Why Mexico’s market is trouncing Canada’s—and the one move that could flip the script.

Current Trade Tensions Between Canada, the U.S., and Mexico

Two World leaders sit in separate but identical interrogation rooms. Hours pass. Finally a door knob turns and a familiar silhouette fills the doorway.

“Mark,” President Donald Trump booms, sliding a chair around to straddle it. “I just had a beautiful chat—a perfect chat—with President Claudia Sheinbaum. You won’t believe what she just offered me… ”

And just like that, Canada realizes Mexico has already made a deal.

What 2018 Taught Us About U.S.-Mexico Trade Strategy

Veteran trade-watchers will remember this playbook. During the 2018 NAFTA rewrite, Mexico signed its side letter with Washington weeks before Canada, leaving Ottawa to haggle over dairy quotas while Mexican negotiators cooled their heels outside the room. They hated it then, but they never forgot how well it worked.

Fast-forward to February 2025: the U.S. slaps 25 % tariffs on almost everything crossing both borders. Mexico moves first—agreeing to deploy 10,000 National Guard troops on migration duty and share real-time fentanyl intel. In return it pockets a 90-day reprieve that shields roughly half of its export basket. Canada, by contrast, is singled out for extra levies on “non-USMCA” goods, and Canada’s calls go straight to voicemail.

Mark Carney’s first months in office were defined by earnest sound-bites, “We’ll be our own best customer,” “Canada is the most European non-European country”—great campaign slogans but Carney knows nothing replaces America as Canada’s most important trading partner (even if fickle). Prime Minister Carney is well positioned to step onto the pages of history by earning the faith Canadians placed in him and dealing with Trump.

