“Patience and perseverance have a magical effect before which difficulties

disappear and obstacles vanish”

– John Quincy Adams

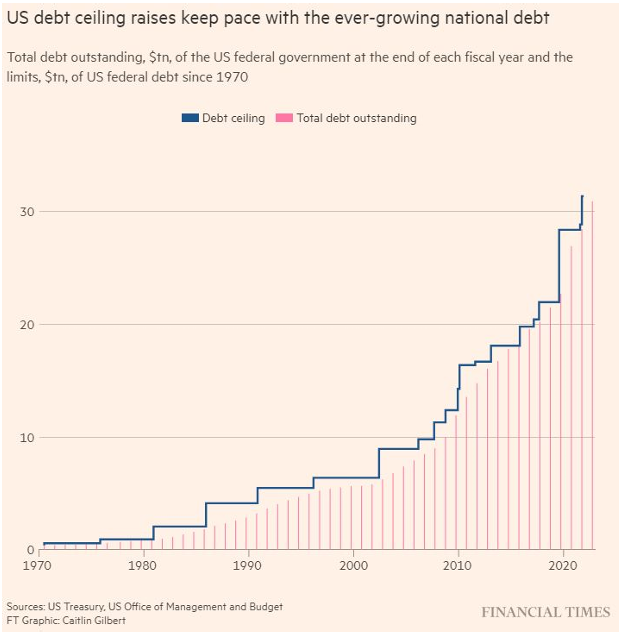

Same, But Different – A U.S. Debt Ceiling Update

At the time of writing on May 31, the U.S. government is getting closer to finalizing an agreement to prevent a default on its debt ahead of a June 1 deadline. However, this does not mean everything is back to normal for investors, as the usual back-and-forth of negotiations comes at a time where the Federal Reserve is intent on punishing debt with high rates.

We have seen a great deal of volatility over the past few weeks in North American equity markets due to the U.S. Treasury’s efforts to raise money. The Treasury has been carefully managing the government’s finances in 2023 to stay under its debt limit of $31.4 trillion. Consequently, the Treasury General Account, or the government’s main checking account at the Federal Reserve, has been reduced from approximately $580 billion at the start of the year to around $58 billion as of May 26 – the lowest level since 2017.

Once the government agrees on a new debt ceiling, the Treasury will then start to fill its account back up. This means issuing a large amount of short-term Treasury bills (T-bills), which are a type of debt that the government pays back within a year. The release of these T-bills could reach about $1.4 trillion by the end of 2023, which is about five times the average amount issued over a three-month period before the pandemic.

This massive issuance of bills has the potential to lower bank reserves as people withdraw their deposits and shift their money into these safe and relatively high-yielding government debts.

As mentioned, while most of this is routine (the debt ceiling has been raised 78 times since 1960!), this year’s ceiling debate is unique because it’s happening at the same time the Federal Reserve is shrinking its balance sheet, which hasn’t happened before. After growing its balance sheet through a process called quantitative easing (money printing, buying bonds and mortgage-backed securities) during the 2008 financial crisis and the COVID-19 pandemic, the Fed started to reverse and unwind last year, a process known as quantitative tightening. This action withdraws liquidity or money from the financial system.

The upcoming issuance of T-bills will cause a significant shift from adding money to the economy to withdrawing it. If managed well, and the buyers of the T-bills are primarily domestic institutions, there’s a history of neutral market impact.

The Treasury General Account balance dropped by around $360 billion in the past five months. This decrease represents money spent by the government that was not collected from taxes or borrowed, and it equals about 3.3% of the country’s economic output during those months. If the Treasury raises $650 billion over the next three months, it will drain the equivalent of 9.8% of the country’s economic output, a significant shift.

We are monitoring these events daily and will position portfolios accordingly to the data at hand.

