Gold Seal Monthly Review

“Every day is a journey, and the journey itself is home”

– Matsuo Chuemon Munefusa

Barstools and Backdrops – Growth Themes Defy Traditional Gravity

What movie won Best Picture at the Oscar’s in 1994? You’re not realistically expected to know offhand, and I’ve reflected recently that I may be in the final demographic of Advisors that remembers a time when this once-asked barstool trivia question simply ended with an “agree to disagree” outcome. Where today the resolution to our spirited evening debate would be solved by a quick consult with “The Google”, my Motorola flip-phone of the era and its numbered keypad were of no use in providing assistance with my query that evening. Instead, we’d all go home, do our independent dial-up research, and return to ridicule each other for lack of trivia knowledge at a later date. In the moment, there was an acceptance of ambiguity and a tolerable patience threshold that was embedded in conversations, conflicts, and even business dealings. Not only does this ‘acceptance’ no longer exist today, but allowing it is recognized as technological ineptitude. Answers are to be delivered immediately and accurately, opinions are to be not only validated, but affirmed, and cause should quickly lead to an effect. It’s this mentality that for some, makes today’s capital markets so incredibly frustrating. That’s understandable – certainty is addictive and quickly becomes an investor’s accepted status quo. 2020 through 2021 represented a period of cause and effect with immediate gratification, as the largest central bank intervention or “money printing” effort immediately caused stock valuations and prices to soar. That was expected to lead to inflation, and while there was a relatively short lag before we saw those effects, we still accepted 2+2=4 as:

“There is more money in the economy available” – Increased Money Supply

+

“Consumers have healthier savings portfolios” – Wealth Effect

=

“I should charge more for my goods and services” – Inflation

This inflation was an almost certain response, as was the ensuing swiftest increase in interest rates we’d seen since 1982 to combat it. When you consider that over 60% of the US retail money that has come into the market since 2014 has done so since 2020, it’s fair to say that there is a large cohort of investors that have come to expect an immediate market movement to reflect the latest news, inflation or interest rate outlook. Further, two thirds of new retail investors are under 45 years of age and by nature of career development were unlikely to have participated in the 2008 financial crisis, let alone the 2000’s dot-com bubble. The environment to which they are accustomed is one of low rates, a history of investor bail-outs, suppressed inflation, peak globalization and strong, consumption-led demand. These are not the prevalent conditions of today.

In contrast to the accommodative environment that led to high stock valuations, we now sit here today over two years into coordinated restrictive global efforts to raise interest rates, “de-print” the money supply and ultimately cool-off a heated inflationary market. Rather than the immediate market response in the defensive direction, we’ve watched the U.S. market hit all-time highs in March of this year and Canada follow suit the following month. Investors felt the rush and same sense of satisfaction that they’d remembered from their 2020 gains, but without the prerequisite causes to lead to the effects. Those expecting updated conditions to be reflected with conservative stock prices and valuations in the short term would be left disappointed as they are left waiting – just as I’d have to wait to get an answer on my Oscar winner to rub it in Carson’s face. When you’ve grown accustomed to certainty and immediate response, that’s infuriating.

What’s been forgotten is that the true status quo of the capital markets is not one of certainty, and just because stocks may appear overvalued based on some factors, it does not immediately follow that they must revert to a mean or fair value. At all times, market prices are thought to represent the “best guess” of the present views and outlooks of its collective buyers and sellers. Difference of opinion is the complicating factor, and intuitively, if we all agreed on an outlook and appropriate price, we’d all just pay the $277 for a share of Microsoft (MSFT:$389.30) that’s reflective of its earnings, and the share price wouldn’t fluctuate. The second-level question then becomes: if stock market prices are defying the restrictive gravitational pulls towards our traditional market assessment factors, what other growth perspectives are being digested into today’s valuations that are providing a support at this lofty level?

You’re going to have to promise me you won’t stop reading (from boredom) when I say: Conventional economics would dictate that economic growth is a function of investment in the labour force plus investment in capital, multiplied by a technological efficiency measure called “Total Factor Productivity” (TFP). Analysts love to phrase things like that, but our analysis needn’t go any further than our trivia bar analogy.

