Unprecedented Housing Market Trends in Canada

Canadians have watched in morbid fascination as housing prices march inexorably higher. The real estate sector had already been hot when the Bank of Canaday dropped rates to basically zero following the pandemic – effectively pouring gasoline on the fire. Now that they have ratcheted interest rates higher by 5% higher most economists have been expecting the market to cool. After a very short period of smouldering, the sector has burst back into flames and no one at either the Bank of Canada or the Government of Canada seems to have an answer for why the housing market refuses to crack.

This is particularly confusing given just how unaffordable real estate has become. Because of the rise in rates, fixed payment mortgages are seeing the amortization period being extended to 50, 60 and even 90 years! https://www.thestar.com/business/2023/06/27/rising-mortgage-rates-fixed-payment-woes-some-homeowners-seeing-amortization-periods-skyrocketing.html How would like to have a 90 year amortization term?

A Paradox: Why Housing Prices Remain So High

If I’ve done my math correctly, this means that a homeowner with a $1,000,000 mortgage paying 5% interest will pay over $2,157,000 in interest payments alone over a 60 year term (assuming rates remain at 5%). In a country that prizes home ownership as highly as Canada, I would have expected this development to have been greeted with howls of outrage if not growls of anger. Not so much.

The Dog That Didn’t Bark: A Story of Real Estate Mysteries

It reminds me of Sir Arthur Conan Doyle’s “Silver Blaze” story. Sherlock Holmes fans will recall that Holmes deduced that the disappearance of the race horse (Silver Blaze) was an inside job since the barn dog didn’t bark during the night of the disappearance. Here’s the dialogue between Scotland Yard Inspector Gregory and Sherlock:

Gregory: “Is there any other point to which you would wish to draw my attention?”

Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Holmes: “That was the curious incident.”

If only there was some credible reason for why housing prices in Canada are double that of the US. What could it be? You might think that someone in the Government or at the CMHC or at the Bank of Canada could put their finger on the issue. Amazingly, we don’t hear any barking from any of these agencies.

The Hidden Factor: Canada’s Population Growth and Housing

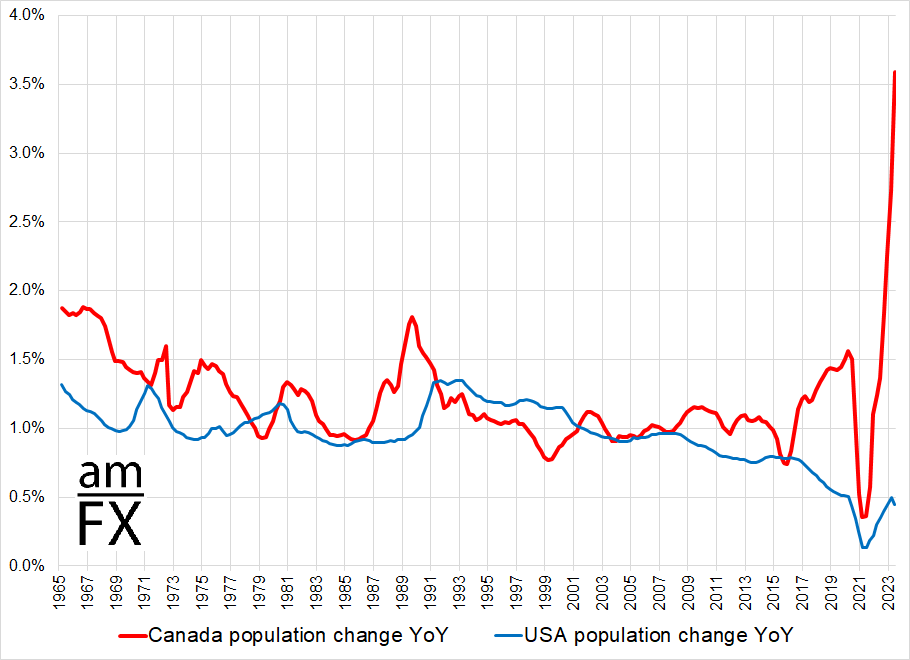

Then I came upon a chart on Twitter comparing Canadian and US year over year population growth. Wow, Canadian population growth is almost twice its former peak and 3 times its average over the past 60 years.

https://twitter.com/donnelly_brent/status/1673686540877193216

The Impact of Immigration on Housing and the Economy

Have no doubt Canada is very blessed to have a progressive and functional immigration policy and I for one am an enthusiastic supporter of population growth – in part because I see no way of escaping our GDP growth crisis without robust population growth. That said, this chart is a shocker – population growth of almost twice the 60 year peak and nearly 3 times the average is going to be disruptive.

Consequences for the Economy: A Rolling Expansion?

Portfolio manager Adam Butler of Resolve summed it up well in a Tweet commenting on this chart:

The benefits of a thoughtful, progressive immigration policy are hard to overstate.

However, this level of immigration without a MASSIVE federal investment in urban densification, housing, healthcare, childcare, public transport, education and training, etc. IN ADVANCE is DISASTROUS. https://twitter.com/GestaltU/status/1673701764481073157

What Does This Mean for Investors?

