Overview

- Office Update

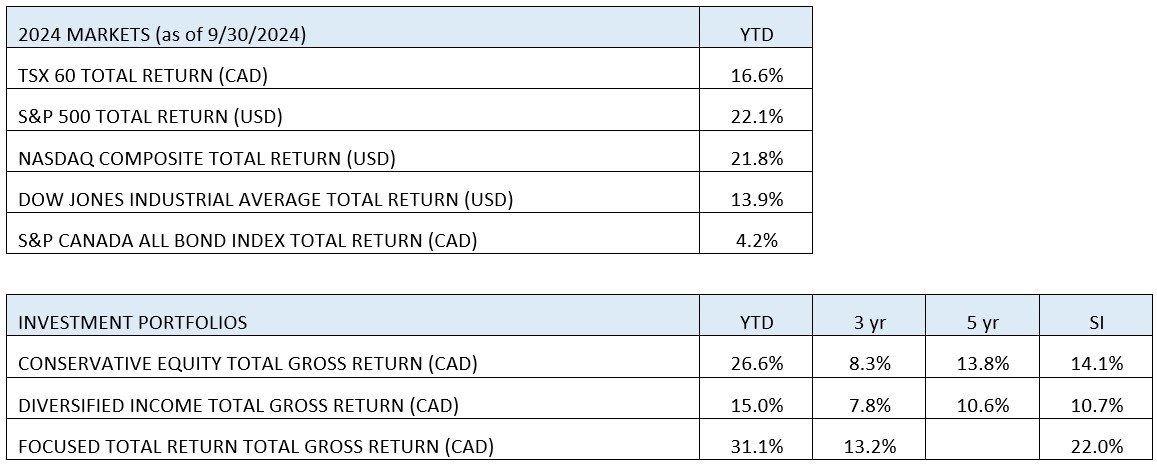

- Portfolio and Market Performance

- Macroeconomic Issues

- Notable Company News

- Economy and Market Outlook

Office Update

In some very exciting news, Michael had a baby born in September. We’re sure everyone will join us in congratulating him on his recent addition to the family.

Portfolio and Market Performance

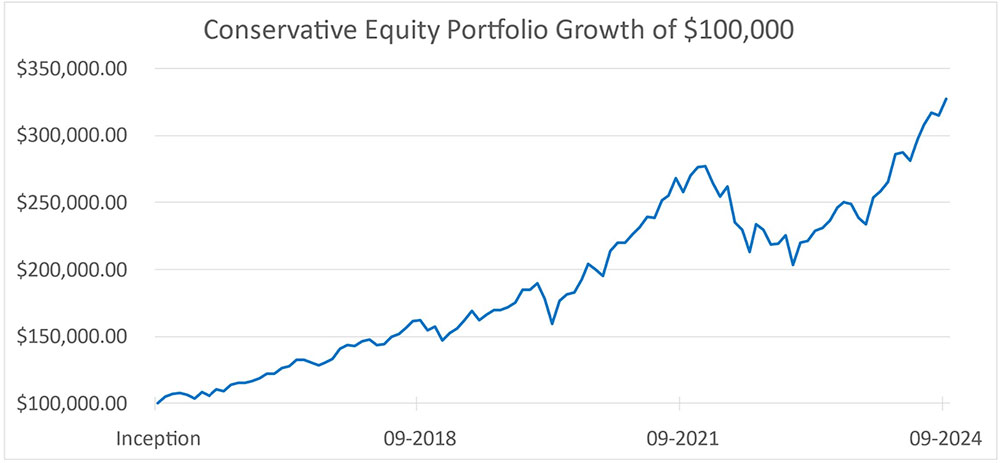

*Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

As there is so much going on in the world right now, we thought we would skip the single company highlight this month and take some extra time to discuss some of the bigger macroeconomic issues.

