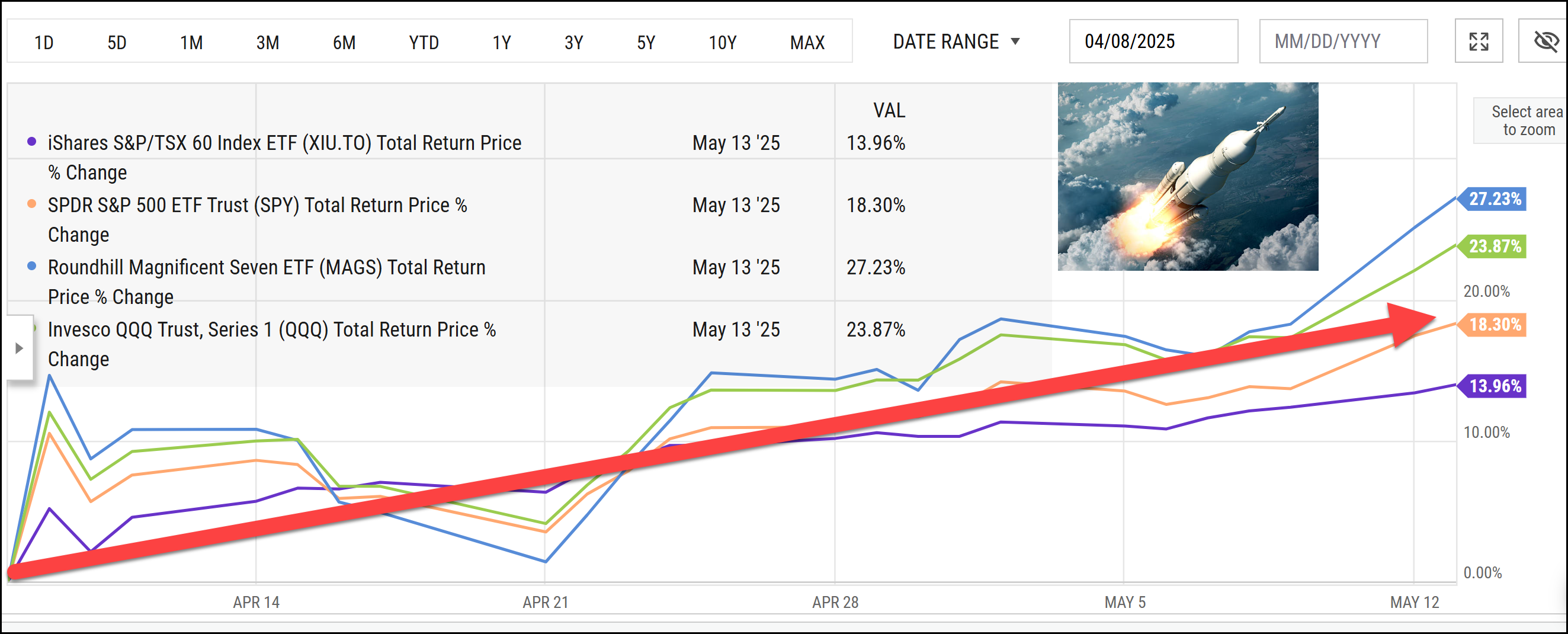

Market Surge: A Rapid Recovery from the Lows

U.S. stocks have now rocketed almost 20% from their recent lows. Canadian stocks have bounced almost 15% and the Magnificent 7 tech stocks have advanced over 27% from the “end of the world” lows seen less than 5 weeks ago.

YCharts.com © 2025 YCharts, Inc. All rights reserved

A Recovery Rooted in Historical Patterns

This stunning recovery should come as no surprise to you. For the last several months I have been writing and creating infographics to illustrate that history predicted exactly this outcome (though the time frame is a surprise). Sometimes I need to take a victory lap, so bear with me while I repost some of the info-graphics I created to illustrate this point.

