Overview

- Team Update

- Portfolio and Market Performance

- Portfolio Update

- Market Commentary

- Global Outlook

Team Update

We went to Winnipeg in the first week of October alongside a few other large teams from across the country for a Wellington-Altus advisory board meeting. The purpose of these meetings is to focus our resources on the areas we think matter most to you, our clients. We would like to thank everyone who has provided us with feedback over the last year as we are continually looking at ways to improve the service we provide.

Meanwhile, our office renovations continue and we’re being told the construction should be complete by mid-October. We’re still waiting on furniture before we plan an appreciation party; apparently, it’s on a ship somewhere in the Atlantic Ocean. Once we have a solid completion date we’ll start sending out invitations for you to join us in celebrating our new space.

Our next few months will include reviewing accounts ahead of year-end.

Portfolio and Market Performance [i]

Year-to-Date Performance as of September 29, 2023

- TSX 60 Total Return, C$: 3.0%

- S&P 500 Total Return, US$: 13.1%

- S&P Canada All Bond Index Total Return, C$: -1.3%

Doing a traditional 60/40 portfolio with the three indexes, on average you would end up with 4.3% year to date, 4.2% over three years, and 5.4% over five years.

For context, Canada’s largest mutual fund is the RBC Select Balanced Portfolio, at about $50 billion in assets and a fee of about 2%. Its return is 2.7% year-to-date, 1.8% over three years, and 3.4% over five years.

The Conservative Equity Portfolio returned 17.4% year to date, 6.1% over three years, 8.1% over five years, and 11.5% since inception (October 2015).

The Diversified Income Portfolio, which is our balanced portfolio used for many of our clients’ registered accounts, returned 2.2% year to date, 5.6% over three years, 7.1% over five years, and 7.9% since inception (July 2017).

The Focused Total Return Portfolio returned 28.8% year to date, 9.0% over three years, and 16.7% since inception (April 2020).

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

We made no portfolio changes in September as we feel our portfolios are well positioned. Over the past year we have been trading up in quality in our portfolios, preparing for an economic slowdown. That means increasing our exposure to mega-cap growth, or what Goldman Sachs has coined the “Magnificent Seven.” We own all but one, and they are our largest holdings by design to shield our portfolios during economic slowdowns. The Magnificent Seven are Microsoft, Apple, Google, Amazon, Nvidia, Tesla, and Meta.

The only name we do not own is Meta.

We feel no need this month to discuss these holdings except to remind you that these are the companies that have been driving performance this year.

Market Commentary

We are seeing an exodus by global and U.S.-based money managers from Canada. In the last month, we’ve seen a large selloff in Canadian stocks, Canadian bonds, government bonds, and the Canadian dollar.

We have more sellers than buyers in both Canadian debt and Canadian stocks. The TSX is down over the past month, and the Canadian bond market is under downward pressure as well. It’s rare that we have both the stock and bond markets going down at the same time. Lastly, the Canadian dollar also declined over the past few months, supporting our belief that this wasn’t a selloff in one market or another but rather a selloff of Canada.

In this context, let’s look at our Canadian holdings and how we’ve positioned the portfolio. A year ago, we proposed that Canada would be weak, and that companies that have low debt and a lot of cash on their balance sheet, such as the Magnificent Seven, were going to do well in this environment ¬– and that scenario has been playing out.

One of the first things we do when analyzing a company is to look at its balance sheet and cash flow statements. How much debt does the company have and how much interest does that debt cost? What is the cash flow of the business and is it sufficient to service the debt in the event of a downturn? Most of the companies we own have very little debt or no debt at all.

However, some industries typically by their nature carry larger amounts of debt due to the large amount of hard assets needed to run their businesses. These include power utilities, with their assets being power lines and power plants; telecommunications companies, with their assets being communication lines and equipment; and real estate, with their assets being land and buildings. Some of these assets require a large upfront expense, but then can be billed on for decades.

In these areas we look at how their debt is structured and prefer to see longer-dated debt that will not need to be renewed anytime soon and is spread across many periods. When structured properly, the risk of having to refinance a large proportion of debt at higher rates is mitigated.

