When the TFSA was introduced in 2009, most Canadians pictured a piggy bank. The government called it a “savings account,” and the banks marketed it that way, so people treated it like a safe place for cash or GICs. But that was the wrong image entirely.

What they should have pictured was an acorn. The TFSA was never meant to be a piggy bank. It was a seed with the potential to grow into something far greater. Over the years, contribution limits have expanded, and today Canadians who have been eligible since the start have $102,000 of room. That tiny acorn has already become the trunk of a young oak, strong enough to support decades of tax-free growth.

The only problem? Ottawa called it a “savings account.” Branding matters, and that one word led millions of Canadians (including advisors) to underestimate its power. Imagine if instead of the clunky “Tax-Free Savings Account,” they might have rolled out the Future Freedom Account.

How Advisors Missed the Forest for the Oak Trees

From the start, many in the industry got it wrong. They told clients to use the TFSA for bonds and GICs, since interest income is “fully taxed” outside. On paper, that seemed logical. In practice, people used it to fund a holiday or new car. In doing so they missed out on extraordinary growth potential.

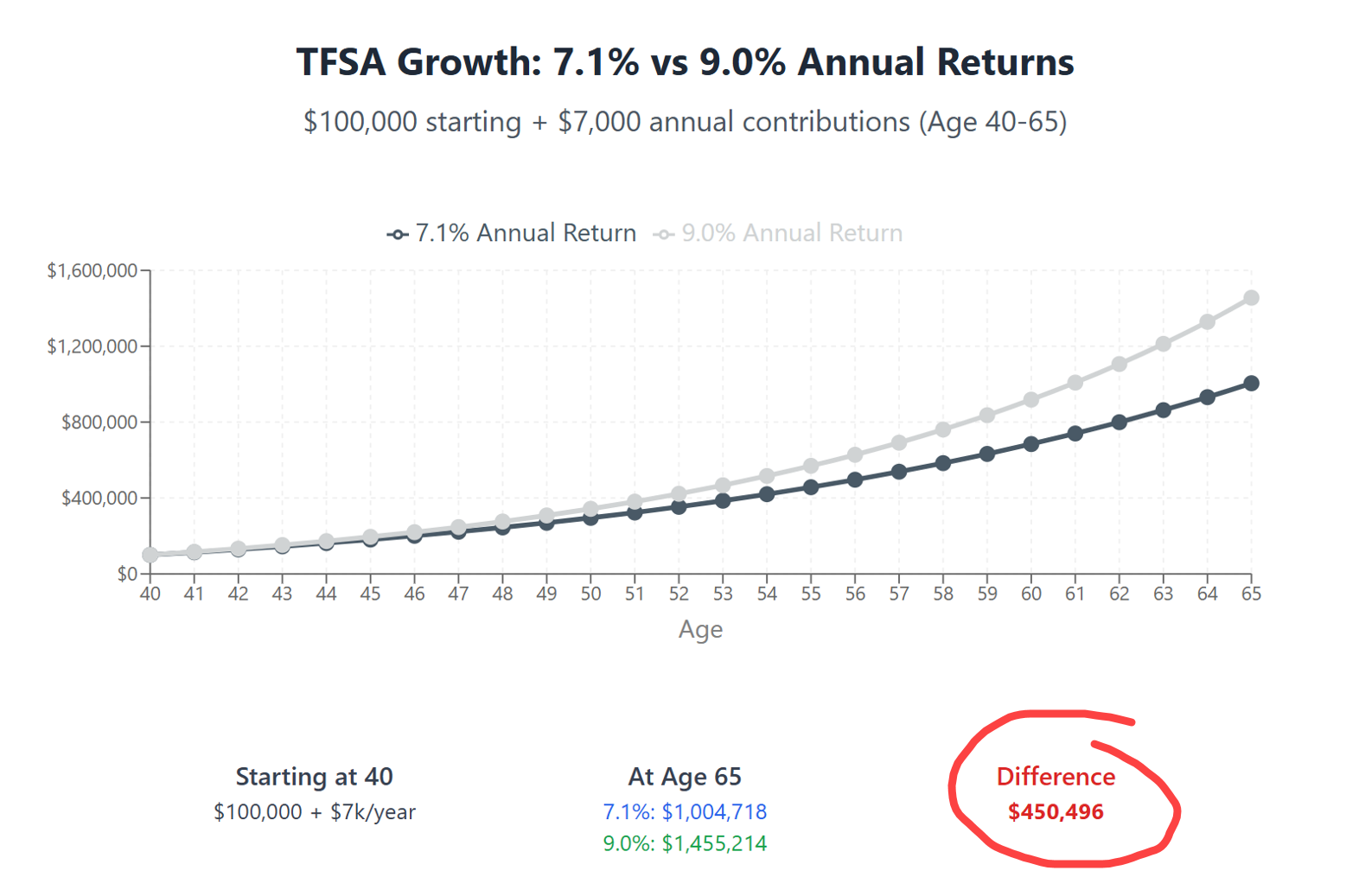

Let’s dig a little deeper in the illustration above. We modelled an aggressive 9% rate of return—some would say that’s too high, so below we compare it to a 7.1%, “balanced” return. Do you see what I see? Over 25 years a gap of over $450,000 in performance widens. Don’t you want that in your TFSA?

That’s the second lesson today. It’s not just that you should think of your TFSA as a Freedom Fund—but that you should house your most performant investments in the TFSA. (For reference my North American Focused Equity Portfolio has averaged over 12% annual returns over the past 14 years.) That delta continues to grow the longer you hold the TFSA.

