Overview

- Office Update

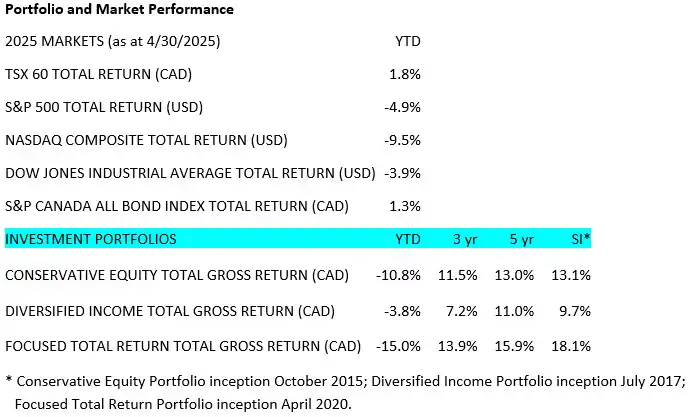

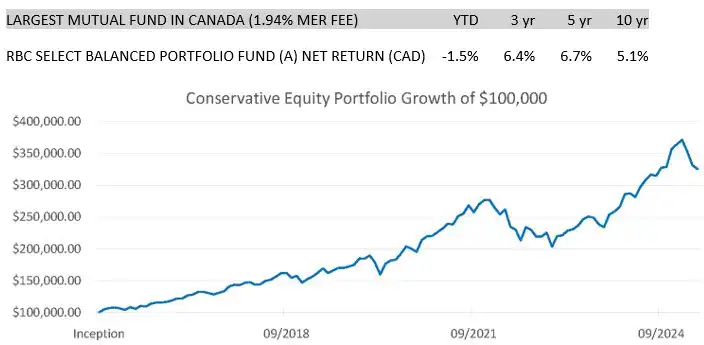

- Portfolio and Market Performance

- Portfolio Update

- Rapid-Fire Earnings

- The Canadian Election

- Market Outlook

Office Update

Tax season is wrapping up. It’s our busiest season, but our team did a great job! We believe this is one of our strong suits: being able to help our clients with tax prep. We’ve got a great team.

Shout out to Mary, Debbie, Alison, Ivan, and Francesco. Thank you, guys, for the great work!

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

There were no changes to our portfolio in April; however, this is not to say we were not extremely busy with all the market activity this past month. We examined 5 companies very closely but ultimately decided not to add them to our portfolio as we felt the companies we already held were better from a risk/reward standpoint. We did not make major allocation adjustments as we were very happy with where we have allocated capital.

April was a very volatile month, with markets moving down 15% after “Liberation Day” tariffs before recovering by the end of the month. We haven’t seen this sort of volatility since the pandemic’s 35% 1-month pullback.

This is a reminder of what we had said previously: you have to look through the volatility.

As Buffett and Munger have said, the stock market is a device for transferring money from impatient investors to the patient.

Munger complemented this with his emphasis on patience and discipline, noting that the big money is made not by buying or selling, but by waiting.

So, we wait!

Much of the volatility we’re seeing is a result of the trade war, or should we say, the uncertainty around tariffs is causing market anxiety. April markets went down by 15% at one point but finished the month down only 2%. Market top or all-time high to bottom last month was 21%, but have recovered to only 7% off their all-time high.

What’s the concern? It’s that the longer this goes on, the more likely we have a supply chain shock similar to 2021. Manufacturers and distributors have stuffed their channels with inventory ahead of April 2, but those inventories won’t last forever. Some are storing goods in special warehouses before clearing customs, hoping the tariffs come down. The elephant in the room is China, but fortunately the U.S. and China have scheduled trade talks in Switzerland; this aims to de-escalate the tariff standoff between the two countries.

Meanwhile, our newly elected prime minister, Mark Carney, just met with President Donald Trump at the White House to begin our negotiations. How did it go?

Well, that depends on who you ask.

We first watched the meeting highlights from a centre-right news feed, and the interpretation was that Carney came off weak or timid. Then we watched the entire meeting on YouTube unedited and without commentary. We also watched Carney’s press brief afterwards.