In our Conservative Equity portfolio, roughly 30% of equities are Canadian or listed in Canada, whereas the average Canadian has over 50% of their assets in Canadian holdings. We call that home bias. The Canadian market represents about 3% of the global markets, yet Canadians on average have over 50% of their investments in Canada. We, on the other hand, are agnostic; we build our portfolios from the ground up, and as a result we are comfortable looking outside of Canada to find the best investment opportunities.

There are however a few quality companies in Canada. From a high level, we currently own three utilities, two railways, two banks, one telecommunications firm, two insurance companies, one grocer, and one commodity/fertilizer stock. Our Canadian basket of high-quality equities is very stable and quite defensive. The two banks that we own, TD Canada Trust and Royal Bank of Canada, are among the largest in Canada and among the safest in the world. We own two rails, Canadian Pacific Railway and Canadian National Railway, which are extremely well-run oligopolies. Fortis, Brookfield Renewable Partners, and Northland Power are power utilities with long-term fixed contracts. Intact and iA Financial are leading insurance companies with very little debt. Telus is one of four telecommunications companies in Canada – another oligopoly – with a handsome dividend. Nutrient is among the largest fertilizer companies in the world. Metro is the best run Canadian grocer. We would consider all of our Canadian holdings, best-in-class businesses.

In this environment of rising interest rates, much like the average Canadian who has to ensure they can pay the increasing interest on their mortgage, companies must ensure they borrow cautiously as to afford the increase in interest on their loans. As interest rates have gone up, analysts have been concerned about the effect on the housing market and what kind of effect this would have on the average Canadian homeowner. The same thing holds true for companies that have a lot of debt; with interest rates going up, we want to make sure the burden of higher borrowing costs is spread out over many years.

You can have a great business, but debt is the one thing that can cripple any business.

Interest rates have risen dramatically worldwide in the last year, and it’s starting to affect certain economies. We think it’s going to affect the Canadian economy more so than the U.S., and some companies will be more affected by higher rates than others. People are waking up to this fact, and institutional investors are starting to sell Canadian assets.

We’re looking at what we own and we’re not concerned; we own great companies. The only two industries that have a lot of debt in our portfolio, are telecommunications and utilities. Telus, our telecommunication stock, has debt that matches the assets they have, but Telus also has been very strategic in laddering out that debt. What that means is, if you have $20 billion of debt but you’re able to stagger the maturities over 50 years, you’re not overly concerned about short-term interest rate moves. Just like if you have a 30-year mortgage in the U.S. – that’s the most popular mortgage in the U.S. – these interest rates aren’t affecting Americans that have locked in a mortgage rate for 30 years.

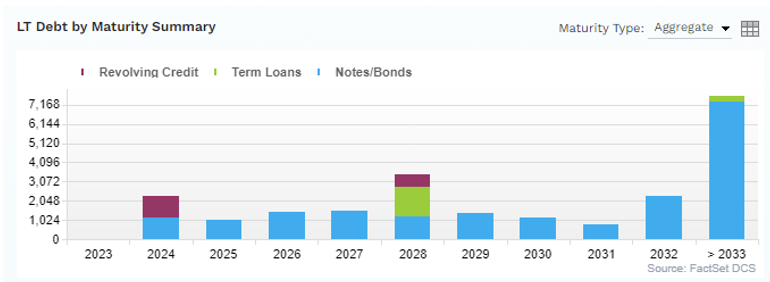

Here is a chart that illustrates the debt maturities held by Telus, for example.

This graph illustrates when their loans mature and when they are going to renegotiate the terms. The blue bars represent debt maturities, and we can see that on average they are very well spread out over time and very well sheltered from rising interest rates as most of their debt is already fixed with favourable rates for many years.

We’ve been light on utilities and telecommunications over the last two years. We reduced Telus to just 1% weighting in the portfolio as the asset was trading at all-time highs. It wasn’t debt considerations, it was valuation; Telus was trading higher in terms of a multiple on earnings than we’ve probably ever seen it. We thought it was a great business but thought the price wasn’t justified. So, we trimmed dramatically. That being said, we try not to go to 0% on quality names. Our intention is that if the company gets cheap enough and other parts of the portfolio rally, we’re going to be buying more of Telus in the future. In the meantime, we’re collecting a 6.5% dividend while we wait.

