Gold Seal Monthly Review

“The future does not come in forecasts or headlines. It arrives in how we respond to the uncertainty between them.”

The Budget That Passed and the Questions It Leaves Behind

With the passage of the 2025 federal budget on November 17 after the razor-thin 170-168 House of Commons vote, Canada finds itself at a crossroads. The budget is now law and we no longer have to speculate about its intentions. Instead we must ask: what does it mean for the economy, for households, for investors, and for the spending sanity of Ottawa?

What passed:

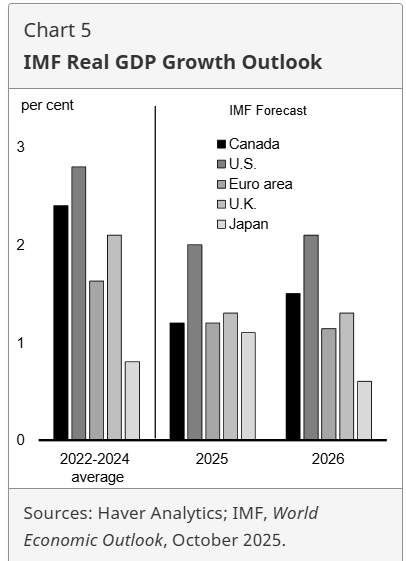

At its heart, the budget carries forward the priorities laid out back on November 4: an anticipated deficit of $78.3 billion in 2025–26, with deficits exceeding $50 billion annually for the next five years. It comes amid weak investment, trade headwinds (especially from U.S. tariffs), and cautious growth; the International Monetary Fund expects Canada to post the second-fastest growth in the G7 in 2026–27, but only after a sluggish near-term recovery. Much of that ranking reflects how weak growth is across the rest of the G7, rather than a true acceleration in Canada’s underlying productivity or per-capita output.

The government touts this as a “reset” budget: infrastructure and nation-building are emphasized, with the hope of jump-starting productivity and diversifying away from over-dependence on the U.S. But the more cautious voices have begun to question the scale. According to the Parliamentary Budget Officer, the chance of achieving a declining deficit-to-GDP ratio as promised is only 7.5 per cent.

What we are watching (and what you should too):

- The modest capital expenditure component. Some analysts point out that the increase in capital spending is only about $8 billion per year starting 2026-27, which is small relative to the $528 billion in program spending projected that year. That suggests the “nation-building” rhetoric may be louder than the scale.

- Inflation and interest-rates. With deficits at this level and tax-revenues under pressure, the risk of higher interest costs is elevated. It may not matter if interest rates stay static, but if inflation or external shocks force rates up, Canada’s borrowing cost will bite. The budget appears to count on stable or improving growth, which is a leap in the current climate.

- Tax and policy stability. On the plus side, no major surprise tax hikes for middle income earners. But for business and complex-estate planning, the clarity is less helpful. Savings targets and structural reforms are aspirational; the execution will tell the story.

Our verdict:

This budget deserves measured praise and measured caution. It is worth acknowledging that Ottawa avoided triggering an election with the vote as it gives a degree of political stability in a fragile economic moment. The investment in infrastructure and focus on diversification are strategically sensible, especially given the trade-shock backdrop. However, we feel the scale of “investing for the future” falls short of what is arguably needed for a generational leap. The slack in the capital budget is meaningful. The reliance on growth and restrained borrowing costs feels optimistic in a world that is increasingly volatile. In short: it’s a credible budget, not a transformative one.

What this means for our clients:

As a team, we will be keeping our eyes on fixed income spreads, credit-markets and the Canadian dollar. Policy risk hasn’t disappeared, it’s just shifted. For business owners and high-net-worth clients: this is a good time to review succession and tax-planning assumptions. For households: affordability remains under pressure, and new spending doesn’t yet offset structural headwinds, so caution remains warranted.

The Wellington-Altus Advanced Wealth Planning Group has created a concise overview of the key measures from the 2025 Federal Budget, which can be viewed here.

