source: Midjourney

One vehicle you hear before you see. The other you feel in your chest before you see. A whine transforms into a high-pitched scream as the Formula 1 race car’s turbocharged engine, revving at nearly 15,000 rpm causes you to cover your ears involuntarily. By contrast, the deep throaty roar of the naturally aspirated V8 Trophy Truck engine sounds like a rocket at liftoff – the sound impacts your chest long before assaulting your ears. Differences aside, both vehicles are engineered for top speed – they just run on different courses.

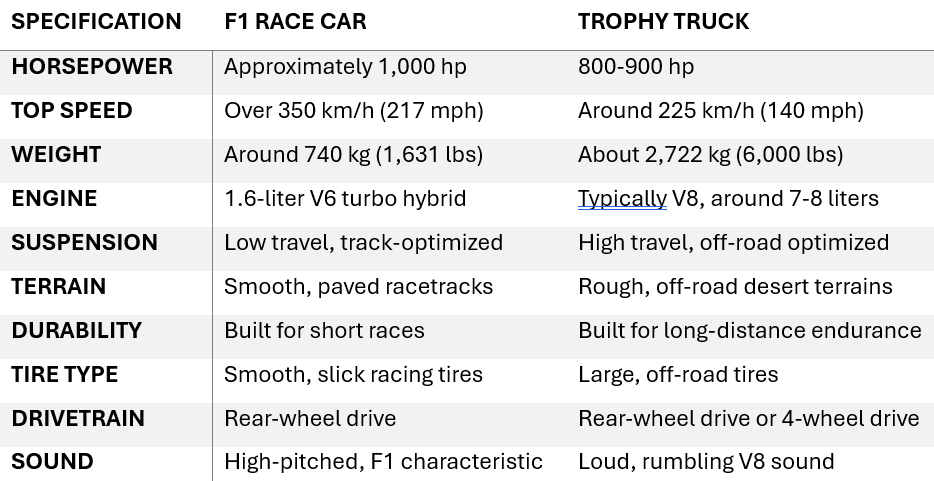

A casual glance at their specifications illustrates just how different these vehicles are. Which would you rather drive? Me, I’d pick the Trophy Truck – not that I’d want to drive it at 225 km/h (well maybe 😊). I’m more a Coke than Perrier kind of guy – but that’s just my preference. What about you?

Investors exhibit preferences too – for the last several years the clear preference has been for the F1 race car of investments – technology and “growth” stocks. I’ve written a lot about the subject and am an enthusiastic supporter. But they aren’t the only race in town. Coming up on the inside, to overtake the F1 car is a burly Trophy Truck!

source: Midjourney

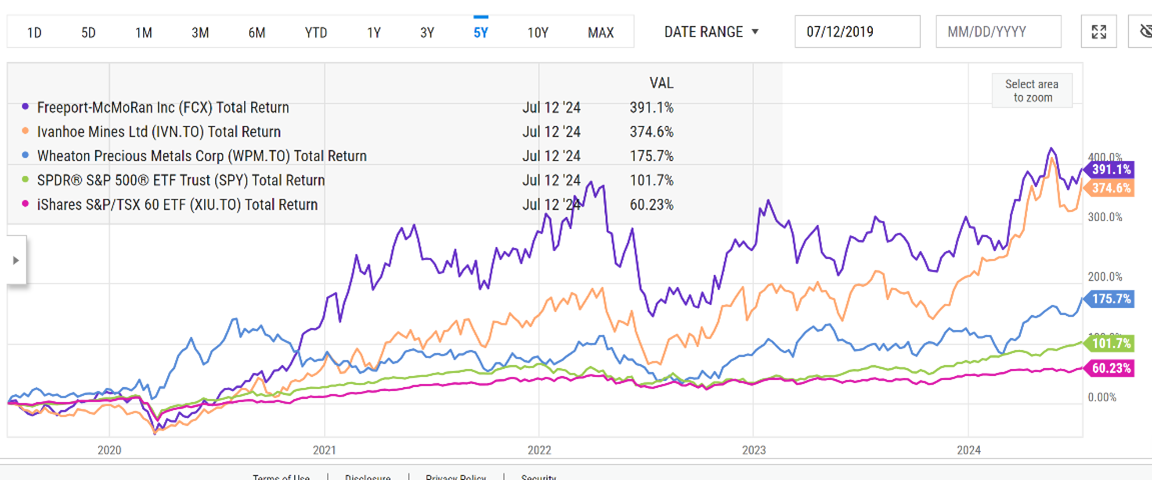

Imagine driving on the 417 in the fast lane. You look in your driver’s side mirror and there, blasting along the grass median, you see a Trophy truck overtaking you in the rough -throwing mud and grass in its path! That was my reaction when I plotted the five year returns of copper and gold producers compared to the S&P 500 and TSX 60.

source: YCharts.com

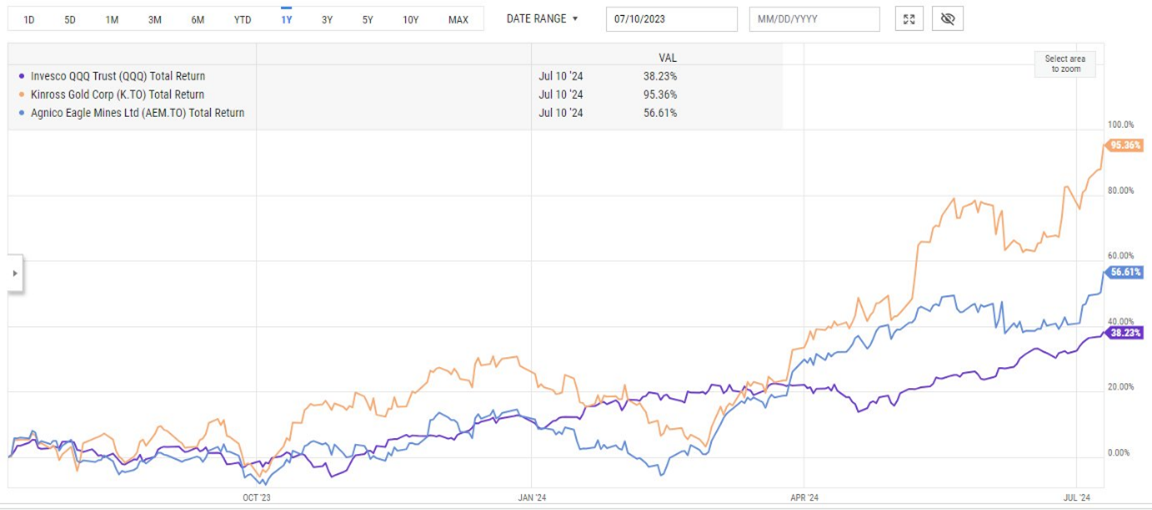

Some of the large companies in the much disliked mining sector have almost 4x’d the S&P 500 over the past 5 years. If the energy transition is to occur, more copper will need to be mined than has ever been produced to date. The Gold sector is also coming on strong as well. Over the past year it has done even better than the “F1-like” Nasdaq Composite:

source: YCharts.com

Happily, investors don’t have to choose between race vehicles – we can own both! I particularly like owning commodity related companies not just because of how fast they’ve been growing lately – I like them because they tend to have low correlation with the F1 type Technology names. By owning both we can make the ride less bumpy!

At the end of the day – investors might prefer this type of truck!

source: Midjourney

Glen