While generally a cause for celebration, retirement often comes with its fair share of financial anxiety. Research indicates that many people fear outliving their savings, resulting in an inability to enjoy life to the fullest throughout retirement.

Advisors can assist clients with sorting out what has been called the “nastiest, hardest problem in finance”1 by creating a cash flow and income stream to help them live well in retirement without the worry of running out of funds.

Generating a cash flow stream can have a very positive impact on retirement. Cash flow can help smooth out annual income and personal tax liabilities and help fund unexpected expenditures that may arise.

What is cash flow, and how is it different from income?

Quite simply, cash flow is not reported on a personal tax return and is not subject to income tax, whereas income is. The most common sources of cash flow are cash or chequing accounts and an individual’s TFSA.

While every situation is unique, here are a few questions to get started on a retirement funding plan:

- How do you envision retirement? It’s important to understand your retirement lifestyle goals and spending patterns. Do you plan to spend most of your assets or leave an estate to intended beneficiaries?

- What are the risks? Do you expect to enjoy good health and a long retirement? Most retirement plans project living and associated lifestyle expenses to age 90 and beyond. Retirement plans should be revisited every few years to adjust for the key risks of health care costs, inflation, poor sequence of returns, or any deviations from your assumptions.

- What sources of funding are available? An efficient drawdown plan from all available sources helps to minimize taxes, put more funds into your hands during your retirement years, and maximize your estate value where applicable.

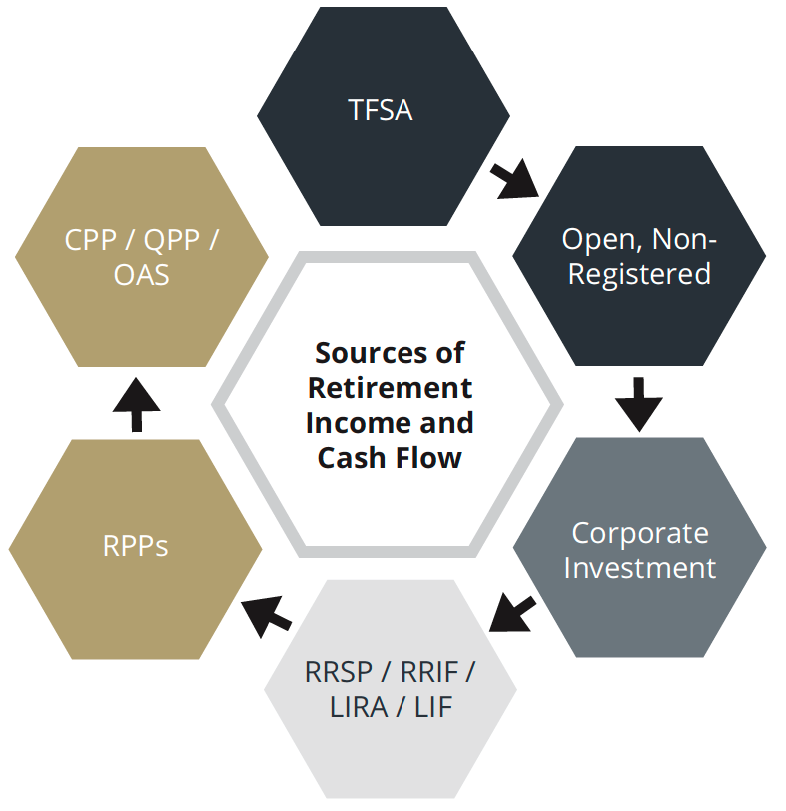

First, let’s review some of the typical sources of cash flow and income as they relate to: flexibility, taxation of such and control.

Registered savings and Defined Benefit Pension Plans

Many Canadians save for retirement using Registered Retirement Savings Accounts (RRSPs) and Locked-In Retirement Accounts (LIRAs), which allow contributions to grow tax-free within the plan. Withdrawals from such plans in retirement are taxed as regular income, subject to certain rules:

- RRSPs must be converted to Registered Retirement Income Funds (RRIFs) and/or an annuity by the end of the calendar year the account holder turns 71.

- LIRAs have additional unlocking and age considerations depending upon the province of residence. In certain circumstances 50% of a LIRA can be rolled over to a RRSP, and the remainder can be converted to a Life Income Fund (LIF) and/or an annuity upon retirement, the earliest at age 55 and the latest being the end of the calendar year the account holder turns 71.

- Withdrawals must adhere to the minimum (and maximum, in the case of a LIF) percentages outlined per the account holder age on January 1 each year. For RRIFs it is possible to elect at the time of conversion to use a spouse/CLP’s age.

- Up to 50% of RRIF/LRIF/annuity withdrawals can be split with a spouse/CLP given Canada’s eligible pension splitting rules.

- Spousal RRSPs remain a useful retirement tool and can help to balance retirement capital, income and associated taxes for a couple: the higher-income spouse contributes to a spousal RRSP, and ultimately the RRIF withdrawals are taxed in the hands of the lower-income spouse in retirement.

Defined Benefit Pensions are another consistent, stable source of retirement funding for those who have access. Pension payments are taxed as regular income, may also be indexed to inflation, and are eligible for pension income splitting with a spouse/CLP.

Non-registered investments and corporate assets

Tax-Free Savings Accounts (TFSAs)

TFSAs offer the ultimate in tax efficiency and flexibility in retirement funding, as income and gains generated in the TFSA and withdrawals are tax-free.

Key strategies

Once you understand your retirement goals and sources of funding, your Wellington-Altus advisor can prepare a Retirement Funding Plan outlining one or more scenarios for your consideration. Here are some strategies to contemplate:

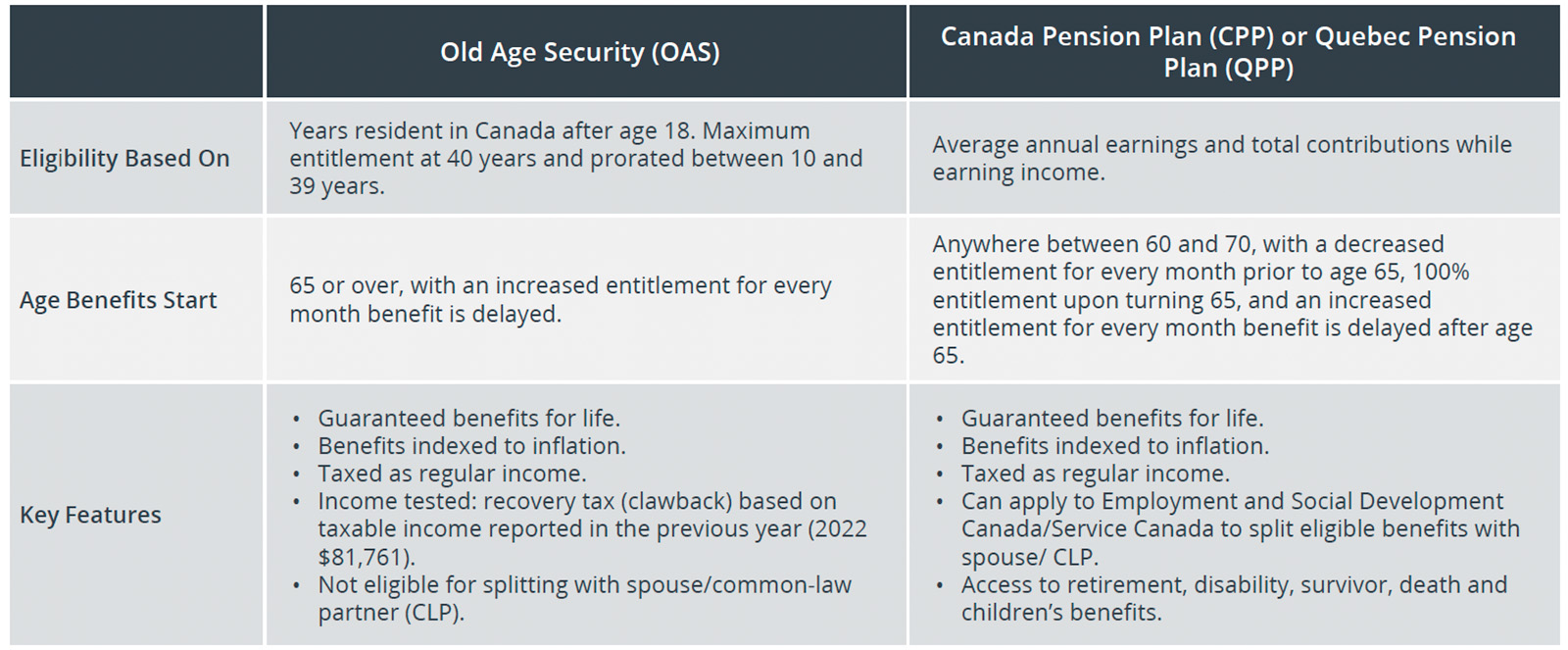

- Delay government supports. Despite the opportunity to take higher guaranteed, indexed payments for life, only 1% of Canadians delay CPP income to age 70.

- Draw down RRIF assets early to bridge the gap before accessing delayed government supports, thereby smoothing income and the associated tax impact throughout retirement. Use any excess marginal tax rate room to fund TFSA contributions and then non-registered investments.

- Ensure you are utilizing all available tax credits, deductions and income-splitting opportunities (e.g., pension income splitting and pension income tax credit).

- Consider requesting the Canada Revenue Agency use your current year’s anticipated income as a basis to reduce or eliminate the OAS recovery tax/clawback if a large capital gain was realized, or a one-time income receipt was reported in the prior year. Please reach out to your tax advisor to complete Form T1213(OAS) “Request to Reduce Old Age Security Recovery Tax at Source Year____” in this instance.

- Mitigate the OAS recovery tax/clawback by strategically timing the receipt of taxable dividends where possible, splitting pension income with a spouse, or realizing large amounts of income before starting OAS, while being mindful of OAS automatic enrollment and proactively delaying the start of payments up to age 70.

Conclusion

Because every client’s situation is unique, it is impossible to craft a retirement funding plan that considers every possible scenario. Spending shocks, changes in family status and foreign taxation are examples of events that can lead to different planning outcomes. Having a deep understanding of your spending and estate planning needs, knowing when further analysis is warranted, appreciating any assumptions and stress-testing the results under different scenarios is key when developing a successful retirement funding plan.

1 Nobel prize-winning economist William Sharpe, Barron’s, November 2019.