Overview

- Office Update

- Portfolio and Market Performance

- Portfolio Update

- Holding Highlight

- Rapid-Fire Earnings

- Budget 2024 Recap

- Market Outlook

Office Update

Thank you to everyone who came out to our client appreciation event last month – it was a hit! The oysters and little lobster crackers were really, really good! We had a lot of positive feedback and requests for another event in the future.

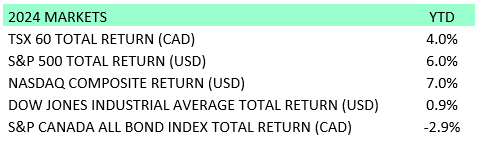

Portfolio and Market Performance (30/04/2024)

![]()

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

There were no major changes to the portfolios this month, as we’d made a lot of changes earlier this year. Since then, the markets have been rising then falling, effectively flat.

Holding Highlight

Canadian Pacific Kansas City Southern

Canadian Pacific has a very long and deep history in Canada and is a part of our very founding.

In 1871, British Columbia agreed to join Canada, having been offered many promises. Among those was a promise that a railway would be built linking BC to the rest of the country. Originally BC had asked for a wagon road, but in negotiations Canada sweetened the deal by offering a coast-to-coast railway in exchange for more federal control.

A deal was struck and like any good government infrastructure initiative, corruption was rampant. Sometimes it’s better not to see how the sausage is made. There were a lot of bribes and scandals and in 1881 a syndicate of Scottish businessmen incorporated Canadian Pacific and began construction of the railway.

In 1882 during construction, of the 9,000 railway workers, 6,500 were Chinese Canadians often doing the most dangerous work. It was difficult work, with around 1 in 9 workers dying on the job – a sobering reminder that the country and infrastructure we use today was built on the sacrifice of generations before us, who often gave their lives. Of course, I learned all about the railroad’s construction growing up watching David Carradine as a railroad worker in Kung Fu; I’m not sure everyone will get the reference but if you’ve watched the 1970s series it was a classic.

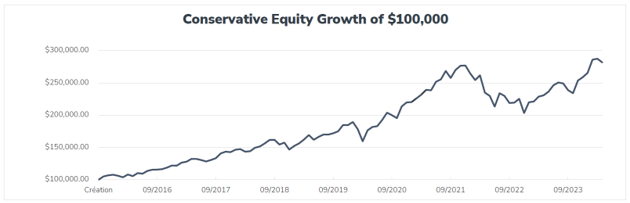

Here is a picture of the CP rail line completion with Donald Smith driving in the last spike. Embarrassingly for us finance people, Donald’s experience on the board of the Bank of Montreal did not help him much in driving that spike in. He missed and bent the first spike on his first try, so they had to pull it out and find another spike for this picture.

A lot has changed since its founding, including most recently expanding all the way to Mexico with the acquisition of Kansas City Southern in 2021. Among the many Canadian things and businesses, we can thank CP and the iconic Fairmont hotels that were built across Canada. Ovintiv, formerly Encana, is an oil and gas company valued at about $20 billion that was spun off from CP and Fording Coal.

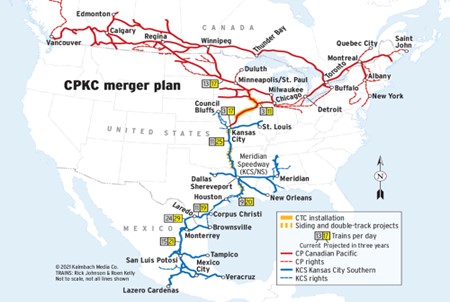

Here is a map of the combined rail network with CP rail assets in red and Kansas City Southern rail in blue. This is why we added to this position when the buyout was announced; we see their coverage and scale as a competitive advantage.

