Overview

- Office Update

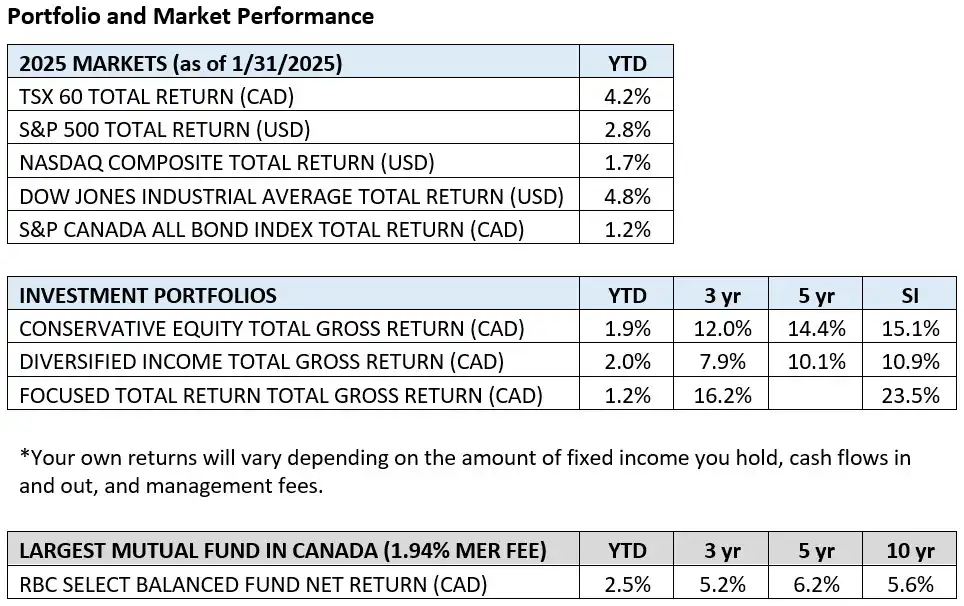

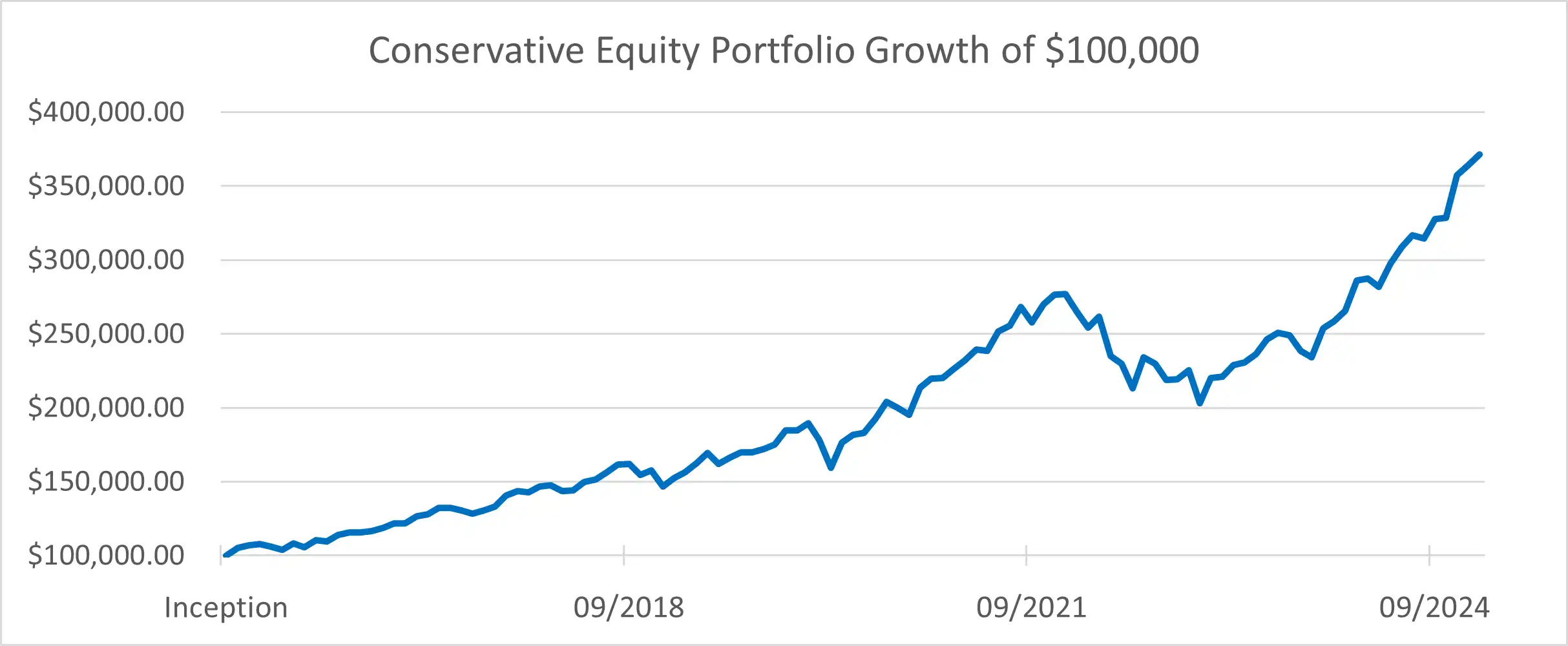

- Portfolio and Market Performance

- Portfolio Update

- Media Narrative

- Rapid-Fire Earnings

- Market Outlook

Office Update

We are starting to roll out access to our new client portal. Our goal is to get everyone on the new portal by the end of the month. Expect an email from us in the coming weeks with your access information. As many of you know, this is an initiative we’ve been personally involved in since joining Wellington-Altus, so we’re quite excited that it’s finally here.

Don’t forget that it’s RRSP season.

Please wait until March for your tax packages.

Portfolio Update

We sold out of TELUS and moved the proceeds into CN Rail and CP Rail. The phone companies have been having a tough time ever since the Liberals placed restrictions on the way they do business. We added to CNR and CP as we believe North America is entering a period of increased economic growth due to artificial intelligence (AI) advancements and onshoring business trends. We were able to do this at a very good price with shares being heavily discounted due to shorter term tariff concerns.

We also trimmed our exposure to Microsoft to add to NVIDIA. NVDA has traded down recently due to the DeepSeek narrative, when the reality is that all mega-cap growth companies are increasing their AI capex spend, not decreasing it. According to the most recent earnings call, Google, Microsoft, and Meta have all increased their budget for AI chips.

An interesting note about NVIDIA: NVIDIA’s fiscal numbers are very odd. They report what we would mostly say was their 2024 year as their 2025 fiscal year since their Q4 ends in January 2025 and the earnings are reported in February 2025. As a result, many people don’t calculate the company’s current price-to-earnings (PE) ratio properly. For example, based on street projections, earnings for the next 12 months are estimated at $6.14 per share, so the company is currently valued at 20 X earnings and 16 X next year’s earnings with a 40% long-term growth rate. This is not expensive.

Media Narrative

Over the past few weeks, a noticeable trend has emerged in media coverage of the DeepSeek situation, and the ongoing fentanyl and border crisis: both have sparked significant fear and extreme reactions. Upon receiving a few emails from concerned clients, it’s clear that anxiety is prevailing in the current climate. Our advice remains straightforward: We’re entering a new era where much of the mainstream media (MSM) has a distinct bias against incoming U.S. President Donald Trump, particularly evident in Canada with heightened levels fear and a deep loathing of the new American president. When it comes to your investments, it’s crucial to check biases and look beyond immediate reactions; focus on the long-term outlook instead of getting swept up in the daily news cycle and emotions.

