EXECUTIVE SUMMARY – WELLINGTON-ALTUS PRIVATE WEALTH INC.

APRIL 2025 MARKET UPDATE

Overview

- Office Update

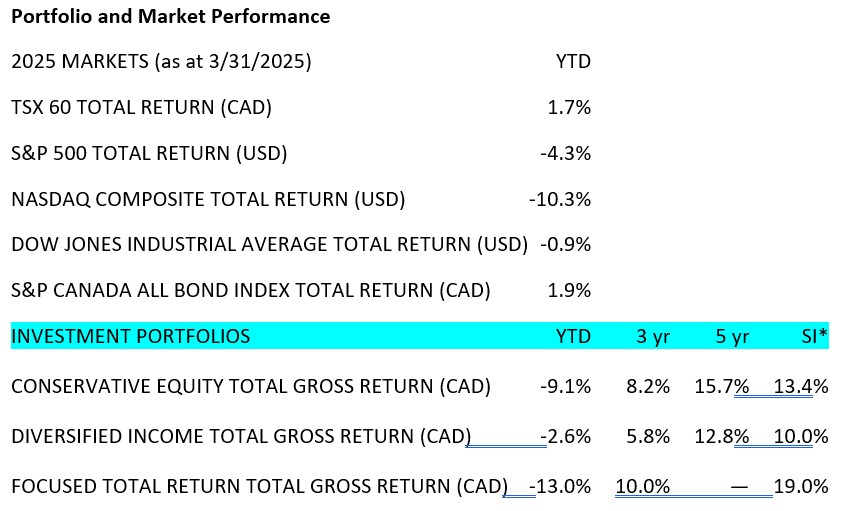

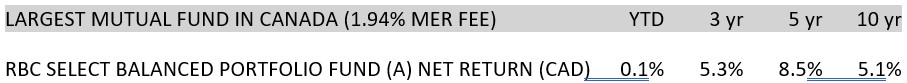

- Portfolio and Market Performance

- Portfolio Update

- S. Economics

- Globalization and Trade

- The Canadian Election

- Interest Rates

- Market Outlook

Office Update

It’s tax season and your tax documents for your investments with us should be available. Most, if not all, were mailed out by our team, but if you are missing anything please reach out to us and we will assist.

The new client portal is up and running. If you haven’t had a chance to check it out, we suggest you do. We’re quite happy with the results and the portal will continue to improve through the year.

Conservative Equity Portfolio inception October 2015; Diversified Income Portfolio inception July 2017; Focused Total Return Portfolio inception April 2020.

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

We sold out of UnitedHealth (UNH) and used the proceeds to buy a position in JPMorgan (JPM).

UNH is the largest health benefits manager in the U.S. This system has been slated for major cost cutting and reforms under the new Secretary of Health and Human Services Robert F. Kennedy Jr. We have been worried that UNH may be a target for a highly public “win” as it along with all health insurance providers are widely unpopular in the public eye. An example of this was seen last year when the CEO of UNH was assassinated in broad daylight, which caused a surprising reaction from some, citing their dislike of the company’s practices. With a sweeping review, we would like to stay on the sidelines as the industry is put under more scrutiny.

We’ve owned JPM for many years but sold our position in late 2022 as we were trying to reduce our U.S. bank exposure. Interest rates were going up fast and we were concerned about the possibility of a looming recession. Higher interest rates would cause loan losses to increase and more businesses and homeowners to default on payments. However, JPM’s purchase of First Republic assets of roughly $200 billion in 2023 was a brilliant move and the bank has profited significantly.

At the end of last year, JPM held about $624 billion in securities, had about $1.4 trillion in loans, and held about $2.4 trillion in deposits.

Today, we are buying the shares back as we see the efforts by the Trump administration to cut regulation to grow the economy, which we will discuss in more detail below.

Fun fact: Jamie Dimon became CEO of JPM in 2006. Under his leadership, shareholders of JPM have averaged an annual return of 18% per year. Jamie Dimon has that special touch we look for in CEOs and has delivered shareholder value for 20 years.

U.S. Economics

What is the U.S. government actually trying to achieve?

