Gold Seal Insights

“Always vote for principle, though you may vote alone, and you may cherish the sweetest reflection that your vote is never lost.”

– John Quincy Adams

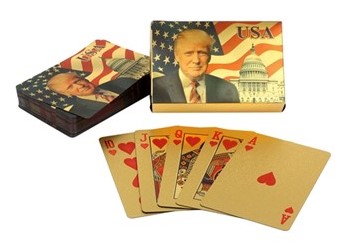

Playing the Trump Card: How to Play When the Deck is Shuffled

Has anyone ever seen a sequel that was better than the original? Let’s take a closer look at this yearend “blockbuster”. With former President Donald Trump’s recent re-election, the U.S. faces new economic priorities that could impact financial markets, everyday expenses, and long-term investments.

This election has stirred strong emotions, with varying opinions about the return of Trump’s policies and their societal implications.

We certainly hope our readers understand that at Gold Seal Financial Group, our diverse clientele will undoubtedly have varying opinions on the contentious societal implications from the outcome of this election, and hope it’s appreciated that our role here is not to provide opinions on the social aspects of either platform or of either candidate’s character. Our role is to provide an objective outlook on the fiscal impact of this political shift, what it means for your financial well-being, and how to play your hand after the deck has been shuffled.

Initial market reactions to Trump’s victory have been optimistic, with stocks rising across major indices like the S&P 500 and the Russell 2000 Index. Investors are betting on Trump’s expected economic agenda, which focuses on deregulation, tax cuts, and tariffs. Sectors like banking, energy, and traditional manufacturing are likely to benefit from these changes. Think of the markets as adjusting their sails to catch a favourable wind—investors see Trump’s policies as boosting growth in specific sectors, but it’s important to recognize potential shifts and risks in others. Impacts on the technology sector remain uncertain at this time, as the likely short-term boost in de-regulation may pave the way for accelerated artificial intelligence and blockchain development. However, these initiatives may have that growth bottlenecked by the anticipated tariffs on importing the semiconductors relied upon to provide processing power for both. It’s of note that in the case of Taiwan semiconductors (TSMC), this tariff consideration was also a priority on the President Joe Biden platform.

Tariffs were integral to the Trump campaign, promoting a nationalist approach to growth with the goal of spurring American manufacturing and therefore becoming less reliant on trade and foreign policy. Tariffs act like a toll gate on imported products, raising the cost of items like electronics, appliances, and other consumer goods. Adding these “tolls” can and likely will increase everyday costs, pushing inflation higher. Economists warn that this could become a balancing act for the U.S. Federal Reserve, which may feel pressured to slow rate cuts to avoid further inflation, even if the economy begins to cool.

Trump’s plan to extend the 2017 Tax Cuts and Jobs Act, set to expire in 2025, also has significant implications. By continuing these tax cuts, he promises to lower taxes for individuals and corporations, which could mean more take-home pay and higher profits. However, these benefits vary widely depending on income. The proposed tax extensions would reduce tax burdens across income levels, with middle-income households potentially seeing an average relief of US$1,700, while higher earners, such as those with incomes around US$1.8 million, could gain closer to US$50,000. This approach also includes extending the corporate tax rate reduction from 35% to 21% and potentially lowering it further to 15% for many companies, aiming to provide broad-based tax relief.

Specific proposals, such as tax exemptions for veterans, police, and firefighters, could also affect certain demographics uniquely. More widespread tax relief initiatives include making auto-loan interest tax deductible and exempting overtime and tip income from taxation.

In Canada, the ripple effects of Trump’s policies are being watched closely. His proposed tariffs could challenge Canada’s trade relationship with the U.S., . Analysts predict that tariffs of 10% or more would cost Canada billions in economic output, as cross-border trade becomes more expensive and complicated. If Trump revisits the U.S.-Mexico-Canada Agreement (USMCA), as he has suggested, Canadian businesses may face additional hurdles to maintaining seamless access to U.S. markets. Trump’s tax cuts for U.S. companies could also impact Canada’s competitive edge in attracting investment, as American firms find more incentives to keep capital at home. Canadian investors, therefore, may need to brace for increased volatility in trade-sensitive sectors and a potentially (and likely) weaker Canadian dollar.

