Market Commentary

2023 Fourth Quarter Commentary

Download this article as a PDF.

In the fourth quarter, pessimism about the future path of interest rates was replaced by optimism, and bond and stock prices both rallied significantly and closed the year well into positive territory.

Economic Backdrop

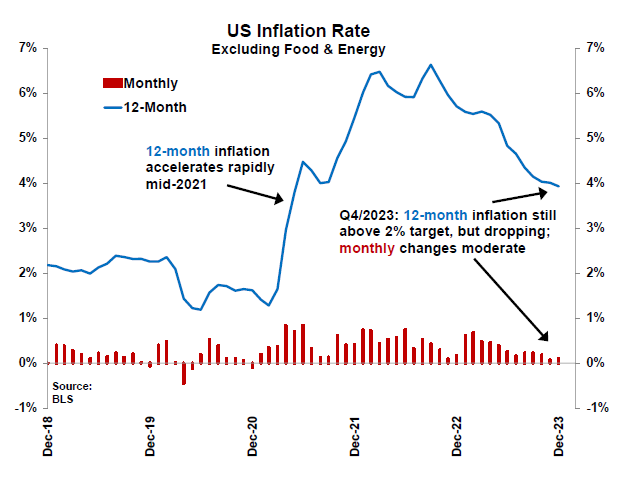

The good news that prompted the late-year rally is that central banks’ battle against inflation seems to be well in hand. The U.S. 12-month core inflation rate continues to decline, and the 1-month changes no longer include the half-percent spikes often seen in 2021 and 2022. Investors even began to entertain the prospect of interest rate cuts in 2024.

However, two considerations mitigate against financial markets’ newfound ebullience. First, the third and fourth quarter inflation trends were very similar; it seems to us that the third quarter’s pessimism and the fourth quarter’s optimism were both overdone. Secondly, at 4%, core inflation still has considerable distance to fall until it reaches the 2% target set for it by the U.S. central bank, the Federal Reserve. After letting the inflation genie out of the bottle for the first time in four decades, central bankers will be loathe to immediately declare victory, cut interest rates and go home when inflation eventually meets its target. Instead, forbearance will likely be a central banker watchword for some time, to prevent the belief that they’re “soft on inflation” from taking root.

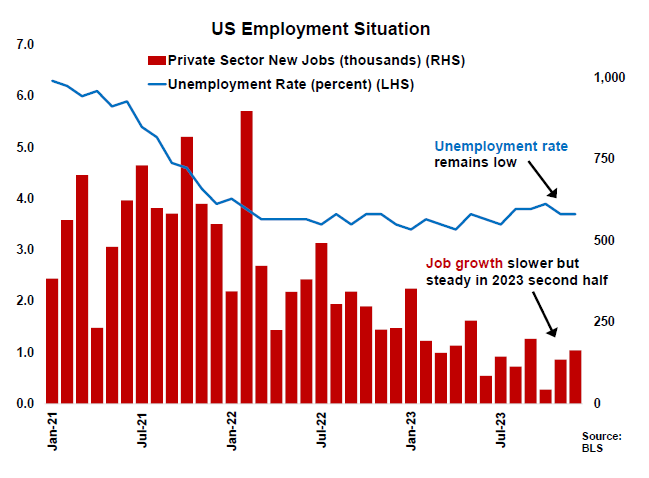

The U.S. economy showed few signs of stress despite the last two years’ higher interest rates. Employment growth was slower in the second half of the year but remained robust, unemployment rates were little changed, and the labor force participation rate for Americans ages 25-54 remained at its highest levels since before the 2008 global financial crisis.

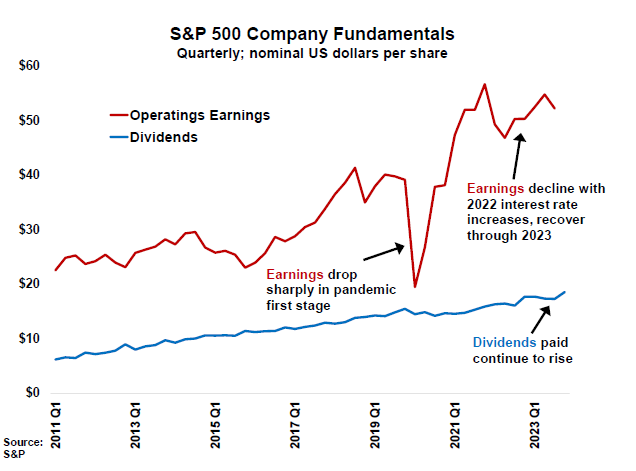

The quarterly operating earnings (income; profits) of the largest 500 U.S. companies that constitute the S&P 500 index turned sharply and fell in the first two quarters of 2022, but then levelled off and grew through the rest of that year and 2023. The aggregate dividends paid by those companies barely skipped a beat, and are now nearly 20% above their pre-pandemic levels.

Financial Markets

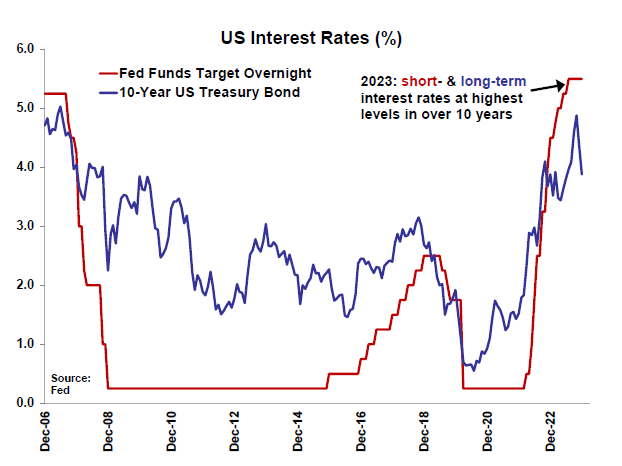

The U.S. target overnight interest rate, which is controlled largely by the Federal Reserve, and the interest rate (“yield”) on 10-year U.S. federal government bonds both rose steeply in the last two years as the pandemic receded, inflation soared, and central banks worldwide raised short-term rates to try to squelch said inflation. Short and long rates are now at their highest level since before the 2008 financial crisis.

However, the short-term rates (in red) were unchanged in the latter part of 2023, as the Fed signalled that it was finished with rate increases. Long-maturity bond yields (in blue) fell sharply in the last two months. Because bond prices are inversely related to interest rates, long-bond prices rose commensurately and ended the year with returns well into positive territory.

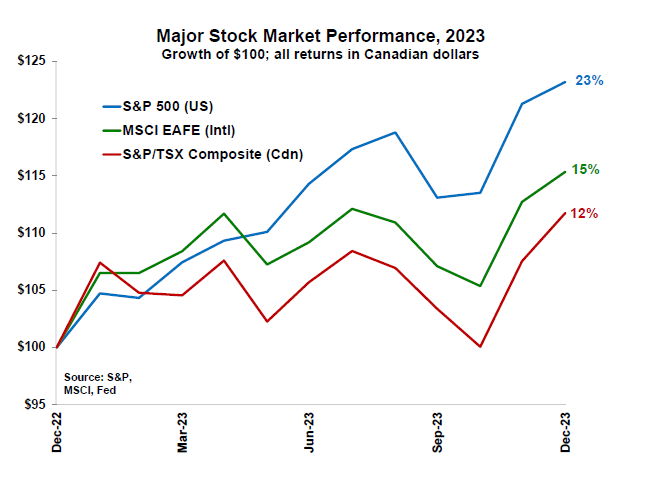

U.S., international and Canadian stock market returns for the year for large companies were about 23%, 15% and 12% respectively, measured in Canadian dollars (the effect of foreign currency fluctuation for the year was modest). This was a welcome reprieve from their 2022 declines, but the headline numbers don’t do the results justice, and so the chart instead shows the path of those returns. From the end of October to year end, all three regions’ stocks rose about 10% and turned what was then a lackluster year into an above-average showing.

2023 Portfolio Returns

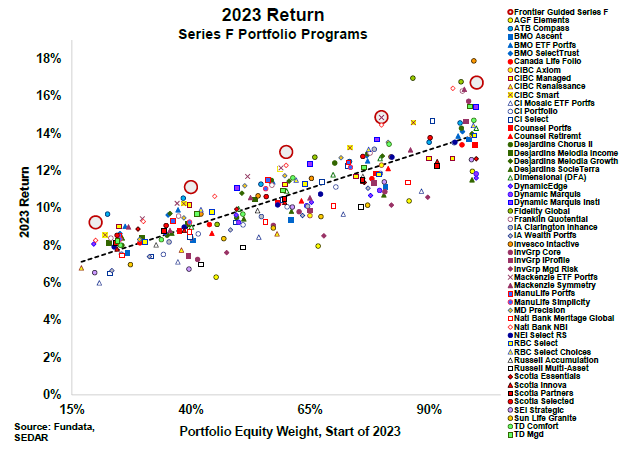

The Frontier Guided Series F model portfolios’ 2023 returns ranged from just above 9% for the most conservative, to slightly over 16% for the most aggressive portfolio. The chart below plots each portfolio’s return against its start-of-year overall stock weight, and compares them to 51 similar portfolio programs which collectively have nearly a half-trillion dollars of assets under management. The model portfolio returns were about 2% ahead of their average peer at both ends of the risk range. Some of this was due to the models’ lower costs, but that’s only part of their performance advantage.

* These returns represent the returns of model portfolios only, not live portfolios, and do not represent the returns of any client. Individual account performance may differ materially from the representative performance history in this chart, due to factors including but not limited to an account’s size, the length of time the strategy has been held, the timing and amount of deposits and withdrawals, the timing and amount of dividends and other income, trade execution timing and pricing, foreign exchange rates, and fees and other costs. This is not an official statement from Wellington-Altus Private Wealth (“WAPW”). WAPW cannot verify the accuracy of these performance numbers. Please refer to your official WAPW statement for your specific performance numbers.

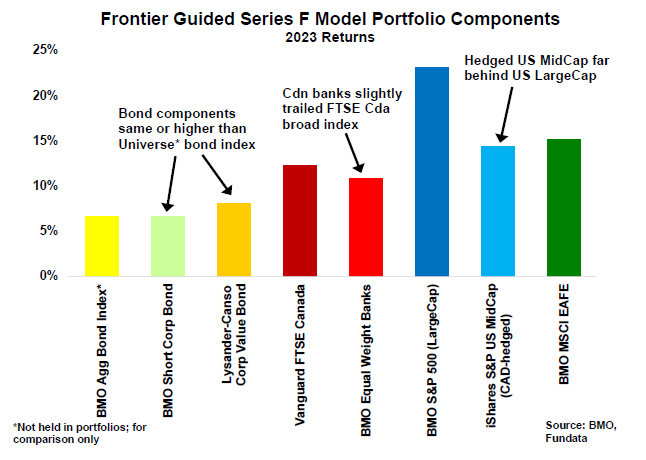

The Frontier Guided models’ fixed income components both rose less than the benchmark index and most of their peers during the late-year bond rally because they hold mainly shorter-maturity bonds, which are less sensitive than longer-maturity bonds to interest rate movements. However, both components also have a higher ongoing yield because they hold mainly corporate bonds. Corporate bond prices also benefited somewhat from a decline in corporate relative to government bond yields, and so the components ended the year essentially even with (BMO), or ahead (Lysander-Canso), of a comparable Universe bond index ETF.

At the growth end of the spectrum, the all-equity portfolio’s return was roughly 2% above its typical peer. Some of this is due to its cost advantage but the rest belies simple explanation, because its off-benchmark holdings hurt more than they helped this year. For example, its S&P U.S. hedged mid-cap stock index holding trailed its S&P 500 large-cap holding’s return by 9%.

Conclusion

The broad economic environment changed little from earlier quarters, but investor enthusiasm for the prospect of interest rate cuts in 2024 propelled a late-year rally in bond and stock prices that generated double-digit stock returns for the year, and which erased most of the 2022 stock decline and half of the 2022 bond decline.

We believe this late-year optimism was excessive, just as the mid-year pessimism was equally misplaced. However, the overall economic situation remains sound, as central banks are hitherto winning their war with inflation and have done so without creating a recession. Stock market fundamentals remain strong, and stock valuations are not stretched.

That doesn’t mean a curveball won’t come our way, but it does mean that by sticking to sound principles, investors will continue to reap the benefits offered by financial markets.

Cheers to you in the New Year!

Gene Hochachka

*Mr. Hochachka is an independent consultant to Scott Fleischhacker, and is not an employee of Wellington-Altus Private Wealth Inc. (“WAPW”), nor is he registered in any capacity with WAPW. Mr. Hochachka is registered with the Alberta Securities Commission as an advising representative, but does not provide portfolio management advice or registrable services directly to clients of WAPW.

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor.

© 2024, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca