Gold Seal Monthly Review

Tariffs and Taxes and Trade Wars, OH MY!

We were supposed to be talking about financial technology this month. That was the plan. A deep dive into how artificial intelligence (AI), automation, and blockchain are reshaping financial markets, and how that ties into a strategy we’re launching. But, tariffs have interrupted everything. When a policy shift disrupts global trade, drives inflation, forces central banks into action, and has the potential to realign capital flows across the world, we shift gears. So, here we are, and Ryan will save his Silicon Valley roleplay for later in the month.

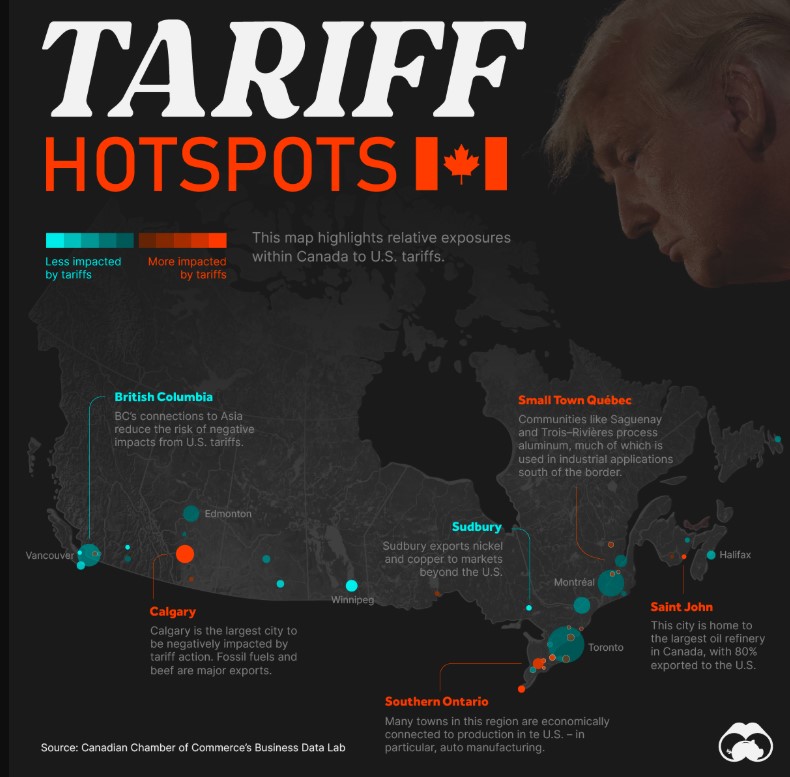

The tariffs are now live: 25 per cent across the board, 10 per cent on energy. This has been telegraphed for months, so no one should be surprised, but the real question isn’t whether tariffs get implemented. The real question is, are they staying?

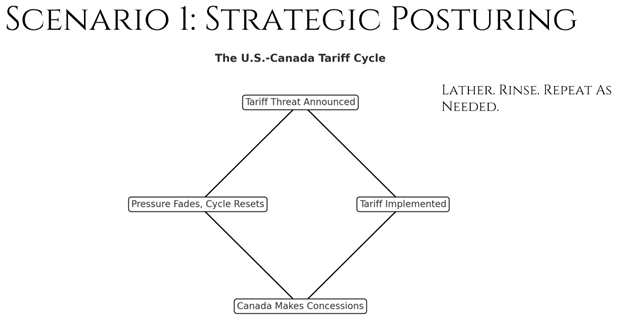

There are at least two ways this plays out, or “scenarios” if you will. Scenario 1 is the familiar cycle we’ve been living all year: the threat of tariffs, the announcement, followed by a phase where Canada makes some concession, either real or symbolic, then pressure fades, and the cycle begins again when the next demand comes up. We know this game. It’s how this U.S. administration exerts leverage on everything from border security to defense spending. If we stay in that loop, the impact of the tariff threats should optimistically dissipate over time as they’re taken less seriously. The longer Canada exists in this space and cycle, the more time there is to diversify trade and supply routes. That doesn’t mean the status quo is painless, but it does mean it’s relatively predictable while still hurting the economy short-term.