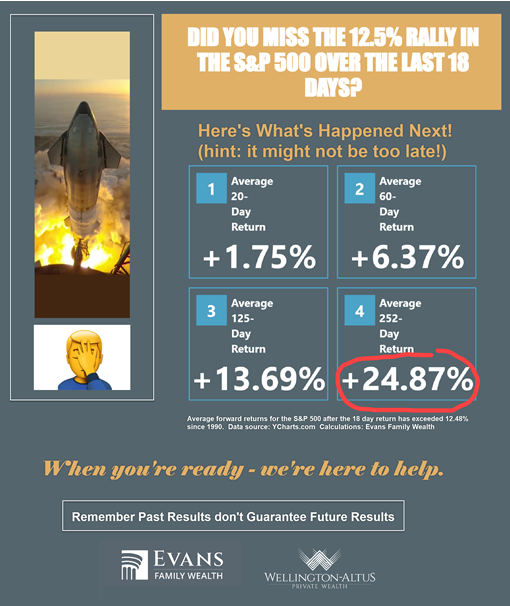

Navigating Volatility: Avoiding the Selloff Trap

After President Donald Trump extended the tariff negotiation period for 90 days, lots of pundits suggested “selling the rally”. Not us:

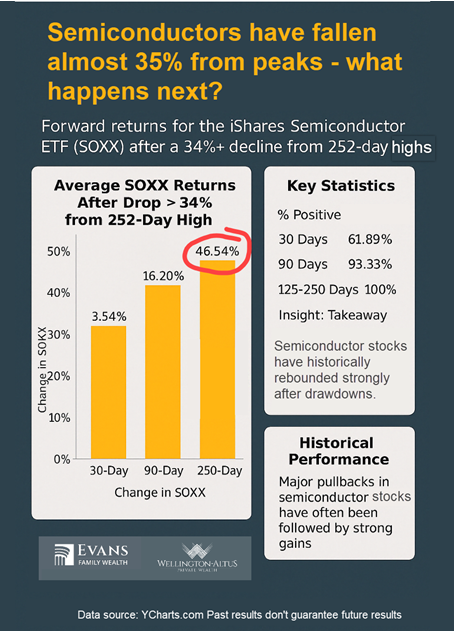

Betting on Innovation: Semiconductors as the New Oil

At the low, semiconductors (which we view as the “new oil”) had fallen 35% and cynics were calling the sector a bubble. Not us:

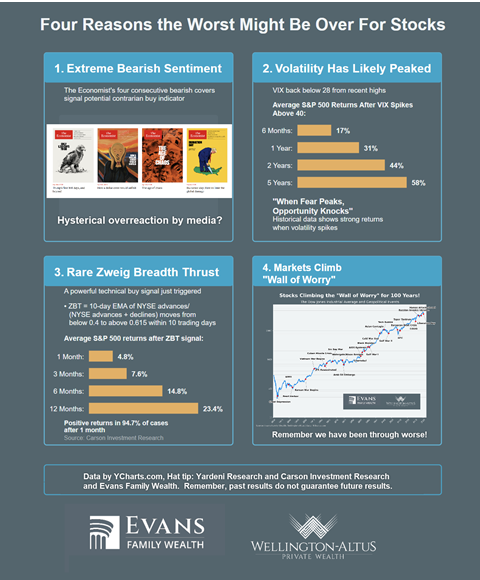

Media Noise vs. Market Reality

Finally economists were ratcheting higher their recession probabilities and magazines were printing bearish cover stories and forecasting new lows for stocks. Not us:

Historical Trends Show Why We Stay Bullish

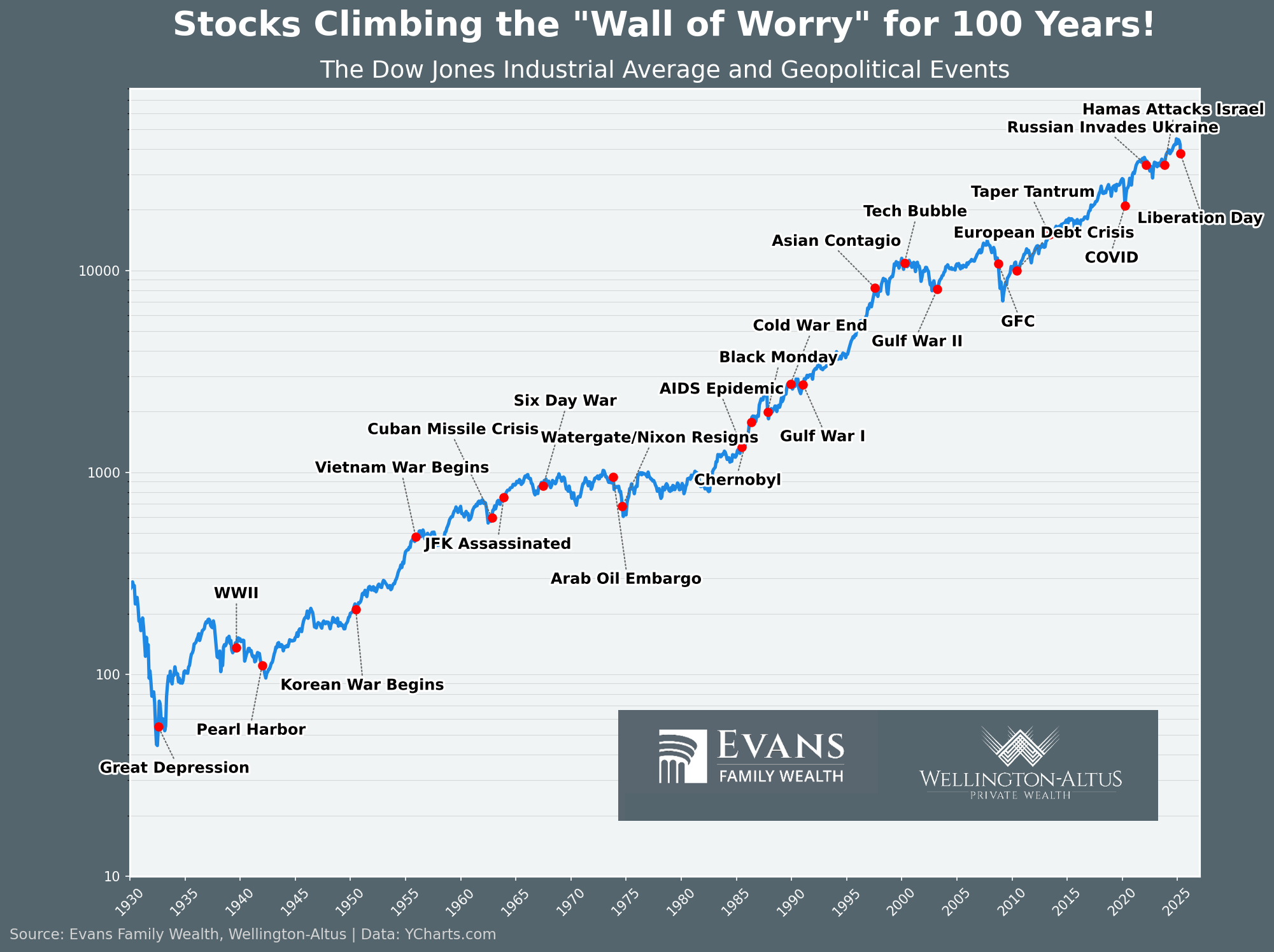

Let’s blow up the chart in the lower left quadrant of the infographic above because it illustrates why we default to a bullish outlook – history:

Investor Discipline: The Power of Holding Tight

Congratulations on holding tight and not making the mistake of panicking out of stocks—I’m serious—you don’t realize how many capitulated out. Well done.

Caution Ahead: Interest Rate Risks Loom

Now a word of caution. Briana and I aren’t “spiking the ball”. Problems abound (particularly in Canada where the “elbows-up” rhetoric has morphed into glum silence). While Trump’s climb-down on tariffs is good for stocks it is proving more worrisome for bonds (interest rates are rising on U.S. long term bonds). If that persists, the stock market will have something new to worry about soon.

Investing Is an Infinite Game

That said, let’s celebrate while we can! Investing, like global trade, is an “infinite game”. There are no final victories or defeats, just iterations along a path that generally climbs up and to the right!

Watch the Video: Market Vindication: Why History Always Beats Hysteria

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen