The Santa Claus Rally

T’was the night before the strategy meeting, when all through the floor

The portfolios were shining, but Gold Seal wanted more;

The yields were printing from the bond desk with care,

With hopes that some rate cuts soon would be there;

Both Powell and Macklem were snug in their beds;

Dreaming rosy speeches for each of their Feds;

From restless Canada we’d pulled back our drift;

For saving that economy would take a tour by Taylor Swift.

When in the U.S. markets there arose some faint chatter,

Between recession and soft-landing, it might be the latter;

And up from our Bloomberg’s, to the trade desk we ran;

To review our positions and come up with a plan.

We pulled up the market but saw no green glow;

While growth was stable, valuations were low.

When then caught our eyes, with a big streak of green;

A Magnificent Seven, pumped up like Charlie Sheen.

Soaring to the moon with a share price so high;

We knew in a moment the driver was AI.

More rapid than stimulus the buy-orders came;

As investors rejoiced and called them by name:

“Buys on TESLA!, on Google!, on Microsoft! and Meta!

On Apple!, on Amazon! and that new one Nvidia!”

Technology stocks with horizons so new,

Why buy five hundred when just seven will do?

Like a bandit snuck in through a Wall-Street back-alley;

We welcomed again this Santa Clause Rally.

So up to new highs, seven stock prices grew;

Paving way for broad stock gains, and for some bonds too-

And then with some focus we heard on the roof

A softly pitter-patter from a familiar hoof-

Inflation had landed, which last year was great;

Now footsteps so light that it must have lost weight.

Down the chimney it fell, much like oil prices;

So that the consumer could pay for their vices.

Now up from their slumber rose the two Fed Bank Chairs,

Suspecting inflation they ran down the stairs;

And finding their target, at inflation they sprang,

Which retorted “Ok boomers” in millennial slang;

“But you’ve clearly shrunk! Our efforts were epic!”

“You fools” it replied, “I just took Ozempic” (NVO:NYSE +48.11% YTD)

Foe now felled; the bankers proclaimed a rate-hold;

Though worried investors were still running to gold.

International markets celebrated conquered threat;

But Canadians couldn’t hear over the sound of their debt.

And the Gold Seal team, having witnessed the mess,

Made some adjustments in effort to cure client stress.

While the year held surprises and we certainly weren’t wrong;

It was clear for the moment that it’s time to go long.

For the bearish investors were no longer wary;

Over rates that had risen like the pitch of Mariah Carey.

Meeting done and trades placed that almost had settled,

We reflected on a strong year and provinces peddled,

“But wait,” exclaimed Tanya, “before you go home…

“Won’t you turn our notes into a bad Christmas poem?”

And that’s what we did without putting up a fight,

So Happy New Year from Gold Seal, and to all a good night.

A Look Back at a Year that Wasn’t Supposed to be Good

With a US market decline of -19.4%, rampant inflation breaching 9%, and declining economic growth, 2022 was a doozy. The stage that was set for 2023 may as well have been post-festival Woodstock as the long touted North American recession was set to materialize at any moment, interest rates rose in an effort to quell inflation, and all the usual associated suspects would then materialize: unemployment, depressed wages and stock market declines. What’s come to light this month as we review our year of monthly newsletters is that we were able to do a fairly creative job of describing the same persistent market conditions in a different way each month despite an unchanged outlook. As that relates to our positioning changes: the rhetoric didn’t change, and neither did we. The three messages that our “broken record” kept skipping to were:

- Rate hikes are unsustainable, and we will be returning to a lower interest rate environment.

- Inflation will dissipate as consumers burn through their pandemic savings.

- Canada has a great destination but a bumpy ride to get there.

Though the position was sound, the year served as a test of resolve particularly in an industry where being too far ahead of your time is indistinguishable from being wrong. Consider for instance, the hedge fund star Marc Cohodes, famous for his short selling of distressed companies during the Great Financial Crisis of 2008, who opened a position betting against Canadian real estate… in 2016. There are limits to how much time can pass while still being able to say “I told you so” and in that regard, 2023 gave our team a run for our money. In February of this year, we’d adjusted to a moderate overweight of fixed income, an underweight of Canadian equities, a less significant underweight to US stocks, and an overweight to international markets. While an adjustment was later made to increase conviction in this positioning, our strategy remained static throughout the year. Meanwhile, in the markets:

- Interest rate hikes persisted.

- Inflation persisted.

- Regional banks were threatened by the collapse of Silicon Valley Bank (SVB).

- Artificial Intelligence drove a stock market rally while threatening job replacement.

- Job reports surprised to the upside with unemployment hitting lows.

- Canadian banks set aside money for credit losses anticipating consumer defaults.

- The Russia-Ukraine conflict extended into its second year.

- The Israel-Hamas conflict escalated into armed warfare.

- Chinese real estate posted significant defaults.

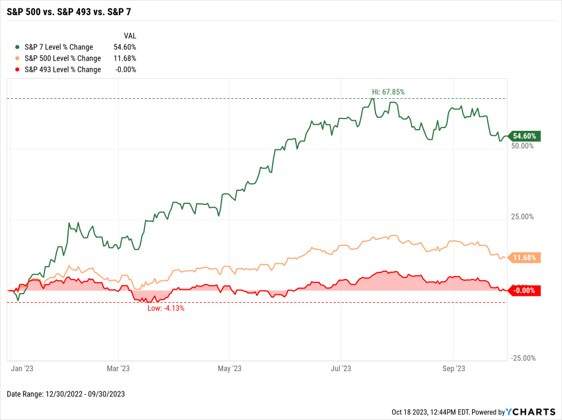

- The “Magnificent Seven” drove market performance to the end of Q3, with the rest of the stock market posting flat returns.

- Taylor Swift announced she was, in fact, coming to Canada on her Eras tour.

While that last point is more of a test of who actually reads this, it’s fair to say that 2023 was a year of uncertainty, with a market that declared clearly and concisely, “Well yes, but actually no.” Specifically, there were seven “Yes” votes and four hundred and ninety-three “No” votes:

To the end of Q3 this year, just seven stocks had driven nearly all market performance, rising +55% for the year where the rest of the market had done nothing. It wasn’t until November of this year that the market digested news that rate hikes were likely at an end, and the broad market began to participate in year-to-date gains. The subsequent 9-day S&P500 winning streak to the end of December 19th that accounted for most of this year’s Santa Claus Rally was part of the longest on record since 2013.

Looking forward, uncertainty lingers as investors continue to pile into recession hedges such as gold, declining oil prices signal reduced demand from the economic slowdown, and North American interest rates fall in anticipation of an economy that needs assistance. Thus far, the economy has proven resilient and job figures continue to surprise to the upside. You simply can’t have a recession when everyone is gainfully employed. That said, between gold prices, oil prices, and employment figures, someone here is wrong in their outlook.

2023 served as a good tool for evaluation. These are the years that test whether or not our clients have the “just right” fit for their investment strategy, and where management of our convictions as portfolio managers is tested just as much. Given the degree of excess uncertainty over the past year, we encourage our clients to also reflect on how they reacted, how they felt, and whether or not their portfolio balance was a source of stress this year. If there was discomfort, it may be worth revisiting a discussion on investment strategy with your advisor. Similarly, we check to ensure that our convictions are controlled and that we’re able to cut through the noise and generate target returns through adverse conditions. Our December quarterly rebalance will take place during the gap between Christmas and New Year’s this year, and we’ll be providing a full update on positioning changes in our January newsletter.

Final Thoughts For 2023: Unveiling The Path To A 1.75% Federal Funds Rate

In an ever-evolving landscape, Dr. James Thorne uses the trilemma of Truman’s foresight, Gandhi’s humility and Churchill’s hindsight to help investors navigate the complexities surrounding interest rates in the coming years. Read the full analysis in his Market Insights here.

Gold Seal Insights

Tanya’s Tips: Year-end tax planning

Tanya’s Tips: Year-end tax planning

Tax planning should be a year-round affair. But as year-end approaches, now is a particularly good time to review your personal finances and take advantage of any tax planning opportunities that may be available to you before the December 31st deadline.

As we enter the final weeks of 2023, here are some tax tips you may wish to consider: Year-end tax tips for 2023.

Mallory’s Memo: Year-end charitable giving tips

Mallory’s Memo: Year-end charitable giving tips

The holiday season can be a great time review your charitable goals. In addition to reaffirming your commitment to the causes that matter most to you, reviewing your charitable giving goals before the year-end can help you to align your donations with your financial plans and ensure that you are maximizing your impact while taking advantage of available tax incentives. Note that donations can be carried forward for up to five years, but those you wish to claim for 2023 must be made before December 31st.

There are numerous ways to donate to charity beyond direct cash gifts. Options include grants, endowments, foundations, insurance products, and donor-advised funds, often utilized by universities and hospitals. Donating securities with unrealized capital gains or using life insurance are innovative methods. With life insurance, a donor can either own a policy and designate a charity as beneficiary, receiving tax benefits upon death, or name the charity as both owner and beneficiary, receiving immediate tax benefits while paying premiums. Specialized products now allow for a one-time premium payment, offering benefits like ongoing cash flows for charities through insurance dividends, reduced policy lapse risk, and immediate tax receipts for donors. Tanya Wilson, a licensed insurance agent, can provide personalized quotes for these charitable giving insurance options.

Insurance products are provided through Wellington-Altus Insurance Inc.

Brendan’s Banter: The Christmas gift that keeps on giving

Brendan’s Banter: The Christmas gift that keeps on giving

For those invested in our Serenity Signature Yield portfolio and/or our equity models that carry the sleeve, ‘tis the season for Christmas distributions. It is common for some alternative investments to announce a special dividend for year-end. Two of our holdings, Kensington Private Equity fund and Westbridge Capital Partners are providing some nice presents. Kensington announced a special distribution of $1.70 per unit, bringing the total to approximately 10% this year. Westbridge announced guidance for an additional 2.40%-2.67% by year-end, bringing the total distribution of the fund to a range of 9.75% -10% for the 2023 calendar year.

The other two strategies within the model are also providing positive estimates for year-end. Centurion Apartment REIT is likely to finish the year with a return of around 7.36% and Merchant Opportunities Fund is estimating a return of 12% +/- 1%. All holdings within our Serenity Signature Yield sleeve carry no stock market exposure.

Best wishes to Madison!

Best wishes to Madison!

Our Administrator Extraordinaire, Madison Chlum, is off on maternity leave this Christmas, with her baby girl due to make an entry into the world in the coming weeks. We all wish Madison much rest and relaxation (and sleep) over the holidays as she prepares for this motherhood adventure. Be sure to watch for cute baby photos in our upcoming newsletters.

Noteworthy Links

- Can Canadian homeowners stay on top of mortgage payments in 2024?

- Canadian Population Growth Is A Double Edge Sword For The Economy

- Ontario woman loses $750,000 to online scammers using an Elon Musk deep fake AI video

- Time Person of the Year: Taylor Swift

- About a Third of Canadians set to cut back on spending in 2024 due to cost of living crisis

- What to know about making year-end Charitable Donations

- Lifetime Capital Gains Exemption to Top $1M in 2024

- TFSA limit rises to $7,000 for 2024, officially

- 5 Key Bitcoin and Digital Asset Trends to Watch in 2024

Picture of the Month