Spotlight: Leadership in Focus

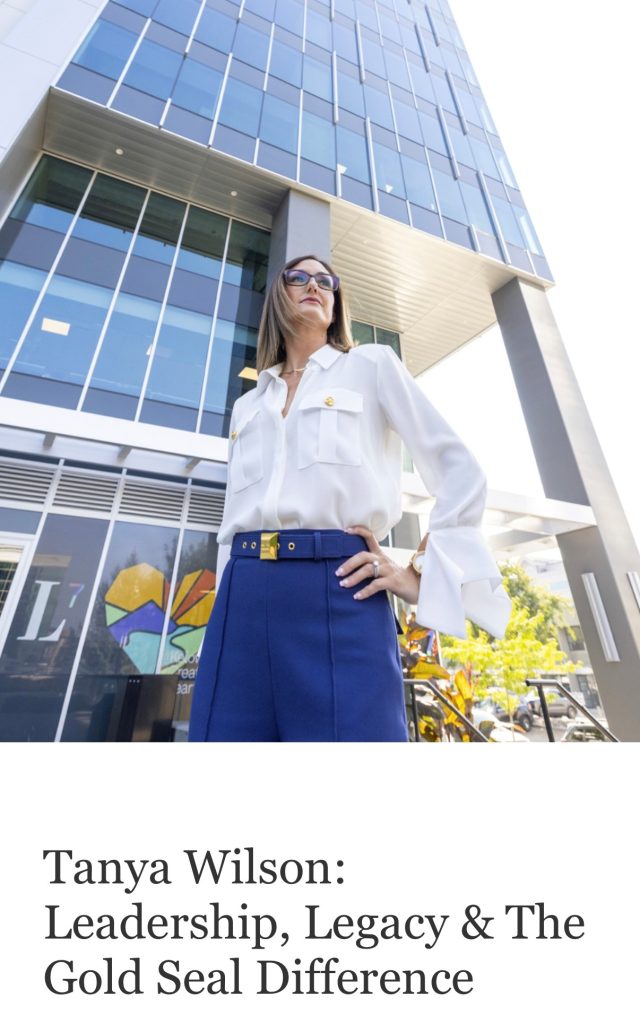

We’re proud to share that Tanya Wilson was recently featured in LIV Magazine’s “Leadership & Legacy” series – a profile that explores how vision, integrity, and purpose have shaped both her career and the Gold Seal approach to client service. It’s an insightful look at what drives the team’s commitment to excellence and authenticity.

For clients and colleagues alike, the piece captures what makes Gold Seal distinct: a culture where deep expertise meets genuine care. It’s a reminder that excellence in finance isn’t just measured in returns, but in the confidence clients feel knowing their future is in capable hands.

→ Read the full feature in LIV Magazine

Market Insights: Wealth in a CapEx Supercycle.

In his latest Market Insights publication, our Chief Market Strategist Dr. James Thorne turns his attention to one of the most powerful yet overlooked forces shaping global portfolios today: the emergence of a CapEx-driven supercycle. He outlines how decades of underinvestment are now giving way to a historic rebuild of energy systems, manufacturing capacity, intelligence infrastructure, and the physical backbone required for an AI-enabled economy. From the resurgence of North American industrial policy to the race for secure supply chains and technological self-sufficiency, Thorne argues that we’re entering an era where wealth creation will increasingly follow the flow of real investment rather than financial engineering. It’s an essential read for anyone tracking the structural trends that will define capital markets in the decade ahead.

→ Read Dr. James Thorne’s full November Market Insights report

Gold Seal Insights

Mallory’s Memo: Maximizing your RESP

Mallory’s Memo: Maximizing your RESP

With back-to-school season in full swing, many families are turning their attention to education savings — and how to make the most of what they’ve built. When it comes to Registered Education Savings Plans (RESPs), knowing how and when to take money out can make a meaningful difference.

There are two main types of RESP withdrawals. Educational Assistance Payments (EAPs) include government grants and investment growth. These are taxable, but often result in little to no tax because students typically have low income. Post-Secondary Education Payments (PSEs) are your original contributions and can be withdrawn tax-free while your child is enrolled. Drawing EAPs first, while a student has tuition and basic credits available, usually maximizes the tax advantage.

If not all the funds are used, families can transfer unused RESP income to another child or, in some cases, to their own RRSP to keep those savings working. With a little planning, every RESP dollar can go further and stay focused on its original purpose: helping your child succeed.

→ Read the full RESP planning guide from our Advanced Wealth Planning team

Noteworthy Links

- What a surging national deficit could mean for Bank of Canada rate cuts

- Bank of Canada cuts again as growth slows

- Canadians edge up holiday spending amid lingering economic jitters

- Gen Z feels left behind in the race for financial success

- Unmotivated sellers could be keeping Canada’s housing market frozen

- New Data Reveals Life Insurance Can Support Canadians’ Mental Well-Being Amid Widespread Household Financial Stress

- Trump, Carney and the Western Awakening

Picture of the month

When markets are low, the line is empty because courage is required precisely when confidence is scarce; when markets are high, the crowd rushes in because euphoria masquerades as insight. The quiet secret of successful investing is learning to act when others won’t, and to pause when everyone else can’t.