To Infinity and Beyond—Let it Grow

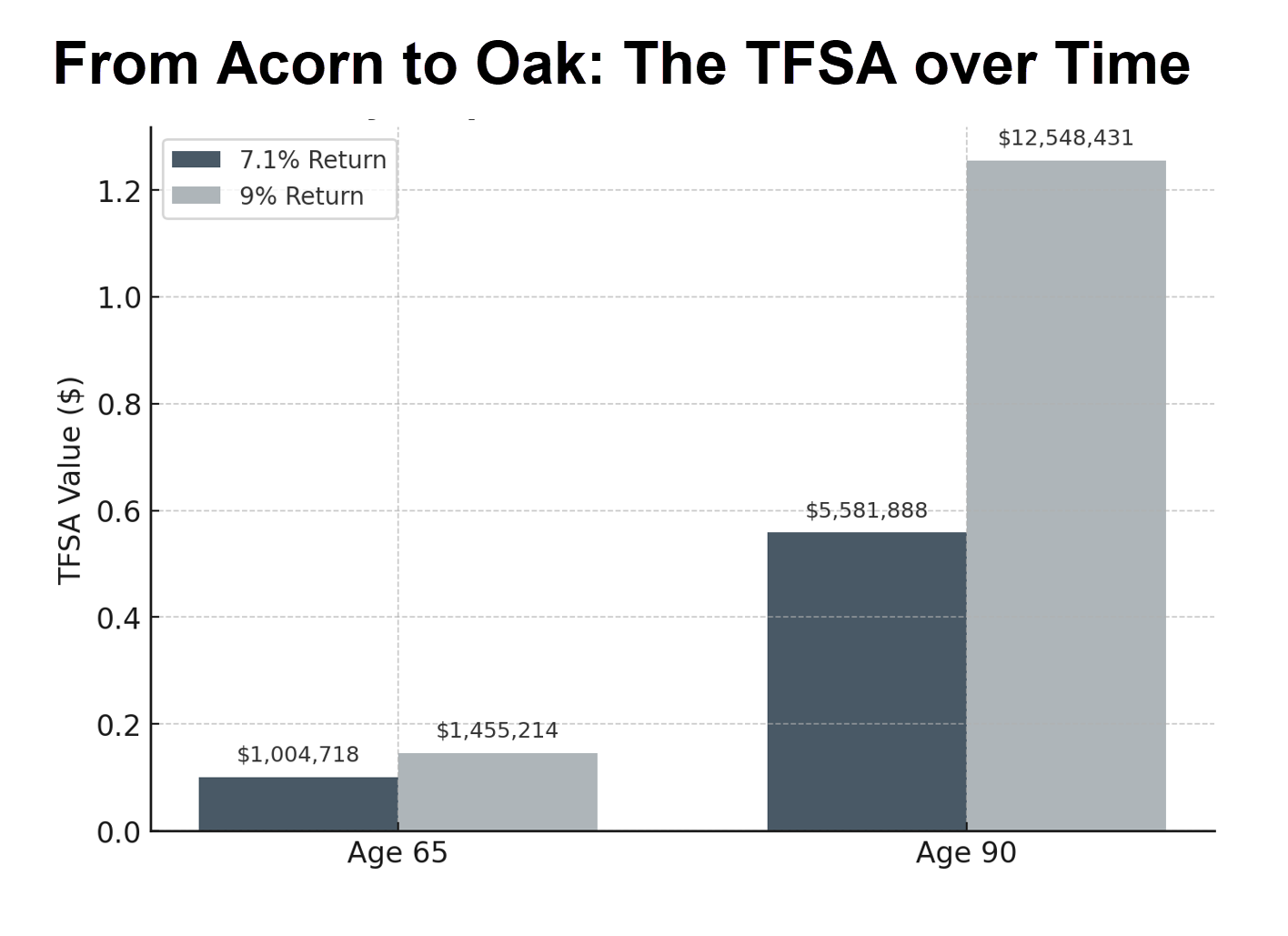

Imagine that your RRSP and non-registered savings were sufficient to fund your retirement—your TFSA could then just continue to grow into a mighty oak tree to shade your beneficiaries with tax free funds. How high do you imagine that tree could grow?

This is generational wealth. To be clear, I’m not telling you not to withdraw from your TFSA. I’m telling you to withdraw from it last. Let it grow. The point of the exercise is to remind readers of the opportunity that Prime Minister Stephan Harper and Finance Minister Jim Flaherty created for them. Every single Canadian investor has the potential to create generational wealth if they use the TFSA to maximum effect.

That is the difference between treating the TFSA as a piggy bank and treating it as a Future Freedom Account.

The Blueprint for Growth

In my first career as an architect, we created designs and oversaw the construction of our designs. It’s what I do. Currently I’m working on a series of e-books helping investors manage their investment vehicles. I’m finding that much of conventional wisdom gets it wrong.

The “location, location, location” cliche is a useful reminder to reimagine the roles of non-registered savings, RRSP/RRIF savings and tax free savings in your wealth building strategy. The first e-book to come out will be on the TFSA. I call the TFSA the Penthouse—it is the most prized location. Expect to see more news about this soon.

Help me Get the Word Out

I’m convinced that many Canadians haven’t grasped the significance of the TFSA opportunity. Your brothers and sisters, nieces and nephews, your children and your friends haven’t seen the opportunity for what it is. Please forward this post to those you think might benefit—tag me in the email so I can follow up directly. Now more than ever, we need to share the Good News!

Glen