Canada versus the U.S., and why there’s been this exodus over the past month.

Personal debt, and how that might impact the Canadian economy is the big concern. How long will interest rates be kept at these high levels, and what effect is it going to have in Canada? As mentioned, in the U.S. most homebuyers take a 30-year mortgage, so they’re not as affected by higher rates this year. They also don’t have as many lines of credit as Canadians. In Canada, we homeowners generally take five year fixed or variable rate mortgages. Roughly 30% of Canadian mortgages are variable rate. What that means is that as interest rates rise, the interest you pay – and hence your whole payment – will go up. Interestingly, four of the six big banks have structured their variable rate mortgages in a way that as interest rates go up, your payment stays the same, but the interest on that payment increases and it also can increase the amortization period of the mortgage. That happens to a certain point but eventually – and this is happening now – the rates have gone up far enough that the payments that people have on these variable mortgages is not enough to cover even just the interest. Banks are calling clients to increase their mortgage payments because the amount they’re paying the isn’t enough to cover the interest. That’s the first issue we’re having in Canada.

A second issue is that many Canadians have also taken lines of credit tied to these mortgages, and they’ve used these lines of credit to pay down other forms of debt such as credit cards and personal loans. Now it’s coming back to bite them, because as interest rates have gone up, the payments have also gone up dramatically.

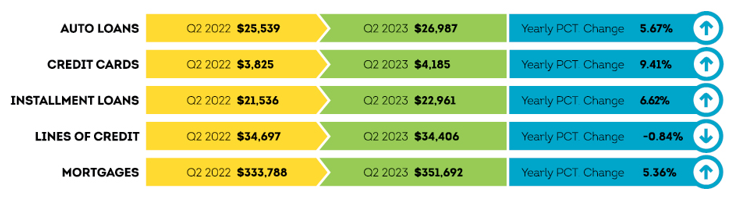

Here’s an interesting chart published by TransUnion this month that gives some color to what is going on with household debt. TransUnion is a credit rating agency; along with Equifax, they are the sole companies that rate the creditworthiness of the Canadian public.

The big item of interest for us was how different consumer credit balances are changing. Below you can see that all debt balances have been increasing this year with the sole exception of lines of credit, which have reduced slightly. We believe this is because lines of credit typically have a larger portion that is floating interest so they would be the first area of debt some Canadians choose to pay off. However, overall you can see that consumer debt is increasing, pointing to an imbalance between income and expenses for many Canadians.

Source: https://www.transunion.ca/lp/iir

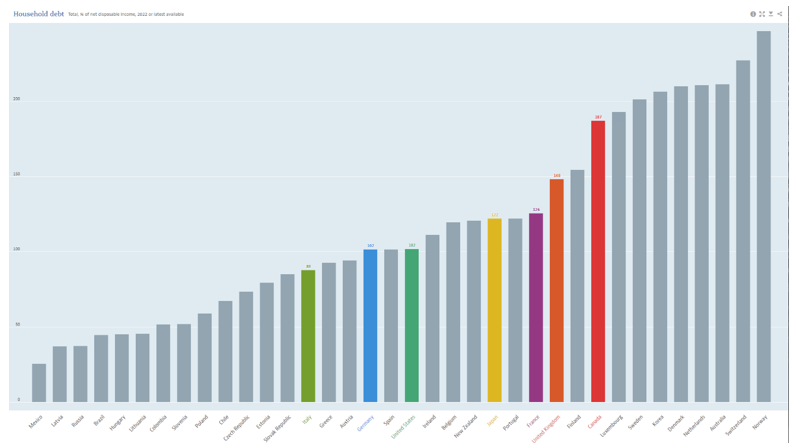

Canadians are carrying more debt and paying more interest than most other developed countries, and as a result have less disposable income left over at the end of the month.

According to Statistics Canada, total Canadian household debt is about $2.8 trillion or $71,000 per capita, and about 3/4 of this is mortgage debt. Government debt is about $2.1 trillion or $52,000 per capita.

In terms of personal debt, which is what most financial experts are worried about, Canada ranks worst among G7 countries, with a household debt-to-disposable-income ratio of 187%. For comparison, the Organization for Economic Cooperation and Development data puts the U.S. ratio at 102%. We’re really on the high side, and what this means is that Canadians are much more sensitive to the rise in rates vs. our neighbours to the south.

