Many individuals approaching retirement wonder if there is an optimal age to begin taking their Canada Pension Plan retirement pension benefits (CPP). The question often arises because CPP is calculated based upon the age at which an individual starts to receive monthly payments. Though the standard age to start CPP is 65, Canadians can start receiving CPP as early as 60 or as late as 70.

The standard CPP entitlement at age 65 is reduced by 7.2% for every year (0.6% per month) taken before 65 and is increased by 8.4% for every year (0.7% per month) taken after 65.

Should individuals defer taking CPP to take advantage of the increased CPP benefit entitlement? It depends.

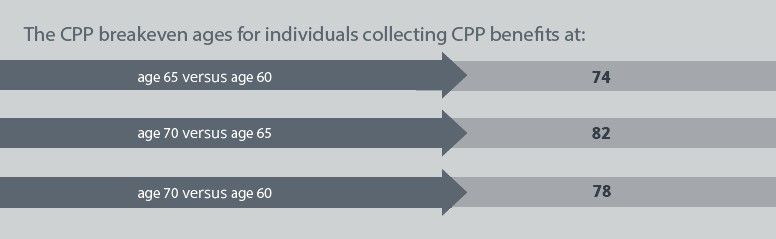

The CPP breakeven age is a good starting point to evaluate one’s options; however, it should not be the sole factor in deciding.

What is the CPP breakeven age?

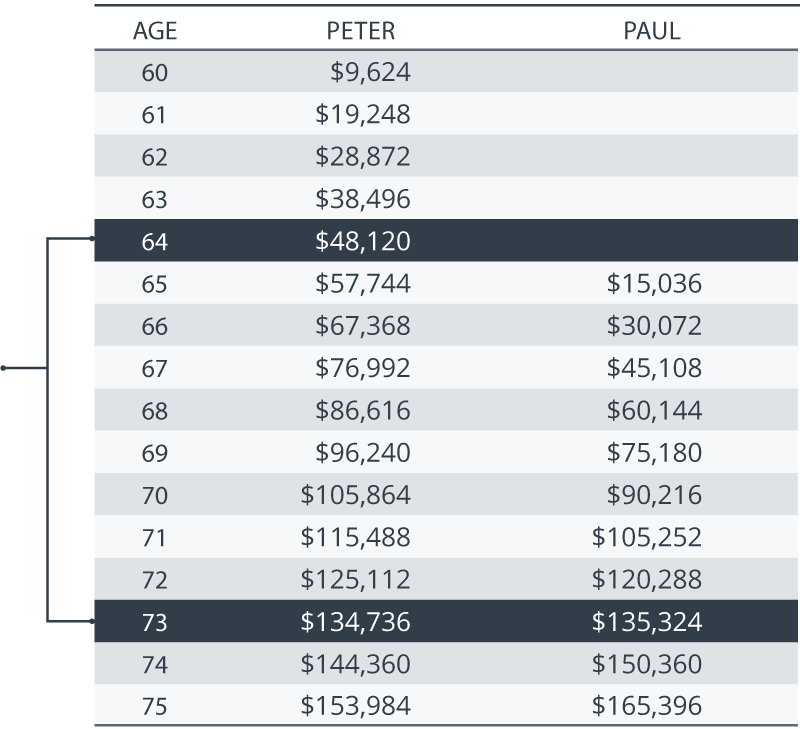

This concept is best explained with an example. Let’s assume Peter and Paul are both 60 years of age in 2022 and will be eligible for the maximum CPP benefit at age 65. For 2022, the maximum benefit at age 65 is $1,253/month ($15,036 per year).

Peter decides to take CPP now at age 60, and as a result his benefits are reduced by 36% to $802/month or $9,624 per year. Paul decides to wait until age 65 to start collecting his CPP benefits. The table on the right demonstrates the cumulative annual CPP payments they will each receive.

Peter has collected almost $50,000 before Paul has received his first CPP benefit payment. The general perception is that Peter will be permanently better off financially. This is incorrect. If Paul lives beyond the breakeven age of 74 (73.9 to be exact), he will not only catch up to Peter, but he will also receive greater benefits than Peter for having delayed receipt of his CPP to age 65.

This analysis does not consider annual inflation adjustments to CPP benefits, which may further increase the pension entitlement of an individual who chooses to delay receipt of their CPP benefits.

Key takeaways

- CPP benefits, which are guaranteed and indexed over one’s lifetime, can be increased by 42% if deferred to age 70.

- If an individual is in reasonable health and has other assets and income streams to support their retirement lifestyle needs, it is generally recommended to defer taking CPP benefits as late as possible.

- Lifestyle matters. Don’t delay taking CPP if it is needed to enjoy retirement lifestyle needs today!

- While the breakeven age is a good rule of thumb, the optimal age to start CPP benefits should be decided in the context of a person’s overall financial situation. Consult a Wellington-Altus Advisor to discuss CPP benefit options.

Consider starting CPP early if…

• Your current health (or your family history) suggests you might have a shortened

life expectancy,

• You wish (or need) to retire early but lack sufficient savings, income and cash flow to achieve your retirement lifestyle requirements.

Consider delaying CPP early if…

• There is a family history of longevity and you are in great health,

• You expect to remain in the workforce but don’t yet qualify for the maximum CPP entitlement.

These additional years of earnings will increase your basic CPP pension.