Detonating a Tactical Financial Nuclear Weapon: Sowing the Seeds of a New Financial World Order?

The Ukraine/Russia crisis may mark a historic moment in the evolution of geopolitical balance. While there have been calls for a military response by the West, we should not overlook the significance of the sanctioning of the Russian Central Bank. A tactical financial nuclear weapon has been detonated and we have entered a new cold war. However, in this era of globalization, the consequences may be far reaching. For one, the eurodollar and petrodollar markets are no longer “safe” to those countries who are not friends with the West.

With the U.S. explicitly willing to sacrifice the position of the U.S. dollar as the dominant global reserve currency, will today’s events be remembered by generations to come as the historical pivot point that shaped a new financial world order?

Download this article as a PDF.

“With proper tactics, nuclear war need not be as destructive as it appears.” — Dr. Henry A. Kissinger

The Ukraine/Russia crisis has highlighted a historic moment in the evolution of geopolitical balance. While the humanitarian perspective cannot be overlooked — and for which we should reserve a significant amount of empathy — from an economic perspective, the current events may well be remembered as a pivotal period in financial history for generations to come. By sanctioning the Russian Central Bank, the West has detonated a financial tactical nuclear weapon — a fundamental turning point that may usher in a new era for financial markets. However, in doing so, the U.S. has explicitly acknowledged that it is willing to relinquish its position as having the world’s reserve currency, opening the doors to a potential global currency war.

Investors should take note: In the short term, the economic sanctions placed on the Russian Central Bank will tighten current financial conditions — with markets already undergoing a historic level of tightening — further slowing global economic growth. But more profoundly, over the longer term this is likely to signal the “official end”1 of the Bretton Woods financial system, the consequences of which may be felt for decades to come.

How Did We Get Here?

Three historic events have shaped the financial markets and allowed the U.S. dollar (USD) to achieve dominance: the post-WWII Bretton Woods Agreement (1944), the Suez Crisis (1956) and the oil shock of the 1970s. Prior to the USD, the U.K. pound sterling was the primary global reserve currency through the 19th century and largely until WWII. Recall that the “current” version of the USD only came into existence in 1914, upon the creation of the U.S. Federal Reserve. In WWII, the U.S. was the main supplier of weapons to the Allies, who paid in gold, thereby making the U.S. the largest owner of gold and the return to a gold standard impossible for the rest of the world.

It was as a result of Bretton Woods that a new monetary system was constructed. The global reserve currency was now the USD, backed by gold. This would signal the death of the British empire’s dominance and the demise of the City of London as the finance centre of the world. The last phase of European colonialism would be replaced by Wall Street.

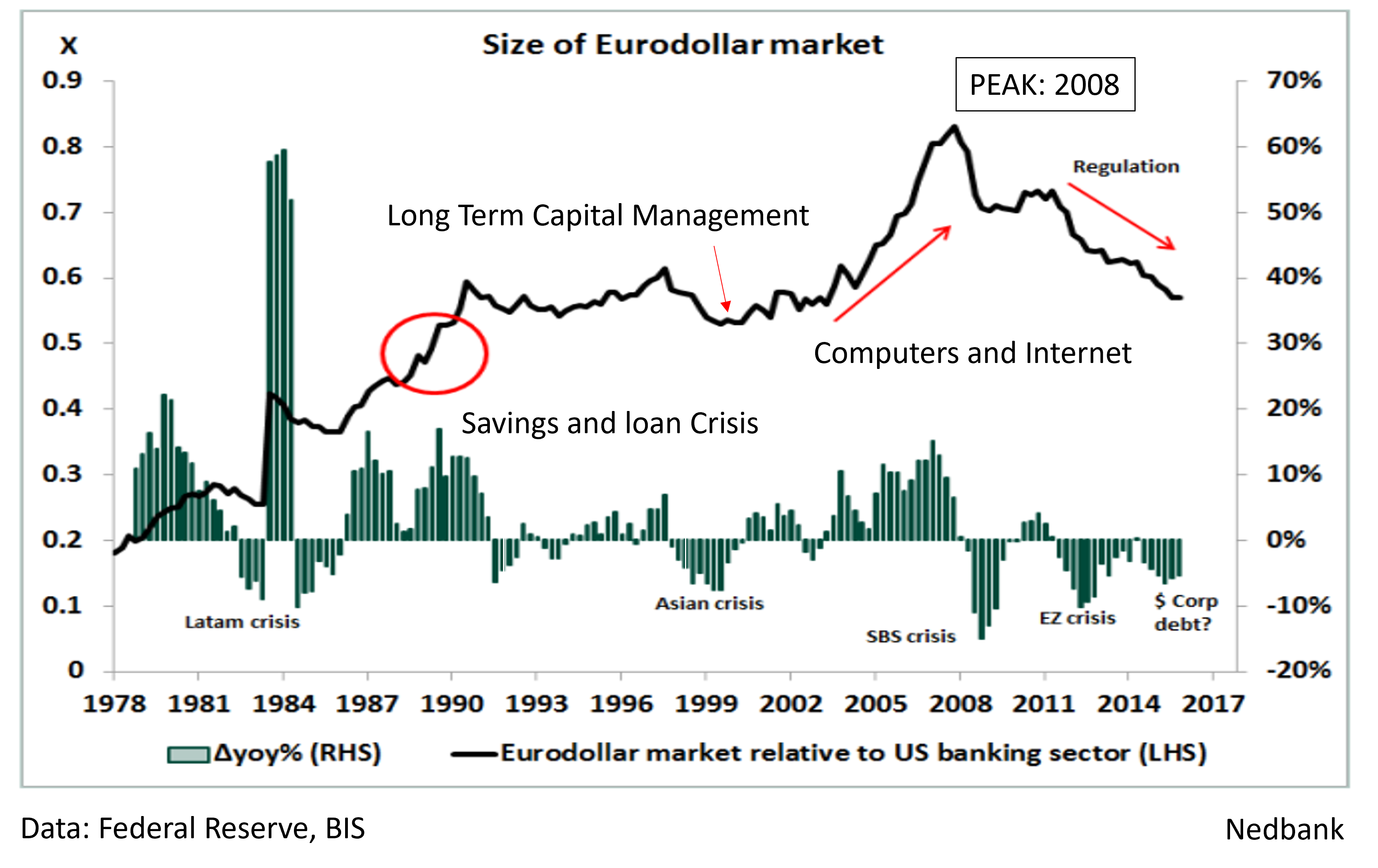

The Suez crisis in 1957 would put in motion an evolutionary process that changed the face of the global banking and financial system through the birth of the “eurodollar” market, an unregulated market of financial innovation. The eurodollar market is simply a ledger system between banks that is not fully transparent and outside the control of traditional banking regulation. While there are varying accounts of its origin, many trace it back to the Soviet Union’s invasion of Hungary in 1956. With fears that Soviet bank deposits in the U.S. would be frozen in retaliation, funds were shifted to a Soviet-owned bank with

a British charter. The British bank would then deposit funds in U.S. banks. Thus, there would be no chance of confiscating those funds due to their association as British. London recognized the demand for this market and it was agreed that these USD transactions would not be subject to domestic laws. As such, the offshore banking and shadow banking markets were born.

The eurodollar system was initially a USD payment system that quickly morphed into a source of funds system. This profound — but mostly ignored — event changed the dynamics of inflation and the global money supply, ushering in an inflationary period that forecasters wrongly assume still exists today.

Evolution of the Eurodollar Market

The oil crisis of the 1970s legitimized the “petrodollar” market. This allowed the USD to evolve from being backed by gold to being backed by oil. Incidentally, during this time, OPEC recycled petrodollars into the eurodollar market in an attempt to shield itself from U.S. sanctions. Soaring oil prices generated large trade surpluses that were denominated in U.S. dollars. In 1971, then-President Nixon suspended the convertibility of dollars into gold, largely due to rising U.S. balance of payments deficits. History suggests that when an empire begins to run deficits, it starts its slow decline. The solution in the 1970s was to get oil denominated in USD. Fast forward to today and the solution is far more complex.

A New Cold War

Today, as a result of the Ukraine/Russia conflict, the world has lost its peace dividend. While some have voiced concerns over a lack of military response from the West, the financial sanctions against Russia may be an equally effective foreign policy weapon. A new cold war is upon us. Yet, in this increasingly globalized world, economic consequences are not limited to Russia and may create potentially unexpected outcomes. For one, the situation is forcing non-Western nations to consider diversifying from the USD payments system. Is this the beginning of a new financial world order?

