Overview

- Office Update

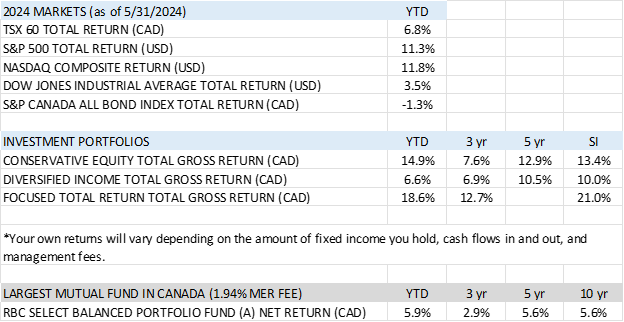

- Portfolio and Market Performance

- Portfolio Update

- Holding Highlight

- Rapid-Fire Earnings

- Market Outlook

Office Update

The buzz around the office this week is the announcement of the 2024 Brokerage Report Card. For a 5th year in a row, Wellington-Altus Private Wealth, was recognized as Canada’s top investment dealer. The survey is conducted by Investment Executive magazine to measure Canada’s top investment dealers on various criteria that are rated by a firm’s own advisors, and is closely followed by the firm executives.

We noticed when going through the details of the ratings, our lowest score was in the category of client account statements and portals. This is something we had previously mentioned we were working on, so as a bit of an update we are getting a working model up and running this month internally and I think we can expect the new online portal available to our clients shortly after.

Recent interview

Recently I was asked to do an interview on Brighter with Herbert. Herbert interviews all sorts of industry leaders from robotics experts, AI engineers or supply chain management professionals. I was asked to speak about my experience as a retail portfolio manager, managing investments for clients and how we handle the volatility of TSLA shares in clients’ portfolios.

For those interested, here is a link: https://www.youtube.com/watch?v=XFYx_dvDuDM

Portfolio and Market Performance

Portfolio Update

In the last month, we sold TD Bank, trimmed Fortis, and added to Brookfield Renewable, Northland Power and New Flyer Industries.

Holding Highlight

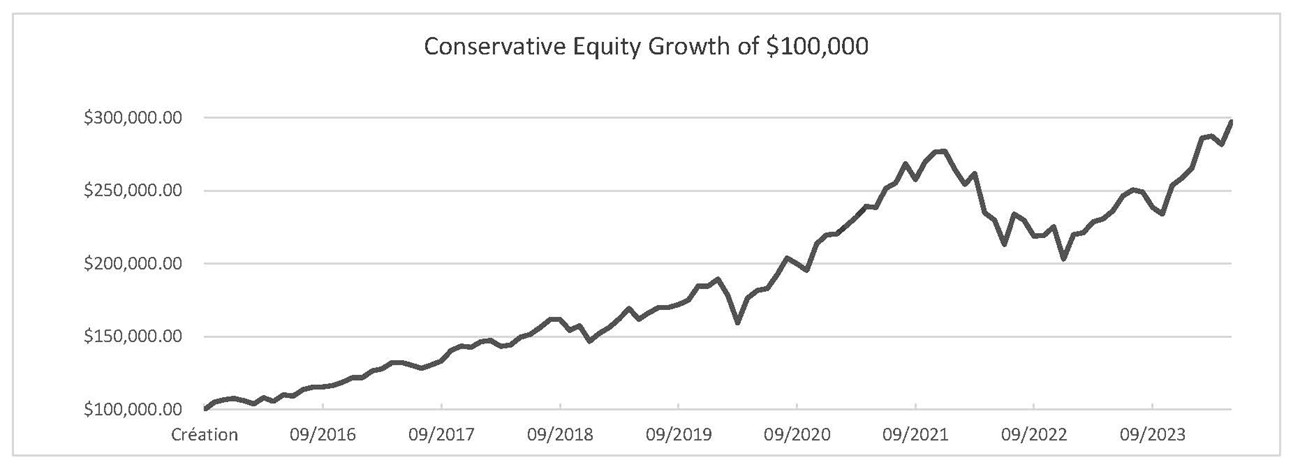

New Flyer Industries

New Flyer was founded in 1930 in Manitoba as a motorcoach manufacturer. They went public in 2005 and are coming up on their 20th year as a publicly traded company. They are a true Canadian success story and is the leading manufacturer of transit buses in North America, in particular, zero emissions transit buses.

From 2010 to 2020, the company grew heavily through acquisitions, using debt to finance the purchase of some of the largest bus manufacturers in the U.S. and U.K. This strategy hit a brick wall once the pandemic hit, as cities halted the purchase of transit buses and the motor coach travel industry dried up.

The stock went down significantly, and New Flyer had to cancel their dividend in 2022. Things began to turn around last year as the industry started to rebound and cities began placing bus orders again.

In short there has been a lot of volatility, or if I wanted to explain it to one of our kids, the wheels on the bus go round and round while the price of the stock goes up and down.

Sorry, too many nursery rhymes at home – we couldn’t help ourselves.

Today, the company is worth about $1.9 billion and holds about $1.3 billion in debt. New Flyer did $3.6 billion in revenue in 2023 and is slated for $4.6 billion in revenue for 2024, with earnings expanding further in 2025 and 2026.

The company is going through a major turnaround. Coliseum Capital Management, took a 26% stake in New Flyer last year and has been instrumental in turning things around. The second- and third-largest shareholders are also experienced investors through Turtle Creek owning 8% and Fidelity owning 5%.

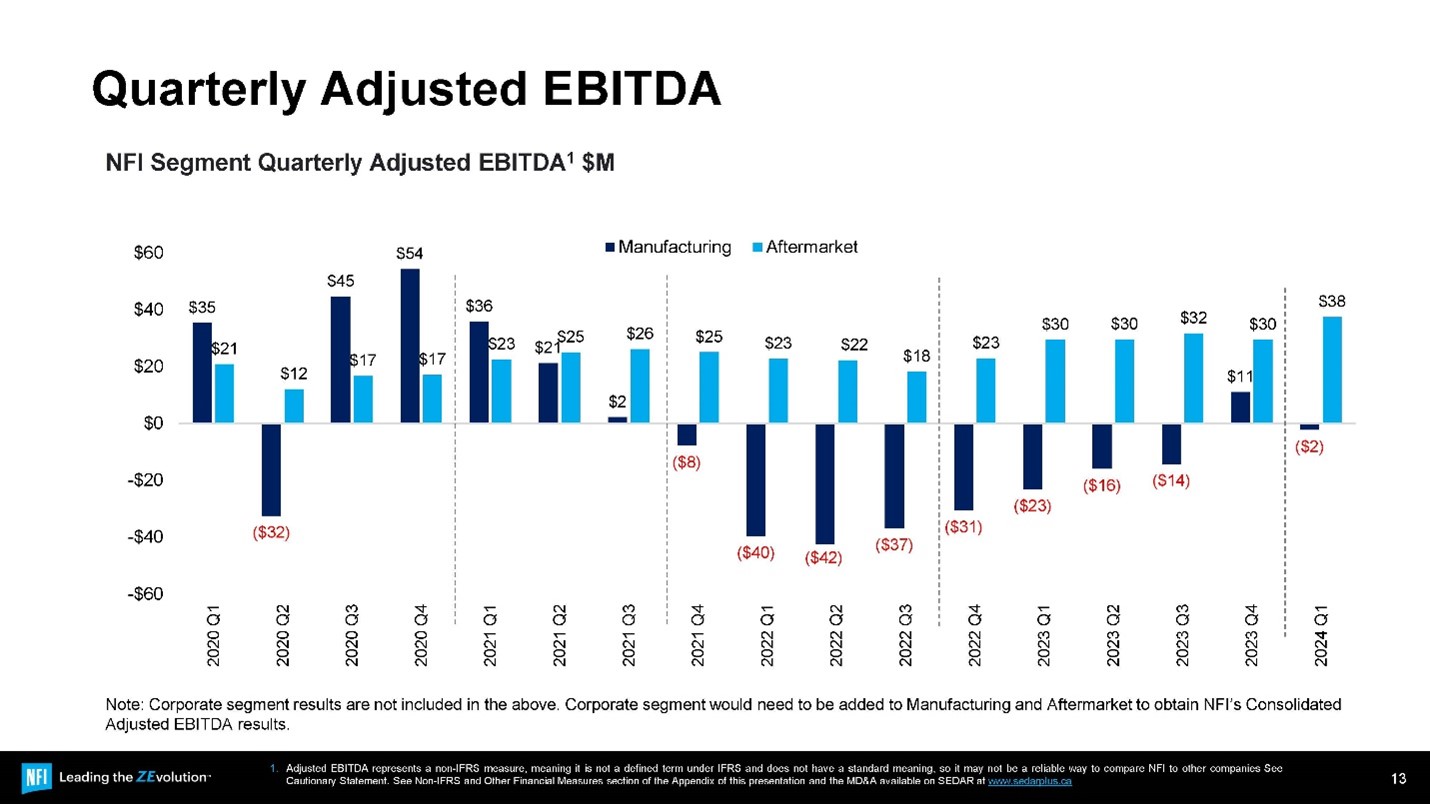

Presently, the company likes to divide their business into two parts, which can be seen in the chart below. The dark blue bars represent manufacturing and the light blue bars represent aftermarket. We love maintenance and service businesses, this was a big part of why we invested in United Technologies years ago; the service contracts for plane engines and elevator maintenance were a gold mine.

Source: NFI Group

You can see how stable that is. When you look at the manufacturing earnings in dark blue you can see how New Flyer started losing money through the pandemic and got crushed. You can also see where we are with this turnaround and why we feel like the path forward is exciting.

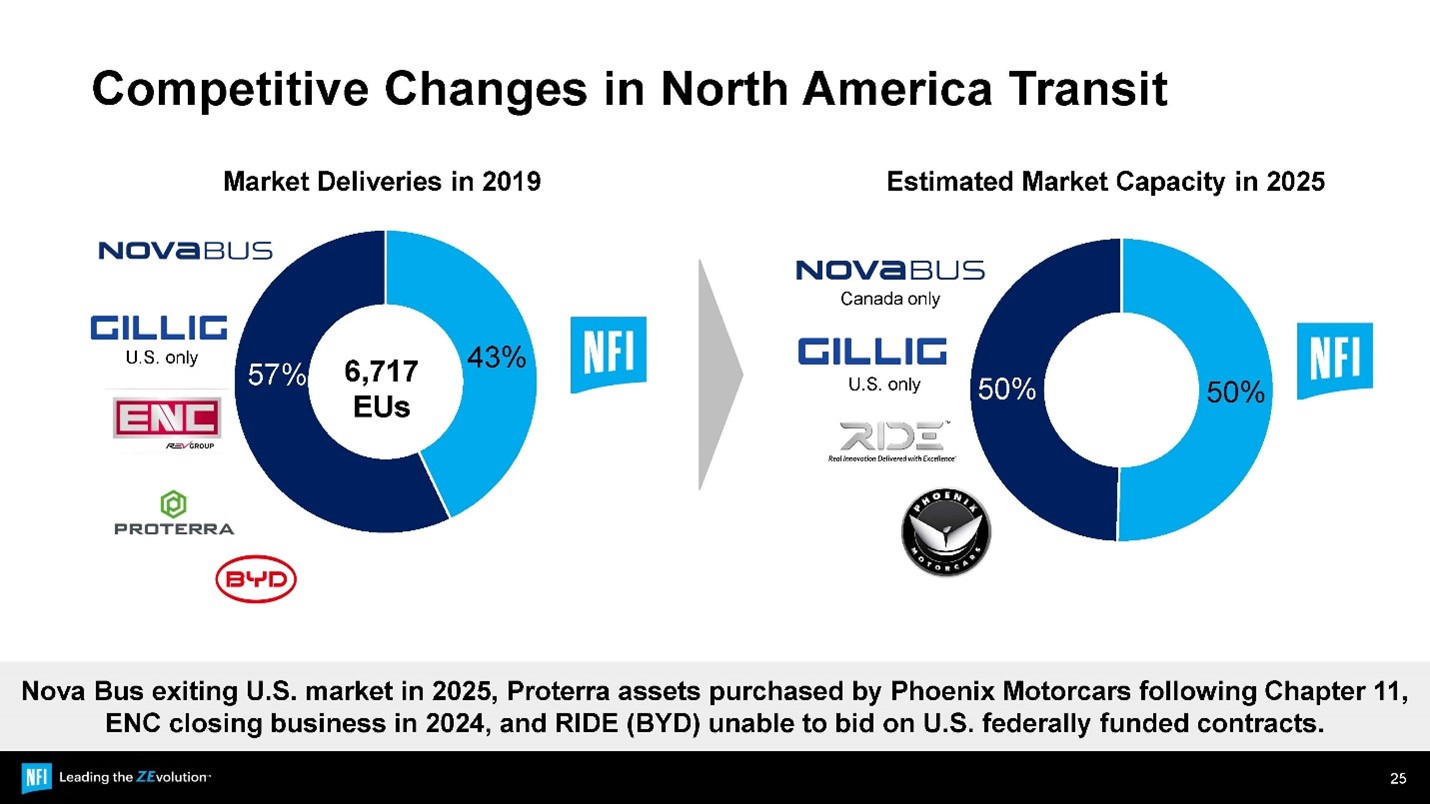

Let’s get to some of the winds that are blowing the stock in the right direction. First, a decrease in competition; through the pandemic most of their major competitors either went bankrupt, had to scale back their business, or saw legislation written forcing them out of business, an example being BYD-owned RYDE not being eligible for any contracts under federal transit funding.

Source: NFI Group

The next wind is government money. We’ve been talking about the overspending, and a lot of that infrastructure money is going to public transit. The U.S. represents about 70% of their revenue, U.K. 20%, and Canada 10%.

In the U.S., Federal Transit Authority annual funding went to $20 billion from $12 billion after they added an additional $100 billion in funding through the JOBS Act. Similar initiatives have been playing out in the U.K. and Canada as well.

New Flyer is currently delivering about 19% of the buses they make having zero emissions and expects to reach about 40% by the end of next year. We expect this to continue to fuel an acceleration in their growth. They also have been partnering with other companies that are working on autonomous transit buses to make them more reliable and safer. They have been involved in trials in the U.S. since 2019 with Robotic Research and in the U.K. through Fusion Processing for Level 4 autonomy since 2023.

We are very happy to now own a small part of this great Canadian business with a global client base and are excited to watch as it grows its earnings and revenue as municipalities modernize their transportation fleets.

Rapid-Fire Earnings

Canadian Banks – Royal Bank was probably the cleanest and showed good capital markets growth. National Bank has shown the most growth overall and best total return this year. BMO has had loan losses piling up and is underperforming. TD is tied up in money laundering issues. Overall, we are seeing loan losses across all institutions increase quickly as expected with a weakening Canadian economy.

Costco – Great numbers. Quarterly earnings per share are up 29% from the same quarter last year. e-commerce is up around 21% in Q3 2024, and 9.1% increase in net sales for the quarter.

