Gold Seal Monthly Review

“If you have knowledge, let others light their candles in it.”

– Margaret Fuller

Canada’s 5-star Advisory Teams Revealed!

We’re excited to announce that Gold Seal Financial Group has been honored as a 2024 5-Star Advisory Team by Wealth Professional Canada!

This recognition reflects our unwavering dedication to you, our clients, and our commitment to providing exceptional financial advice and personalized service. We’re incredibly grateful for the trust you place in us every day.

The 5-Star Advisory Teams list celebrates the best in the industry, and it’s truly an honor to be included. This award is not just about us—it’s about our client’s success, the unparalleled support of Wellington-Altus, and the shared journey toward achieving our client’s financial goals.

Thank you for your continued support and for being an essential part of our Gold Seal family. We’re excited to keep working together to create a bright financial future!

Japanese Summer Blockbuster Drops “Godzilla” on Markets

“The flapping of the wings of a butterfly can be felt on the other side of the world.” – Chinese proverb

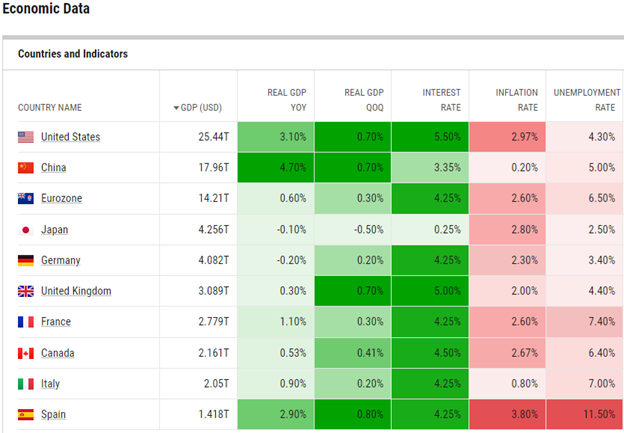

Between presidential pull-outs and assassination attempts in the U.S., the largest-ever IT service disruption, the fear of an AI bubble bursting , and U.S. unemployment hitting 2021 levels causing a revival of recession fears, summer 2024 has brought some unexpected twists to financial markets. Despite the gravity of these headlines, none rattled investors quite like the significant downturn we saw on Monday of this week. The catalyst for this market shake-up was Japan’s central bank raising interest rates for the first time in over 15 years. Despite the butterfly-flap-sized increase from a range of 0-0.1% to 0.25%, the signaling of tightening financial conditions caught many investors off guard and led to a sharp drop in the Nikkei index, which dropped over 12% in it’s worst day since Black Monday in 1987. It didn’t take long for the impact to ripple through global markets, including North America.

A major factor behind the dramatic market reaction was the unwinding of the “yen carry trade.” For years, investors borrowed yen at very low interest rates to invest in higher-yielding assets elsewhere – including U.S. tech. When the Bank of Japan raised rates, the cost of borrowing yen increased significantly, causing a sudden spike in its value. This forced investors to quickly sell off other assets to cover their borrowed positions, contributing to the market volatility we witnessed.

The sudden rise in the yen’s value—nearly 10% against the U.S. dollar—meant that many institutional investors had to act fast. This rapid selling created a ripple effect, leading to significant drops in major indices. For instance, the NASDAQ 100 lost nearly $907 billion in market value in just one day. This sell-off was particularly hard on tech giants like NVIDIA, Apple, and Microsoft.

As a result, Monday’s high trading volumes caused interruptions in major brokerage platforms like Fidelity and Schwab, underscoring the widespread impact of the yen carry trade unwinding. This should serve as a stark reminder of how interconnected global financial markets have become, and how quickly overnight developments can be digested in our domestic markets. If there are (somehow) any of our clients that still believe they can time the market, please do take note of the following chart showing that by the time trading resumed after the weekend, most of the damage was done.

Despite the initial panic, Japanese and U.S. markets showed signs of recovery merely one day after the downturn. The Nikkei index rebounded with a 10.2% gain, marking its largest daily increase since 2008. This bounce-back highlights the resilience of the markets and the importance of keeping a calm, measured approach during periods of volatility.

While Wall Street’s “fear gauge” (VIX/CBOE Volatility Index) hit it’s highest level since the pandemic market declines of March 2020, the U.S. economy appears to be much less rattled. This week, the Atlanta Fed went as far as to further raise its target for U.S. third quarter real GDP growth to 2.9%. Globally, the primary economic risk factor remains a resurgence of our presently moderating inflation readings that would require interest rates to remain elevated. Conversely, our high rate environment is presently serving as the cushion for our inflation soft-landing. The bull-case remains that a severe slowdown in economic growth and rise in unemployment would be met with substantial rate cuts – a tool that was not available during the already rock-bottom rate environment of 2020.

Furthering this optimistic case is the presently record breaking $6.15 trillion in money market funds, representing cash on the sidelines. While some of this is due to the suckers that went running to cash when everyone started screaming “recession” in 2022, the record cash buildup is completely reasonable when investors can achieve solid returns by parking savings in high-yield cash accounts. Rate cuts in response to economic distress would remove that incentive and drive a wave of return-seeking cash into global equity markets, driving stock valuations higher. Fundamentally, earnings have also been surprising to the upside even within the already mega-cap tech sector, with Meta reporting 22% revenue growth last quarter. It’s difficult to worry about a fall with this many lifelines.

Lifelines and economics aside, investors must always be wary of exogenous or outside shocks and systemic surprises that don’t show up in leading data. Our two most significant market events over the past two decades should serve as prime examples. Post-2018 rate cuts painted a picture of a stimulated and growing economy before the outside shock of a global health pandemic rocked financial markets. Loose financial conditions and regulation in the early 2000’s drove economic growth before it was discovered that the high-grade reserve collateral the banks were using to support their deposits were backed by defaulting sub-prime mortgages in 2008. Monday was a reminder for our clients that systemic risks do exist, and if the market activity of that day caused you to take action on your portfolio, that portfolio is objectively not suitable for you and urgent discussion with your Gold Seal Advisor is very politely requested. While dramatic market movements can be unsettling, our goal is to help you navigate these changes with confidence and clarity, ensuring that your financial goals remain on track despite the ups and downs of the market.

Presently, our model “Serenity Portfolios” are enjoying the benefits of a high-rate environment and potential for rate cuts with an overweight to Fixed Income and Bond positions. We maintain a very moderate overweight lean into U.S. markets, a slightly more pronounced lean into discounted international and emerging markets, and an underweight to Canadian markets that Gold Seal Portfolio Manager Ryan Archambault describes as “the shortest on Canada I’ve been in my career”. More on that in our next newsletter, as the Bank of Japan disrupted our initially planned content.

If you have any questions or concerns about your portfolio, please feel free to reach out. We’re here to provide personalized advice and support to help you stay focused on what matters to the success of your wealth plan. Spoiler alert: It has very, very little to do with the value of the yen.

Gold Seal Insights

Brendan’s Banter

In my opinion technical analysis is best used when the markets are in pullback or correction mode. This analysis provides a picture of where the markets should find support (previous levels investors are inclined to invest). When the upward sloping line (upward trendline), from October 2023, was broken late last month, the “charts” would suggest further downside was evident. The market was looking for a reason to take a breather. The first increase in interest rates in Japan after almost 15 years (and the effect of the “carrying trade” as Ryan so eloquently described) and the negative jobs data in the U.S. gave the markets that reason it was looking for.

Most investors will ask: Are we there yet? My short answer is, I don’t think so. With the election looming and the U.S. economy showing signs of recession, it may take a while (weeks/months) before the market continues its upswing.

The good news is that the relative strength index (a score of 30 represents oversold markets and 70 represents overbought markets) is currently reading 33.22 suggesting the bottom is nearby. At 4950 on the S&P 500 (approx. 5% lower from here) we would reach the previous bottom back in April. Future economic data and the central banks’ decision on interest rates will be the defining factors.

Tanya’s Tips: Resist the emotional rollercoaster

Tanya’s Tips: Resist the emotional rollercoaster

There will always be events that cause ups and downs in the financial markets, and it’s easy for many to overreact to short-term news. However, it’s our behavior rather than market volatility, that frequently poses the greatest challenge to successful investing. Adjusting our mindset to recognize that market fluctuations are natural, normal, and healthy aspects of investing is essential.

I often encounter clients eager to invest their cash during a market peak. My advice is to hold off until a more opportune moment arises (namely, a market downturn), allowing for investment at more favorable valuations. However, when such opportunities present themselves, these same individuals not only hesitate to invest the previously earmarked cash but also express a desire to liquidate other components of their portfolio.

Something seems wrong here, doesn’t it?

To be a seasoned, successful investor, we must resist the urge to react impulsively and instead focus on the quality of our investments and our long-term goals and objectives. The Gold Seal Financial Group is here to provide guidance and support in this regard.

Noteworthy Links

- What investors need to know about stock market corrections

- CSA orders crypto firms to start joining CIRO

- The Economy is Landing: Inflation Is near the 2% Target

- Why deficits, private and public, will soon set the economic tone

- Are you a workaholic? Here’s how to spot the signs

Picture of the Month