In its place, we will be discussing:

- The war in the Middle East, Israel/Iran

- The upcoming U.S. presidential election

- Interest rate cuts in the U.S. and China

- The looming port strike. (Update: as of publishing, was resolved until next year)

Portfolio Update

We sold Disney and Nutrien in September to reduce risk heading into the more volatile months of the year while also realizing tax losses for some clients.

Macroeconomic Issues

Geopolitics

Iran launched a major missile strike in early September on Israel. Thankfully, it appears the majority of the 200 ballistic missiles were shot down by the U.S. and Israel, leading to minimal damage. The markets briefly dropped mid-day until it was reported there were no deaths, which would indicate a more measured response from Israel, and less risk.

Financially we can expect less risk from a war between Israel and Iran. First, the U.S. and Canada today produce much more oil than during the Gulf War, so the impacts to oil here should be less severe than what was felt during previous conflicts. However, it would not be positive in the short-term for inflation. Also, Saudi Arabia has been restraining production to keep oil prices high, and recently said they would be increasing production as Iran and Russia have not been as restrained, which should help any disruptions.

Generally, we see major market effects from this conflict to be short-term in nature as the world adapts. Our largest concerns are longer term with how this could affect the dynamics between Russia, China, and the U.S.

Our longer-term hope for this situation is that the old guard in the Middle East is replaced and brings decades of peace and prosperity as the Saudis and Israelis hope to create a new tech and innovation hub in this area of the world by working together. This is what everything was on track for, as the Saudis had been signing agreements with Israel to change the financial landscape of the Middle East. This is what we believe Iran has been trying to prevent through their proxies and why they encouraged Hamas to attack Israel October 7th last year as a last desperate attempt to destabilize the region and hold onto what control remains.

Saudi Arabia, the largest country in the Middle East, has been selling off their $2 trillion oil business and is using the money to diversify into technology and renewable energy and transform the future of the region as the world becomes less and less oil reliant. This was the vision of the 39-year-old de facto leader of Saudi Arabia, Prince Mohammed bin Salman Al Saud, who came to power in 2017. This is a sharp contrast to the leader of Iran, 85-year-old Ayatollah Khamenei, where there is a major generational split in ideals.

We believe the future of this region could be very bright if the younger, more modern leaders can execute on their vision for a more productive future for the Middle East.

But, if a full-blown war broke out? How would we react as investors?

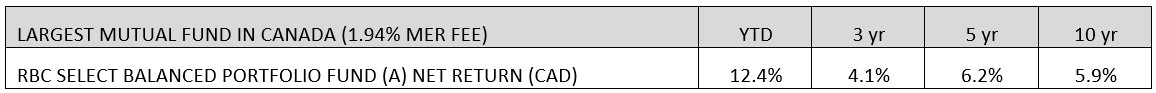

The quote “Buy at the firing of cannons” is a variation of the well-known investment adage “Buy on the cannons, sell on the trumpets,” which is attributed to London financier Lord Rothschild from the early 1800s. This phrase encapsulates a contrarian investment strategy that suggests buying stocks at the outbreak of war or major geopolitical conflicts and selling them when peace is restored.

The key principles of this logic:

- Market overreaction: Geopolitical tensions typically trigger sharp sell-offs, often driven by fear and uncertainty rather than fundamental economic changes.

- Historical resilience: Stock markets have shown a tendency to recover and continue their long-term upward trend following geopolitical shocks.

- Contrarian thinking: This strategy involves going against prevailing market sentiment, buying when most investors are selling because of fear.

Historical evidence of this logic:

- During the Second World War, the U.S. stock market initially dropped after the Pearl Harbor attack but rebounded strongly in subsequent years.

- The Cuban Missile Crisis caused a sharp market decline, followed by a quick recovery once tensions eased.

- The S&P 500 fell more than 4% immediately after Russia’s invasion of Ukraine in February 2022 but rebounded to higher levels within a month.

- More recently, in the spring of 2024, when Iran attacked Israel, the S&P corrected 5% on its way to 5,700. Buying the dip during the attack was rewarded.

U.S. Presidential Election

As expected, things are heating up south of the border. With the U.S. presidential election just around the corner, we can expect lots of headlines and drama this month leading up to November 5.

One item we’ve already spoken of is the tendency for people to say things leading up to an election that are never executed when in office. An example we gave was healthcare, and of course we are already starting to hear talk of limiting drug prices for Eli Lilly and Novo Nordisk, which is affecting those stocks. Our experience is that much of this pressure dissipates after elections.

Overall, the U.S. presidential election next month should not have a material impact on the businesses we own. Owning great businesses that continue to innovate is what mattered most over the last 20 years. Great businesses will do well despite government policies, not because of government policies.

Interest Rates

South of the border, the Federal Reserve has finally begun cutting interest rates. They reduced the benchmark interest rate by 0.5%, bringing it down to a range of 4.75% to 5%. This is the first move of many to come over the next few years. In Canada, of course, we’ve already made two quarter-point cuts, so we are now on the same path.

In Canada, inflation has fallen to 1.6%; in the U.S. it has fallen to 2.4%. With 2% being the U.S.’s target, inflation certainly appears to be under control.

Bond markets have been rallying the last few months. Last year we explained why we should invest in bonds and not leave money in bank GICs at 5%. What’s been the result? Our bond portfolio over the last 12 months has returned 9.5%, while being more tax efficient. A GIC would need to pay 12% interest to get the same after-tax return as most of the return in our bonds was capital gains.

Moving over to China, the Chinese government has announced a broad stimulus program to boost the Chinese economy. They are cutting reserve requirements for banks to release more liquidity into the economy. Additionally, China’s central bank has reduced interest rates to encourage borrowing and investment. They have announced increased infrastructure spending as well as more subsidies in targeted areas of their economy, such as real estate and electric vehicles.

This combined package should help lift the Chinese economy this year and assist in the global soft landing coming out of COVID-19 after the last few years. We think the effects of this should not be understated for Canada as it is helping give a boost to both our commodities and mining businesses, and our housing market.

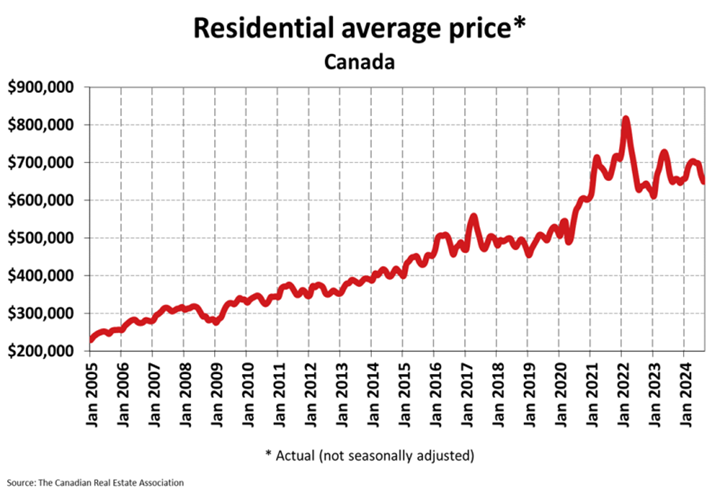

Canadian real estate has been slow moving the past two years, coming down from peak prices during the pandemic. Going forward we are starting to see an easing of downward pressures. While not the primary driver, Chinese buyers still have an effect, and the weak Chinese real estate market and economy certainly has not helped our housing market the last two years.

Source: https://creastats.crea.ca/en-CA/

More importantly, with interest rates now in decline the affordability of mortgages will begin to improve over the next 12 to 18 months.

Port Strike

In the U.S., most ports are shut down because of a union strike. This is hardly unexpected. Logistics managers, operating with foresight, would have anticipated such disruptions and adjusted their orders accordingly. Contrary to Wall Street’s consensus, many in this field operate with a forward-looking perspective. The Logistics Managers’ Index (LMI) indicates a preparedness that should render this strike a non-issue for those truly attuned to the intricacies of supply chain management. Of course, mainstream media will appear surprised.

The TV clips of this event are straight out of The Sopranos with union leader Harold Daggett saying, “I will cripple you, and you have no idea what that means,” It looks and sounds like a good, old-fashioned mob extortion scheme, except instead of protection money they want a 61.5% raise over six years and to stop all modernization and automation of ports.

In our opinion, that this is happening around the time of the election is not a coincidence, as the union likely sees this as their only window if the Republicans win the election next month.

In Canada, the government just forced the rail workers to collective bargaining when they tried to strike. In the U.S., President Joe Biden is the most pro-union president ever, so it may play out a little differently.

Notable Company News

ASML – The Dutch government has announced they will oversee licensing for all deep ultraviolet (DUV) immersion tools that ASML wishes to export. Formerly, this was limited to specific versions, and was overseen by the U.S. Essentially, for national security reasons, the company can no longer export anything without approval from the Dutch government. ASML is downplaying this, saying it will have no impact. We think it will have some impact, but it is necessary.

A reminder: The microchip as we know it today was developed with a lot of U.S. military funding, which is why the U.S. government still puts global controls on chip technology. They let ASML make the tools in Europe and TSMC prints the chips in Taiwan using the technology they developed as long as the U.S. can control who gets it. This move by the Dutch government is inserting them in the middle to make sure the U.S.’s wishes are followed—not just to the letter but also to their intent.

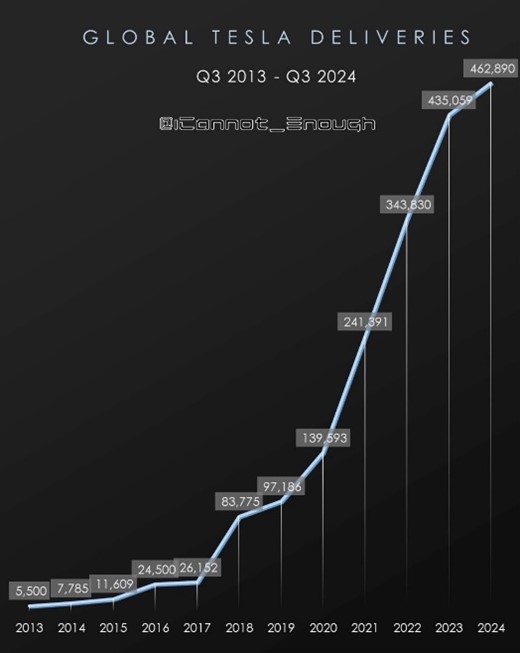

Tesla & Nvidia – Auto is one of many industries that will further enlarge NVIDIA’s ever-expanding addressable market.

We listened again to some highlights of the TSLA Q2 earnings call. Here are some key takeaways:

- Demand is very high for NVIDIA graphics processing unit (GPU) hardware.

- NVIDIA GPU hardware is often difficult to get.

- Elon Musk, the CEO of Tesla and SpaceX is quite concerned—there’s a sense of urgency.

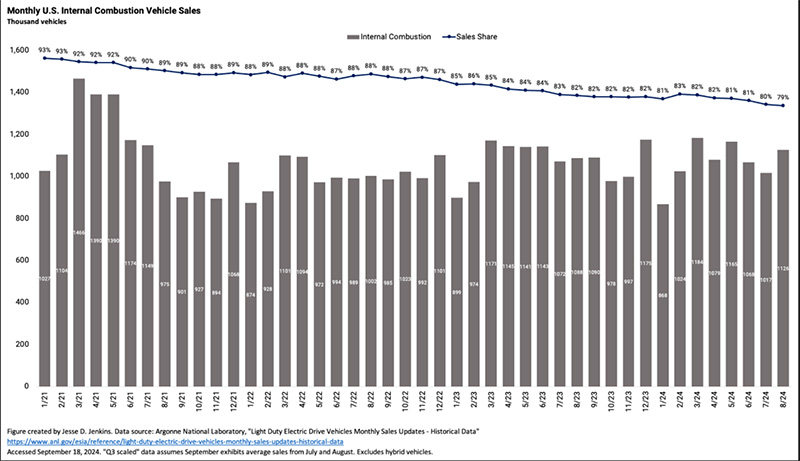

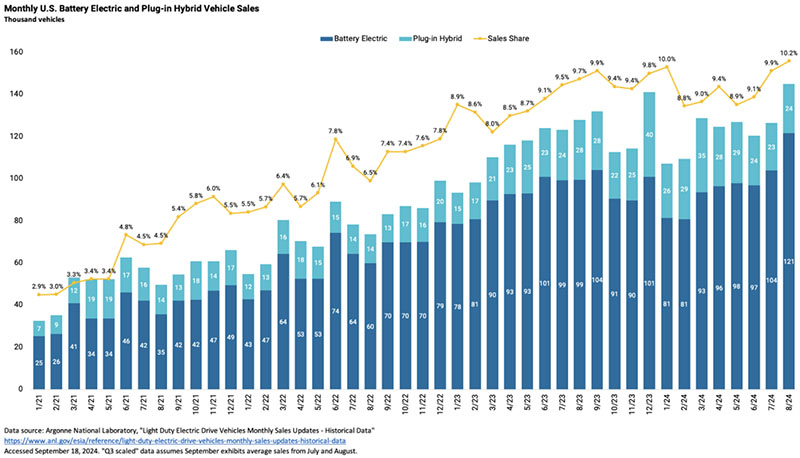

Source: https://x.com/JesseJenkins/status/1836524868877324417

Source: https://x.com/ICannot_Enough/status/1841465795068542996

A few weeks later, Larry Ellison, the co-founder of Oracle, and Musk had a dinner meeting with Jensen Huang, the CEO of NVIDIA, at Nobu in Palo Alto. This gathering was not just a casual dinner among tech moguls but had a pointed agenda: Ellison and Musk were there to plead for more GPUs from NVIDIA, which are crucial for advancing AI technologies.

What was discussed: According to Ellison, the meeting could be described as them “begging” Huang for more GPUs. This desperate need comes from the strategic importance of AI in NVIDIA’s business and research plans. Ellison mentioned during an analyst meeting that Oracle is planning to build what could become the world’s most powerful AI supercluster, powered by 131,072 NVIDIA Blackwell GPUs.

This scenario not only spotlights NVIDIA’s pivotal role in AI hardware but also reflects the broader tech industry’s race towards AI supremacy, where computational power is the new battleground.

We are in the early stages of an AI arms race and if you don’t have the compute, you can’t win.

Rumour has it that by the end of the dinner, Jensen agreed to prioritize NVIDIA GPU chips to Musk and Ellison over the competition.

Economy and Market Outlook

September was volatile and we expect October to be no different as we head into the U.S. presidential election. Historically the market is down roughly 1% in October during election years, so let’s just expect it and if it happens, we won’t be surprised. Mainstream media will find a way to put a spin on it, but the reality is that it usually happens for no particular reason.

We are still bullish leading into the end of year and next year as well. We are already looking into 2026 and anticipate some kind of market correction by then.

Longer term, we expect the markets to do quite well into the next decade as AI spending and innovation should drive much of the growth.

~~~

We’d like to wish everyone a Happy Thanksgiving with your families. We find it very easy to find things to be grateful for. We too often lose track of just how lucky we are, but we feel truly fortunate. We would also like to take this opportunity to thank everyone for their continued trust and confidence in our group.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045