Gold Seal Monthly Review

“Everybody talks about tariffs as the first thing. Tariffs are the last thing. Tariffs are part of the negotiation.”

– Wilbur Ross

There is No Good Time to Write a Financial Newsletter in 2025

Much has transpired in North America since we released our traditional, playful holiday poem and at this rate, we may not be able to lose a month on lighthearted coverage. By the time this newsletter is published, it’s likely that another executive order, artificial intelligence (AI) breakthrough, government resignation, prorogation, tariff, or other market-moving development has emerged—somehow still managing to be absent from our 2025 bingo card. Among the latest disruptions, President Donald Trump’s tariffs on Canadian goods have created a new economic landscape, one that demands strategic adjustments rather than reactionary panic.

The 25% tariffs on Canadian imports and 10% on Canadian energy exports signed into law by U.S. President Trump have forced many industries to reassess their strategies. Canada exports 75% of its goods to the U.S., meaning a sudden increase in costs for American buyers could hit demand and slow trade. However, we also need to consider that since peaking at 0.83 US/CDN in June of 2021, the Canadian dollar has taken a nose dive to 0.69 US/CDN. That 17% depreciation of the Canadian dollar does significantly help offset some of the price increases for U.S. importers. But, beyond immediate cost considerations, tariffs have historically rippled through an economy in complex and often unpredictable ways.

Before tariffs are even applied, uncertainty alone can freeze investment decisions, as businesses struggle to commit to long-term plans without clarity on pricing structures, supply chains, and cross-border demand. We saw this as soon as the threat was uttered with Canadian steelmakers rejecting orders to the U.S. In some cases, U.S. buyers will accelerate orders of Canadian goods ahead of the tariff’s implementation, giving the illusion of short-term growth. Now that the executive order is signed and that ship has sailed, those same buyers will now undoubtedly cut back, leading to an economic drag that lasts well beyond the initial adjustment period.

Once the tariffs are active, the impact filters through several channels. The most direct effect is an increase in the price of Canadian goods for U.S. buyers, which, depending on the industry, can lead to substitution effects. If there are cheaper alternatives, demand for Canadian exports will drop more sharply. However, in industries where Canadian goods are more difficult to replace, the decline in demand may be more gradual, though still persistent. The extent of the damage depends on whether U.S. companies can absorb the cost or must pass it on to consumers. Retaliatory tariffs from Canada add another layer of economic pain, reducing U.S. exports into Canada and potentially triggering further rounds of economic countermeasures. This kind of drawn-out trade conflict erodes business confidence, depresses investment, and can weaken job creation on both sides of the border.

The landscape in Canada was already shaky, with U.S. tariffs serving as the last straw on the economic camel’s back. The Canadian government has now responded in kind, with Trudeau announcing 25% tariffs on $107B of U.S. goods, including beer, wine, bourbon, fruit, and household appliances. Additional measures on critical minerals and energy procurement are being considered, all of which add another layer of inflationary pressure at a time when households are already stretched. Meanwhile, the Bank of Canada has stepped in with its sixth consecutive rate cut, bringing the policy rate down to 3%. Governor Tiff Macklem warns, however, that if tariffs lead to sustained inflation, the Bank of Canada may have to shift its focus back toward controlling price pressures rather than continuing to support economic growth.

Further complicating the landscape is the political uncertainty following Trudeau’s resignation announcement. Mark Carney and Chrystia Freeland have emerged as frontrunners in the Liberal leadership race, with Carney making waves by pledging to scrap the consumer carbon tax. At the same time, Pierre Poilievre’s Conservatives hold a significant lead in the polls. Poilievre has built momentum on the back of his “Axe the Tax” campaign centred on carbon pricing and held a press conference on January 2 where he called on the federal Liberal government to recall Parliament in the face of the U.S. tariff announcement.

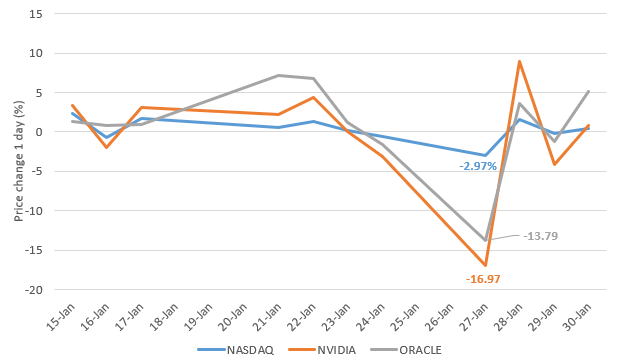

While macroeconomic and political developments dominate the headlines, external factors continue to reshape financial markets in ways that cannot be ignored. The AI revolution has taken an unexpected turn with the rapid rise of DeepSeek, a Chinese startup whose AI models are now competing with industry leaders like OpenAI and Meta at a fraction of the cost. DeepSeek’s AI assistant has overtaken ChatGPT as the top free app in the U.S. App Store, sending shockwaves through the tech sector. The company claims its AI models are 20-50 times cheaper to operate than OpenAI’s equivalents, raising serious questions about the future of AI investment. Even Nvidia’s stock took a hit as investors reassessed the long-term viability of traditional AI infrastructure spending. When you need less processing power, you need less chipsets. These developments are more than just a tech story—they are shifting the fundamental economic landscape and deserve the attention of investors looking to position ahead of structural market changes.