The war has introduced a significant exogenous shock on the world economy, its magnitude and persistence still highly uncertain. Russia is one of the world’s largest exporters of commodities. Ukraine is equally rich in commodities, including wheat and neon — which is used in the production of semiconductor chips. Commodities are fungible, it is true, but Russia needs Europe as a client — too many wrongly assume that Russia can simply divert oil and natural gas from Europe to other areas. It takes time to build new pipelines to supply markets. Russia’s Nord Stream 2 took years to construct and cost over $11B. Regardless of war, oil always finds a home if there is a market for it — most likely, off-market energy transactions are expected to become more prominent.

More profoundly, we may be witnessing the end to the era of the petrodollar and the eurodollar that financed global growth and supported the USD as the global reserve currency. No longer seen as “safe” for those who are not friends of the West, alternatives to transacting in USD are now being considered. Even Keynes prophesized at Bretton Woods that USD dominance would be short lived. Today may be the turning point.

Russia is now forcing European payments for oil and gas to be in rubles. Saudi Arabia has also signalled it may accept Chinese RMB in payment for oil, in perhaps another move that signals the petrodollar’s impending fate. China’s importance to Saudi Arabia as an export market has increased — the Saudis have been China’s top oil supplier this year, a position that Russia temporarily held in December 2021. Under pressure from the West, China has been deliberately quiet, methodically rallying support among developing nations while it continues to oppose sanctions against Russia.2

Will China Emerge as Dominant?

If China wants to displace the USD with the yuan as the global reserve currency, it has a far ways to go. Currently, the greenback comprises around 60% of global reserves versus the yuan’s 2.5%. In fact, China still uses the USD to settle its commodity transactions. And, to become a relevant international currency, it is inevitable that China will face the Mundell-Fleming trilemma, which suggests that a country must choose between free capital mobility, exchange-rate management and monetary autonomy. Making the RMB a reserve currency will increase its value relative to the USD and accelerate the reshoring of manufacturing to the United States. High commodity prices may also set it on the road to a late-1990s-style currency crisis.

Yet, China’s digital currency, the “eCNY” — a pilot project reportedly established in 2014 and years ahead of any other world players in the digitization race — recorded almost $10B in transactions in the first 10 months of 2021. The digital yuan has already begun to be used in transactions with Thailand and the UAE. China has been pushing to legitimize its currency internationally, and by improving the ease of cross-border payments, it will have greater success in increasing offshore use of the RMB. Ironically, the SWIFT payment system, from which banning Russia was touted by the popular press as a potential weapon of mass financial destruction, is actually sorely inefficient and costly, with countries such as China and Russia having existing alternatives.

As Keynes predicted at Bretton Woods, becoming a global reserve currency has extreme long-term economic consequences for a country that the CCP may be unwilling to endure. Of course, the rise to become a reserve currency does not happen overnight. However, longer-term investors should acknowledge that the evolution of money, credit, payment and settlement systems may have reached a turning point today and will continue to evolve, just as they did in 1945 and 1957. Investors need to take note.

Are There Alternatives?

In a recent letter, Larry Fink, Head of Blackrock, suggested that “a global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of laundering and corruption.”3 Mr. Fink also noted that digital currencies could help bring down the cost of cross-border transactions. Recall the recent event in El Salvador where bitcoin was made legal tender. Not coincidentally, Russia has recently proposed bitcoin payments for its oil and gas exports.

To be clear, this is not to suggest that bitcoin or ethereum will become global reserve currencies, but the willingness of U.S. policymakers to accept that the USD may relinquish its dominance sows the seeds of opportunity for significant disruption. Chair Powell’s recent statement may be foretelling: it’s “possible to have more than one large reserve currency.”4 It is also difficult not to dismiss the origins of the unregulated eurodollar market and its link to Russia’s fears of economic reprisals. Will history, perhaps, eerily repeat itself today? Interestingly enough, the blockchain is a ledger system that is fully transparent.

Perhaps foreshadowing its fate, when the current global financial system was developed in the aftermath of WWII, prominent policymakers warned that the Bretton Woods Agreement would eventually need to be replaced. It was predicted that the USD as the medium exchange for the global economy would end when the U.S. evolved from a creditor to a debtor nation and that the standard of living would fall, causing a rise in populism and the need for a new period of extreme structural adjustment.