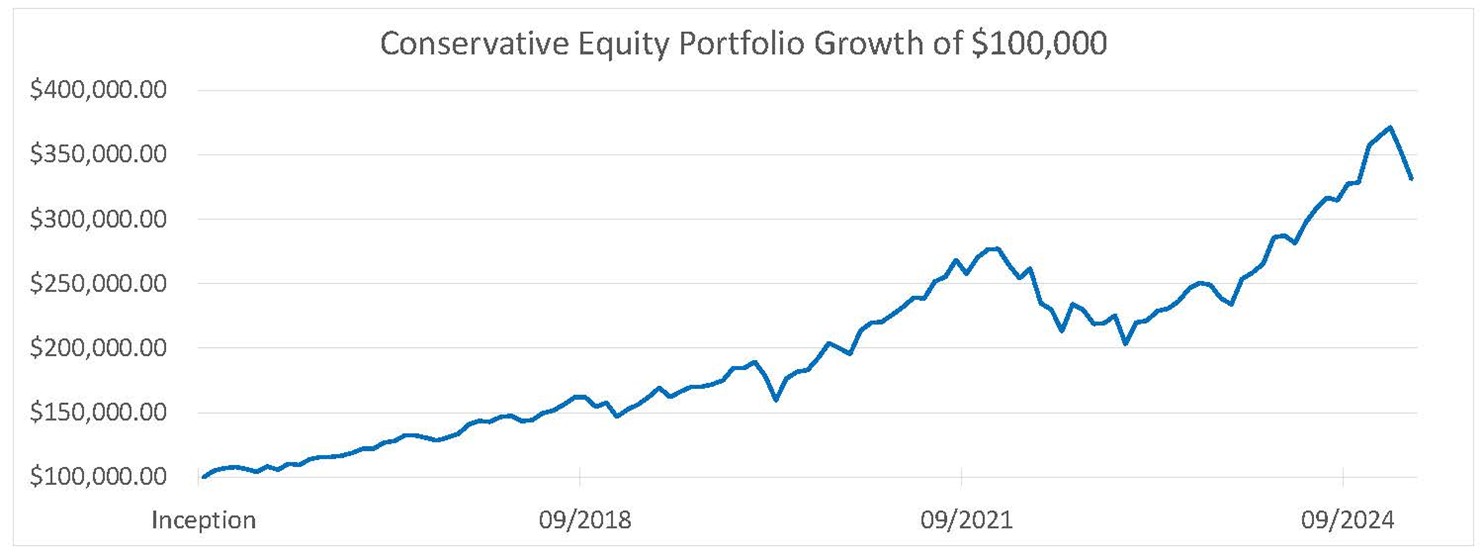

To better understand what’s going on in the U.S., we need to know some of the key players: the U.S. Secretary of the Treasury, the U.S. Secretary of Commerce, and the Department of Government Efficiency (DOGE).

Secretary of the Treasury Scott Bessent is a former partner of Soros Fund Management. George Soros is the billionaire investor who is said to have “broken” the Bank of England. Turns out, according to Bessent, it was he who had the idea and brought it to Soros in 1992.

Secretary of Commerce Howard Lutnick is chairman and CEO of Cantor Fitzgerald, which is a leading global financial services firm.

The Department of Government Efficiency includes Elon Musk and a half-dozen other very successful businesspeople, including the co-founder of Airbnb and the head of investment banking at Morgan Stanley.

In a recent interview with the All-In Podcast, Secretary Bessent outlined his 3-legged approach to fixing the U.S. deficit. To be clear, many people believe that eventually the U.S. must get the deficit under control, or it will be forced to with potentially undesirable consequences.

Here is the plan to grow the economy significantly while reducing the deficit:

- Try to bring down the massive federal debt. First, cut waste, fraud, and abuse. Then try to make the government more efficient to get spending down in a controlled way over time, without causing a recession, which would bring down interest rates, and lower inflation. This would be positive for the lower and middle classes.

- Deregulate the private sector. This, combined with lower interest rates, would be a massive stimulus to the private sector, which would increase growth and hiring.

- Deleverage the government and shrink its workforce, while leveraging up the private sector and growing its workforce. This would create a boom for America.

High-level objectives:

- Cut government spending on fraud, waste, and abuse with a goal to save US$1 trillion.

- Find ways to increase government revenue by US$1 trillion.

- Once the budget is balanced, look to reduce the government debt.