Costco said their top performers in the quarter were food court, pharmacy, and optical. To us, this points to a good indicator that inflation is coming down because these are the places you start to go to more when you are looking to save money. The $1.50 hot dog and drink is a prime example.

As a side note, grocery was one of the items we were tracking 2 years ago when we were trying to confirm if inflation was coming down. We would look at price changes between fresh produce and meats versus things like canned goods and frozen foods, the idea being you can see people making financial choices at the grocery store pretty clearly.

Salesforce – We don’t own Salesforce anymore. We had been concerned, and rightly so. The stock got decimated by this round of announcements, down 20% after reporting earnings. The numbers were okay, not great, but certainly not better than people had hoped. After the earnings announcement, majority of the software companies traded down.

In short, we think it’s not just about the numbers. We think people are starting to realize that the moats and walls protecting these enterprise software companies are coming down. This space is going to undergo a lot of change in the next few years.

The most important point for us, though, was that this is more proof that we are not in an AI bubble. A company that talks a lot about AI got brought back down when their fundamentals, like earnings and sales, didn’t match the hype. This is a sign of a healthy market.

Nvidia – What we have learned since trimming our position: They are moving faster than their competition. Nvidia chips are the most efficient to run from a cost-of-compute perspective. This is why Nvidia CEO Jensen Huang recently stated that even if the other chip companies gave away their chips for free, they would still be too expensive.

Since it was just recently Formula One weekend in Montreal, we thought we would use an analogy.

Imagine you are Red Bull Racing. You’re a great team and you have a great car, but without the best driver, you won’t win as many races. When teams win races, they make hundreds of millions of dollars in prize money and sponsorship. Last year, Red Bull paid Max Verstappen over $50 million to drive their car. And they won almost every race. If they cheaped out and got a second-rate driver, they would have won fewer races and made less money. Or put another way, even if their second-rate driver were to race for free, he would still be too expensive.