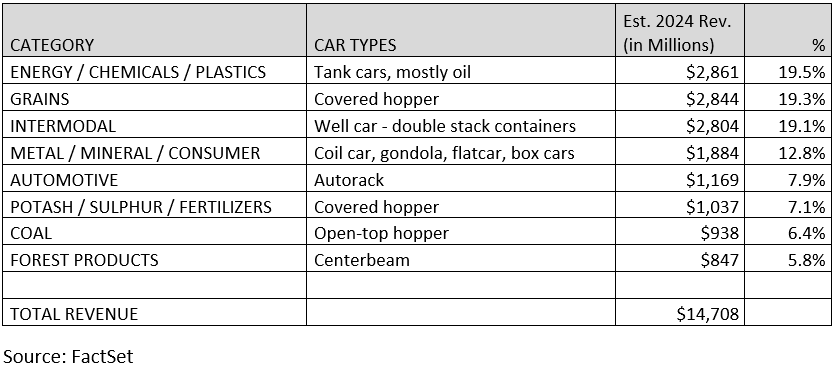

Now what do we own today? Here is a top-down view of the company with the split of different types of products they transport with their share of revenue. You can see it’s a pretty diversified business when it comes to customers.

Rapid-Fire Earnings

Amazon – Revenue is up 13% from a year ago, higher than expected. EBITDA was $31 billion this year vs. $20 billion last year. Net profits went to $10 billion this quarter from $3 billion. In particular, a big story was Amazon Web Services, with 17% growth year-over-year while the street was expecting only 15% growth. It’s this business-to-business web hosting and services where they really make their money.

Visa – It was another great quarter. The company announced its highest sales ever recorded: $8.8 billion. That’s up 10% from last year. Earnings were up 20%. International growth continues to be its strongest area, with big profits on currency conversion. This company is a juggernaut.

Eli Lilly – EPS is up approx. 60% from last year. We think as long as the total addressable market (TAM) keeps growing, you need to own this stock. We believe the TAM could reach a trillion dollars per year by the end of the decade. And right now, Novo Nordisk and Eli Lilly are the market leaders. The forward estimates just keep going up, raised from $40 billion to $42 billion for this year. Eli Lilly’s amazing growth is constrained by production and they remain in shortage of supply.

AMD – We were split on what we thought about the rate of GPU growth and AI computer chips. Is the growth disappointing? Perhaps. People were expecting a magic trick so the stock is down. In fact, they had a great quarter, taking more market share from Intel. They also announced a newer version of AI chips coming, which shows great focus and execution.

FB – This stock’s results are an important indicator that we aren’t in an AI bubble. Meta talked about spending money on projects that would not generate positive cashflow in the foreseeable future, and as a result the stock tanked -15%. This reaction was from investors reminiscent of the tone-deaf spending in 2022 that put the company in a rut before it changed course.