Detonation Has Its Consequences

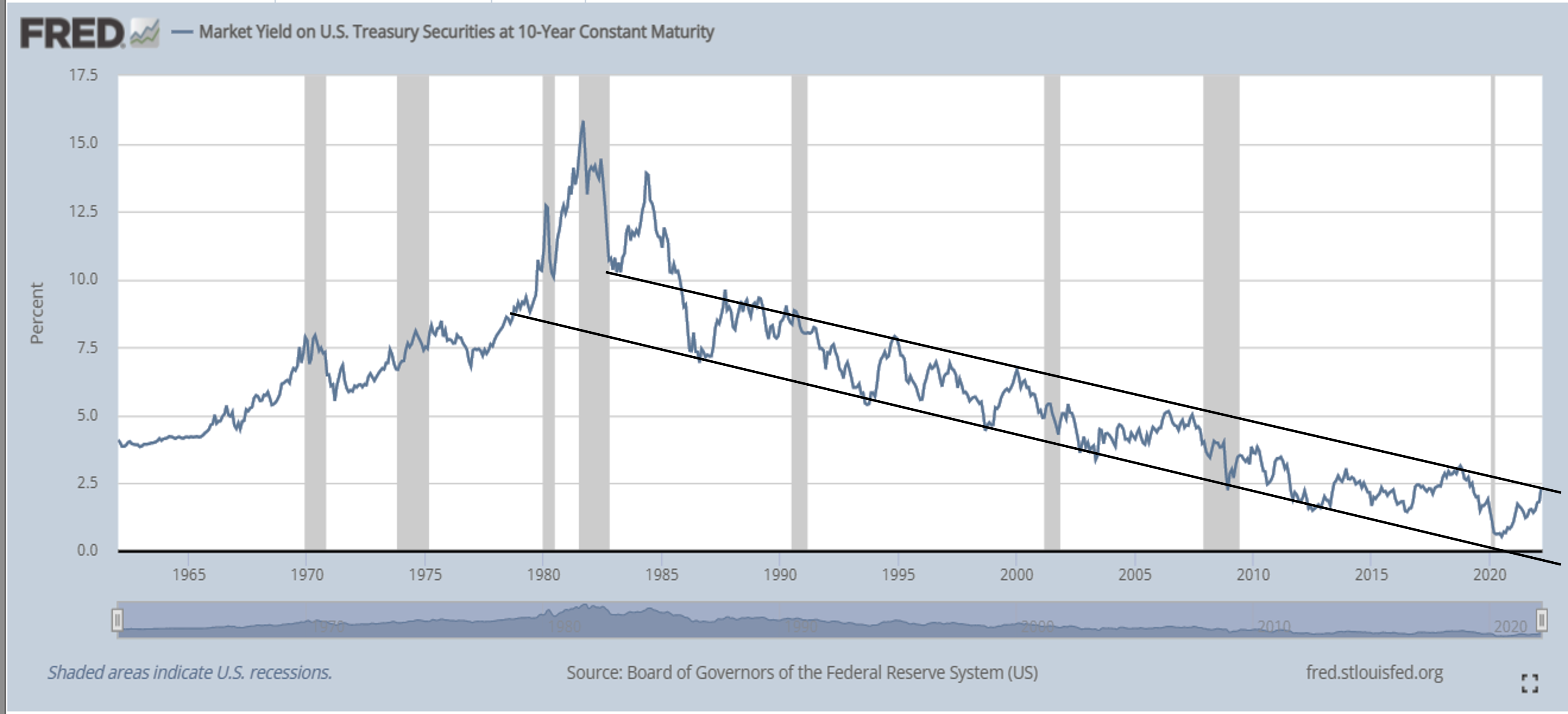

To be sure, the sanctions have created a significant negative supply-side shock to the global economy. This inflationary shock, coupled with the lingering effects of the Covid-19 pandemic, will mean inflationary pressures may last longer than many had forecasted. These dual effects have many desiring front-loaded rate hikes in response. Yet, we may forget that even before Covid-19 and the Ukraine crisis, we had entered into a period of slow growth. Since 2008, inflation has been transitory and the secular foundations of the global economy point to an era of low economic growth and interest rates. Yes, secular stagnation. Simply put, the inflation and economic growth situation we are witnessing today mirrors the pre-1957 eurodollar world.

However, consider that the long-term secular forces unleashed by the Covid-19 pandemic are not going away. The U.S. bond market has tightened substantially ahead of the Federal Reserve, yet the bond market is questioning whether the desired hikes will stick. To be clear, raising rates will not solve the price increases caused by supply shocks.