So, think of Nvidia GPU chips as the clear race leader in AI chip technology. Not only are they winning every race, but they are moving faster than all of the competition. Everyone else is picking up scraps for whatever Nvidia cannot fulfill in terms of order volume.

Recently Nvidia announced great numbers and continued growth. This past weekend they announced yet another new and better chip to be released and an accelerated cycle of one new platform every year, twice as fast as they were before every two years. Competition can’t catch them.

Nvidia also announced a 10 for 1 stock split in June and should be showing in accounts by the time this newsletter is released.

Brookfield Renewable Corp – The company signed a deal with Microsoft to provide 10.5GW of power over the next 5 years in the U.S. and Europe. That’s a little less than a third of all the energy that Hydro-Québec generates. Or most of the energy used to power the Maritimes.

For some context, Hydro-Québec’s generating fleet comprises 61 hydroelectric generating stations and 24 thermal plants with a total installed capacity of 37.2 GW.

BEP currently produces 32.5 GW of power. So, this deal with MSFT grows that base by 30%. And BEP has another 150k GW under development. Which would bring them to 200 GW in the future.

Big tech renewable energy demand is growing at 50% per year according to Brookfield. Big tech represents most of the volume growth with corporate customers. Northland Power should also benefit from this trend.

U.S. Election – Don’t get caught up in the noise.

Interest Rates – They have started to come down; one of many cuts to come, in our opinion.

The government was causing inflation by printing so much money. The Bank of Canada raised interest rates to tame inflation, thereby adding to our day-to-day costs as mortgage and car payments are our largest expense. However, higher interest rates did not affect the amount of money our government is spending, i.e., deficit money printing.

Now that rates are beginning to come down, we should see the reverse is true. Lower rates should reduce inflation as the Canadian consumer is tapped out.