The potential benefits to Americans include lower taxes—the U.S. government could eliminate income tax on everyone earning below $150k per year. They could increase the social security benefits to seniors without increasing the age to qualify. With lower interest costs and inflation, workers would keep more of what they make and could save more.

Globalization and Trade

In 1985, the average labour cost in China was around US$0.16 per hour, while in the U.S. it was around US$12 per hour, so it was about 75 times more expensive to operate a business in the U.S. Today the average cost of labour in China is around $5 per hour, while the cost of labour in the U.S. is around US$32 per hour. Now the U.S. is six times more expensive.

The average annual income of a Chinese family in 1985 was about $600, while today it is around $15,000. With much of the Chinese population lifted out of poverty, the social benefits of globalization are diminished going forward, while the labour cost benefits from this point onward are incremental.

In order to have an economic advantage to onshoring businesses you need to solve the following:

- Keep taxation low – Most companies, before moving to a location, will not only look at the tax rate but will also look at the state and federal debt levels and deficits as these are an indicator of future taxation. The U.S. is currently working on this and has promised a reduced corporate tax rate for those that build in the U.S.

- Reduce labour input costs – Promote and develop a lead in robotics and artificial intelligence. The U.S. is the leader.

- Make energy abundant and cheap – The U.S. is working on deregulation and fast-tracking of electricity projects, as well as oil and gas projects.

- Secure an adequate supply of cheap materials – The U.S. is looking to Greenland, Canada, and the Ukraine for rare minerals deals, and putting import restrictions on steel and aluminum to onshore smelting and production.

- Reduce transportation costs – Automatically reduce transportation costs by onshoring.

If all of these points are addressed, capital will naturally flow to your country. Tariffs, which can tip the scales initially, cannot solve these issues in the long term. We think that Scott Bessent and Howard Lutnick understand this and will rely more heavily on these forces to drive trade than on tariffs.

The Canadian Election

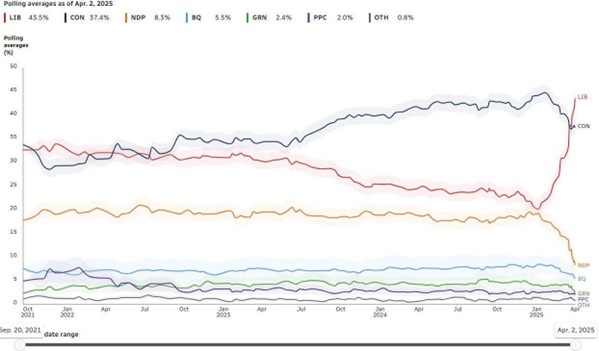

Canadians will be going to the polls to elect a new federal leader on April 28, as we had expected. The Liberal party, under Prime Minister Mark Carney, has had continued positive momentum with betting markets now putting them in the lead with a 66% chance to win (the CBC Poll tracker now giving them a 93% chance to win, and betting markets through Polymarket giving them a 66% chance to win).

With one week remaining, it is a tight race but remember that often a fresh candidate gets an initial bump. The question now is if Carney will be able to hold onto the current lead as we head to the finish line.

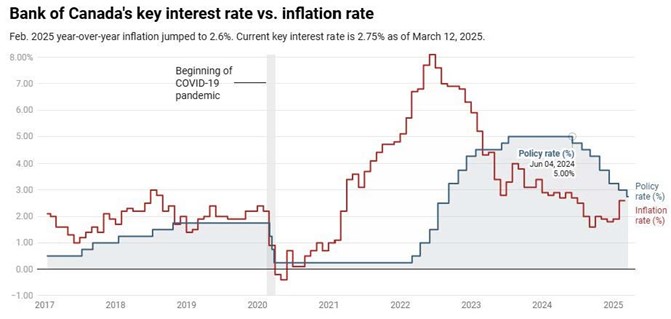

Interest Rates

We believe that rates will continue to come down in Canada and the U.S. Currently, you can find a 5-year fixed mortgage in the 3.75% area, and we suspect that will be sub-3% by the end of the year.

Market Outlook

Despite the noise by the news media, we believe the markets will do quite well into the end of the decade. In the short term, the Wall Street experts we follow have a 7,000 target on the S&P 500 by year-end. It’s currently at 5,600 so that’s a 25% upside from here. Longer term, we still see the S&P 500 over 15,000 before the end of the decade.

~~~

We wish you all a great start to spring.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045