Complicating the chosen path for policymakers are the daily predictions of a synchronized global recession reported by the media. Will central banks raise rates substantially into the teeth of a recession? The risk, of course, is that significant rate hikes are likely to further push economies into deeper recession. Ultimately, the debate comes down to two questions: Will inflation fall enough in the coming months? And, can the central bank terminal rate be pushed higher this cycle? I would suggest that the answer to both is yes, with the caveat that monetary policy normalization will take longer than many desire.

Interest rates have had a historic rise this year, indicating that credit conditions have already begun to tighten. We should not overlook that the five-year five-year forward rate is well anchored at the 2% range while we experience peak inflation. With persistent inflation, there has been a growing conviction that rates will continue to rise significantly. In just a few months, markets moved from anticipating three or four 25 bps hikes to seven or eight. More recently, some have suggested a 3% terminal rate. The risk for central bankers and investors is that eventually all of the uber-hawkish proclamations about tightening must either be followed through with action or disproven by the incoming data. The flipping between hawkish and dovish, with market forecasts having a half-life of about 15 minutes, is likely to continue until conclusive evidence has been presented.

Historical Yield on the 10-Year U.S. Treasury Bond

What Does This Mean for Investors?

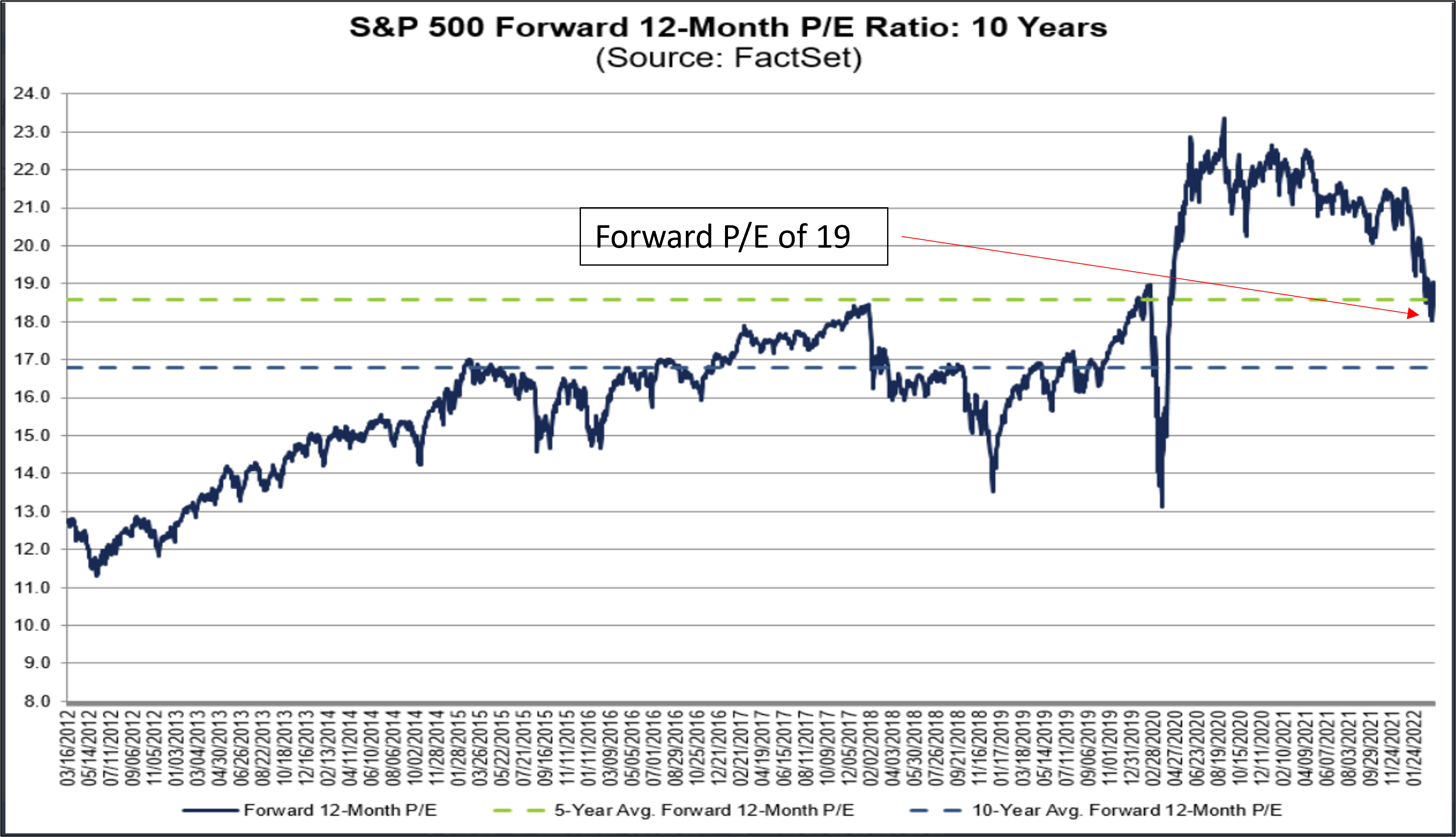

As we entered 2022, the year-end target was S&P 5,300 based on 12% earnings growth. The forecast was for a difficult first half of the year, followed by positive returns to the equity market, a typical mid-term election cycle year, and an assumption that 2022 was “the year of the Fed.” The view was that the market would also experience multiple compressions caused by the fear that the Fed would tighten aggressively. Will they blink and make a policy mistake and tighten the economy into a severe recession? At the time of writing, the jury is still undecided.

With the S&P 500 forward earnings multiple now at 19x, the multiple compression happened at a very rapid pace — faster than initially thought, suggesting that the lows for the year may already have taken place. Growth was assumed to slow dramatically, but with the economy reopening, inflation would also fall by Labour Day. I continue to firmly believe that the underlying foundation of the global economy is slowly evolving away from secular stagnation. But this evolution will take time.

Multiple Compression Has Already Occurred