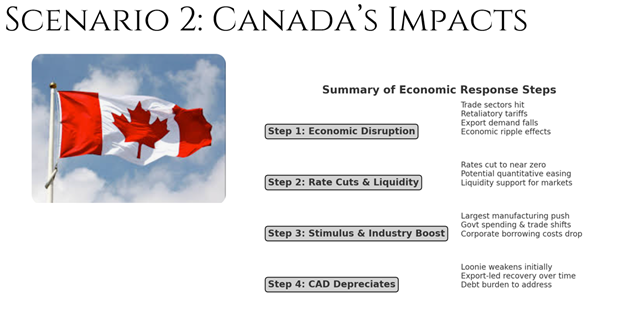

Source: Mackenzie FinancialBut then there’s Scenario 2: the tariffs don’t go away, and we’re following the gameplan outlined by President Donald Trump’s pick for Chair of the Council of Economic Advisers, Stephen Miran . If that happens, and when the understanding becomes that tariffs are a permanent fixture, there is a substantial short-term economic shock. Trade-sensitive industries take the hit first, such as automotive, plastics, agriculture, construction, and mining. Really, it’s anything reliant on cross-border trade. Retaliation tariffs aren’t just an option to be considered, they’re essential if you’re going to mitigate the U.S. taking more purchasing power and effectively having Canadians pay for this with currency. So, retaliation looks to be exactly what Canada will do. The Bank of Canada steps in to cushion the blow, cutting rates aggressively to ease financing conditions. If the damage deepens, that “printing press” that we brought out through COVID-19, quantitative easing, may come back as a tool to stabilize employment. At the same time, the government pivots toward its largest manufacturing and resource investment push in decades. Borrowing costs collapse, businesses seize the opportunity to expand, and trade relationships outside of the U.S. become a priority. A weaker Canadian dollar starts making exports more competitive, but that only kicks in after a painful adjustment period.

On the U.S. side, things don’t exactly go smoothly either. Tariffs act as a direct tax on imports, causing inflation to spike. Trade-sensitive industries, particularly those reliant on cheap materials, face rising costs, and with supply chains already in flux, this pressure feeds directly into consumer prices. The U.S. Federal Reserve then finds itself in a policy trap: does it cut rates to combat rising unemployment, or raise them to fight inflation? Both options carry risks, and the balance will be nearly impossible to manage cleanly. That said, raising rates to tame inflation does nothing to address the tariff policy, which is the cause, so cutting rates to support an economy where unemployment is rising is really the only choice. Meanwhile, confidence in the U.S. as a reliable trade partner and reserve currency anchor may start to erode. If tariffs hold, this doesn’t just impact trade, it forces global economies to rethink their reliance on the U.S. dollar. Countries that were already seeking alternatives might accelerate their plans. This is how long-term shifts in global economic power begin.

And that brings us to the final, most critical piece—Trump holds the policy lever to reverse all of this at any moment. If inflation runs too hot, if unemployment spikes, if markets push back hard enough, he can walk it all back overnight with an executive order. In that scenario, it’s an advertised political win whereby the U.S. strongarmed trade negotiations and single-handedly triggered a market rebound. The narrative becomes that trade partners were forced into submission, and tariffs were the tool that got it done. But even if that happens, the world has already moved further down the path of reducing dependence on U.S. trade and capital flows. The longer tariffs stay in place, the harder that trend is to reverse. And that’s where this really ends, whether the tariffs last for six months or six years, the economic consequences of how this plays out are already in motion. For now, we have to manage through this tariff downturn with full knowledge that any resulting bear market or economic recession has an “off-switch”, a luxury that did not exist through 2008 or 2020. We know that:

- It’s the lofty “Magnificent 7” leading the downturn, which was crowded out to the point that valuations were overly optimistic and perhaps unrealistic.

- Market activity so far looks to be tariff policy driven, so the source and fix is known and easily identifiable.

- The U.S. Federal Reserve and the Bank of Canada have more room to act to cushion short-term economic disruption, with capacity to cut rates from 4.5 per cent and 3.0 per cent respectively. In 2020, Canada’s cuts from 1.75 per cent were sufficient to largely insulate the market from economic standstill when combined with government spending. We argue that the rate cutting cycle that both kicked off last summer proactively anticipated economic weakness, effectively starting the cutting cycle for this early.

- The forward price-to-earnings for U.S. stocks (measure of stock price relative to earnings for valuation) was sitting at ~21.1 at the start of the quarter, which is to say “I will pay 21.1 times what your company is generating in earnings for a share of ownership in it”. This is just above it’s long-term median of 19.2. Stocks are expensive, but if you didn’t feel they were four years ago, you can’t feel that way now. The past four years have been a good time.