Crypto, AI, and the Company Caught in the Crossfire

It wouldn’t be possible to cover the stock markets of May without mentioning the meteoric rebound of tech-giant Nvidia (NASDAQ:NVDA), the monkey of the tech world that has now successfully jumped from the branch of the crypto and blockchain buzzword to the artificial intelligence (AI) vine. For those who may have missed the media coverage this month, this Delaware incorporated, Silicon Valley based computer card manufacturer posted a run of +31.5% from May 24-30, adding to its now 257% gain since the lows it hit on October 14, 2022 (to May 30 pricing). The rally briefly pushed the valuation of the company to over $1 trillion USD as well as towards a new spot on the podium as the sixth largest company in the world. With so much movement in a short time and the tailwind of media attention, it’s rational to ask where this company may have a place in your own investment strategy, just as we did. Reconciling the Nvidia success story with our investment philosophy at Gold Seal Financial Group had ultimately resulted in the decision to exclude the stock from our U.S. Equity strategies, but it was close. The core of the business is strong: its graphics card and data center business is undeniably now the industry leader in the semi-conductor card space. Just six years ago, Intel had been the leader of the pack, worth as much as both Nvidia and rival AMD combined. Today, Nvidia is worth more than the other two combined.

It’s not the core business that has driven share price rallies over those past six years. Instead, it’s been the rosy prospect of exponential revenue growth based on new applications for their hardware products, firstly cryptocurrency, and most recently generative AI. The investment thesis is that rapid adoption of both technologies would drive a surge in demand for the hardware driving its system, and Nvidia is uniquely positioned with the scale to mass produce the product. This outlook is sound and matches well with the companies we like to target. After all, only a handful of prospectors made money directly from the mines of the gold rush. The real money was made by those who sold shovels.

Nvidia’s cryptocurrency adoption served as the first warnings that these growth expectations may prove too lofty and highlight the risk that new technology is vulnerable to change. The initial mainstream heavyweight of the cryptocurrency market had been Bitcoin, which was all about processing power. Many of us have seen pictures in the news of the large “Bitcoin Farms” with walls and racks filled with computer-like processing units (called ASICS) whose sole purpose was to mine Bitcoin. To oversimplify, mining is nothing more than assembling a record of all Bitcoin transactions that have occurred, while also solving a math problem. It’s energy intensive, and the more processors and higher processing power you have, the higher chance you have of solving the math problem, providing the record of the transactions that occurred, and winning a Bitcoin as a reward. The flaw in this protocol was exposed when a group of hackers targeted an exchange directly, spoofing a very high level of processing power, but provided falsified transaction records. This was the collapse of the MtGox Bitcoin exchange in 2014 and these hackers swindled $460M USD with the heist. The response to this vulnerability is where Nvidia comes in.

The second largest mainstream cryptocurrency is called Ethereum, and rather than rely on outright processing power, their protocol was focused on the number of units involved in the mine. The units best fitted for the job: computer graphics cards. Nvidia had rapidly acquired market share in this space from 2017 onwards and by 2020, demand was so great for their cards from miners that there were year-long waits for their top tier cards. Seemingly endless demand allowed Nvidia to raise prices and their share price rocketed over 964% from pre-pandemic levels to it’s first high of $330 in November of 2021. This is where the cautionary tale begins.

Recognizing the environmental impact of all the energy consumed by cryptocurrency mining, the developers made a change to the protocol in the interest of environmentalism. Mining Ethereum would no longer require intensive card processing, but rather rely on miners putting up some of their currency as collateral to ensure transactions were correct. Overnight, the demand for mining graphics cards fell off a cliff and the share price lost 67% of its value through the following year.

Outlook for the company’s growth had been dampened and the valuation of the stock, for a time, returned to a level reflective of only its core business. That outlook proved to be short-lived, as the release of a generative AI technology called ChatGPT in November of 2022 renewed hopes and lofty-again growth expectations for the company that provided the cards best suited for AI processing. While some demand did return immediately, it was Nvidia’s earnings release guidance on May 24, 2023, that projected sales increases of 53% in the coming months that immediately sent the company up 22% in after-hours trading. With new, unknown growth potential reinstated, Nvidia’s share price took off once more.

There does exist an outcome where:

- Generative AI does become embedded in most new technology

- Nvidia also retains its position as the uncontested leader in the space

With these two assumptions, the share price today could be justified. Presently, that’s a price 200 times higher than the company’s present earnings. But, when a business proves this lucrative, you typically begin to see competitors aggressively compete to pull at the leader’s market share. As we saw during the immediate collapse in crypto card demand, technology developments can also cause demand and expectations to evaporate overnight. The fact of the matter is that generative AI, or processing a vast library information set to mimic reasoning, is just one step on the road towards general AI, which is true sentient reasoning. For example, think of the AI driven car passing a stop sign. It understands the stop sign meaning and acts accordingly. But, if the stop sign symbol is part of a marketing ad on the side of the road, that carries a different meaning. A four-year-old human can reason through that, but generative AI presently cannot. The process today currently calls for the type of processing that Nvidia chipsets are well suited for, but we do not know what the next step in AI is going to look like technologically or from a regulatory perspective. When the downside potential of this rapid adoption is the return to the value of only it’s core business, the downside probability presently places Nvidia outside of the risk tolerance in our portfolios.