The success of a bar trivia night, which is measured by the amount of questions we’re able to crank out and the cash generated for the bar, is going to be directly related to the amount and quality of trivia players that show up. In our story, that’s the labour force. The more that the bar owner has invested in his own infrastructure which, in this case is the bar and its services, the more people will be attracted to show up and the greater the crowd the bar can hold. That is the bar owner’s investment in capital. Our bar would thrive and grow by improving its attendee numbers and investment in its capacity and offerings, just as an economy would grow with improvements to its labour force or investment in its infrastructure. Where North America is concerned, we presently have two different countries taking two very different approaches to influence this equation.

Ultimately, the traditional model states that investment in labour is more important than investment in capital, and this is inarguably where we begin to highlight Canada’s approach to driving economic growth. Between permanent and non-permanent residents, students, refugees and asylum seekers combined, Canada’s immigration exceeded one million people in each of 2022 and 2023. It only took another 9 months after reaching 40 million people in June of 2023 to add another million people to ultimately achieve a population of 41 million by March of 2024. Presently, our 3.2% annual population growth rate exceeds that of every other OECD country, and this is a country already experiencing a housing crisis, where homelessness was declared a national disaster in 1998.

Let’s get back to this bar. There’s two components to our trivia-based labour force that can influence event success. The first is the quantity of people showing up, and in this regard Canada has excelled as a developed climate destination with attractive immigration policies. The second labour-based component is the attendance of highly educated or specialized patrons that have the knowledge base to work through our collective question set, with the financial stability to run up a bar tab in the process. These are the bar-stars, and Canada needs more of them. If you take the approach of focusing only on quantity of attendees, there’s a maximum useful number of people in the room that we’d call “marginal utility” in economics. At first, you can add more people to get more teams and participation in our trivia games, and the additional experiences and perspectives will lead to additional questions answered and more bar tabs. However, as more and more people show up, you begin to experience diminishing returns as too many perspectives lead to table arguments and squabbling, too much noise to articulate answers, and without investment in additional bar infrastructure, overcrowding that actually serves to deter attendance by your desired bar-stars.

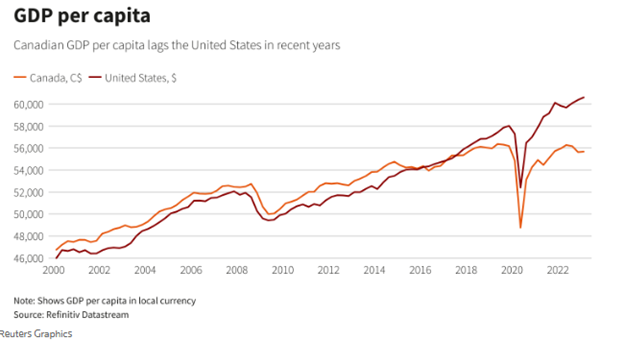

It’s this additional and sudden influx of people that also disguises the state of affairs, albeit temporarily. Consider in isolation a bar table of 5 people that each has $100 to spend for the evening, resulting in an event output of $500. Now, expand this same table to 15 people that each only have $35 to spend for the evening for a total of $525. On the surface level, your output/event success, or GDP has increased by $25 or 5%. The markets like positive GDP growth and tend to increase in value on such news, just as Canada’s did through the first quarter of 2024. However, the contribution to this growth per-person in our story was only $1.67, and it goes without saying that the quality of the bar experience by those 15 people on constrained spending budgets falls far behind that of the initial 5 people with ample spending budgets. That’s our present issue: GDP growth per capita, or per person in this case, is decreasing such that additional people are not contributing to growth at the same pace as previously, and the additional population is now experiencing a deteriorated quality of life. Further, our ability to invest in the infrastructure to accommodate these additional patrons has fallen far behind their pace of attendance, as even our own Canadian Mortgage & Housing Corporation states that it would take the addition of 3.5 million housing units beyond what is planned to restore any semblance of housing affordability. In short, our population has expanded at such a pace that exceeds the required investment in infrastructure to accommodate. “The Canadian economy on a per-capita basis is flat on its back,” said David Rosenberg, chief economist and strategist at Rosenberg Research. Through population growth “you can create this mirage of economic prosperity, but in the end that’s what it is, a mirage,” he said.\