In the bond market, Trump’s win has already pushed up Treasury yields, signaling that investors expect a future with higher government spending and inflation. Bond yields are like a thermometer for economic expectations; when they rise, it’s often a sign that investors believe growth—and perhaps inflation—is ahead. Higher yields could benefit new bond buyers, offering better returns. However, for current bondholders, rising yields mean lower bond prices, which can lead to volatility and lower returns, particularly for long-term bonds.

The global market response also underscores how Trump’s policies might create both winners and losers. European markets, sensitive to Trump’s potential tariffs and trade policies, experienced a pullback. Tariffs targeting countries like China (60% or higher) could dampen international trade and slow global growth, impacting sectors worldwide. For U.S. investors, this means potential opportunities in domestic stocks but more caution toward internationally exposed sectors. Our portfolio positioning already expressed that we were more optimistic on the Stateside of U.S.-China trade relations, having maintained an underweight to Chinese equity since inception in 2022, and a U.S. equity overweight since February of 2024.

At Gold Seal, our role is to help you navigate these changes and keep your financial goals in focus. Political shifts can create economic ripples, but they don’t have to derail your financial plan. If you have questions about how these developments may impact your portfolio, we’re here to discuss the best course of action. One of the most challenging aspects of our role is to remain impartial and objective, focusing on the fiscal facts without bias. That said, should you have views driven by any societal, socioeconomic, or environmental (ESG or otherwise) factors, we’re here to assist in building tailored solutions and can screen portfolios appropriately. We thank all of our clients once again for your confidence in our team’s approach in helping you adapt to this evolving landscape, as we aim to provide clarity and guidance for your financial future—no matter how the cards fall.

For those looking for a quick highlight reel, here’s our top 15 takeaways:

- Market Optimism: Stock indices like the S&P 500 and Russell 2000 rose, reflecting investor optimism around Trump’s pro-business stance.

- Tariffs on Imports: Trump’s proposed 10%-20% tariffs on all imports, especially from China, could raise consumer prices in the U.S. and impact trade relationships.

- Higher Inflation Risk: Increased tariffs and expanded spending may drive inflation higher, complicating the Federal Reserve’s goal to keep it in check.

- Tax Cuts for Wealthy & Corporations: Extending the 2017 tax cuts would primarily benefit high-income earners and large corporations, boosting their profits.

- Impact on Middle-Income Households: Middle-income families could see smaller tax reductions, though less significantly than wealthier households.

- Financial Sector Growth: With anticipated deregulation, the banking sector could expand, benefiting from Trump’s policies on reduced financial oversight.

- Energy Sector Boost: Trump’s support for oil production and rollback of climate policies may fuel growth in fossil fuels, likely benefiting U.S.-based energy companies.

- Bond Market Volatility: Rising Treasury yields indicate inflation and spending concerns, creating volatility for current bondholders with possible lower returns.

- Potential U.S. Dollar Strength: Anticipation of higher interest rates could strengthen the dollar, impacting global currency markets and trade costs.

- Effect on Canadian Economy: Trump’s tariffs could hurt Canada’s export economy, with estimates suggesting billions in economic losses if U.S.-Canada trade is disrupted.

- Challenges for U.S. Trade Partners: Major trading partners, especially in Europe and Asia, may see weakened demand from the U.S. and rising trade costs.

- Reduced Market for Immigrants: Trump’s proposed large-scale deportations of undocumented immigrants could reduce the labour force, particularly in sectors like construction and agriculture. That said, with the U.S. labour force participation rate below 2019 levels, fewer immigrants may create additional opportunities for citizen participation in those roles.

- Uncertainty in Renewable Energy: Renewable energy stocks may struggle under Trump’s policies, which focus on traditional energy and reduced climate-related investments.

- Weaker Canadian Dollar: As the U.S. dollar strengthens, Canada’s dollar may weaken, raising costs of U.S. imports for Canadian consumers.

- Increased U.S. Competitiveness: Lower corporate taxes and deductions for research and development could attract business investment back to the U.S., creatin