Gold Seal Monthly Review

“A candle loses no fire by lighting another flame.”

– James Keller

Tax Season Reminders and Key Dates!

It’s tax season and the Gold Seal Financial Group is busy putting our clients’ tax packages together. Some of you have directed us to send documents directly to your accountants, which we will do once all slips have been generated. For those clients that like to get a head-start on their taxes, here are some important dates to remember and how-to’s:

Slip Generation Date guidelines:

- T4RSP / T4RIF / T4A slips: Early February

- T5 slip / T5008 summary: Late February

- T5013 summary: Mid March

- T3 slips: Late March – Early April

It’s important to know whether you have received all of your documents before you file your return. To determine this, please consult your Personalized Checklist within the 2023 Tax Information Package.

Accessing your tax documents:

For your convenience, your Wellington-Altus Private Wealth tax documents can be accessed through your online client portal. To access this:

- Login to your account through our Gold Seal Financial Group Website or THIS LINK.

- If this is your first time signing in, click “Start here”

- To reset your password, click “Forgotten password?”

- If you don’t know your User ID, please contact us.

- Click on the “Documents” tab. Select from the dropdown menu:

- “Tax Slips” to access your tax slips issued by our custodian National Bank.

- “Reports” to access your supplementary tax packages, which may include the following:

- 2023 Tax Information Package, which includes:

- Your Personalized Checklist

- Realized Gain/Loss Reports

- Enhanced Fee Summary: this details management fees paid on non-registered accounts.

- Third-Party Checklist: This is a summary of tax slips prepared and distributed by 3rd parties such as mutual fund companies. The slips will arrive by mail from those companies.

- Foreign Property Report: Assists with the completion of a T1135 if required.

- 2023 Tax Information Package, which includes:

Please note that if you have elected to receive your tax slips by mail, you will continue to receive them as elected. However, the supplementary tax documents will only be available through your online client portal.

Key Reminders:

- Do not file your return until all slips have been generated. This may require you to wait until April to file.

- Third party providers will be mailing slips to your home. These are separate from what you download from Wellington-Altus online.

- If you have already discussed sending slips directly to your accountant with your advisor, this will be done on your behalf.

March Market Insights by Dr. James Thorne

As central bankers grapple with new economic realities, investors must prepare for a new era in monetary policy. Learn why Dr. James Thorne believes financial instability and a looming credit crisis are about to take center stage over inflation in his March Market Insights.

Gold Seal Insights

Tanya was recently interviewed by Globe and Mail to discuss “financial infidelity” and why it sometimes exists in spousal relationships.

Tanya was recently interviewed by Globe and Mail to discuss “financial infidelity” and why it sometimes exists in spousal relationships.

Here’s the good news: most spouses say they aren’t keeping financial secrets from each other. Now, for the bad news: in an online survey The Harris Poll conducted in 2023 on behalf of NerdWallet Inc., 14 per cent of Generation Z (ages 18 to 26), 5 per cent of Generation X, and 3 per cent of baby boomers in Canada admit they’ve hidden a purchase from their significant other. Read the full article here.

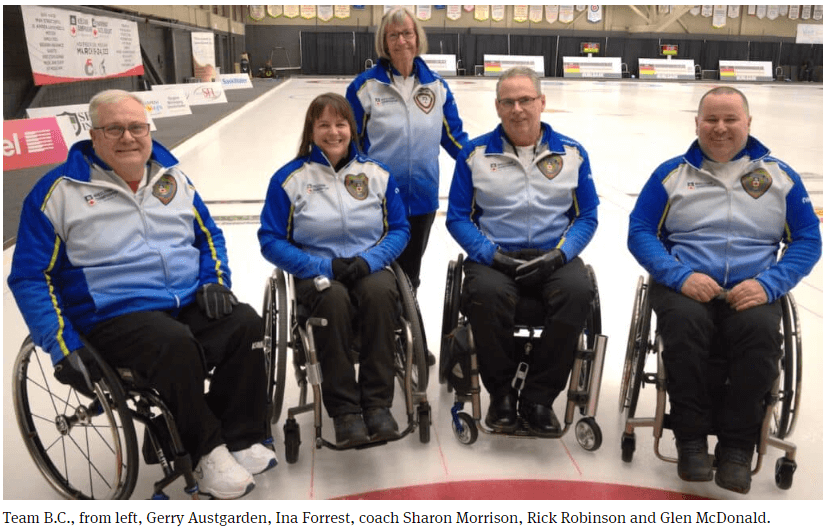

Gerry’s team is off to the Canadian Wheelchair Curling Championships!!!

Starting on March 24th, the country’s best wheelchair curling teams compete for the right to be crowned as Canadian champions!

We are proud to share that our very own Gerry Austgarden, along with his team, are representing B.C. at this event.

Please join us in wishing Gerry and his team the best of luck!

Noteworthy Links

- Seniors and their families caught up in botched CRA attempt to crack down on tax evasion

- Tax Tips – What you need to know for tax-filing season

- 5 Things that Are Unlikely to Change Irrespective of Who Wins The 2024 Election

- Ottawa extends foreign buyer ban on Canadian homes to 2027

- Canadians paying billions of dollars in ‘excess’ bank fees: report

Picture of the month