Both the DeepSeek narrative and the fentanyl/border issue were allowed to escalate over the weekend, leading to extreme conclusions. In the case of DeepSeek, some argued it signified the end of AI, while the fentanyl/border crisis was misconstrued as a trade war. The media played a significant role in amplifying these situations, fostering unnecessary fear in the markets. The lack of objective reporting, particularly from some of Canada’s primary broadcast outlets, alongside the political maneuvering from Trudeau and Trump, serves as a stark reminder of the importance of rational decision-making in a fast-paced world. Incorrect assumptions can lead to misguided portfolio decisions.

As we’ve all heard, the U.S. had threatened to impose 25% tariffs on all Canadian goods and 10% on energy. We are not certain if Canada has been fumbling this ball through incompetence, negligence, or if it’s been willful mismanagement. The U.S. president, after running a campaign promising to close the borders and stop the flow of fentanyl into his country, asked the countries on each border to help him on the issue that he had been elected on. While the CBC had reported that Canada responded to the U.S.’s border and drug complaints with a package, it appears they in fact did nothing.

Everything that had been reported by the news in Canada had already been part of the fall budget. The $1.3 billion spending on the border and on the drones and helicopters they were purchasing was all just part of normal spending and was not a response at all to our neighbours’ complaints. Unfortunately, the Americans aren’t that dumb and realized the Canadians actually came back to them with nothing and went ahead with a tariff threat.

Now, what we can’t tell is if the Liberals did this purposefully so they could point the finger at Trump for what is an extremely weak dollar and economy that existed before Trump came into office. It’s a lot of political theatre in our eyes with no substance. We certainly hope that in the upcoming elections, people see through the theatre because as a country we need to do better.

What was not talked about in the media? The newly formed U.S. Department of Government Efficiency (DOGE).

The MSM would have us think that what DOGE is doing is wrong or bad, but they were hired by the American people to reduce government spending—something we desperately need up here in Canada.