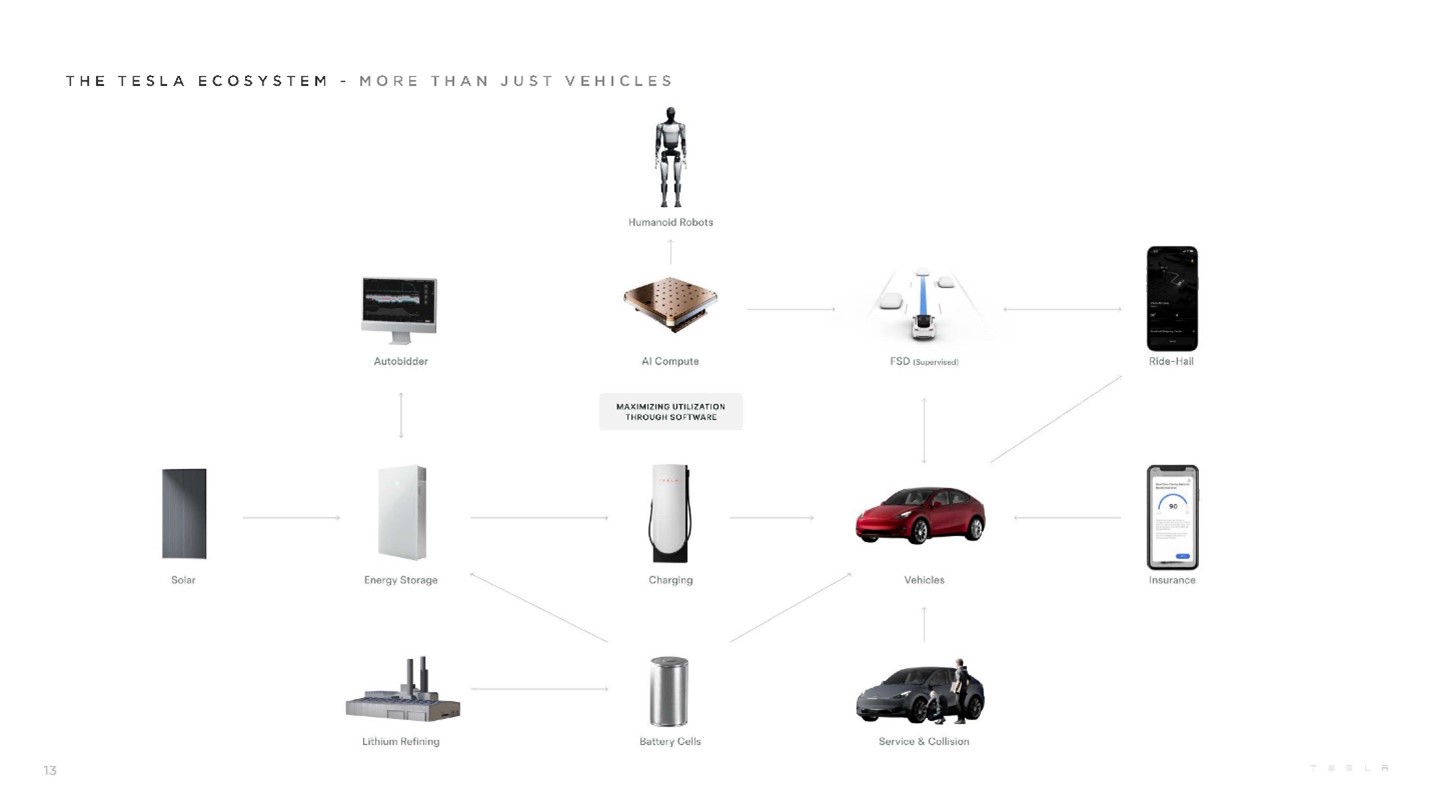

Tesla – When we discuss Telsa, we try to explain all the reasons why we believe it’s a good long-term investment. If we were to name all the business lines from most valuable to least valuable in the future this is what it would look like: 1. humanoid robots, 2. Robotaxi, 3. Autonomous/FSD vehicle software, 4. energy, 5. EV sales, 6. insurance, 7. charging stations.

Let’s call this the Tesla rabbit hat, and every few years, Elon and team are going to pull a rabbit out of the hat. You don’t exactly know when, but you know it’s going to come. This is one reason we don’t trade or try to time the market with TSLA shares.