- If history serves, you don’t want to be out of the stock market when the stimulus hits. That’s rate drops, and government spending. The market rebound occurs as soon as the news breaks that there are back-stop supports in place.

- We echo again; the economy is not the stock market. It is entirely possible and precedented to have asset holders fairing nicely while the working class struggles. If there is a solution in sight that allows the affluent to prosper without providing any benefit to the working class, that’s generally what transpires.

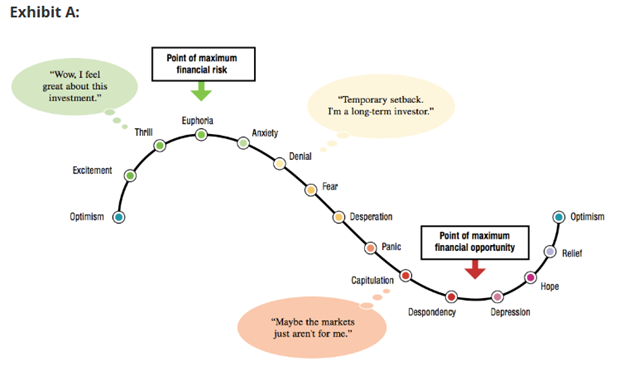

With this in mind, we’re treating this uptick in market volatility as more of a shakeout than valid recessionary risk. It tends to be fear of the unknown that materially moves markets, where there is no identifiable end in sight. That’s almost a requirement, as in Investor Psychology Exhibit A below, to be able to push beyond regular anxiety and fear, to true desperation, panic and capitulation.

We’re not of a view that we’re going to be selling into North American stock declines and are happy with our positioning walking into whatever this ends up being. Unless systemic risks come to light and under the assumption that this market activity remains tariff driven, we will be navigating this development with the understanding that the time to examine our risk levels for a downturn was last year when markets presented euphoric sentiment. We’re going into this with dry-powder in the portfolios with a fixed income overweight and will be ready to go on a stock/equity shopping spree should we get far enough down the investor psychology pathway. We will remain vigilant for news and developments that would challenge our views on the market landscape.

Gold Seal Insights

Tanya’s Tips: Keeping your emotions in check

Market volatility is a natural part of investing, but it can still be unnerving, even for the most experienced investors. During times of market uncertainty, it’s essential to stay focused on the long-term perspective and remember the importance of sticking to your investment strategy. While downturns may cause short-term anxiety, history shows that long-term investors who stay the course often reap the rewards.

Market volatility is a natural part of investing, but it can still be unnerving, even for the most experienced investors. During times of market uncertainty, it’s essential to stay focused on the long-term perspective and remember the importance of sticking to your investment strategy. While downturns may cause short-term anxiety, history shows that long-term investors who stay the course often reap the rewards.

Easier said than done, right? When emotions run high, the first instinct is often to act, even if it means making poor investment decisions. To help you navigate this, I’ve outlined a few action items to consider:

- Ignore the noise: During times of market volatility, sometimes the best course of action is to turn off the TV. The media tends to sensationalize market movements, often fueling fear and uncertainty. Staying calm and focusing on your long-term strategy is key.

- Review your 2024 performance: Last year, your returns likely exceeded your target returns, perhaps even doubling or tripling your goals. We saw little volatility in 2024, but typically, markets experience some sort of event each year. Historically, we tend to see a market correction of 8-10 per cent annually, yet 2024 was relatively calm. The correction we’re witnessing now is overdue and necessary for the market’s healthy functioning.

- Consider investing into this downturn: Market corrections are a normal, natural, and healthy part of the investing process. They present excellent opportunities for long-term growth and allow investors to recalibrate and build for the future. This is a great time to consider adding more capital to your portfolio, if it aligns with your risk tolerance.

Remember, investing is a marathon, not a sprint. The key to navigating volatility is to maintain a diversified portfolio, stay focused on your long-term objectives, and resist the urge to react to short-term market movements. Trust in your strategy, stay patient, and know that volatility is part of the journey to achieving your financial goals.

If you have concerns about your investments or strategy, we are always here to discuss and adjust your plan as needed. Let’s embrace the market’s natural rhythms and continue building for the future.

Noteworthy Links

- Economist says “confusion is the key word” in Trump’s tariff policy

- Two-thirds of Canadian businesses say they can withstand a tariff war that lasts more than a year: survey

- US Tariffs May Force Bank of Canada to Weigh Giant Rate Cut

Picture of the month