Overview

- Team Update

- Portfolio and Market Performance

- Portfolio Update

- Interest Rates and Economic Outlook

- Investment and Market Outlook

Team Update

In the office, we are in the process of setting up First Home Savings Accounts for most of our younger clients, often the children and grandchildren of our clients who do not already own a home.

Portfolio and Market Performance

Year-to-Date Performance as of November 30, 2023

- S&P/TSX 60 Total Net Return, C$: 7.7%

- S&P 500 Total Net Return, US$: 20.8%

- S&P Canada All Bond Index Total Return, C$: 3.0%

- NASDAQ Composite Total Return, US$: 38.0%

- Dow Jones Industrial Average Total Net Return, US$: 10.7%

The Conservative Equity Portfolio returned 24.8% year-to-date, 5.9% over 3 years, 10.0% over 5 years, and 12.1% since inception (October 2015).

The Diversified Income Portfolio, which is our balanced portfolio used for many of our clients’ registered accounts, returned 6.6% year-to-date, 5.0% over 3 years, 8.4% over 5 years, and 8.4% since inception (July 2017).

The Focused Total Return Portfolio returned 36.2% year-to-date, 8.7% over 3 years, and 17.7% since inception (April 2020).

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

For context, Canada’s largest mutual fund is the RBC Select Balanced Portfolio, at about $50 billion in assets and a fee of about 2%. Its year-to-date return is 7.4%, 1.5% over 3 years, and about 5% over 5 years.

Portfolio Update

We made a few small changes to our portfolio in November. We trimmed 1% off Johnson & Johnson while adding the proceeds to our existing position in Costco. We also trimmed 1% off Alphabet and invested the proceeds in our existing position in Amazon.

We underestimated the effects the talc lawsuits would have on Johnson & Johnson’s stock, so we began lowering our exposure to the company on the most recent bounce in its stock price.

We also prefer Amazon over Alphabet right now on a growth and risk profile, so we are recycling some profits out of Alphabet to increase our exposure to Amazon. At 13 times price to forward cash flow, we believe Amazon is still cheap on a historical basis.

Berkshire Hathaway

Charlie Munger, Vice-Chair of Berkshire Hathaway and lifelong business partner to Warren Buffett, has passed away at the age of 99.

We’ve followed Buffett and Munger for years, since we began investing. They were the godfathers of investing, and arguably the most successful investors of our time.

A favorite Munger quote? “How to avoid major mistakes: Avoid toxic people and toxic activities.”

Both Munger and Buffet have had a major influence on our investment process and philosophy over the years. Some would say that Munger was to credit for changing Buffet’s investment style from a deep value guy to a quality investor. He would say, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

We’ve taken this approach in our portfolio, moving to higher-quality names, which is a big contributor to our historical performance and success.

His second largest contribution was his belief on diversification. He was a firm believer that overdiversification destroyed returns and was the tool of poor investment managers. Rather than investing a small weight in a large number of companies, we have taken a more focused approach and only purchased companies we believe to be of highest quality.

After studying Buffett and Munger’s successes and failures over the course of their careers, one of the things we’ve concluded is that Buffett is excellent at identifying good investments, but Berkshire Hathaway would not be where it is today if it weren’t for the genius financial architecture of Charlie Munger. They worked extremely well together for 60 years. Whenever they had a disagreement Buffett would say, “I’m right and you’re smart; eventually you will come to the same conclusion.”

I believe Mike and I have a similar relationship.

Charlie Munger was one of the greats of our industry, and he will be missed.

Some may ask what will happen to Berkshire Hathaway when Buffett passes. We’re not overly concerned. The company is a conglomerate of over 150 companies, and these businesses all have excellent management. Berkshire Hathaway has a succession plan as well and will be just fine.

The Walt Disney Company

The Walt Disney Company reinstated their dividend after cutting it during the pandemic. They are also making headwinds in their cost-cutting effort. Activist-investor Nelson Peltz has taken a large stake in the company and is trying to get more support for board seats. We suspect he sees the same opportunity we do: a great franchise that needs to get costs under control. We’d rather own a great franchise that needs to make a few changes to their spending, than a second-rate franchise that has costs under control.