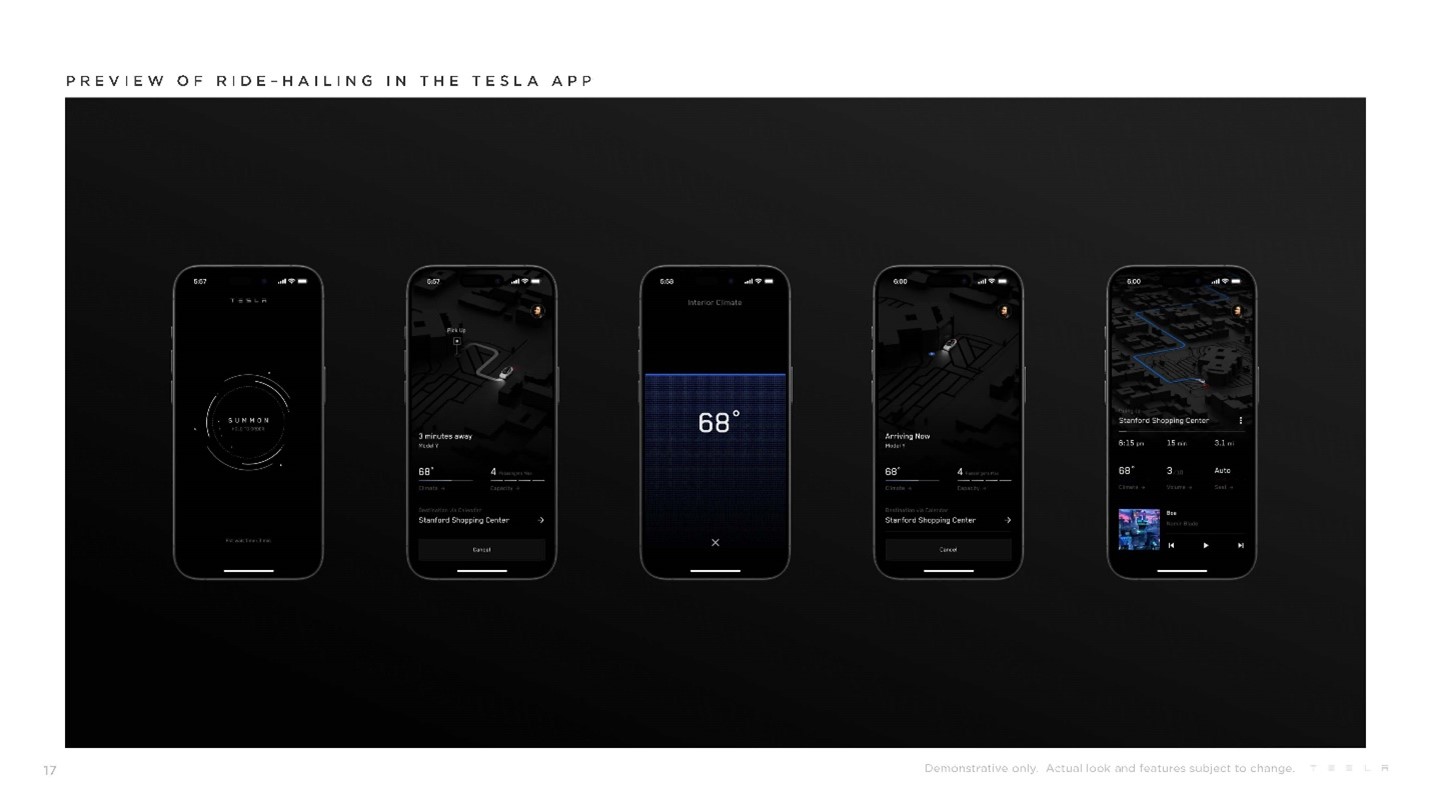

Their earnings call was one of those “rabbit out of the hat” moments, and it was when everyone least expected it. We heard about an FSD licensing deal in the works, Robotaxi insights, new app development, humanoid robots capable of working in a factory, and moving up production timelines of low-cost vehicles.

Musk and the company are playing chess while the legacy automakers are playing checkers. Let us explain.

Over the last few years, the demand for battery supplies has skyrocketed, increasing the prices dramatically. As Legacy carmakers watched Tesla take market share, they finally followed suit in 2021 and went all-in on EVs, which pushed up demand for EV batteries. Then Tesla hinted that they would slow the growth of production and all the Legacy carmakers canceled plans and moved to focus on hybrids.

Then on the earning call, Tesla announced it is not slowing but accelerating growth. With all those canceled battery contracts, Telsa is going to grab even more market share.

This past weekend, Musk flew to Beijing and met with the Chinese prime minister. He paved the way for FSD (Full Self-Driving) rollout in China. This was another big rabbit out of the hat and the market woke up.

China is the largest car market in the world and largest EV market in the world. When Tesla starts licensing FSD to other automakers, this will be huge. Our view is that Tesla will become the primary software provider to global automakers wanting to license FSD.

Federal Budget Recap

Fiscal Outlook

Budget 2024 projects deficits of around $40.0 billion for 2023-24, $39.8 billion for 2024-25, and $38.9 billion for 2025-26.