Of course, it was difficult for any market observer to forecast the crisis in Ukraine and the ensuing events of recent weeks that have reverberated through the markets. We have experienced historic moves in commodities prices and interest rates, amplifying the lack of liquidity in the market. Yield curves have inverted and the narrative has quickly pivoted to the possibility of a global recession. The sanctioning of the Russian Central Bank should be viewed as a pivotal and historical event that has the potential to reshape the financial system as we know it.

However, at this time the words of Dr. Kissinger are worth recounting: “America has no permanent friends or enemies, only interest.” A diplomatic solution will be found in the Ukraine crisis. A potential Iran deal or reengagement of Venezuela and a Marshall Plan for energy should keep oil at a level close to $85 or $90 per barrel by the fall shoulder season. As the economy slows and with a retreat from peak inflation, central bankers may not need to be aggressive. To wit, interest rate hikes do not fix supply shocks. Regardless, the time to position for the inflation trade was in late 2020 and 2021.

To be clear, the commodities supercycle is alive and well, but with the rapid increase in valuation levels as of late, there may likely be better entry points later this year. Instead, adhering to the old trading adage may have its merits: buy low, sell high — and, during these volatile times, rinse and repeat. In this highly illiquid market, proactively rebalancing portfolios is a must. As well, with a slow-growth economy and an inverted yield curve, investors should consider investing in long-duration assets.

We are living through a pivotal point in history, triggered by a terrible war. While history reminds us to never let a crisis go to waste, at the same time as investors we should retain a high degree of flexibility, while maintaining a large dose of humility.

— James E. Thorne, Ph.D.

References:

[1] The Bretton Woods System came to an end in August 1971 when the USD was no longer pegged to gold. However, the Bretton Woods System created a lasting influence on international currency markets that continues today with the USD reigning as the global reserve currency.

[2] For example, on March 24, 2022, the Solomon Islands confirmed it was creating a partnership with China to tackle security threats.

[3] Larry Fink, The Power of Capitalism, March 2022.

[4] Testimony of Jerome Powell before U.S. Congress, March 2, 2022. https://www.youtube.com/watch?v=Y6jeDUDWjNU, at 1.48 minute mark.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Financial Inc. (Wellington-Altus) is the parent company to Wellington-Altus Private Wealth (WAPW), Wellington-Altus Private Counsel Inc. (WAPC), Wellington-Altus Insurance Inc. (WAII) and Wellington-Altus USA. Wellington-Altus (WA) does not guarantee the accuracy or completeness of the information contained herein, nor does WA assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

©2022, Wellington-Altus Private Wealth Inc. , Wellington-Altus Private Counsel Inc., Wellington-Altus Insurance Inc. and Wellington-Altus USA. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION. www.wellington-altus.ca.