Tesla

Tesla started deliveries of its newest model, a pickup truck they call the Cybertruck. Despite being controversial looking, it has some impressive science and engineering behind it. We view Tesla’s models 3 and Y to be roughly 10 years ahead of the competition, and now they come out with a next generation vehicle that’s even further ahead. It will probably take 2 to 3 years before the mainstream media and legacy automakers wake up to the fact that Tesla has created another category killer. They did this with the Model S, Model 3, and Model Y, all becoming the number one selling car in its segment at some point throughout the past decade. We remember when the Model Y was released; the mainstream media critiqued it and today it’s the world’s number one selling car with industry leading margins.

Tesla released the Cybertruck ahead of time to a few automotive journalists and YouTubers to review. And so far, despite the truck’s appearance, the reviews have been quite positive.

Tesla has over 2 million preorders for this vehicle, more than any other car in history. It will take time to ramp up production and therefore will not have a material impact on company earnings for a few years. However, it’s a great example of what this company is capable of manufacturing.

Our Definition of Conservative Investing

When it comes to equity investing, what is considered a conservative or low-risk business? What is considered a blue-chip stock?

At one time, IBM, Sears, Nokia, Kodak, General Motors, Xerox, and General Electric were all considered blue chips and conservative investments. What do these companies have in common? They did not innovate and were eventually disrupted.

Apple, Microsoft, Amazon, Google, and Tesla – these are the companies that disrupted the traditional way of doing things.

When we analyze a business, we look at the fundamentals of that business. We try to focus on the direction of the business and also take into account their financials. How much debt does the company have? Is the company an innovator or disruptor, or are they at risk of disruption? These are important questions to ask when making an investment.

We did not simply choose to invest in these companies because they were “new tech” or trendy; we believe these companies are innovating faster than their competition and eating their lunch.

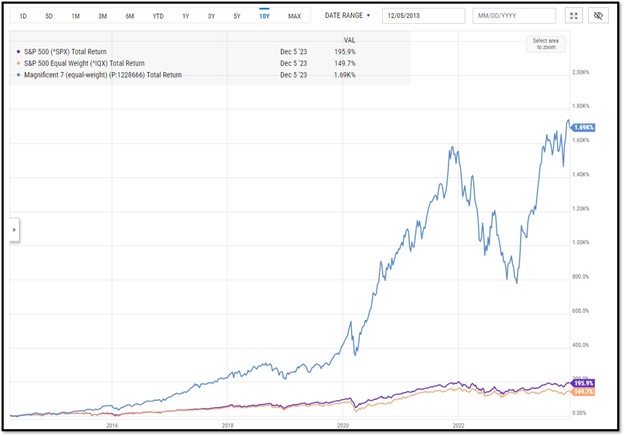

Here’s a chart with three lines of data to illustrate: the S&P 500 Equal Weight Index, the S&P 500 market weight index, and lastly an equal weight basket of the Magnificent 7, over the last 10 years.

Analysis: Investors who owned these companies in their portfolio over the last decade did quite well. Investors not invested in these companies did not do as well.

Interest Rates and Economic Outlook

Canada’s GDP was released last week. The numbers showed the Canadian economy contracted by -1.1% in the third quarter. The biggest detractor, business investment, was down 10% on the quarter, with international trade being the second-largest detractor, specifically our commodity exports like oil. Consumer spending was flat, while housing construction was up.

In contrast, U.S. GDP, which was also released last week was very strong, up 5.2% in the third quarter. Some of the big differences include that business investment was up 10%, exports were up 6%, and personal spending was up 3.6%.

Our argument on the Canadian economy, unfortunately, appears to be pretty dead-on. We had said previously that our higher personal debt levels would drag on spending, which is evident in these numbers.

Another argument we’ve made is the lack of business investment due to the U.S.’s aggressive corporate tax policies that were not mirrored by Canada. Well, there is a fairly massive difference in investment with us being down -10.1% and the U.S. being up 10.5% on the quarter.

Lastly, we have argued that the Canadian economy is too exposed to commodities and is not as balanced as the U.S. We are seeing these effects in the export numbers as lower oil prices dragged our exports to a total -5.1% on the quarter, with U.S. exports being up 6%.

There is a clear divergence in the effects of what are extremely similar rate hikes both in size and pace. The general consensus, as we spoke about last month, was a negative outlook on Canada and a flight of capital from the country.

We see this in bond yields as well. Our 10-year bond yields had a lower peak than the U.S. in early October and have fallen further since, with the peak being 4.3%, dropping a full 1% over the last 2 months to 3.3% in the first week of December. This is an indication that people think our economy will fall harder because of these rates and the central bank will be forced to drop rates to prevent an economic recession and to stimulate growth. In comparison, the U.S. 10-year bond yields peaked at 5% and have since fallen to 4.1%, with a consensus that their economy will not go into recession.

