Gold Seal Monthly Review

“Laughter is the best cleaner for the soul.”

Spring Cleaning your home? What about your finances?

Now that spring has sprung and many of us are in spring cleaning mode, don’t forget to declutter your finances! This is a great time of year to check in and eliminate any unused or unnecessary expenses.

Do you have any of the following?

- Unread magazine subscriptions

- Unwatched streaming services

- Unused gym memberships

- Forgotten app subscriptions

- Outdated software subscriptions

- Services that do not match your financial goals

- Products that no longer align with your lifestyle needs

- Forgotten automatically billed services

- Overlapping or redundant accounts or services

Steps to purging:

- Take a thorough inventory. A great place to start is your most recent three-months of investment, bank, and credit card statements. This can also be a great place to start when building a budget. If you do not yet have a written budget, reach out to our team to receive a worksheet.

- Determine which expenses no longer provide sufficient value and returns. Prioritize large ticket items and services first.

- Cancel or renegotiate these subscriptions and services. Consider consolidating investment accounts to improve strategic planning, reduce complexity, and potentially save on fees.

- Set calendar reminders to regularly review expenses prior to renewal dates. This can help prevent future clutter build-up.

- Make a plan to redirect the money saved by eliminating financial clutter towards your financial goals.

Purging financial clutter can save money, simplify life administration, reduce stress, and ultimately contribute to improved financial well-being.

Inflating stocks to record levels

While Spring has sprung, Canada’s inflation rate continued to cool. The Consumer Price Index (CPI) went up by 2.8% in February, a slight drop from January’s 2.9% and lower than the 3.1% economists had anticipated. Food prices saw a significant improvement, with the rate slowing to 2.4% from the previous month’s 3.4%.

There’s talk of a possible rate cut by May, though the market sees little chance of this happening, viewing a cut in June or July as more likely. This anticipation has sparked speculation among wall street analysts that the U.S. Federal Reserve may choose to postpone any reductions in interest rates until the presidential election has passed. It seems Canada might reduce rates before the U.S. does.

The Federal Reserve’s Jerome Powell noted that inflation is on a downward trend while the job market remains robust, which is positive news. Most Fed officials “see it as likely to be appropriate” to start cutting their key rate “at some point this year,” he added. However, experts like Larry Summers and Mohamed El-Erian caution against the Fed cutting rates too quickly, pointing out that with February’s inflation at 3.2%, it’s still not close to the 2% goal. They highlight the risk of inflation getting out of hand. Summers expressed confusion over the rush to ease monetary policy following Powell’s comments.

For investors, this scenario suggests confidence in the central banks’ ability to manage the inflation spurred by the global lockdown, signalling that the situation is under control, though the process isn’t finished.

This also means that 2024 could be a compelling year for bonds. Here’s what investors should understand about the outlook for the bond market and what to watch as the year unfolds.

Important Update on Bare Trust Tax Filings

CRA recently announced that bare trusts are not required to file a T3 trust return for the 2023 tax year. This comes as welcome relief given the uncertainty and heavy compliance load generated by the new bare trust reporting requirement. The full CRA announcement can be found here.

Gold Seal Insights

Tanya’s Tips: Reminder of how interest income is taxed

With rising rates, there has been increasing interest in guaranteed investment certificates (GICs). Now that tax season has arrived, here is a reminder of their tax treatment, as well as the taxation of bonds.

The taxation of GICs — GICs are often “locked-in” and cannot be cashed in until their maturity date. As an example, for a five-year GIC purchased on July 1, 2023, the invested capital must remain in place until July 1, 2028, in order to receive the interest earned. However, this doesn’t mean that there isn’t a tax liability. For non-registered accounts, any accrued interest must be reported on an annual basis, even if it has yet to be received. Accrued interest is reported based on the anniversary date of the GIC’s issue. So, for the five-year GIC noted above, the interest accrued during 2023 would be the equivalent of six months: July 1 to Dec. 31, 2023. For 2024, a full year of accrued interest would be reported. The exact amount would depend on when interest is calculated and compounded; in most cases, interest is calculated every six months, though some products may compound interest daily or monthly. A T5 information slip will be issued for interest amounts of $50 or more. This interest income is fully taxed at your marginal rate in the year it is earned.

