“I do not think one can explain growth. It is silent and subtle. One does not keep digging up a plant to see how it grows.”

– Emily Carr

Oh Canada…

Like the family birthday party that you reluctantly agreed to, only to be berated by relatives on your plans for the future and relationship status, this Canada Day long weekend we’re taking a look at our nation and asking the hard questions. This year, Canada’s not exactly bragging at the dinner table, with the S&P/TSX having posted a relatively meagre 3.97% return for the first half of 2023, with the economy (real gross domestic product) growing 0.8% in the first quarter. In fact, Canada’s feeling a little left in the dust as the U.S. shakes off inflationary woes to post a 15.91% YTD gain on the S&P500, and the rest of the world finally joins the post-Covid rebound to post 11.67% (MSCI EAFE) during the first half of the year.

We’re still going to take the opportunity to bring up Canada’s ex, the U.S., that broke it off with our trade exemptions back in 2018 and went running to a much younger Mexico, but only as subtle encouragement to get back on that global dating app. We knew that this was going to be an uncomfortable discussion. Our Serenity investment models were formed against the backdrop of a rising interest rate environment, and raising rates into an economy with the highest level of household debt in the G7 has heightened many potential short-term risks. Accordingly, since inception last year, we have been underweighted in Canadian investment by 3% relative to our long-term strategic targets on all growth portfolios. That said, we’re still invested in our country’s success and haven’t given up on Canada’s potential and space in the global investment landscape.

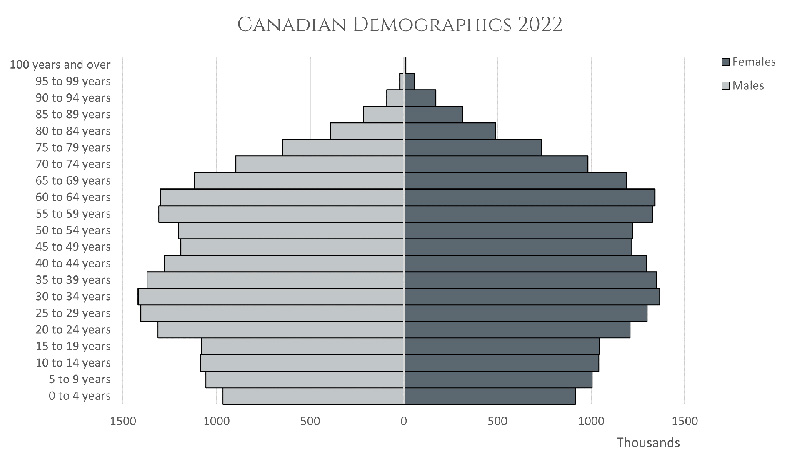

The landscape is daunting, and from a population perspective, Canada is presently facing a once-in-a-lifetime demographic decline. Below is a standard demographic chart with the population broken down by age in five-year increments. Canada is shown first and the United States is below that. As seen in the Canadian chart, our former largest working cohort, the baby boomers, are aging into retirement and have largely finished paying into our government system via taxes. The new largest working cohort, the Gen X’ers, are entering their prime earning years and are mostly able to pick up that tax burden for the time being. After that, we have a problem on our hands.

Over the past 150 years, as the Country transitioned from agricultural farm communities to thriving city centers, children transitioned from their role as one extra farmhand to a luxury good. That has led to our present state, where our population replacement rate, or rate of birth required to sustain our population numbers at this level, is 2.1 births per woman. Collectively, we sit at 1.4 as of 2020. Unattended, this creates problems coming down the pipeline as fewer workers fund our system, and more retirees draw from it. This inequality also stunts economic growth as a reduced labour force limits our national output. The younger workers are traditionally the leading consumers, with their larger life purchases still ahead of them: the house, the car, tuition, etc. This generation drives demand for the goods and services of the companies we invest in, and in Canada their numbers are declining. Clearly, the structure at present is not conducive to population or corporate growth.