Amid all these moving pieces, our approach to overall portfolio strategy remains unchanged. While there were no tactical asset mix changes made this quarter, there were significant changes made to our model holdings that we feel better align our strategy with the themes we’re now navigating. Our fixed income allocations are adjusted in anticipation of further rate cuts while carefully managing inflation risks. On the equity side, we maintain our underweight position in Canadian markets, currently sitting at -7%. Currency-wise, our Serenity Portfolio investors have benefitted from having the majority of their holdings denominated in U.S. dollars and unhedged. Our full listing of portfolio changes detailed separately below represents exposure adjustments that we find prudent for navigating the governments, policies and events still to come. The temptation to time investments and change strategy based on reactionary events is ever-present, but history consistently rewards those who focus on fundamentals rather than headlines.

There is never a perfect time to release a newsletter, just as there is never a perfect time to invest. The nature of financial markets is unpredictability, and while the headlines will continue to roll in, long-term wealth-building relies on strategy, not reaction. The trades for 2025’s themes were made in 2024, and this year we’ll be positioning for next-step themes, as always. Looking to next month’s newsletter, we’re going to be taking a deeper dive into all things “Frontier” market: AI investments, disruptive technology trends, blockchain and God forbid, crypto currency. This will coincide with the launch of new investment opportunities in this space on our platform. It’s important to note that these offerings will not be added to our core Serenity models by default and will be included in your portfolio by request only. We (Ryan, reluctantly) recognize that many of our investors have had an interest in investing in these technologies and sectors, and we figure if you’re going to drink, we’d prefer you do it in the house under adult supervision. Stay tuned.

Portfolio Update – January 2025

No changes to overall tactical asset mix this quarter.

Fixed Income Moves

- VSB: Trimmed to 20% (from 25%)—rate cut expectations already mostly priced in.

- VAB: Exited (from 20%)—dropping our passive exposure to general Canadian bond market.

- BSKT: New 25% allocation—added for active approach and added flexibility with corporate credit.

U.S. Equity Changes

- Added: Intuit (2%)—strong growth outlook.

- Boosted: Broadcom (from 2% to 4%)—rising revenue & EPS.

- Cut: Analog Devices (from 4% to 2%)—weakening outlook.

- Exited: Moderna (from 2%)—investment thesis no longer holds.

Canadian Equity Shifts

- Added: Shopify (5%), CIBC (5%), Manulife (4%), Constellation Software (4%), CN Rail (3%), National Bank (3%)—growth & financials tilt prudent for potential conservative fiscal policy.

- Reduced: Enbridge (to 4%), CP (to 3%), Loblaw (to 2%), Rogers (to 2%), Telus (to 2%), Brookfield (to 2%), WSP (to 2%), Topaz (to 2%)—tightening exposure in favour of growth factors.

- Adjustments reflect a steady hand—staying ahead of shifts, not chasing them.

Gold Seal Insights

Tanya’s Tips: Federal Government Defers Capital Gains Inclusion Rate Increase to 2026

In a significant update, Finance Minister Dominic LeBlanc announced last week that the federal government will postpone the planned increase to the capital gains inclusion rate—from one-half to two-thirds—until January 1, 2026. This is a shift from the previously scheduled implementation date of June 25, 2024.

For those who had already made financial decisions based on the earlier timeline, this announcement may come as a shock. However, it does provide clarity for 2024 tax planning, allowing individuals and businesses to adjust accordingly.

What Stays the Same? Despite the delay in the inclusion rate change, some key measures remain on track:

- Lifetime Capital Gains Exemption (LCGE) Increase – The planned increase to $1.25 million for qualified property remains effective June 25, 2024. This is not being pushed to 2026.

- $250,000 Annual Threshold for Individuals – Individuals will still have the first $250,000 of annual capital gains taxed at the lower 50% inclusion rate, with only gains above this threshold subject to the new two-thirds rate. However, this change is now scheduled to take effect January 1, 2026.

- Canadian Entrepreneurs’ Incentive – This measure, introduced in the 2024 Federal Budget, remains on course to take effect on January 1, 2025.

What This Means for Tax Filings

Given today’s announcement, the Canada Revenue Agency (CRA) is unlikely to enforce the higher inclusion rate for 2024 unless new legislation is passed. For businesses and individuals who already filed tax returns based on the original June 25, 2024 timeline, amendments may be required to recover any excess taxes paid. If this applies to you, consulting with your tax professional is advised.

For the official news release and additional details, visit the Department of Finance website.

As always, if you have questions about how these changes impact your financial strategy, we’re here to help.

Noteworthy Links

- US benefits from Canadian trade at least as much as Canada

- What a Trump trade war would mean in nine charts

- Here’s how Canada can stop making things worse

- Indigo’s Best Books of 2024

- How to make your 2025 financial goals last beyond January

- Trump tariffs would push Bank of Canada to cut interest rates more this year, says BMO

Picture of the Month