The taxation of bonds — Interest income is also generated from bonds. Interest earned in non-registered accounts, often paid semiannually, must be reported each year on a tax return. The rapid rise in bond yields has resulted in many “discounted bonds” that may offer greater tax efficiency when compared to a GIC. When purchased on the open market, a bond’s price can fluctuate based on changes to its stated interest rate. If the bond is purchased at a lower price and sold at maturity, a portion of the return will be a capital gain, taxed at a lower rate than interest income. Also notable, when accrued interest is paid at the time of purchase, it is deductible as an investment expense on a tax return for the year in which you bought the bond.

Brendan’s Banter : Spring clean your portfolio

Brendan’s Banter : Spring clean your portfolio

Welcome to April. Since our newsletter theme is Spring Cleaning, it’s a GREAT time to “clean up” our portfolios and position our capital for the next leg. It’s also a great time to trim positions to build cash to prepare for any “bigger” expenses we may have looming. Will you be travelling in 2024? Do you need to purchase a new vehicle? Perhaps a home renovation is planned? It’s a good time to chat!

The markets have been resilient since the Fall of 2023. We’ve been hearing many of you comment on how well your accounts are doing, for good reason. Canada’s S&P/TSX Composite Index is finally back to all-time highs achieved in early 2022. It has taken Canada a lot longer to get here than our friends down south and we suggest this is due to a myriad of reasons. To name a few:

- Gross Domestic Product (GDP) and Market Size – The U.S. has a larger GDP and market size compared to Canada. This larger market can offer more opportunities for businesses and investors.

- Innovation and Technology – the U.S. is home to many of the world’s leading technology companies and innovation hubs such as the Silicon Valley. This fosters innovation and attracts talent from around the world.

- Financial Markets – The U.S. has the largest and most liquid financial markets.

- Corporate Tax Rates – Historically, the U.S. has had lower corporate tax rates compared to Canada, which can attract businesses and investment.

