The Geological Origins of the Montney Formation

Long before the Rocky Mountains soared, before the clash of tectonic plates shaped the land we know as Alberta, a vast, shallow sea covered its western edge. Over millions of years, sands and silts quietly settled on the ocean floor, layer upon layer, as the world above evolved. These sediments would slowly compress, trapping whispers of ancient gas within.

The Discovery of a Hidden Resource

Hidden for over 200 million years, this buried treasure remained undiscovered until the 1950s. But it wasn’t until the early 2000s, when a revolutionary technique called fracking unlocked its true potential, that the Montney Formation was revealed as one of the world’s richest sources of natural gas.

source: ChatGPT

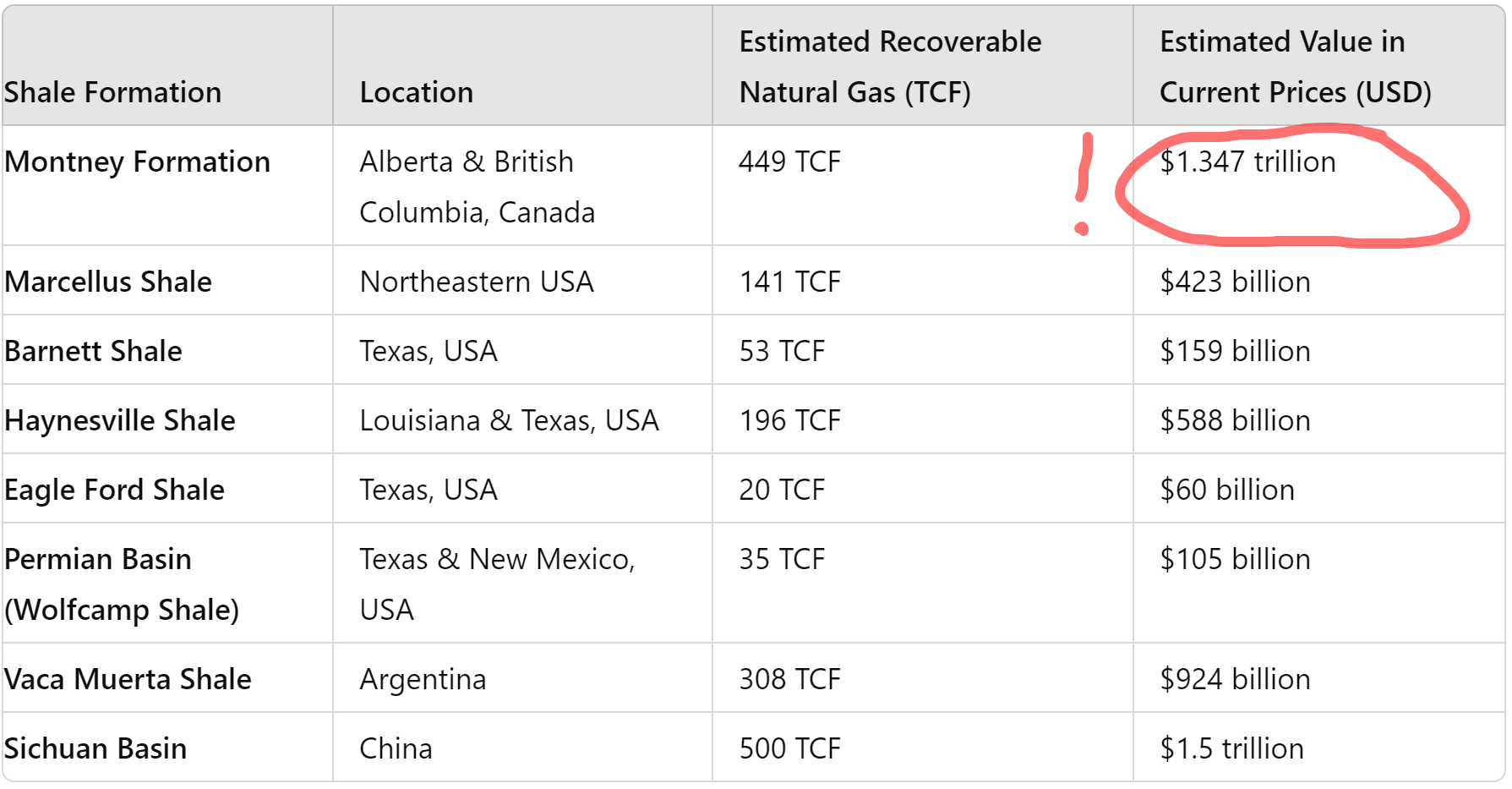

The Immense Value of the Montney Formation

The Montney Formation’s vast potential has been likened to the legendary shale gas formations of Texas, yet its scale is even more staggering. With an estimated value of US$1.3 trillion dollars, the Montney holds enough natural gas to power North America for decades. It’s a colossal resource, dwarfing many other global reserves. But the true value of the Montney lay dormant until recent innovations in infrastructure made it accessible on a global scale.

The Long Road to Infrastructure Development

For decades, the immense promise of the Montney Formation was tantalizingly out of reach. It took nearly two decades of pushing, lobbying, and navigating bureaucratic red tape before the crucial infrastructure was finally put in place, allowing the Montney to become the powerhouse it was always destined to be.

Coastal GasLink Pipeline photo: CBC.ca

The Role of Pipelines in Unlocking Montney’s Potential

At long last, the completion of critical infrastructure has unleashed the true potential of the Montney Formation. Pipelines like the Coastal GasLink have become vital arteries, carrying the long-awaited bounty from this remote region to the West Coast. From there, newly operational LNG facilities, such as the LNG Canada terminal in Kitimat, transform the gas into a liquid state, ready to be shipped to energy-hungry markets across Asia. This long-overdue network of infrastructure has finally elevated the Montney from a promising regional asset to a global energy powerhouse, firmly establishing Canada as a pivotal player on the world stage.

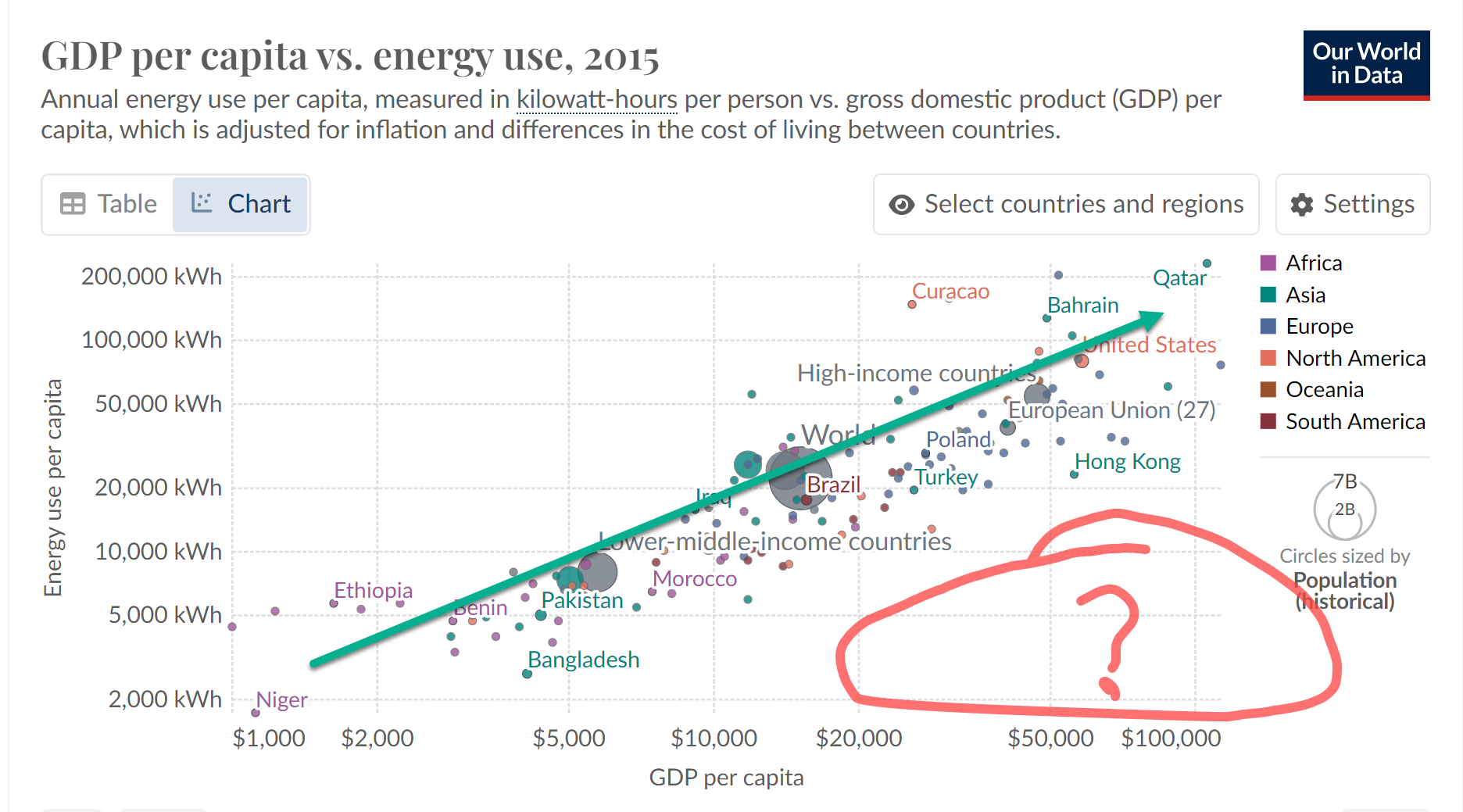

A Pragmatic View on Energy Development

Of course not everyone will share my enthusiasm for these developments. I’m an energy pragmatist—this chart guides my thinking.

