“Some things have to be believed to be seen.”

– Ralph Hodgson

Gold Seal Monthly Review

To our valued clients, we are trying something a little different this month. We have offered our market update in two formats – video or editorial. Please review both options below and let us know which one you prefer using this survey link.

As always, thank you for the trust you have placed in our team.

Fall Market’s Steam: “Come on in, the water’s warm”

As the first of the fall leaves begin littering the ground and we pack up our summer backyards, there is one pool still open with rising steam signaling “come on in, the water’s warm”. That pool is the global capital markets and despite dropping temperatures, it is still running hot. Whether it’s the U.S. market that just posted its best year-to-date performance for the first nine months of the year since 1997, or China’s stock market posting its largest rebound gains since 2008, it’s hard to resist dipping a toe in the water a little longer and later in the economic season than normal.

Our team’s strategy positioning has certainly had us wading waist deep for about two years now, but at our most recent September portfolio rebalance, we were prepared to lean in a little more and go for a nice winter doggy paddle.

In what former Wells Fargo investment strategist Jim Paulsen describes as an “Everything Market”, you’d have been hard-pressed to lose money through the first three quarters of 2024 even if that meant throwing darts at a strategy board. After all, just within North America:

- Stocks are behaving as if a “soft landing” has already happened, rising substantially.

- Gold is behaving as if we are in a major economic crisis, reaching new highs this September.

- Bond yields are falling like the U.S. Federal Reserve (the Fed) has already finished cutting rates, so bond prices are rising.

- Real estate prices are rising as if rate cuts just started.

Meanwhile,

- Oil prices are falling as if demand is disappearing.

- Natural gas prices are rising as if demand is growing.

- Americans’ assessment of current economic conditions (consumer confidence) is deteriorating.

- Even after the Fed’s September 50 basis points rate cut: the market is pricing over 2% worth of additional rate cuts over the next 12 months, the most since the 1980s.

- In Canada, 1 in 20 (5%) businesses just closed in June, marking pandemic levels of insolvency.

And, for North America, all of this is against the backdrop of fiscal uncertainty as the U.S. prepares for its presidential election in next month, and Prime Minister Justin Trudeau’s most recent survival of a non-confidence vote slates the next Canadian federal election for October 2025. If any of our readers have a crystal ball and can predict who or which asset class is wrong here or how this will play out, we’d appreciate your mystical readings. That said, and as far as elections are concerned, the U.S. market has historically never really cared much for, or acknowledged the president’s contribution to stock market growth:

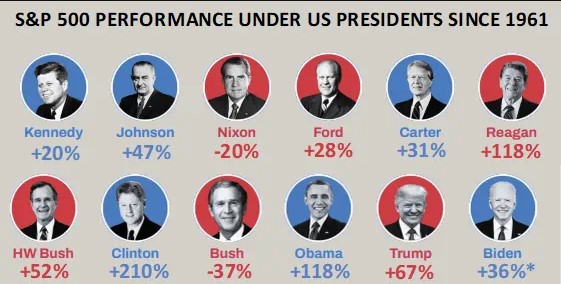

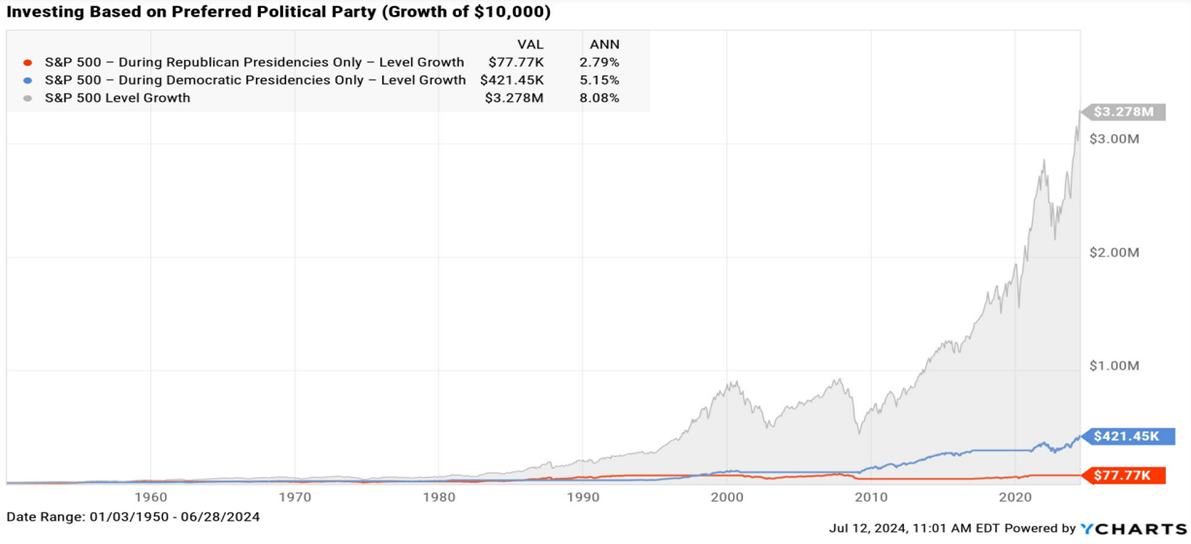

The only two negative market presidential tenures were former President George W. Bush having posted a -36.7% return when navigating the sub-prime mortgage crisis, and former President Richard Nixon who had posted a -19.8% market return after decoupling the U.S. dollar from gold during the “Nixon Shock”, which were coincidentally also policies aimed at reigning in inflation. Further, the U.S. market has not rewarded investing according to only one political affiliation. The data from 1950 to 2024 shows a total average market returns of 8.08%, which dwarfs the investment returns realized if only investing during Democratic administrations (5.15% annualized) or Republican administrations (2.79% annualized).

© 2024 YCharts, Inc. All rights reserved

With political influence eliminated as a lead contributor, what we’re left with is a global backdrop that tells a congruent story. Economic growth is stabilizing positively. Inflation risks have moderated. High interest rates have now provided an allowance for cuts to combat future shocks. Unemployment has risen, but not alarmingly so.

Changing conditions call for changing strategies, and the Gold Seal Financial Group held its Q3 Asset Mix Committee meeting on Friday, September 13, with trading taking place the following week in advance of the Fed’s announcement.

The following tactical asset mix changes were enacted with the September rebalance:

- -3% Fixed income

- +1% U.S. equity

- +2% International/emerging market equity

The trimming of our Fixed Income strategy almost marks the end of an era, as for our team, it represents the unwinding of what we’d all lovingly referenced as the “pivot trade”. The pivot trade was ultimately positioning for the understanding that rates in the Canadian interest rate and bond environment had risen lock-step with the U.S. to a level that was unsustainable for the Canadian economy, which would require more drastic cuts than the market had priced in. With the expectation that longer term interest rates were far overestimated, we had extended the terms (duration) of our high-grade sovereign bond strategy, to benefit in the event our rate-cut expectations materialize. That duration strategy has returned 13.1% over the past 1 year to September 30*, which for those familiar with clipping government bonds at a retail bank, is an impressive return to be making from government backed, relatively risk-free securities. Our reduced position in fixed income now reflects an emphasis on high yield, corporate debt that has yet to benefit from spread contraction, and an emphasis on liquidity within our government debt strategy. From our perspective, this sleeve is cash on the sidelines, poised to strike.

