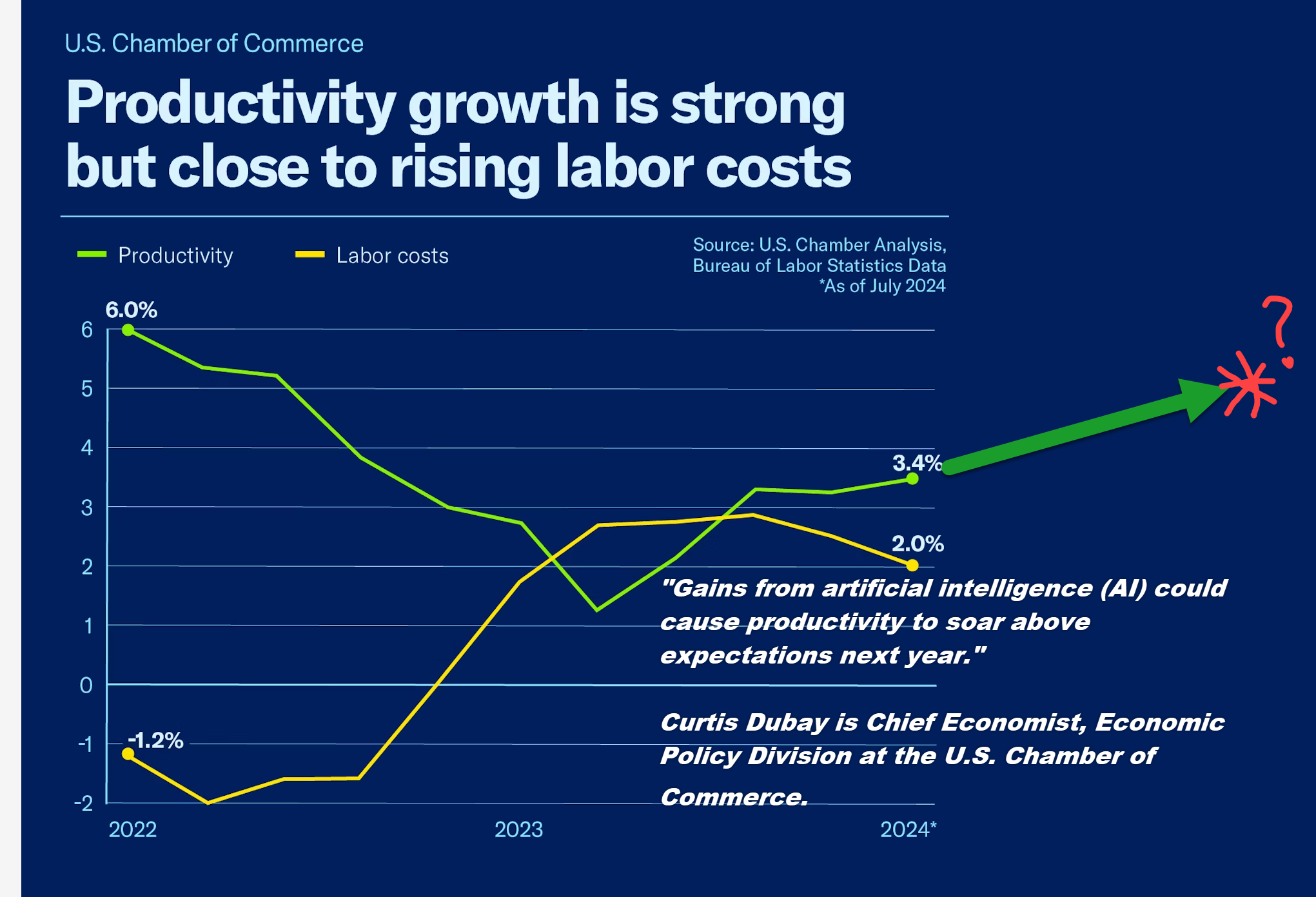

How AI Will Transform Productivity Growth in North America

This year, I’m working on the development of AI Agents to help me with my portfolio management and marketing–Briana and I will soon have a team of AI Agents helping us research and market our portfolios and services. Imagine that every professional in every field will have this kind of bump in productivity. What does that imply about productivity growth in North America? The U.S. Chamber of Commerce is expecting AI to cause productivity to soar. Imagine the U.S. economy growing at 4% or 5% a year rather than 3%.