Source: https://data.oecd.org/hha/household-debt.htm

Another concern is that our economy is less diversified than the U.S. What’s worrisome is that housing and construction comprise roughly 20% of our GDP. That is higher than most countries. As interest rates go up, we are seeing a cooling in the housing market. Construction is down, and the rising cost of owning real estate is adding more downward pressure. We don’t yet know the full effects this will have on our economy, however it won’t be good.

That brings us to a point we’ve talked about a few times over the past year, and that’s that we have the federal government running extreme fiscal policy, which is creating inflation, while the Bank of Canada’s Governor Tiff Macklem tries to cool inflation by aggressively raising interest rates. While it may not break the economy, we feel it’s certainly putting more cracks in the system.

We will be sharing with you an interesting read written by our Chief Market Strategist, Dr. James Thorne, that talks about the dichotomy between fiscal and monetary policy in Canada, and how it’s basically a recipe for disaster if it continues.

We believe the central bankers see what is going on but don’t talk about it publicly and suspect that Canada will become less aggressive sooner than the U.S. if indeed our economy is weaker. We will be quicker to adjust, but the bankers won’t talk about it until they have to.

Let’s take a moment to discuss what’s been driving markets this past month, especially in the U.S: bonds. Government long-term yields in the U.S. are higher than we’ve seen in years. What’s driving this is good economic data. It’s a strange situation where good news has been bad news for the U.S. bond market, and equity markets.

The bond market is much larger than the equity market, and it trades off a lot of different fundamentals than the equity market does. As investors we typically spend more time researching equities and keep our bond investments very safe and boring. We don’t want to take risk, but the things that are causing concern for the bond market ¬¬– a strong jobs market, the economy in the U.S. that’s growing more than people thought it would, a good corporate environment –these are causing people concern, thinking bankers will have to keep interest rates higher for longer, and that’s what’s driven higher bond yields in the U.S. We, however, see this is a positive. The U.S. economy is stronger than people thought. There may be more growth in the next few years. This is actually an ideal setup for the equity markets in the U.S. going forward. If the economy is indeed strong and the jobs are good, as we’re seeing, that means that our companies can grow, which isn’t a bad thing.

Looking in the rear-view mirror, it’s been difficult to own longer-dated bonds. Anything longer than two years has gone down over the past year, but that being said, looking forward and in the environment ahead of us, we are optimistic. It has been difficult to build a properly balanced portfolio when yields and interest rates were virtually zero. It hasn’t created the same sort of diversification or cushion in the portfolio, but now when you can get 4% or 5% on government bonds, they’re much more attractive.

Global Outlook

Inflation and a strong economy are good things if you own a company that will grow with the economy over the next 30 years. The data we are seeing, while it may cause shorter-term volatility, is extremely positive on the longer term, which is where we are focused.

We believe we are very well positioned for the next 12-24 months in our weightings. If our call is somewhat right, we may even pick up a few points of excess return.

If Canada continues to soften going into year-end while mega-cap growth outperforms, come December we may see tax loss harvesting in Canada. We would be buyers of Canadian stocks at that point.

Looking into year-end and next year, we expect U.S. markets to continue to rally. We should also begin hearing the narrative that rates will come down, which would put upward pressure on bond and equity prices.

Long-duration equities and bonds should do well in this environment.

~~~

We hope everyone had a wonderful Thanksgiving with their loved ones. We’ll check back in with you in early November.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045

haleinvestmentgroup.ca

The information contained herein has been provided for information purposes only. The information has been drawn from sources believed to be reliable. Graphs, charts and other numbers are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance. This does not constitute a recommendation or solicitation to buy or sell securities of any kind. Market conditions may change which may impact the information contained in this document. Wellington-Altus Private Wealth Inc. (WAPW) does not guarantee the accuracy or completeness of the information contained herein, nor does WAPW assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Before acting on any of the above, please contact your financial advisor. WAPW is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

© 2023, Wellington-Altus Private Wealth Inc. ALL RIGHTS RESERVED. NO USE OR REPRODUCTION WITHOUT PERMISSION.

www.wellington-altus.ca