It’s important to note that while we do not invest directly in these frontier technologies or securities, it is, as evidenced, crucially important to do our best to understand them and their potential implications on the tangible businesses in which we invest, like Microsoft, Alphabet and Texas Instruments. These companies have also participated in the momentum of the sector but have, for the most part, more diversified lines of business.

This piece is not meant to act as a buy or sell recommendation on NVDA, but rather to assist in business evaluation and risk considerations.

Gold Seal Insights

Tanya’s Tips: Life After Work: Thriving in Retirement

Retirement is often portrayed in popular culture as an idyllic and rewarding time for relaxation, leisure activities and enjoying the company of family and friends. Research indicates that many people find the reality far less appealing – even if they are financially well prepared, they are not emotionally prepared. With guidance and careful preparation, many people can thrive in retirement as they pursue new interests, develop connections, make meaningful contributions, and explore the world around them.

Making the transition from a full-time career to retirement can be stressful, but the better prepared you are, the easier it will be. Here are some key life considerations that our retired clients typically encounter as the demands of full-time work draw to a close, and ideas for coping with the changes that will come:

- Purpose and meaning. Business owners, professionals, and those who have strongly identified with work and successful careers often feel an acute loss of status in retirement. Filling this bucket may involve paid or unpaid work, leadership activities, or the start of a new venture.

- Contribution. Like having a purpose, many of our retired clients feel the need to be useful. They should explore what matters most to them and how they can apply their skills, talents and wisdom to “give back” to a cause that is larger than themselves.

- Health and aging. No one can avoid the consequences of aging, and many feel limited by their declining health and mobility. It’s important to find ways to accept our changing physical, mental and emotional selves and to pay attention to nutrition, exercise and rest.

- Mental and emotional wellbeing. Even if you have been looking forward to it, the major changes associated with retirement can result in stress, anxiety and a loss of confidence. Tactics to support your mental health may include mindfulness, meditation, connection with nature and the openness to seek professional support when needed.

- Primary relationships. Retirement alters the dynamic of daily life with a spouse or partner, causing friction around small and larger issues. Many retired couples discover substantial differences about money, moving, and the amount of time they will spend together. It’s important to discuss your vision of retirement and not assume that your partner’s is the same.

- Family and friends. Many people underestimate the value of social connection at work, and the loss of daily interaction can leave some feeling lonely. Close friends and peers may still be working, making it important to seek out new connections. Alternatively, family and friends may make additional demands on your time, making it necessary to set boundaries.

The Gold Seal Financial Group can help you prepare for the many financial and non-financial aspects of retirement. For more information and a list of questions to jump start your reflections on retirement readiness, contact us today.

Mallory’s Memo: CPP Timing & Sharing

Many individuals approaching retirement wonder how to optimize their Canada Pension Plan (CPP) benefits. The question often arises because CPP is calculated based upon the age at which an individual starts to receive monthly payments. Though the standard age to start CPP is 65, Canadians can start receiving CPP as early as 60 or as late as 70. The standard CPP entitlement at age 65 is reduced by 7.2% for every year (0.6% per month) taken before 65 and is increased by 8.4% for every year (0.7% per month) taken after 65. The question of whether an individual should defer taking CPP to take advantage of the increased CPP benefit entitlement depends on many factors including:

- Lifestyle needs

- Life expectancy

- CPP breakeven age

- Anticipated personal tax bracket

- Your spouses’ age

- Your spouses’ estimated benefit amount

- Your spouses’ anticipated tax bracket

If you are collecting or have applied to collect your CPP benefits and have a spouse or common-law partner in a lower tax bracket, you may want to consider sharing your CPP benefits to potentially lower your household’s overall tax bill. This strategy effectively shifts CPP benefits to the lower income spouse who is taxed at a lower tax rate. This does not change the total CPP benefits received, rather it changes who reports the CPP benefits, and the tax paid on them.