Tech Sector Valuations: Why the Naysayers Are Wrong

In the mean-time, it has never been more clear to me that the current batch of naysayers and doomsters thinking that the technology sector is “overvalued” are mistaken. Missed over the Christmas holidays is the fact that this improvement in intelligence comes at a very high computational cost–it’s expensive for OpenAI’s o3 to “think” on a problem for hours at a time! We may see estimates for hardware demand actually increase.

The High Cost of Computational Power in AI Advancements

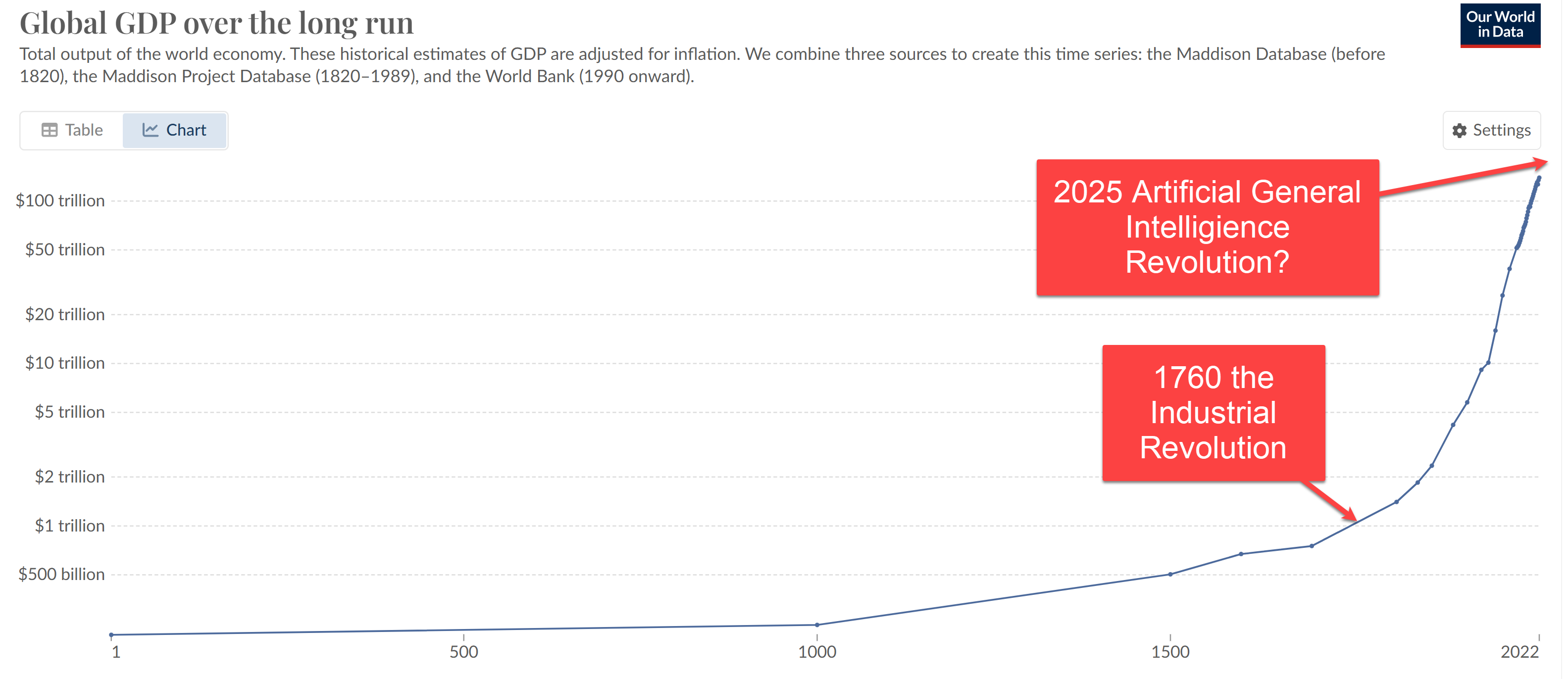

Does this make you anxious or excited? It’s a bit scary isn’t it? Overhyped? Maybe. Whatever my reservations (and I have many) I’m convinced that AGI and superintelligence is inevitable and I want the West to remain in the lead of its development and I want my clients to not miss this technological revolution. The industrial revolution changed the course of human history. Will the AI Revolution have a similar impact?

source: Our World in Data

Silicon Demand: The Future of AI Infrastructure and Growth

I’m not sure who will win this race, but I’m pretty sure it will require a whole lot of silicon. More data centers, more GPUs, more generators and more electricity demand. Today’s leaders seem like reasonable bets. If anything I think this builds the case for relatively more rather than less exposure in portfolios.

Glen