In early December, U.S. Treasury Secretary Janet Yellen said that economists who had predicted the need for high unemployment to rein-in inflation are now “eating their words.” She went on to say that “We’re not seeing the usual signs of a weakening labor market that would make you fear a recession.” Effectively, the people that were calling for a hard landing and a deep recession were wrong.

Last month was one of the strongest monthly gains we saw in our portfolios in its history; the scale was matched by events like the bounce from the market crash at the onset of COVID-19 in March 2020, and the announcement of a COVID-19 vaccine in November 2020. What “earth-shattering” event drove this rise of 8.5% in our equity portfolio last month? Bonds.

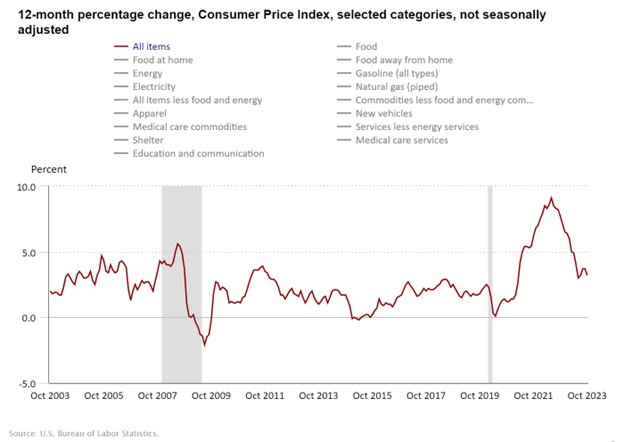

Somehow economists and talking heads on television were able to scare investors into believing that we were in for higher interest rates for a long time, contrary to every indicator we looked at, and that somehow inflation was going to stay and was not going to come down even though month after month we saw the numbers trending downward. Over a 6-month period the U.S 10-year treasuries yield went from 3.3 to 5%. Then, after watching the U.S yields hitting a peak, people could no longer ignore the data and long yields have fallen over the last 2 months to 4.13%.

This was reinforced by the October 2023 Canadian Consumer Price Index (CPI), which came in at 3.1% year-over-year, down from its peak at 8% a year ago. In the U.S. the October CPI was 3.2% year-over-year, with 0% increase month-over-month.

Investment and Market Outlook

People were calling for disaster and were wrong, but that’s not to say we’re out of the woods. We still have some issues in Canada, as evidenced by our GDP, while the U.S. appears to be on more solid ground.

So, what does this translate into for our portfolio? Growth assets should do well in this environment. We still believe we could be in for a nice “Santa Claus” rally that extends into next year.

Last month we discussed the benefits of owning bonds versus GICs. The bonds and ETFs we own in our portfolios have performed very well since then and have benefitted our portfolios. We believe this trend will continue into next year as rates begin to come down.

As the economy slows, we’re calling that by 2025, the overnight rate will be lower by 2.5%. We’ve been saying this for a while and now the Wall Street pundits are coming to a similar conclusion. How will this affect mortgage rates? Currently the overnight rate is at 5%; if that falls to 2.5% by mid-2025, we expect we will see 5-year fixed mortgages between 3% and 3.5%. That’s good for new mortgages and anyone refinancing.

The housing market thus far has been fairly stable, but we’re seeing houses taking a longer time to sell. That’s not really a good sign going forward. We’re not calling for a housing crash but certainly we’re going to see some weakness in sales and downward pressure on prices.

We see housing inventory growing slowly from their pandemic lows as homes sit on the market for longer. With that being said; it’s probably the first “buyers’ market” we’ve seen in a while.

Market Outlook

Our long-term outlook on equities is that we’ve entered a new multi-year bull market that could last well into the next decade. Because of the advances in AI and new technology; we believe it’s going to create a multi-year bull market similar to what we experienced in the ’80s and ’90s. That’s not to say there won’t be volatility, but we believe markets will grow over the next decade. Over the long term, innovation, ingenuity, and ambition prevail.

~~~

For those who wish to join our January call, it will take place on the second Wednesday, the 10th, at 3 p.m. Our Executive Summary will be published shortly after that.

We wish everyone all the joys of the season and look forward to what 2024 will bring.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045