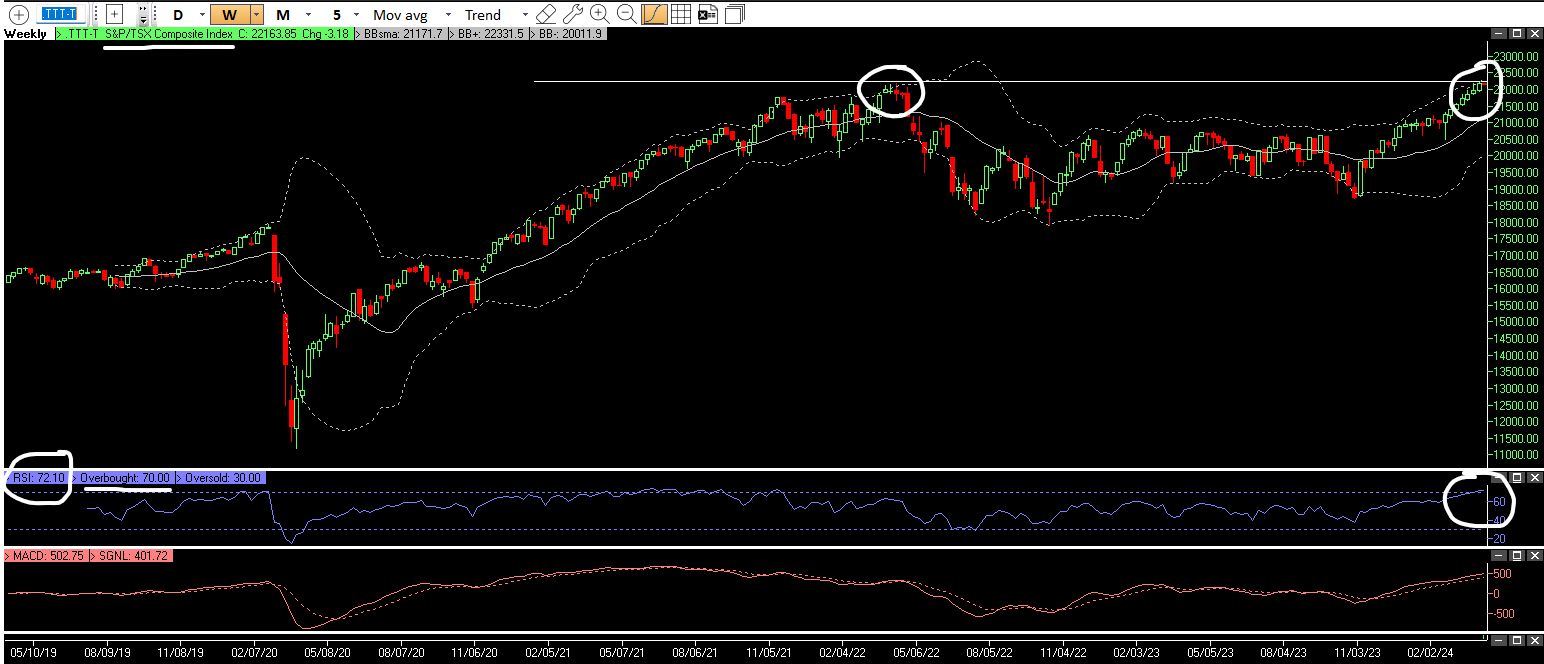

Here’s a snapshot of the Canadian market:

The above 5-year chart shows a double top formation, indicating a bearish (negative) reversal pattern. It occurs when the price of an asset reaches a peak (early 2022), declines, then rallies back to approximately the same level as the previous peak before declining again.

The Relative Strength Index (RSI) also gives us clues as to where the TSX might be heading. The above chart shows a RSI reading of 72.10, confirming the market is overbought. A reading over 70 suggests it is overbought and a reading under 30 suggests it is oversold. Although we don’t know whether the market will move higher from here, we do believe it’s a great time to “clean” the portfolio and remove any clutter.

