Gold Seal Monthly Review

“Optimism is the true moral courage.”

– Sir Ernest Shackleton

A Briefing on the Bull in the Room

It was the best of times, it was the… absolute, all-time, best of times! As the U.S. market (S&P 500) cruised past its previous highs, posting a close of 4,927.93 and +23% 1-year gain to January 29, 2024, it became difficult for investors to recall that 2023 was supposed to be a recession year for North America. All year long, markets had remained cautiously fixated on the U.S. Federal Reserve as it continued hiking interest rates in an effort to cool inflation, in typical late-business cycle fashion. The longest serving Chairman, William McChesney Martin Jr., had once mused that it was the role of the Federal reserve to act as the chaperone who has ordered the punch bowl removed just when the party was really warming up. That is to say that it’s their job to hike rates and encourage saving, rather than spending, to reign in an economy running hot before inflation takes off. The punch was stolen in March of 2022, when the first round of interest rate hikes threatened an end to an era of cheap money. Worries over a slowing economy drove the U.S. market into its second bear market in three years with a -25% decline in the S&P 500 over the first 10 months of 2022. The U.S. economy clearly did not get the memo that recession was imminent, as it continued merrily along, posting above-expectation job growth, ultimately finishing 2023 with an unemployment rate of 3.7%. This was the second consecutive year finishing with an unemployment rate below 4%, which is the longest stretch of unemployment this low in 50 years. Since peaking in June of 2022, inflation worries drifted into the background as price levels (U.S. CPI) fell over 6% by June 2023. As we launch into 2024, optimism permeates the market environment, which we believe warrants additional overall market caution and prudent scrutiny of opportunities on hand. When the market representing an economy grows over 23%, but the economy itself only grows at 3.1% (U.S. Real GDP year-over-year), there is a gap to reconcile.

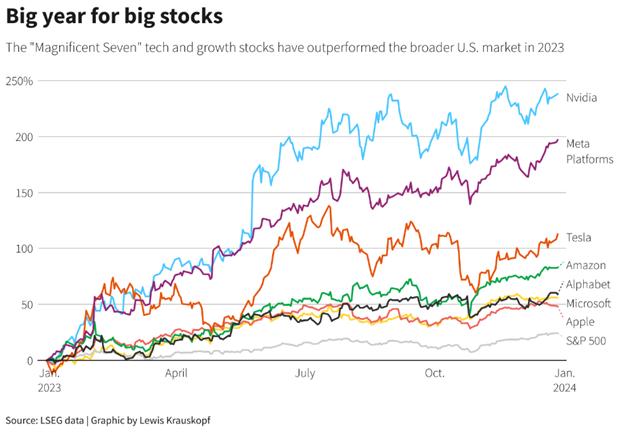

As we’ve covered extensively through the year, growth has not been widespread even within the U.S. market:

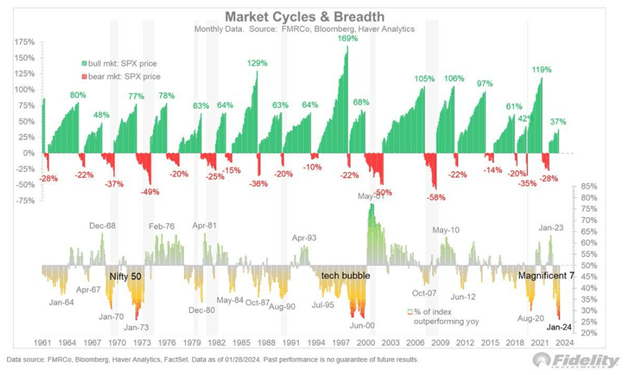

The “Magnificent Seven” stocks listed above drove almost two thirds of total market performance through 2023. While we’ve seen stock market concentration play out many times before, U.S. market growth has never been this concentrated into such a small set of companies. Further, past periods of concentration did not result in positive outcomes, as shown below:

The top chart tracks overall U.S. stock market returns, and the bottom chart shows how concentrated those markets were at the time. For instance, the “Magnificent 7” label of January 2024 shows a market where only 26% of companies in the market are outperforming the market as a whole (bottom chart), and gains since the last correction have been ~37%. This isn’t the first time this scenario has unfolded. Looking back to the “tech bubble” label, we see the same story where only 26% of companies were outperforming the overall market. The terrifying unwinding of that concentration resulted in an alarming -50% decline of the market as a whole. What emerged afterwards was a period of sustained growth, but that growth was more evenly distributed across market participants, with ~75% of companies outperforming the market. A similar story unfolded as concentration built within the “Nifty 50” stocks in 1972 with a very similar outcome. We’d assert that the level of risk becomes elevated when concentration is confined to 7 stocks versus 50, and we’ve long preached that the most dangerous words in this industry are “it’s different this time.”

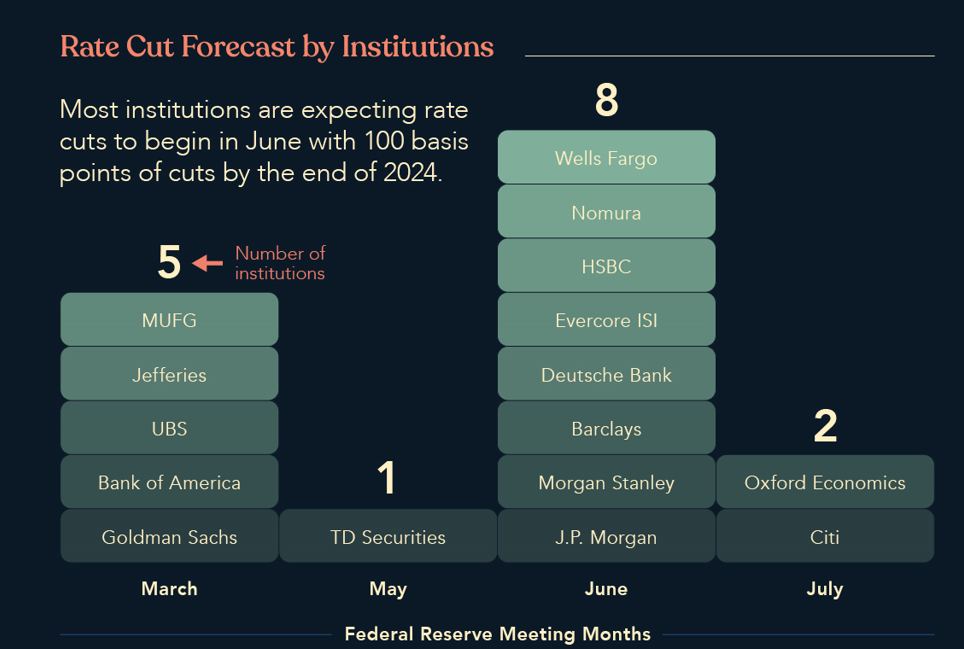

Dangerous words aside, we do need to allow for the possibility that sometimes it is truly different. On the macro scale, the U.S. is currently undergoing a substantial structural change, incentivizing onshoring and reversing the push towards globalization that dominated from the 1990s to 2020. The significant supply chain disruption we all felt from 2021 through 2022 served as a rude awakening that with distance comes vulnerability, resulting in policies directed to bringing industries and their associated jobs back home. The targeted investments brought in with the Inflation Reduction Act in August of 2022 demonstrate a strong start towards incentivizing U.S. businesses to favor domestic production. More recently, a November 2023 update to U.S. export controls more significantly restricted semi-conductor exports to China in order to stall technology adoption and competing production. As we start to observe geopolitical fault lines in the global supply chain and more production moves back to the States, there’s a case for above average economic growth in the years to come. With this shift, coupled with an elevated rate environment that would allow for stimulatory measures in the event of downturn, it’s no wonder we’re witnessing optimism drown out negative sentiment. However, in the absence of a market shock, it is very likely that we’ll see muted interest rate movement as drastic actions on the part of the Federal Reserve could be viewed as having undue influence on 2024 election results. The line of moral hazard exists where rate cuts into a strong economy would bode well for the existing Democratic administration, while further hikes would give credence to the Republican argument that the previous administration failed to tackle inflation.

In our newsletters over the past two years, we’ve touched on the need to continuously take a temperature check of the markets and economy, and to make your portfolio adjustments not during periods of market turmoil, but while market conditions are ideal. In practice, we received many more concerned calls and requests for de-risking through the 2022 downturn than we did through the 2023 recovery. That’s a metric we’d like to change, and we’re continuously striving to improve both our messaging and proactive engagement with our clients to stay ahead of surprise challenges. Market conditions are presently ideal, and it’s more important now to take a moment to reflect on your experiences and feelings over the past five years as they relate to your financial goals. If there was more stress or discomfort than anticipated, it’s likely worth the conversation with your Gold Seal advisor to preserve some of the growth we’ve experienced through the past year and position for what’s to come. We’re ready for that conversation if you are.

Serenity Q4 Tactical Positioning Changes Review

Those invested in our fully discretionary “Serenity” investment models are aware that pending an outlier market event, our portfolios are rebalanced on a quarterly basis following our Gold Seal team’s Asset Mix Committee review meeting. Our Q4 2023 meeting resulted in required investment model changes, and the changes were implemented in our client’s portfolios over the first two weeks of January. We always communicate a detailed breakdown of the changes made through our newsletter in the interest of full transparency, and while we always ensure our strategies remain onside with your Investment Policy Statement, we welcome any questions over these position changes. We are able to accommodate most unique preferences and amend strategy where required. Our full summary of the Q4 2023 tactical and strategy position changes are below.

1: Tactical Review

Reduced Cash Position Across All Mandates

The team collectively decided to move to a target 2% cash position (from 4%) across all mandates, including our Serenity Balanced strategy, which does not typically take part in these tactical position changes. The relatively high interest rate environment we find ourselves in has provided the added benefit of higher-than-normal interest payments being received in our client portfolios, such that we no longer need to target higher cash balances for fee coverage or rebalancing efficiencies. In the near term, the team favours short term fixed income instruments (bonds) which also provide the ability to service withdrawal requests, but with generally higher rates of return than cash balances.

Increased Fixed Income – Serenity Balanced

The -2% cash position has been offset by this +2% target in fixed income in our Balanced Mandate, as represented in our client portfolios by the “Serenity Fixed Alpha” investment sleeve. In short, we favour bonds over cash in a high interest rate environment that will likely prove unsustainable in Canada, and interest payments received have been sufficient to cover short term liquidity needs. Serenity Balanced is recommended for our more risk-averse clients that prefer stability and preservation of capital over growth, and as such, it does not participate in our shorter term tactical equity position changes. With reduced need for cash, and equity being inappropriate for the risk level of the mandate, fixed income/bonds is the only suitable substitute to preserve overall risk tolerance.

Further Reduced Canadian Equity

We have continued to closely monitor our Canadian equity/stock exposure through the year, which has proven difficult as our economic data is muddied by the largest population expansion our Country has seen in modern history. Our team has decided to further decrease our investment in Canadian equities by 1%, to a total -7% underweight position.

We are increasingly concerned by the increased level of household debt within Canada, our falling GDP per capita, and the lagging impact of rate cuts placed in 2022 that will only be felt from late 2024 through 2026. As of late, Canada carries the highest level of household debt as a percentage of our GDP in all of the G7 and as such, our interest expense burden is having a far greater impact on our consumers than our counterparts south of the border. While the U.S. Federal Reserve left rates unchanged in January 2024, messaging after the announcement indicated that cuts within the first quarter of the year were highly unlikely, and Canada may not have the wherewithal to persist at elevated rates as long as the U.S. likely intends to. Should Canada have to cut substantially in advance of the U.S., that will likely be due to increased default rates which would introduce a significant equity risk for Canadian stock investments.

Increased U.S. Equity Exposure Across All Growth-focused Mandates

The reduction of -2% cash and -1% Canadian equity has been allocated to a +3% increased position in U.S. equity for all growth-focused Serenity mandates, bringing our total target U.S. exposure to +2%. Corporate earnings and job gains continue to surprise to the upside even against the backdrop of a higher-rate environment, as U.S. inflation figures continue to decline. While the Federal Reserve has been clear to communicate that they intend to monitor for further confirmation that inflation is no longer a threat, an election year may bind their hands in implementing any surprise rate increases, pending an outlier spike in inflation.

2: Strategy Changes – Serenity Global Alternatives

Our “Serenity Global Alternatives” sleeve of liquid, alternative investments comprises 10% of all Serenity portfolios. The 10% allocation is meant to provide a selection of investments that behave differently than traditional stock and bond assets with the goal of smoothing out portfolio performance over time. We saw this clearly in 2022 when inflation hammered the fixed income market, but our investment in natural resources and commodities through this strategy served as intended as an inflationary hedge. As inflation becomes less of a market-dominating theme, our team found it timely to make adjustments to this strategy to better match our updated environment.

Reduced Natural Resources Exposure

Natural resources had comprised 20% of our alternatives strategy, and as inflationary pressures begin to subside, we found it necessary to reduce this position by -8% to a target of 12%. We are maintaining this position as a hedge against surprise inflationary resurgence.

Increased Global Commercial Real Estate and Infrastructure

The -8% decrease to natural resources has been offset with an increase of +4% to each of global real estate and global infrastructure projects. A strong labour economy bodes well for government investment in infrastructure projects, and commercial real estate presently offers a discount over historical valuations.

Eliminated Silver Position in Favour of Gold and Copper

Another component of our inflationary protection, precious metals, has been implemented with a combination of gold, silver and copper since the inception of this strategy. Silver has had a convoluted short term history since late 2020, when the commodity became target of the “Meme stock” movement, where investors believed they were buying into a short-squeeze opportunity akin to the Gamestop saga. Price levels had remained elevated, and while both gold and silver have historically functioned as “safe-haven” assets, gold has held that role more firmly than its more industrial geared cousin, silver. 2023 saw a fall in demand and rise in the supply of silver driven by rising reserves in Russia and Poland. As the enthusiasm falls out of the meme trade and the supply side begins to overpower the demand side, we feel that our hedges are better implemented by eliminating silver (-10%, entire position) and replacing with an increase of gold (+5%) and copper (+5%). Our view is that gold will take on the full role as our hedge against monetary risk, and copper will continue to serve as an economically linked source of growth.

Gold Seal Insights

Tanya’s Tips: How much insurance do you REALLY need?

You’re a new parent, a grandparent, or a business owner, and you’re asking yourself…how MUCH insurance do I really need? Am I under or over-insured, how can I determine this, who can help me?

Well for starters, a conversation with our team is a great first step! Determining the purpose for the insurance (final expenses, transfer wealth, replace lost wages, or protect your business) will assist you to determine HOW much insurance you need. This will be established with a thorough Needs Analysis.

What’s a Needs Analysis???

What’s a Needs Analysis???

It’s a conversation, with a documented approach to determine the amount of insurance coverage an individual may need to protect themselves, their family and/or their business. Through this conversation, we will start to get a snapshot, a clear picture of areas where the individual is trying to reduce risk and may present possible insurance gaps.

The needs analysis will determine HOW much insurance is needed, and WHAT kind of insurance product will fit your financial and lifestyle needs and goals. When considering insurance products, we will take into account our client’s ability to properly fund their policies as well as determine if they qualify for insurance.

It’s our job, as your advisory team, to understand your financial position overall and how you can achieve your financial goals over time. This forms the foundation of understanding how and where proper insurance can be applied to protect you, your loved ones and/or your business.

Noteworthy Links

- Best explanation of Bitcoin and Blockchain

- Canada extends foreign housing ownership ban

- Macklem says BoC can’t solve housing

- Nearly 25% of Okanagan wineries are listed for sale

- 20 Popular Canadian Tax Deductions and Credits for Tax Year 2023

- Canada’s economy is more ‘fragile’ than the U.S.: Rosenberg

Picture of the Month