Download this article as a PDF.

For clients who have rolled their Registered Retirement Savings Plan (“RRSP”) over to a Registered Retirement Income Fund (“RRIF”) or who have an existing RRIF account in 2022, the following information outlines how their 2023 minimum withdrawal will be calculated. All RRIF withdrawals are reported as pension income on a T4RIF slip.

Here are some basic RRIF rules to consider:

• Withdrawals from a RRIF must begin the first calendar year after which it is established. No withdrawals are required in the year the RRIF is established.

• Each year, a RRIF annuitant is required to withdraw one or more payments that are at least equal to the minimum calculated amount. This is based on the following factors:

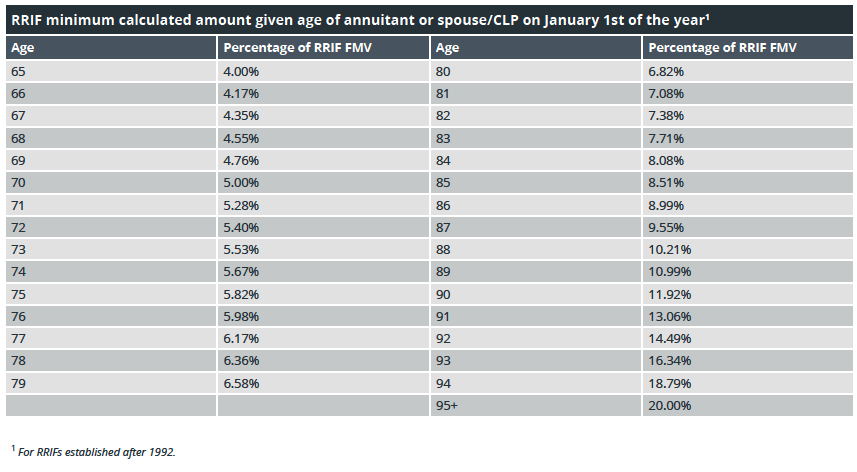

» The fair market value (“FMV”) of the RRIF at the beginning of the calendar year. For practical purposes, the closing FMV on the last business day of the previous calendar year is used. For 2023, that would be December 30, 2022. The FMV of the RRIF is then multiplied by the annuitant’s age factor/percentage.

» Either the age of the annuitant, or that of their spouse or common-law partner (“CLP”) on January 1st can be used in the calculation. The choice of the age is decided at the time of the first RRIF withdrawal and is irrevocable. Generally, the lower age of either the annuitant or their spouse/CLP is chosen, as it results in a lower minimum calculated amount. Additional funds can always be taken as needed.

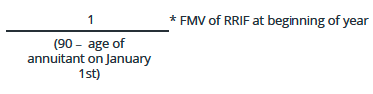

» If the age chosen is lower than 71, the following formula is used to determine the minimum calculated percentage:

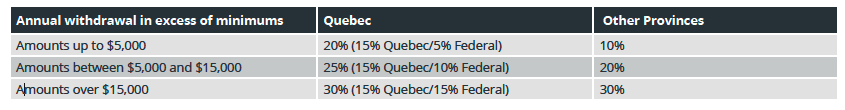

• The minimum calculated withdrawal amount is not subject to withholding taxes. Any RRIF withdrawal more than the minimum calculated amount is subject to withholding taxes, depending upon the province of residence and amount of the excess withdrawal. The following withholding tax rates apply:

• Because no withdrawals are required in the year the RRIF is established, any payments from the RRIF in the first calendar year are subject to withholding tax.

• RRIFs do not have a maximum withdrawal limit other than the FMV of the RRIF. [/caption]

Applying the Rules

To understand the mechanics of the RRIF minimum calculated amount, let’s consider a few scenarios:

1. Jordan turned 65, retired and converted his RRSP to a RRIF in 2022. Jordan’s spouse Meghan is 66 years of age. At the start of the year, Jordan’s RRIF is valued at $600,000. What is Jordan’s calculated minimum amount for 2023?

→ As Jordan is younger than Meghan, his age would generally be used.

→ Given Jordan was 65 on January 1st, his 2023 RRIF calculated minimum amount is 4% of $600,000, or $24,000.

2. Assuming the same facts as in scenario #1, but changing Meghan’s age to 63, what would Jordan’s calculated minimum amount be?

→ Given that Meghan is younger, her age generally would be used in the minimum calculated percentage formula and would decrease Jordan’s calculated minimum amount percentage as follows: 1 / (90 – 63) = 3.70%.

→ Thus, Jordan’s 2023 RRIF calculated minimum amount would be 3.7% of $600,000, or $22,200.

3. If Jordan and Meghan are both 78 years of age and Jordan’s RRIF is valued at $500,000 at the start of the year, what would Jordan’s 2023 RRIF calculated minimum amount be?

→ 6.36% of $500,000, or $31,800.

In Conclusion

This communication highlights how RRIF minimum withdrawal amounts are calculated. There are a handful of situations in which clients may wish to withdraw more than their calculated RRIF minimums. For example, they may want to top up income within their marginal tax bracket or split eligible pension income with their spouse and make use of lower marginal tax rates.

For further information about these and other tax planning opportunities, please reach out to your Wellington-Altus advisor.