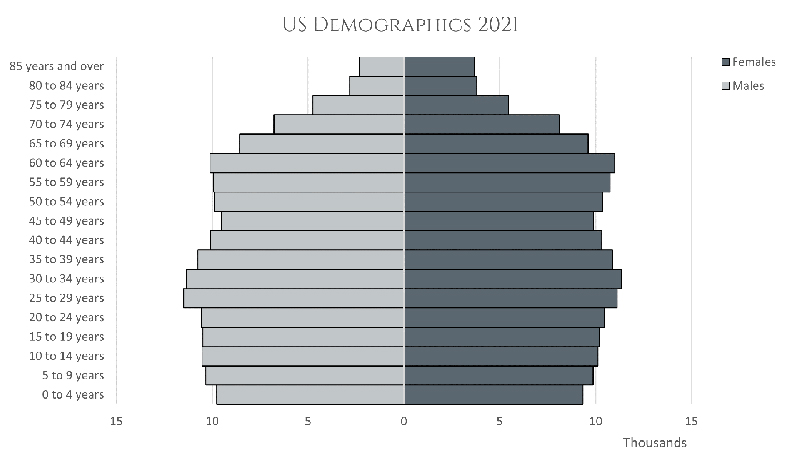

Filling that gap in the U.S. is the millennials. Ryan Archambault, an advisor on our team and the Gold Seal Financial Group quintessential millennial, has long been the most outspoken on the faults of this generation. But even by his own admission, they are an essential piece of the puzzle if the country is to continue consumption-led growth. Not only does the U.S. have the strongest consumption base in the modern world, they’re also increasingly self-sufficient and less reliant on global trade, which only accounts for 10.89% of U.S. GDP. Over recent years, the U.S. has become cognizant of its younger consumption base and the fact that the rest of the world wants to market and sell to it. Trade policies since the Trump administration were geared towards charging for access to that market via tariffs. With the adoption of the United States-Mexico-Canada Agreement (USMCA), the national security exemption available to governments was broadened, increasing the risk of extraordinary tariffs. This is all to say, there are very substantial hurdles that have directly impacted Canadian companies and their earnings. We are still holding on to an 18-22% weighting in Canadian stocks varying based on our client’s risk tolerance, and it’s because a path back to growth does exist, and we believe that we’re already on it.

In direct response to our aging demographic issue, Canada welcomed a record 437,180 immigrants in 2022 with plans to receive 1.45 million more by 2025. Rebuilding our missing consumption base has become a clear policy priority, and 2022 demonstrated that when the welcome is extended, the world is ready to pack its bags and move. Canada plans to double its now 40 million population by the year 2050, and immigration will be an important factor in achieving this. Looking to direct portfolio impact coming from immigration, our Serenity Canadian Conviction stands to benefit when a new Canadian:

- Opens a bank account, applies for credit and invests (BMO, Royal Bank, TD)

- Finds a place to live (Canadian Apartment Properties REIT, Interrent REIT)

- Sets up their utilities (Topaz Energy, TC Energy, Canadian Natural Resources, ARC Resources)

- Buys insurance (Intact Financial)

- Buys groceries (Loblaw Companies)

- Settles in a new neighbourhood development (Brookfield, WSP Global)

- Buys a phone plan (Rogers Communications, Telus Corp)

The list goes on. Beyond near-term recession worries, you will want these names in your portfolio in five years if all goes to plan. Particularly in the case of public Real Estate Investment Trusts that just had one of their worst years on record. The sheer size of the housing deficit we’ll be facing shortly should be enough to entice any potential investor to buy into present discounts.

Immigration directly addresses the largest component of economic growth (GDP), but where Canada is concerned, there is more than one way to skin a beaver. Both investment and government expenditures are two other components of growth that Canada is uniquely positioned to harness over the coming years. Consider that Canada is far from alone in its struggles with an aging population, and the rate of deterioration throughout most of the world is far more severe. When a crisis threatens the value of the dollars your population is earning, you historically see an exodus of that capital into currencies and countries with more resilient and reliable systems. You can look to China’s struggles with capital controls as a modern example of this occurrence, as 2022 was one of the heaviest years of capital outflow since 2016. Capital exodus ideally seeks three criteria: government sponsorship, asset-backing, and yield. Yield is negotiable if you have the other two, as the primary goal was capital relocation and not return on investment. There is an immense and largely untapped opportunity for the Canadian government to harness global capital flight with the issuance of notes or securities tied to the infrastructure and development required to support an expanding population. As yield is negotiable, those projects don’t get burdened with the high capital costs of our present high-interest rate environment. Further, employing Canadian companies (the ones in your portfolio) for the projects ensures that the capital circulates domestically and promotes job growth.

Like our birthday dinner discussion, it’s important to acknowledge some realities, call attention to some challenges and build up and inspire potential – it’s a macroeconomic compliment sandwich. Oh, and at some point, don’t forget to also wish Canada a happy birthday.

Crypto, AI, and the Company Caught in the Crossfire

The U.S. Securities and Exchange Commission (SEC) has been pushing to extend existing regulations—securities, brokerage, and banking laws—to the world of cryptocurrencies. As a reminder, crypto is an industry claiming to be a decentralized and anonymous environment.

In recent news, the SEC has accused Binance and Coinbase, two of the world’s largest crypto exchanges, of selling unregistered securities, among other unauthorized activities. This comes after Binance and its CEO were sued in March by the Commodity Futures Trading Commission for violating derivatives regulations.

Omid Maleka, an adjunct professor at Columbia Business School, shared with Bloomberg, “The SEC is firm on enforcing rules that, if adhered to, would essentially wipe out most of the crypto space.”

When it comes to cryptocurrencies, we’ve never seen an industry with so little regulatory oversight and care, so this new “crackdown” is certainly warranted.

In other news, the Federal Reserve (the Fed) plans to roll out its long-anticipated real-time payment system, FedNow, in July. This will be the first government-created and backed portal to help transfer money in real time. There is some speculation that this platform will lead the way to creation of a Central Bank Digital Currency (CBDC), but the Fed has clarified that it has not decided on issuing a CBDC at this time. Issuing a CBDC is “Something we would certainly need congressional approval for,” Fed Chair Jerome Powell told the House Financial Services Committee in March 2023.

Gold Seal Insights

New Website Announcement!

It’s never too late for a little spring cleaning! Out with the old and in with the new as we unveil our improved and uniquely B.C. website!

Welcome to the refreshed Gold Seal Financial Group Website.

We’ve designed it with YOU in mind. It’s user-friendly, information-rich and offers insights into how we’re transforming lives one financial decision at a time.

Your opinion matters to us! As part of the Gold Seal family, we appreciate and value your feedback. So, take a tour of our new site and let us know what you think.

We consistently refer to the S&P 500 as the best representation of how the U.S. economy is doing. Although this is the case, over 30% of the index is weighted to the following nine companies. Please note their YTD returns as of the close on June 30th:

- Apple Inc: 49.29%

- Microsoft: 42.00%

- Amazon.com: 55.19%

- Nvidia Corp: 189.46%

- Alphabet Inc. (formerly Google): 36.33%

- Meta Platforms Inc. (formerly Facebook): 138.47%

- Berkshire Hathaway Inc. Class B (Warren Buffett’s baby): 10.39%

- Tesla Inc: 112.15%

- UnitedHealth Group Inc: -9.34%

As noted earlier, the market itself is up approx. 15% year to date. How can that be when the average of these nine companies is up 69.37%? Simple, the balance of the market (the other 70%) is dragging the average down. Although the economy is improving, and growth is evident, most businesses south of our border are far from their former glory (December 2021 highs). And investors that were invested in these tech-heavy drivers of the market so far this year also experienced significant negative performance in 2022 (Amazon was down 49.6% in 2022, for example, while the S&P500 was down 19.44% last year). There’s significant benefits to a properly diversified portfolio.

I’ve marked four reference points:

- The bullish channel pattern – markets are experiencing higher highs and higher lows.

- The last high on August 16 that has been broken to the upside, now providing support should markets retrace.

- April 2022 high (4512) which becomes our next resistance level. Given that the Relative Strength Index (circle bottom right of chart) has breached 70 recently and is currently over 68 (level of 70 represents overbought), we suspect the markets could take a breather here.

- March 2022 high (4637), the last level of resistance before we challenge the all-time highs for the S&P 500 back in December 2021.

We believe it could be by the end of 2023 that we challenge all-time highs again. For this to occur we need more than the top 10 companies to drive the market higher. Lower inflation (good data released June 13th showing year-over-year inflation is now at 4% for the U.S.) will go a long way to help.

Mallory’s Memo: Owner Compensation

How should business owners and professionals compensate themselves?

Incorporated business owners or professionals have considerable flexibility regarding the nature, amount, and timing of their compensation. Shareholders who are actively involved in the business can compensate themselves using salary, dividends, or a combination of both.

- Salary is an expense and tax deduction for the corporation, reduces the corporation’s net income subject to corporate tax rates, and is subject to your individual tax rate.

- Dividends are paid with the corporation’s after-tax dollars. The “grossed-up” amount is subject to your individual tax rate, is eligible for the dividend tax credit, and cost the corporation less to achieve the same after-tax compensation in your hands.

The optimal path can be complicated. Canada’s tax system is designed to eliminate any immediate benefit to taking compensation as salary or dividends, but differences in tax rates across provincial and territorial jurisdictions can create an imperfect result. Tax is important, but everyone’s situation is unique. You must consider retirement plans, lifestyle needs, and corporate cash flows. Additionally, the income tax benefits paid by salary or dividends may be offset by tax deductions, credits, or other planning opportunities. These additional considerations are why receiving professional advice is particularly valuable. Developing a written comprehensive financial plan and consulting a corporate tax specialist before deciding is advisable.

Noteworthy Links

- Retirement becoming an ‘elusive dream’ for aging Canadians

- The outlook for bonds has rarely looked better

- Canada’s oil output would plummet by 2050 in a net-zero world, new modelling shows

- Australia’s eSafety commissioner warns Twitter to explain how it is tackling hate speech or face a $475,000 daily fine

- Harvard-trained psychologist: if you use any of these 9 phrases every day, you’re more emotionally secure than most

- World’s best airline for 2023, named by AirlineRatings.com

- Gold Is No Longer a Good Hedge Against Bad Times

- How is an FHSA taxed at death?

Picture of the Month

This month, Apple unveiled its first significant new product in 10 years, an eagerly awaited mixed-reality headset resembling stylish ski goggles.

The product, named Vision Pro, is set to launch early next year with a price tag of US$3,500 (C$4,700). One reviewer likened the experience to “having a giant Apple Watch on my head – but in a positive sense.”

While verdicts on this new venture into mixed reality – a blend of virtual reality and augmented reality – are yet to be decided, it’s clear that Apple has taken a bold stride toward popularizing this technology. Not every Apple enthusiast will purchase the device, but the opportunity to try it will be irresistible. With 520 stores worldwide, Apple boasts a captive audience for demos that rivals like Facebook and Microsoft can only aspire to engage.

Another major advantage for Apple is its extensive network of third-party app developers. This community will undoubtedly be racing to invent novel applications for the headset – some of which might even surprise Apple.