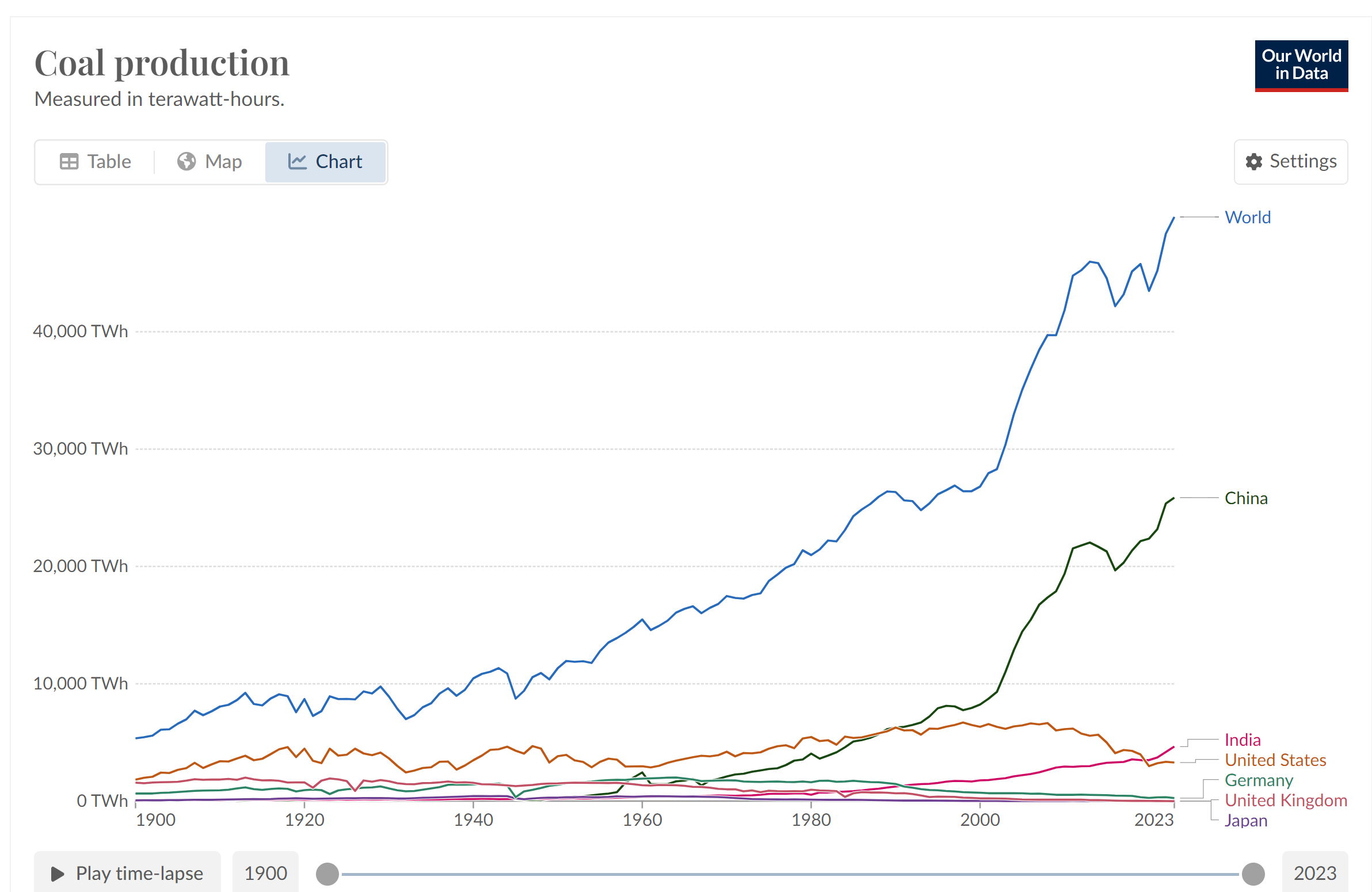

Energy and Quality of Life: A Fundamental Connection

Energy use scales with quality of life. I circled the empty bottom right corner to illustrate that there are no wealthy countries that do not consume large amounts of energy. Energy is life. We don’t get to make these rules. For those still unconvinced, LNG and natural gas remain far more desirable than coal and the rumours of its demise remain vastly overstated.

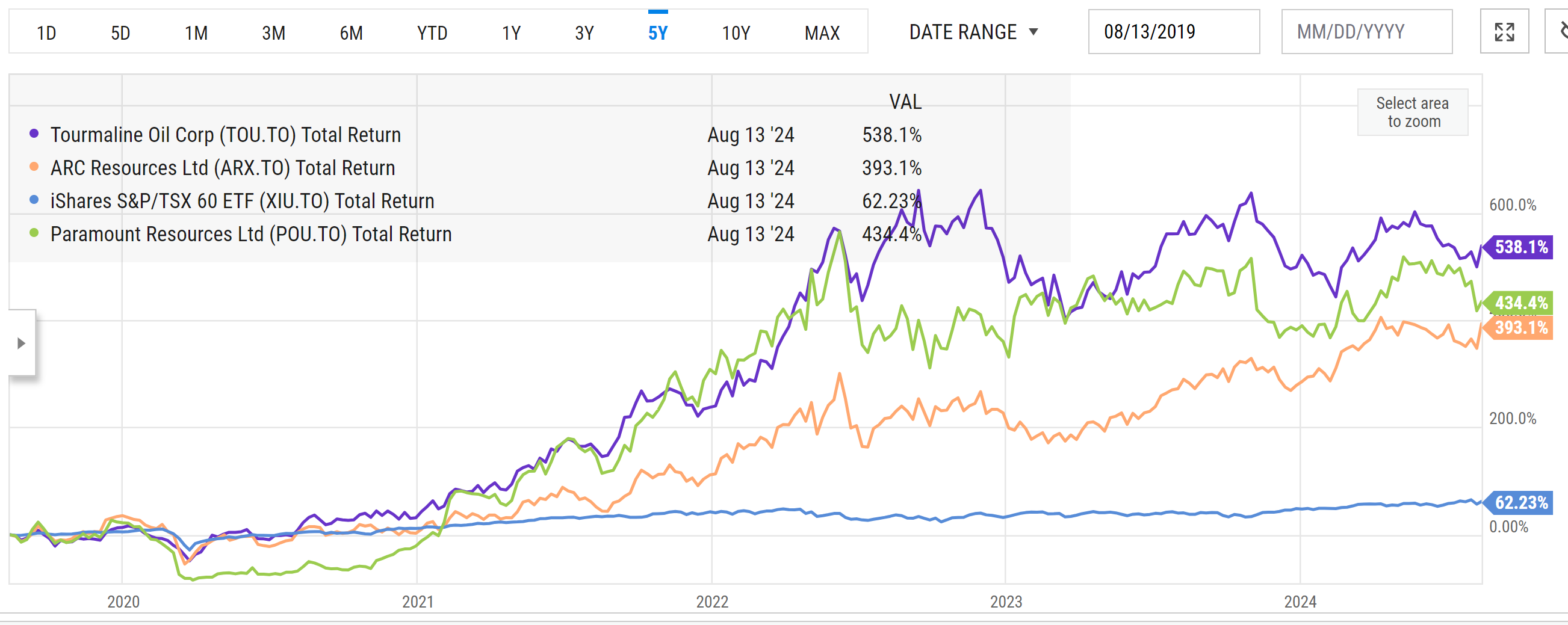

Companies Targeting the Montney Formation

While there are several companies with operations targeting this formation, here’s a snapshot of a few. I’ve held Tourmaline and Paramount for sometime now in my Canadian Focused Equity Portfolio and the North American Focused Equity Portfolio.

source: YCharts.com

Canada’s Energy Blessing: A Gift for the World

Canada is blessed with what the world needs—even as it transitions to a low-carbon future. This 200-million-year-old gift in the making can help investors and the world prosper.

Watch the Video

Want to hear Glen’s take in more detail? Check out our latest video on YouTube and subscribe to stay up to date.

Glen