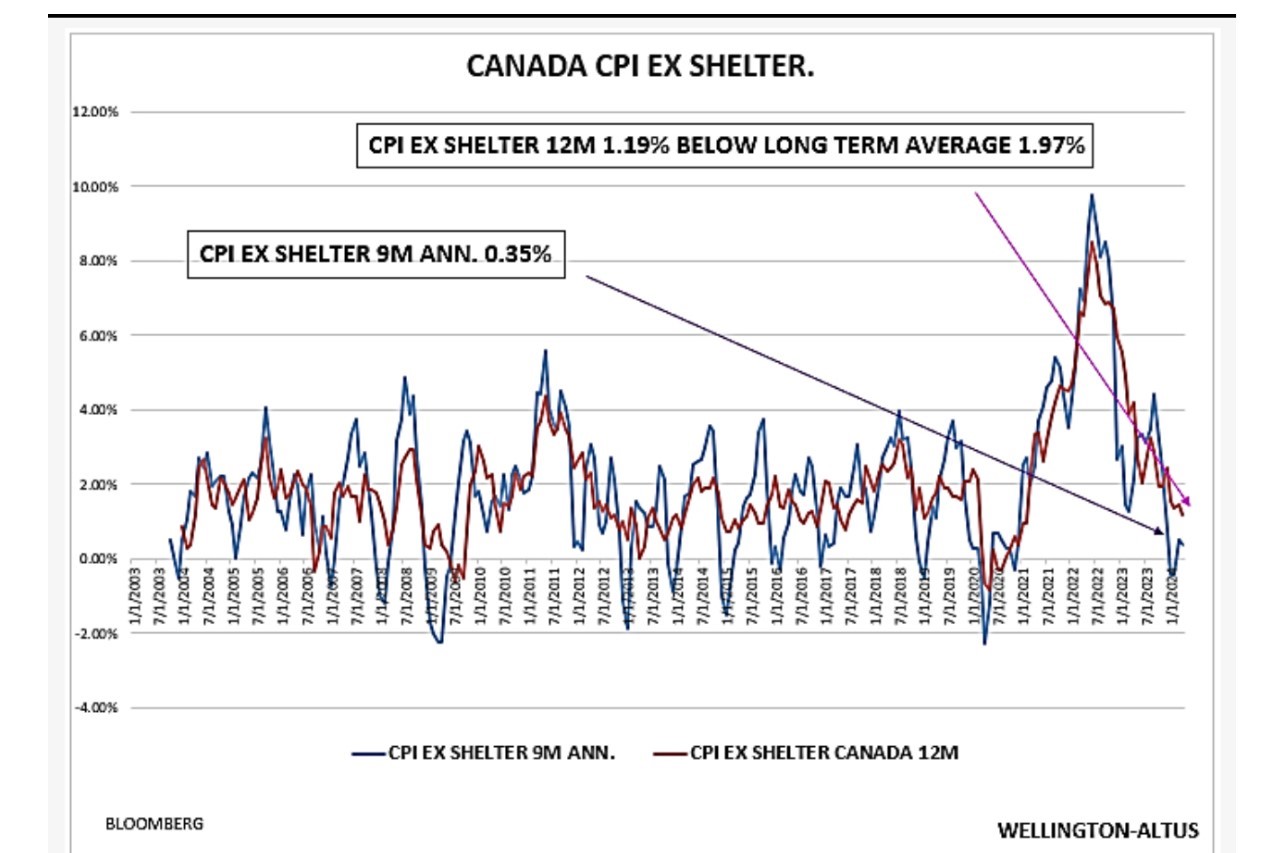

Inflation – Looks to be under control.

Canadian-Dollar Real Estate – We are seeing inventory continue to build.

Non-News that Made it to the Front Page – CNBC Reports: Elon Musk ordered Nvidia to ship AI chips intended for Tesla to X and, xAI; Business Insider: Emails show Elon Musk diverted a $500 million shipment of Nvidia chips intended for Tesla to X instead. This story was reported on by Lora Kolodny based on leaked emails from Nvidia. It’s worth noting Lora has a history of what some consider biased reporting against the EV manufacturer. The leaked internal emails referenced are from last year, which causes us to wonder about the timing of this article with a shareholder vote on the horizon.

Fact: Tesla was not prepared to receive the chips and was in the process of building the facility to run them. This requires massive grid upgrade, cooling systems, racking systems, wiring, and much more.

Instead of the chips sitting in a factory doing nothing until the site was ready, Elon sent them to another company of his, in exchange for XI’s future shipment. As they stated on their last earnings call, this has not slowed down their rate of progress on AI training.

Real News that Didn’t Make it to the Front Page – Japan auto scandal!

The Japanese automotive industry is facing a major crisis regarding safety testing irregularities and falsified data. Several prominent automakers, including Toyota, Honda, Mazda, and Yamaha, have admitted to improperly conducting and manipulating safety tests for various vehicle models over the past decade.

Key Points

- Toyota acknowledged using inadequate or outdated data in collision tests, incorrect airbag inflation testing, and falsified engine power figures for models like the Corolla, Yaris Cross, and Lexus vehicles. It has halted shipments of three models in Japan.

- Mazda admitted to tampering with crash test units by using timers to trigger airbags instead of sensors, and fabricating engine control software test results. It has suspended shipments of two models.

- Honda revealed faking noise and gasoline engine output data for over 3 million vehicles sold in Japan, including the Accord and Odyssey.

- Yamaha halted shipments of a sports motorcycle because of testing irregularities.

- The Japanese transport ministry called these actions a breach of consumer trust and the certification system’s foundation. It ordered on-site inspections at the affected companies.

Implications

- The scandals have dealt a severe blow to the reputation of Japanese automakers known for quality and safety.

- Proxy advisory firms have recommended voting against re-electing Toyota’s chairman, Akio Toyoda, at the upcoming annual meeting, citing the certification issues.

- The Japanese government has expressed regret over the misconduct, which contradicts its corporate reform efforts.

- Automakers have apologized and assured customers of vehicle safety, but production halts and recalls may follow.

- Recall what happened to VW!

Market Outlook

We are halfway through the year and 18 months since the markets bottomed at the end of 2022. Our equity portfolios are up roughly 40% from that bottom and have more than fully recovered. We believe we are in the early stages of another bull market similar to 1995 with the advent of the Internet.

Own quality, stay invested but expect 5-10% pullbacks every year.

~~~

We will not be hosting our call next month as we usually skip a month in the summer while clients are on vacation. We will be back the first week of August for our regular monthly call. As always, if you have any questions or concerns, please feel free to reach out to us.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045