The International Space Station and the Sun source: Andy McCarthy

Perspective Shifts Everything.

When the International Space Station crosses the Sun, a football-field-sized marvel shrinks to a pin-prick against a star vast enough to swallow a million Earths. That contrast reminds us how insignificant the week’s headlines (tariffs, leadership shuffles, even sudden flare-ups overseas) truly are beside the colossal, long-term forces that power wealth creation.

The Numbers Behind the View

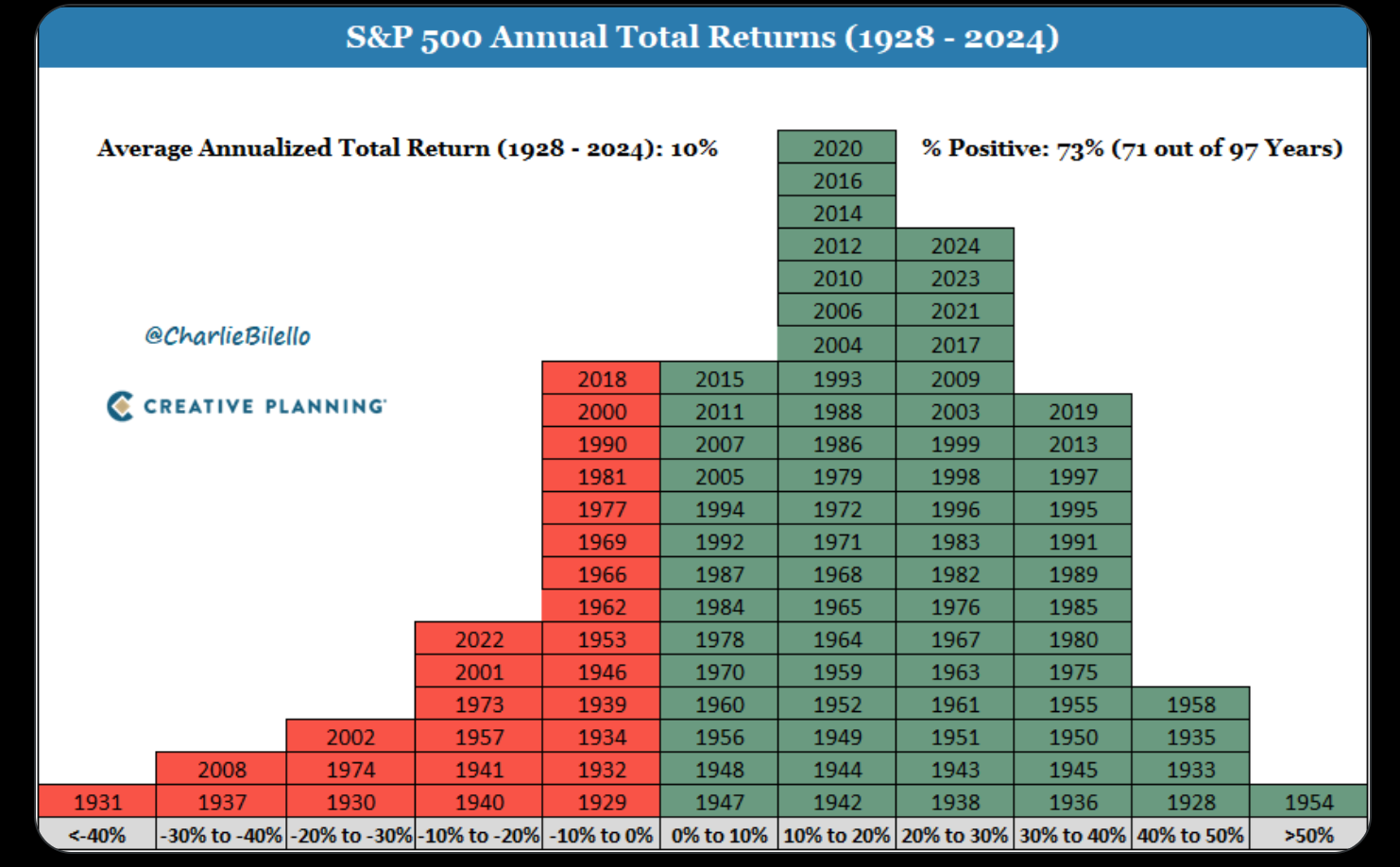

- Since 1928 the S&P 500 has compounded ~10 % a year.

- Only four of those 97 years landed within two percentage points of that average.

- Annual results have swung from +54 % to -44 % proof that the “average” hides wild extremes.

New Market Highs Are Not Warnings—They’re Launch Pads

This month the Nasdaq and the S&P/TSX 60 both punched through fresh all-time highs. New highs are not a ceiling; they’re the launch pad. Wealth compounds fastest when markets leap from one record to the next—just like a rocket clearing the tower.

YCharts.com © 2025 YCharts, Inc. All rights reserved

What It Means for Your Portfolio

- Stay diversified, stay seated. History rewards investors who remain buckled in for the full flight.

- Canadian tilt still matters. Banks, utilities and pipelines deliver the income that smooths the ride while our growth names achieve escape velocity.

- Volatility ≠ failure. Sudden downdrafts (tariff headlines, Middle-East scares, policy pivots) are the price of admission.

Your Next Step

If new highs make you uneasy—or if life changes mean your time horizon has shifted—let’s chat. Book a 15-minute review and we’ll make sure your allocation still fits your plan.

Watch the Video: 3 Investing Lessons from Record-Setting Markets

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Congratulations on keeping your eyes on the horizon. The rumble you feel? That’s the next stage igniting.

Glen Evans