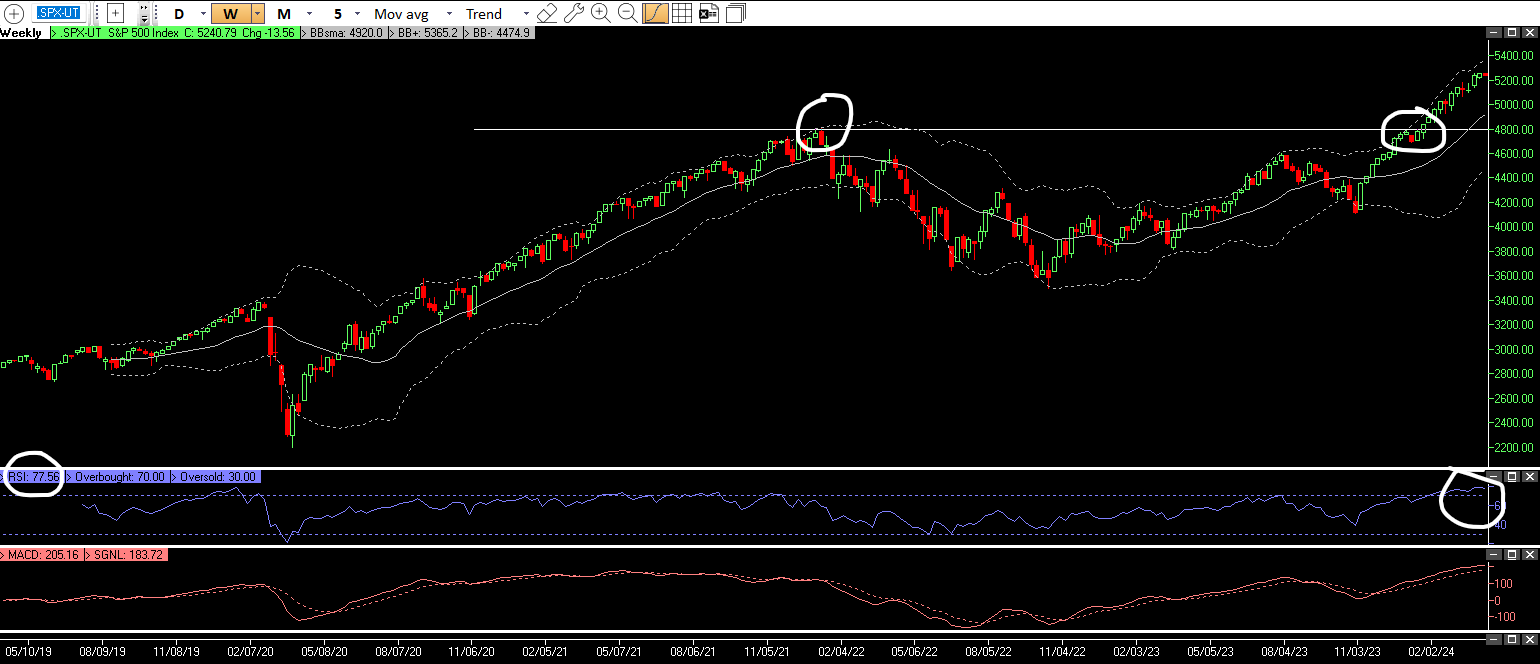

How is the US market (S&P 500)?

The potential double top presented itself earlier this year, but decisively broke the top and is now at all-time highs. The overbought market is even more apparent, currently registering a RSI reading of 77.56. Again, if you may need a little extra for upcoming purchases, in my opinion, now appears to be a perfect time to raise some cash. Happy cleaning!

Reminders For Tax Season: Unpaid Balances Incur Interest at 10%!

It is personal income tax season once again. Given increasing interest rates, don’t overlook the importance of filing your taxes and paying balances and instalments on time, as interest assessed on insufficient payments can be significant.

- Tax Filing Deadlines — The general deadline to file your 2023 personal income tax and benefit return is April 30, 2024. For self-employed individuals and spouses, the general deadline is June 17, 2024 (the usual filing date of June 15 falls on a weekend). However, any taxes owed must be paid by April 30, 2024.

- Late-Filing Penalties — If a return is filed late and a balance is owing, the late-filing penalty is a minimum of five percent of any balance owing, plus one percent of the balance owing for each full month that the return is late, to a maximum of 12 months.

- Interest Charges on Unpaid Balances — Unpaid balances will accrue compound daily interest at the prescribed interest rate. For Q2 2024, the prescribed rate (calculated quarterly) on overdue taxes stands at a very substantial rate of 10 per cent.

Keep Good Records

Remember that both individuals and corporations are required by law to keep tax records for six years from their filing date. The CRA may request these records for audit purposes. The timeframe for recordkeeping may be extended for documents essential in determining a person’s future tax obligations.

As always, we recommend our clients work with a tax advisor to ensure you’re claiming all of the credits and deductions to which you’re entitled and completing all of the required reporting obligations.

Mallory’s Memo:

Mallory’s Memo:

Be Aware: TFSA Contribution Information May Be Incorrect

If you’ve based your TFSA contribution on the CRA’s “My Account” information, be aware that it may not be accurate. According to the CRA, any contributions made or withdrawn in the prior year may not be reflected in current year contribution room until “after the end of February,” since issuers have until the last day of February to submit TFSA transactions to the CRA. Yet, the lag in updating this data may extend to March or even late April. The consequence, of course, is the one per cent per month penalty on excess TFSA contributions, which can add up. And, it appears that a growing number of TFSA holders are being assessed penalties. The total amount of overcontribution penalties paid in 2022 was $132.6 million, more than triple the $41.7 million paid in 2019 and 38 per cent higher than the $96.2 million paid in 2021.

Noteworthy Links

- Canada likely to avoid recession, begin recovering in second half of 2024: Deloitte

- Small businesses face carbon tax hike crisis

- Bare trust debacle makes fools of the law-abiding

- Housing crisis, packed hospitals and food lines: Even in Canada?

- Unlocking Your Locked-in Accounts

- Navigating the Monsters and Bubbles of Today’s Transformative Economy – Dr. James Thorne

Picture of the month

While you Spring Clean your homes, remember that there are many organizations in need of clothing and household item donations. For those that are located in the Okanagan, Big Brothers Big Sisters of Central and Southern Interior of BC (BBBSCSI) eagerly requests that you donate these items either through their RENEW CREW program, or you can drop them off directly to Value Village in Rutland. The clothing doesn’t need to be in good quality as every item is either resold or repurposed. Let’s keep our clothing and household items out of the landfills while supporting our youth through this fantastic organization!!