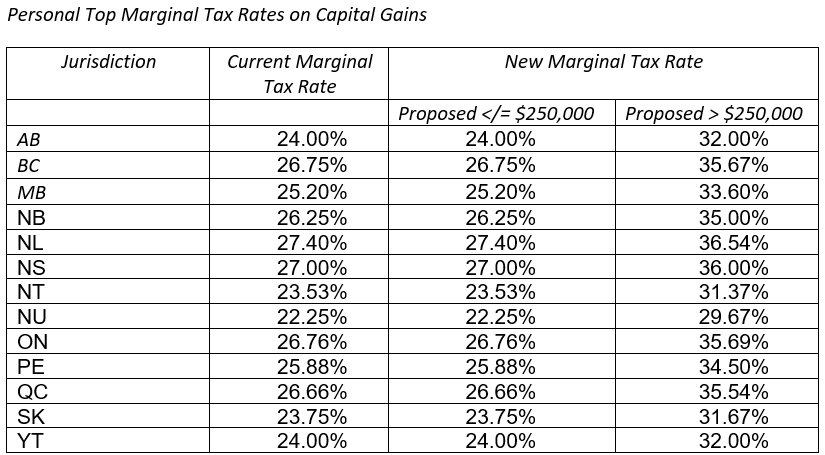

Changes to the Capital Gains Inclusion Rate

Since 2000, Canadian taxpayers have been required to include 50% of realized capital gains in their taxable income. The proportion of a realized capital gain that must be included in taxable income is commonly referred to as the capital gains inclusion rate.

Budget 2024 has proposed an increase to the capital gains inclusion rate to 66.67% from 50% for corporations and trusts. This increased capital gains inclusion rate would also apply to individuals with realized capital gains that exceed $250,000 in the tax year.

Budget 2024 states the enhanced capital gains inclusion rate would be effective June 25, 2024. Budget 2024 also provided information on specific items that will not be impacted by the proposed increase in the capital gains inclusion rates, including:

- the Principal Residence Exemption;

- capital gains earned in registered accounts such as RRSPs, RRIFs, TFSAs, FHSAs, or RESPs;

- pension income or the capital gains earned by registered pension plans.

Budget 2024 states that capital gains realized prior to June 25, 2024 will have the 50% inclusion rate apply, while capital gains realized on or after June 25, 2024 would be subject to the 66.67% inclusion rate. It does not appear that the $250,000 threshold will be pro-rated for 2024, meaning the full $250,000 threshold will be available for capital gains realized on or after June 25, 2024.

Budget 2024 estimates that this tax measure will add $19.4 billion to federal revenues over a five-year period starting in 2024. While no specific legislation regarding this proposal

has been provided at this point, Budget 2024 has stated that “additional design details will be released in the coming months.”

We do not believe this is fair or right for our government to tax the inflation that they created. Governments create inflation by printing money. No one other than government can create inflation. Not oil shocks, not pandemics, not trade wars, unions, or wars. We believe the only thing that creates inflation is government, because they are the only ones with a printing press in the basement of the central bank.

Now that they have inflated all assets with their money printing, they want to increase the tax on those inflation-caused increases.

I have a solution: the adjusted cost base of all assets should increase by the rate of inflation every year. That way we would only be taxed on the “actual real profits.”

Wishful thinking, we guess.

What are we suggesting? No need to pay tax or take gains unless you foresee a forced disposition in the next 2-3 years. Why pay tax now when you don’t have to?

We are looking at corporations and trusts that will not be eligible for the under-$250,000 clause going forward; we may want to shift some of those assets into personal names before June 25. Also, if there are larger assets sales, e.g., real estate or business, consult your accountant about the effects of moving up the closing date before June 25.

Market Outlook

We are still waiting for interest rates to come down; it makes no sense for them to be this high. In our view, the Canadian economy is already in recession. We also believe markets will continue to do well over the next 5-10 years, with minor 5-10% corrections every 6-12 months.

~~~

We hope you enjoy the warmer weather and appreciate the outdoors this month. And be sure to reach out to your accountant if you’re planning to dispose of any large assets so you can time the transaction before the tax hike.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045