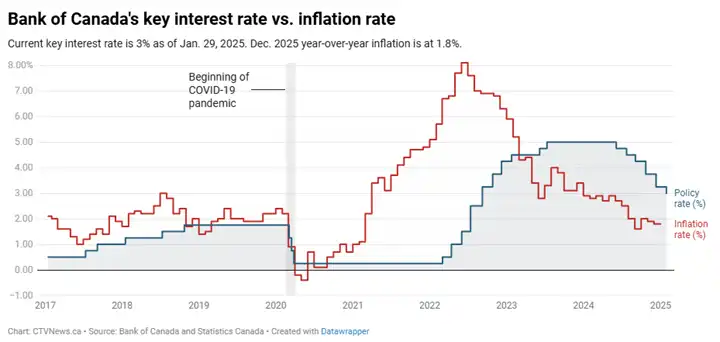

The reality is there is a double benefit for all Americans if they were to bring down government spending.

1) It would bring down inflation so that the cost of food and other goods would be more stable.

2) It would lower interest rates, which would lower the cost of mortgages, car payments, and credit card debt.

These are all good things, in our opinion.

So far, this probe into corruption and fraud has been yielding shocking results. It seems to be on track to cut US$1 trillion out of the U.S. federal budget per year, having already saved around $60 billion over the last 2 weeks. The publicly reported findings are a bit insane. Unsurprisingly, many of the politicians complaining the loudest are actually tied to having received payments. Most major news outlets that were more Democrat received massive funds under the Biden administration; for example, the New York Times received around $50 million of federal money, and the second largest donor to the BBC International was USAID. We looked at a receipt just this morning … USAID paid $550,000 to Politico for a subscription for 37 people. We must be seriously underpaying for our media subscriptions. In reviewing government receipts ourselves, it certainly looks like USAID has been running one of the world’s largest illegal money laundering operations for decades. We all knew there was corruption in government but at least some of it is now seeing the light of day.

We can expect things to continue to heat up as more corruption, theft, and fraud are found as this audit expands to larger government departments.

Rapid-Fire Earnings

Tesla: Had a weak quarter but the stock rose on the news that they would be launching their Robotaxi service in the summer in Texas. No longer solely trading on car business, Tesla is now trading on AI, autonomous driving software, and robotics developments. The Optimus robots production line will be completed in a few months, with the objective of scaling production faster than anything in human history.

Microsoft: Took a hit down 5% on their earnings announcement, while they beat both revenue and earnings expectations. Their cloud business grew slightly less than hoped. They had previously confirmed spending $80 billion for AI infrastructure in 2025.

Apple: Suffering from lower sales of iPhones in China, but their services division, which we’ve been talking about for a couple of years, showed 14% growth year over year. They need to get their act together on AI, where they are behind.

CP Rail: Recently reported their earnings: net income was up 18% from last year. What grabbed headlines, though, was that they saw a big long-term opportunity from nearshoring in the U.S. under Trump. North American trade is growing, not shrinking.

Visa: Beat revenue and earnings, showing a reasonably strong retail consumer with 9% volume growth. Interestingly, what they call “cross border” volume was up 16% from last year, so Americans are travelling.

Google: Traded down 7% on earnings numbers mostly as expected – slightly lighter cloud growth, and less work on cost controls, with margins not where people want to see them. People were expecting a surprise. They announced spending US$75 billion in capex in 2025. They also just launched a new AI assistant.

Advanced Micro Devices: reported recently and shares were trading down 9% the next morning. Again, we remain frustrated on what appears to be a lack of understanding of the market as well as awful reporting by the media. What is reported as “declining data center sales” going forward by CNBC is in fact 94% growth over the last year and a 47% growth rate for 2025. It’s trading at 16 X this year’s earnings and 12 X next year’s earnings with a 50% growth rate.

UPS: While we don’t own UPS, this one grabbed some headlines and went down 14% when they reported earnings. The big item was that their largest customer, Amazon, would be slashing deliveries by 50%. Amazon has become the largest shipper in North America, with UPS losing more and more business. Canada Post was set to run out of money around the middle of this year. Shipping and deliveries could see some major changes over the next 5 years. With Tesla about to launch their Robotaxi, which will not only disrupt taxi and Uber services, it would have the potential to disrupt the last mile delivery operators. For example, a Tesla owner might want to lease out their car at night to a company like Amazon, who would use the autonomous vehicles to make deliveries at night when there is little traffic. Cheap and effective humanoid robots could make the last meter delivery once the car arrives. We see this as a strong possibility within just a few years.

Economy and Market Outlook

The Canadian dollar hit 67 cents at one point last week but now trades around 70 cents. Our outlook is that the longer the Liberals stay in power, the lower our dollar will go. We’ll keep our higher taxes, large deficits, and a labour market that has not increased its productivity in 10 years. Capital cannot be influenced by our government or the media and is leaving the country. It’s that simple.

Our investment outlook, on the other hand, is quite optimistic. We are in the early stages of a bull market, similar to the mid-’90s, most of which will be driven by deregulation and AI. Expect there to be pullbacks every year. They are healthy and normal. We should use them to increase our exposure to quality companies. Own quality, think long term, and ignore the noise. The mainstream media only lives on if we let them influence our emotions.

~~~

Have a great February, everyone!

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045