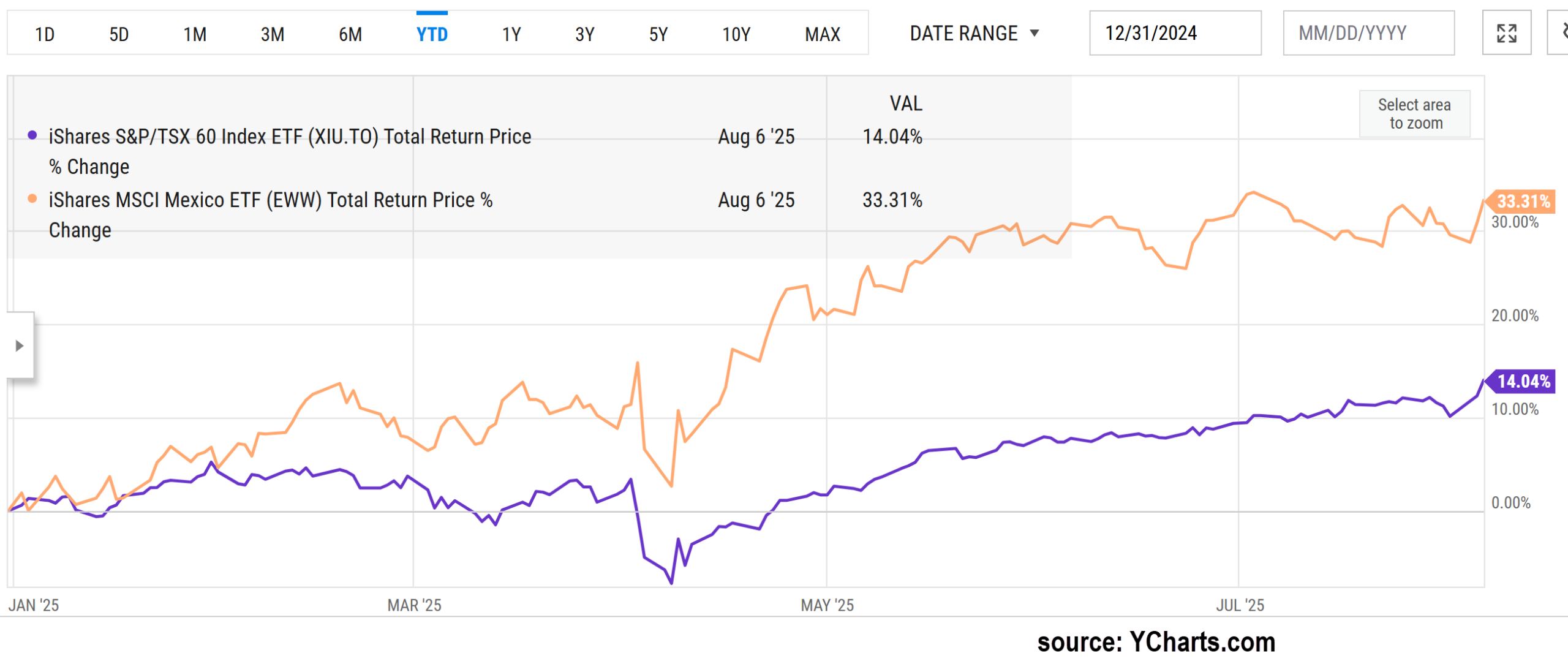

YCharts.com © 2025 YCharts, Inc. All rights reserved

Why Mexico’s Market is Surging Ahead in 2025

Since New Year’s Day the iShares MSCI Mexico ETF (EWW) has surged 33.3%, while the iShares S&P/TSX 60 (XIU) is up a respectable but more modest 14%.

The Key Differences Between Mexico’s and Canada’s Performance

- Mexico’s growth engines are humming. Almost zero exposure to oil in the EWW index means Mexico’s market is not being dragged down by energy, while the rest is growing under Sheinbaum’s leadership.

- Canada’s sector mix is fighting the tape. Contrary to whispers, the Big-Six banks have actually rallied, yet they can’t offset laggards: energy (16% of The TSX 60), export-oriented manufacturing, and a deflating housing bubble, all of which are hamstrung by fresh U.S. tariffs.

- Valuation math favours Mexico. EWW trades at ~13 × earnings and yields 4.4%, while XIU sits near 20 × with a 2.7% dividend. Investors are being paid extra to stomach Mexico’s volatility.

Why the stakes just went up

Tariff tempers have cooled in Canada as the consensus focuses on how much of trade is protected by USMCA. Elbows have come down, but so has the chance that USMCA rolls over unchanged in next summer’s mandatory review. The Prisoner’s Dilemma is playing out in global trade. For years, the parties of USMCA were referred to in the press as the “Three Amigos”, that number seems to have fallen to two. Trust has eroded and they seem to be in more of a standoff than a bromance. Everyone is acting as though USMCA is back on the table—and that means a deal must be struck.

Could Carney’s Diplomatic Pivot Flip the Script?

Sheinbaum holds momentum. Her early concessions bought goodwill in Washington and fresh capital at home. Carney meanwhile has an opening to turn early stumbles into statesmanship. The model is right in front of him: Britain’s Keir Starmer and Mexico’s own Sheinbaum both neutralized Trump’s bluster by going straight to the man, not the mandarins. If Carney swaps photo-op slogans for a blunt message: “Our greatest client is America, and I intend to make us their best supplier” he can still reset the narrative.

What This Means for Canadian Investors

Canada still owns the heavy artillery: a banking system foreign investors trust with their rainy-day cash, a warehouse of critical minerals, and the only G-7 crude that doesn’t sail through the Strait of Hormuz. Those are exactly the things Washington wants nailed down before the 2026 USMCA review.

Mark Carney can turn recent stumbles into lasting wins by walking straight into Trump’s office and pitching a “North-American Security Bundle”. A guarantee of U.S. access to Canadian oil, copper, nickel and rare earth metals, fast-tracked supply financed by the safest banks on the continent—in exchange for bulletproof tariff relief. It’s a deal only Ottawa can offer, and it would flip the current market narrative that favours Mexico.

Timing is everything. If Carney waits for the White House to call, Mexico will keep setting the agenda and investors will keep paying up for EWW. If he goes directly to Trump, he rewrites it and gives the TSX a fresh catalyst to outrun its southern rival once again. We should all wish him success!

Watch the Video: USMCA Standoff

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen Evans