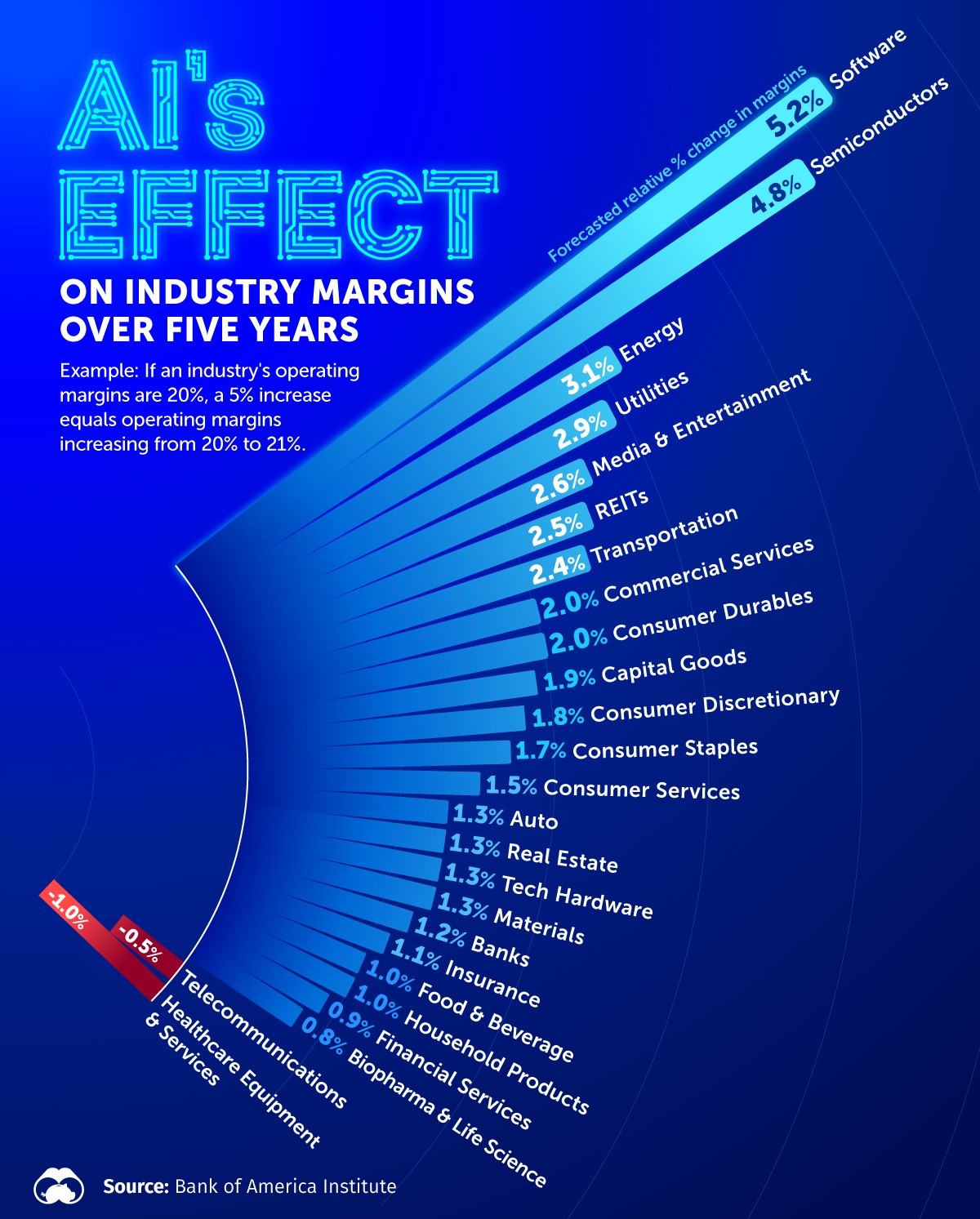

The additional lean into our institutionally guided U.S. All-Cap Growth strategy represents further optimism on productivity gains within the U.S. economy, which are anticipated to be majority artificial intelligence (AI) driven. The adjustment brings our growth strategy to a +3% overweight position on U.S. equities to a total of 28% of our target portfolio.

Finally, the long-proven (with exemption for COVID-19) beneficiary of easing conditions within the U.S. economy, particularly rate policy and stimulus measures, has been international and emerging markets. Intuitively, as the cost of borrowing in U.S. dollar denominated debt decreases and foreign currencies gain strength against the greenback, valuations of international companies tend to skew to the upside as balance sheets improve. Additionally, the most aggressive stimulus measures since the pandemic brought in by China have paved the way for accommodative stimulus for the rest of the Europe, Australasia, and the Far East (EAFE) nations just as the ambitious U.S. 50 basis points cut has paved the way for additional measures in Canada. While we’re still underweight China on a market cap basis, we’ve overweighted our exposure to international and emerging market economies by +2% for a total +5% overweight with this most recent rebalancing.

Presently, while we do encourage questions and dialogue from our clients about the independent outcomes of presidential or prime ministerial elections, gold or oil prices, currency expectations, bond and interest rate expectations, real estate and insolvencies, these topics each represent one piece of the mosaic that is the tile floors of our warm, fall-heated pool. As our team has now rolled out what we view to be a two-movement “risk-on” position, we’ll take pride in our contrarian positions over the past two years, while still beckoning to those now dipping their toe in as conditions ease: Come on in, the water’s warm.

Are unresolved issues still plaguing global markets? With debt levels at historic highs and deflationary forces at play, James Thorne examines where investors should focus in 2025 and beyond.

Gold Seal Insights

Tanya’s Tips: Reasons to Prioritize the FHSA

With recent changes to the federal budget, clients are wondering whether the First Home Savings Account (FHSA) or the Home Buyer’s Plan (HBP) through the RRSP is better for younger family members savings for a future home purchase.

The FHSA allows tax-deductible contributions and tax-free withdrawals for a first home, with a lifetime contribution limit of $40,000 and tax-sheltered growth over 15 years. In contrast, the HBP lets first-time buyers withdraw up to $60,000 from their RRSPs, with repayment required over 15 years to avoid tax consequences. A temporary budget change defers the HBP repayment start by three years.

While both options provide tax advantages, the FHSA may offer more long-term benefits. Starting contributions early can result in greater growth potential, and unlike the HBP, FHSA withdrawals are tax-free and don’t need to be repaid. Additionally, unused FHSA funds can be transferred to an RRSP without affecting contribution room.

In addition to the benefits of both the FHSA and HBP, it’s important to consider timing and individual financial goals. If a first home purchase is several years away, prioritizing the FHSA for its long-term growth potential can provide greater flexibility and a larger tax-free withdrawal. On the other hand, if a home purchase is imminent and substantial savings are already in an RRSP, the HBP may be a more practical option. Each scenario is unique, which is why it’s advisable to contact our team for advice. We’re here to help navigate these options and tailor a plan that aligns with your financial goals.

Noteworthy Links

- How does America get its energy? Excellent instructional video.

- China nuclear sub sank in its dock, US officials say

- B.C. mayors voice discontent over province’s response to drug crisis

- Couple reunited with lost wedding film after 57 years

- Four new restaurants make Michelin’s annual Vancouver guide, including another star

- Former Bank of Canada Official sees jumbo rate cut in October

- 4 Charts on the Rotation Out of Growth and Tech Stocks

- Jim Thorne on Schwab Network: What a soft landing means

Picture of the month

Source: Visual Capitalist