A comprehensive retirement plan is a tool to help you determine the optimal timing of beginning your CPP benefits, and whether to elect to split those benefits. If you have friends or family that do not yet have an optimized retirement strategy, please invite them to contact our team to being the planning process.

Noteworthy Links

- These are the 10 cheapest places in the U.S. to buy a beach house

- When your child isn’t fit to be your successor

- Did scientists accidentally invent an anti-addiction drug?

- World’s biggest nuclear plant may stay closed due to papers left on car roof

- The secret-weapon spice of Indian cuisine

- What you should be reading this summer

- Top 5 tax benefits of an estate freeze

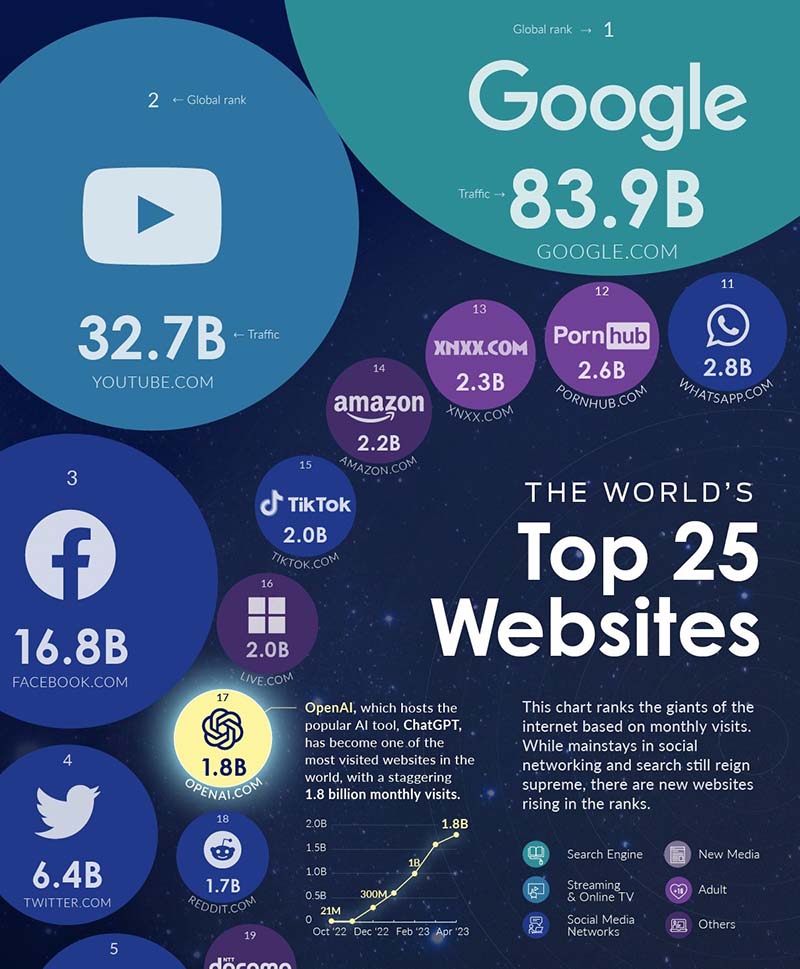

Picture of the Month

Ever wondered who rules the vast kingdom of the internet? The reigning giants like YouTube and Facebook have billions of loyal subjects and shape our virtual journeys. Yet, every so often, a wave of innovation might shake up the hierarchy, and it seems we’re riding one such wave right now, all thanks to generative AI!

Visual Capitalist takes a deep dive into the 2023 digital world’s ‘Top 25 Websites’ based on their traffic numbers. Unsurprisingly, Alphabet and Facebook-owned properties – Google, YouTube, Facebook, Instagram, and WhatsApp – constitute three-fourths of the total traffic on this prestigious list. Talk about digital dominion!

Of course, the most remarkable story this year is the meteoric rise of OpenAI, the creator of ChatGPT and other AI-powered tools. Their web traffic has taken a leap from 20 million visits per month in late 2022 to an unbelievable 1.8 billion in April 2023. At this pace, they might soon outstrip internet heavyweights like TikTok and Amazon.

It’s clear that generative AI is redefining the digital landscape, paving the way for unexpected comebacks and fascinating shifts in power.