To be clear, this is an investment blog, not a political blog – so what does this story have to do with your investments. That’s the Good News. Have you noticed that the recession that has been forecast for over a year now always seems to be six months away? Consensus views change slowly. Ed Yardeni, a reliably bullish economist has this to say: “The permabears will have to postpone their imminent recession yet again based on today’s batch of US economic indicators, which suggests that our “rolling recession” is turning into a “rolling expansion.” https://www.yardeniquicktakes.com/the-promised-land/

The Growing Possibility of Economic Growth

As investors we have to consider the possibility that the bulls are right. How could the consensus have been so wrong? One of the confounding economic realities is that we have come through a period of unprecedented spending. How unprecedented? Consider this, the US spent $4.1 trillion dollars (inflation adjusted) to fight World War II. They spent over $8 trillion on COVID. https://www.bloomberg.com/opinion/articles/2021-03-11/stimulus-checks-biden-s-war-on-covid-demands-wartime-spending#xj4y7vzkg Canada also spent twice what we did on World War II (but emerged with no new industrial base for our ‘investments’). These numbers, like our recent population growth are complete statistical outliers.

Economists using historical precedents to predict future housing prices and economic growth may have no relevant historical precedent to draw from. They may be flying blind.

We have never grown our population at this rate. No one knows what the ramifications are for housing, healthcare etc.

I’m no economist (thank goodness) but if population growth has transitioned to a higher annual expected rate (our current immigration policy represents approximately a base case of 1.3% per year floor from immigration alone) the recession call may be off base.

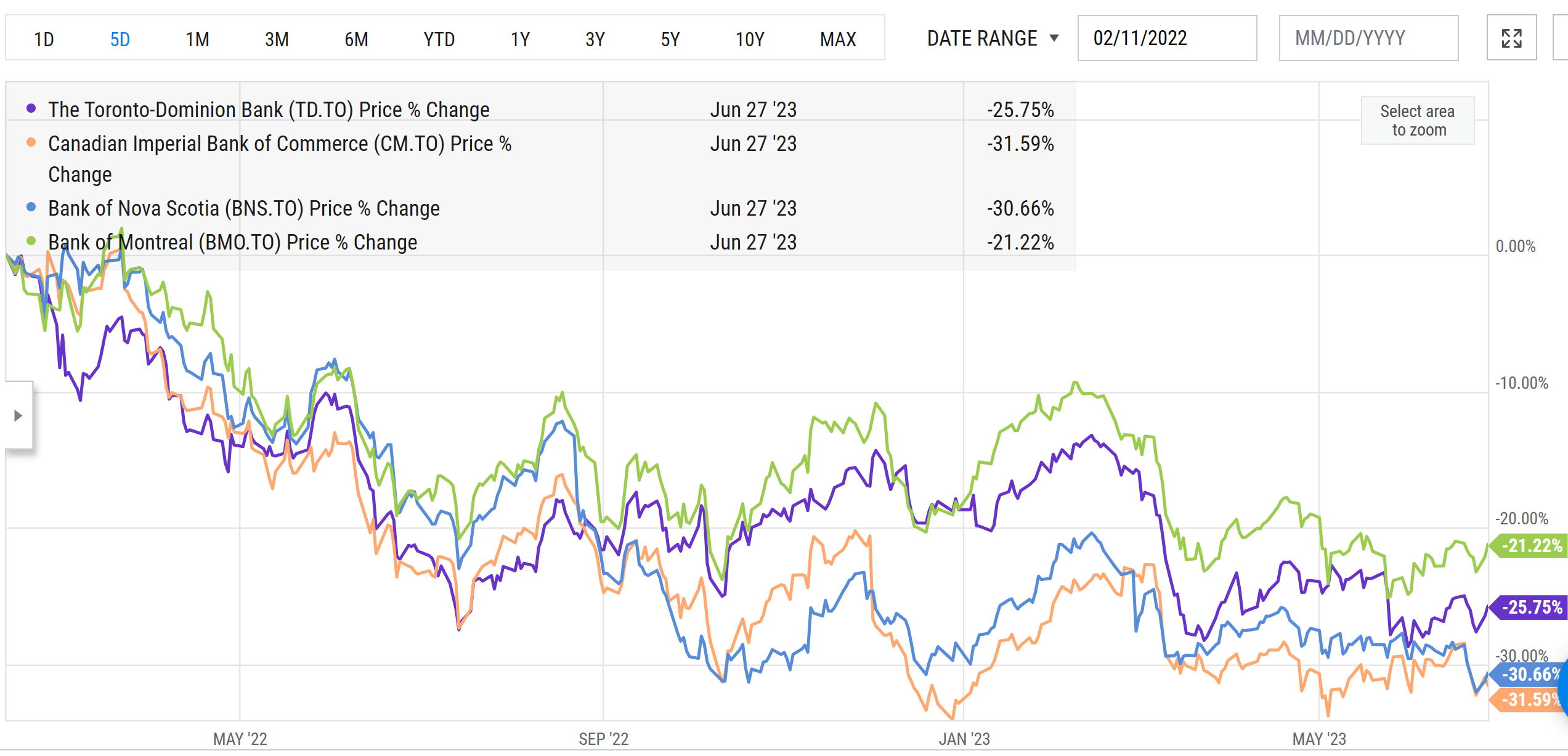

Who wins if that is the case? Obviously not homebuyers. But perhaps the banks? The Canadian banking sector is down substantially from the highs of February 2022. Several are down 25 to 30% and sporting dividend yields of over 5%, some well over 6%.

source: YCharts

Banks May Be the Winners in This Scenario

If we are going to avoid a recession, it seems to me that these banks are beginning to look attractive. I’m not blowing the “all-clear” whistle just yet, it still seems to me that our Central Banks are determined to inflict more damage on the economy, but as investors we have to consider the increasing possibility that the worst is over.

Maybe the bark of the economists is worse than their bite. Meanwhile, Rumble continues to be vigilant.