For now, the Canadian market emphasizes and celebrates minor GDP gains, meanwhile the economy reflects the largest lag behind U.S. GDP per capita in over 25 years. While the highlight reel of the recently released Canadian Federal Budget is covered in this letter below, there’s one directional anecdote I’d share on the fiscal side with regards to this plan entitled “Fairness for Every Generation”, where a key highlight is a targeted increase in capital gains taxation on those with large accumulated gains. Our Canadian trivia teams already have a setup where the bill comes to the table, and each participant’s income is tied to what they’ll owe. When it’s time to settle up the bar tab, the higher income earners cover a larger proportionate share of the bill. When you accumulate more people at the table who begin to demand that the better-off patrons pick up more and more of the tab, not only do those better off patrons leave to find another bar, but the remaining patrons are left with a larger contribution required from each to settle the tab, putting everyone in a worse position. If only there existed a place where taxation and share of these “bills” were lower and that wasn’t trying to fill the room to capacity every night….

Moving on to the U.S. and its own gravity-defying growth factors. Let’s hold the number of people in the bar constant for a moment and assume a similar level of investment in its facilities and services. Now let’s give everyone at the table, regardless of education level or specialization, a 5G, data-connected cell phone – the kind I wish I’d had in determining Best Picture. This is the measure of technological efficiency known as TFP, and it doesn’t incrementally increase GDP/output like labour and capital investment – it multiplies the impact of both. All of the sudden, this trivia night is blowing through questions and challenges at a much faster pace without having to let anyone else in, and without requiring any further investment in the bar’s capacity or offerings. The increased pace of the game without overcrowding allows for better enjoyment, and the patrons in turn run up a higher tab. For the pioneer tech-sector of the United States, this is the promise of new artificial intelligence technology – to drastically improve the growth capabilities and output of even an unchanged or decreasing labour force and capital investment. In the context of valuing a corporation, a company that can now produce much higher sales and revenue without having to hire additional workers or build additional factories should be valued much, much higher than it was in absence of that technological edge. The prospect of A.I. doing for worker productivity what the internet has done for commerce capabilities is extremely attractive to investors seeking better returns on their invested capital. It’s why we’ve seen A.I chipmakers rise to the ranks of the U.S’s “Magnificent 7” most highly valued stocks, and supports the overall theme of tech dominance within the U.S. market. The late 90s also showed a similar period of single-sector concentration based on technological development, where companies poised to benefit the most from internet connectivity became “almost certain” investments. Today, there’s a familiarity and perceived certainty with a smaller selection of corporate names that are sure-fire poised to do the same. The internet did go on to improve North American output exponentially over the following decades, but there were many companies poised on the starting line that did not benefit from its adoption. The merits and impact of artificial intelligence on our output going forward will only be known in retrospect, but with history as precedent, it is very unlikely to benefit the initially expected market participants.

Market prices are supposed to adjust as they digest all information and all perspectives, at all times. Predicting which particular factor or outlook will drive market sentiment in the short term is near impossible. Pervasive themes for this year have been a rapid population expansion in Canada providing room for improved economic growth and in turn, market growth, and the U.S. outpacing both of these growth assumptions with a technological edge. Competing for market sentiment, as we sit pensively evaluating our barstool backdrop, is the restrictive efforts of policymakers in North America to curb consumer spending and inflation, to increase the cost of capital for corporations, to discourage speculative investments, and to ultimately temper over-eager expectations. Between the impact of the largest generational wealth transfer North America has ever seen, to increasing geopolitical conflicts, to supply chain disruption and onshoring, to inflation readings and interest rate assumptions, nobody has the crystal ball or power to know what theme will lead market direction over the short term.

What we do know is that the 1994 Winner for Best Picture at the Oscar’s was Forrest Gump. For those unacquainted, that was the story of an intellectually limited individual that simply didn’t possess the capacity to take hold of any particular direction, and rather lived according to the unpredictable whims of the factors, relationships and circumstances out of his control that presented themselves. Juxtaposed over the tumultuous backdrop of 50 years of living through social movements, changing ideologies, and war conflicts, was Forest’s unwavering and consistent philosophy. In good times and in bad, his approach carried a grounded and moral optimism that could be mistaken for naivety in the context of his current events. We’ll save spoilers, but while his story repeatedly experiences challenges and hardships, Forrest finds fortune through the opportunities that his approach affords him, even when the payoff wasn’t immediate or predictable. I like to think that’s a useful parable for every investor, that while you never know what you’re going to get, a consistent, grounded and almost naïve optimism traverses almost all conditions. That, I feel, is almost certain.

Federal Budget Increases Capital Gains Rates

In situations where the higher capital gains inclusion rate will apply, there may be tax planning opportunities available to spread the capital gain over multiple years to stay within the $250,000 annual threshold. Unfortunately, this is not so simple for those selling real estate not covered under their principal residence exemption. From an asset allocation perspective, this may make public securities more attractive than real estate in the future.

The 2024 Liberal Federal Budget was recently released and includes initiatives such as long-overdue housing measures and increased capital gains tax, which have far-reaching implications for investors.

High-Level Summary:

- The Budget increases the capital gains inclusion rate from 50% to 66.67%, effective June 25, 2024 (up to $250,000 of annual gains for individuals will continue to benefit from the 50% inclusion rate). For corporations and trusts the inclusion rate will be 66.67% on all amounts.

- The Budget confirms previously announced proposals to amend the Alternative Minimum Tax effective January 1, 2024, but slightly softens the impact of these proposals on charitable donations.

- There are no changes to the personal or corporate federal income tax rates.

- Increase the Lifetime Capital Gains Exemption (LCGE) to $1.25m. LCGE is a tax provision which allows individuals to shelter a portion of the capital gains realized on the disposition of shares of a Qualified Small Business Corporation (QCBC) and Qualified Farm or Fishing Property.

- Some of the housing affordability measures include:

- Increase to the Home Buyer’s Plan (HBP) withdrawal limit to $60,000 and temporarily deferring the repayment schedule by three years.

- Increase insured mortgage amortization to 30 years for first time homeowners purchasing new builds beginning August 1, 2024.

- Ban on foreign home buyers and anti-flipping rules

Further details and measure are outlined in the Wellington-Altus 2024 Federal Budget commentary HERE.

Fiscal Outlook:

- 2023 – 2024: $40 billion deficit. Federal debt as a percentage of Gross Domestic Product (GDP) is expected to be 42.1%.

- 2024 – 2025: $39.8 billion deficit. Federal debt as a percentage of GDP is expected to be 41.9%.

- 2025 – 2026: $38.9 billion deficit. Federal debt as a percentage of GDP is expected to be 41.5%.

Further clarification on the Capital Gains Inclusion changes:

Since 2000, 50% of realized capital gains are included in taxable income. This is known as the inclusion rate. Note, capital gains within a registered account are not taxable. Under the current inclusion rate, a $1M realized capital gain would result in $500,000 taxable income. The proposed inclusion rate is 66.67%. For individuals, this new inclusion rate would apply only to the portion of realized capital gains exceeding $250,000 in a tax year. For corporations, the 66.67% inclusion rate would apply to all realized gains with no $250,000 threshold.

Under the proposed inclusion rate, an individual with a $1M realized capital gain would include $625,025 in their taxable income ($250,000 at 50% plus $750,000 at 66.67%). A corporation with a $1m realized capital gain would include $666,700. At the top marginal tax bracket of 53.5% in BC, the proposed changes would cause an increase of $66,888.38 in taxes owed in this scenario ($625,025-$500,000 multiplied by the 53.5% tax rate). For a corporation, the proposed changes would increase the tax bill by $89,185.

Investors are understandably concerned about this proposed change, but the technology industry is being particularly vocal. The Council of Canadian Innovators stated that “The tech industry is viewing this budget as hostile”. Benjamin Bergen, the group’s president, said in an interview “This shows a fundamental misunderstanding of how the innovation economy works. Ultimately, it will set our country back.”

What is notable in the budget is the timing of the estimated revenue from these changes. The delay to June 25th for the changes to the inclusion rate is likely designed to allow for people to plan, but also potentially designed to raise revenue. When we look at the revenue that is expected to be raised by the increase overall, it’s frontloaded. For corporations, almost half of the expected increased revenue from this change is in the first year. “Ottawa is likely anticipating investors will push forward asset sales ahead of June 25 to recognize gains in the current 50% inclusion rate” says Brian Ernewein, senior advisor with KPMG LLP in Ottawa. “That’s why you see a significant revenue pop for 2024-25.”

Moving to the the housing plan, Jules Boudreau, Senior Economist at Mackenzie Investments, notes that the budget will likely not have a huge impact on the Canadian economy, one way or the other. For all the noise made about housing in this budget, Boudreau doesn’t see enough to move the needle. “The housing plan is a nothingburger and won’t do much to loosen land and housing constraints in Canada, the chief force holding back productivity growth,” Boudreau says.

Planning Notes:

In situations where the higher capital gains inclusion rate will apply, there may be tax planning opportunities available to spread the capital gain over multiple years to stay within the $250,000 annual threshold. Unfortunately, this is not so simple for those selling real estate not covered under their principal residence exemption. From an asset allocation perspective, this may make public securities more attractive than real estate in the future.

We will discuss this topic further with clients in our upcoming meetings and welcome any questions.

Gold Seal Insights

Tanya’s Tips: Home affordability considerations for first-time home buyers

Tanya’s Tips: Home affordability considerations for first-time home buyers

The Home Buyers’ Plan (HBP) allows first-time home buyers to borrow from their RRSPs to purchase or build a first home for themselves or a disabled family member, with a repayment period of 15 years. The 2019 limit was $35,000, but the 2024 Federal Budget proposes to increase this to $60,000, effective after Budget Day. Additionally, first-time buyers who withdrew funds between January 1, 2022, and December 31, 2025, can have their repayment grace period extended by three years.

First-time home buyers now have both the HBP and the First Home Savings Accounts (FHSA) as useful tools to help them get ahead. As a reminder, the FHSA gives prospective first-time homebuyers the ability to save on a tax-free basis towards the purchase of a first home in Canada. Like a Registered Retirement Savings Plan (RRSP), contributions to a FHSA will be tax deductible. Withdrawals to purchase a first home will be non-taxable, like a Tax-Free Savings Account (TFSA). There are some interesting planning opportunities with these new accounts, so please reach out to our team if yourself, your child or even your grandchild (age 19 or over) qualifies as a first-time home buyer.

Carry forward amounts do not start accumulating until after the FHSA has been opened so if you plan on taking advantage of these accounts, please contact us right away.

More information on these accounts can be found here.

Market Insights

Dr. James Thorne uses lessons from the 1950s to help investors navigate the changing economic landscape. Learn how in his May Market Insights here.

Brendan’s Banter: Technical Strategy

Brendan’s Banter: Technical Strategy

For the first time since October, the S&P 500 finished a month with a negative return. Recall, last month my banter recommended those requiring an abnormal withdrawal to take advantage of the (then) frothy markets. Pullbacks represent the mildest form of a selloff in the markets and are typically 5-10%. From peak to trough of the recent pullback, the S&P 500 dipped 311.29 points (Peak 5264.85 – Trough 4953.56) or 5.91%. Technically, this is enough of a dip to warrant being called a pullback (5-10%), but I’d like the market come back to 4818, our previous market high in December 2021 (circle at far left of white line). This should provide for a stronger set-up for the next leg higher. It would represent an 8.48% pullback from the peak.

The next degree in severity is a “correction”. If a market retreats 10% or more, you’re in correction territory. Stock market corrections are common and have occurred in 10 of the past 20 years. We don’t believe we’re witnessing the beginning of a correction. As history dictates, having a longer-term plan and sticking to it is key to investment success. History suggests that the markets will always find new highs, eventually.

Noteworthy Links

- History of Tesla & its stock: Timeline, facts & milestones

- Don’t rush to sell assets due to higher inclusion rate, experts say

- CEO pay soars among S&P companies

- Canadians’ outlook on retirement is declining, report finds

- Doctors ask Liberal government to reconsider capital gains tax change

- TFSAs, RRSPs and more could see changes in allowed investments

- Canada eyes June interest rate cut amid falling inflation

- WEF president: ‘We haven’t seen this kind of debt since the Napoleonic Wars’

- Feds to give CRA new powers to compel data from taxpayers

- Increase in Canadian Capital Gains Tax – Cross-Border Tax Impact

Picture of the month