In our opinion, Mark Carney did an excellent job. He stayed calm and respectful. He made his point that Canada is not for sale, and complimented Trump on what he’s attempting to do for his country. He was very diplomatic and represented Canada well. Despite some of Trump’s remarks, he maintained his composure and let Trump be Trump. Trump, on the other hand, appeared less diplomatic, talking about his progress with China and Yemen while meeting with Canada. Towards the end he made some jabs at Chrystia Freeland. While I haven’t always supported Freeland, the comments felt unnecessary, especially in front of the media while hosting our prime minister.

For an initial meeting we felt it was a success. The good news is that Canada and the U.S. are at the table negotiating. We are looking forward to some sort of an agreement on trade so that business leaders can get clarity and make adjustments as needed.

We’re not going to speculate as to how this might unfold, but we will say with some degree of certainty that it will eventually be settled.

Q1 Earnings Highlights – A Rapid-Fire Look:

Microsoft – Reported a record quarter with Microsoft Cloud revenue reaching $24 billion, up 20% year-over-year, driven by robust demand for Azure and artificial intelligence (AI) services. Their earnings drove the entire market higher. They said demand for AI is growing faster than they had expected and they are capacity constrained beyond June. This means even more spending and more growth than people had thought when it came to AI, and the fears that the AI build was overdone are dead.

Amazon – Beat revenue and earnings expectations; however, shares didn’t do that well, as investors fear the tariff impact on their retail sales. Secondly, Amazon Web Services (AWS) is the leader in cloud services and people are nervous they are losing ground to Microsoft. As a reminder, AWS represented almost 2/3 of their operating income on the quarter, growing at 22% over the same quarter last year. Total quarterly EBITDA was $38 billion, and we estimate that half comes from AWS. This year Amazon should do $150 billion in EBITDA. Assuming the AI market is $2 trillion by 2032 and Amazon takes 30%, our 2032 future EBITDA projection: $500 billion annually. While tariffs are causing significant disruption to purchasing habits right now, Amazon has traditionally been the best logistics operator in the world and we trust their ability to adapt.

Google – On their earnings the stock did very well; ad business was more resilient than people had been expecting and there have been noticeable improvements in AI which are now being integrated into their search engine. The quality of their AI, called Gemini, has also improved greatly. Still, they are not the leader. At a hearing by the Department of Justice looking into Google’s monopoly, an Apple executive drove the stock down almost 9%, confirming what we had already been worried about: that for the first time, Google search volumes in Apple’s Safari browser fell in April, giving the opinion that AI search providers will eventually replace search engines like Google.

Apple – While earnings and revenue beat expectations, there were 2 points that drove shares down: first, the ever-important services division that provides so much profit missed expectations; and second, they didn’t provide any forward guidance saying they didn’t know what would happen with tariffs. We still see Apple as weak on AI execution, which we think will be key to the future of their services’s business.

Berkshire Hathaway – Berkshire’s annual meeting was last weekend, often called the Woodstock of value investors. The big headline is that Warren Buffett is stepping down after 60 years as CEO, and shares understandably sank on the news. Their cash holding is now almost $350 billion and it looks like they paused selling stocks. When asked why, he said that Berkshire was an opportunistic investor, and he is okay sitting on cash until something happens that could cause prices to be very cheap. Even though he said it’s highly unlikely that day will be tomorrow, he thought there is a chance over the next 5 years and they are okay waiting. Munger in the past had advocated for a concentrated portfolio of 3-5 high-quality businesses, where rigorous research and conviction justify significant capital allocation. He believes this approach maximizes returns while managing risk through deep understanding rather than spreading bets.

Visa – Earnings beat expectations as always, with growth at a consistent 10%. The major item here is they showed a strong consumer in the U.S. Their travel segment was down slightly, mirroring the reduced travel to the U.S., but strong U.S. domestic spending more than offset.

Eli Lilly – Showed 45% year-over-year revenue growth but is under pressure. CVS is recommending a competitor’s product, but their product showed better results than competitors’. Tariffs are coming to drugs soon, but they have been spending $50 billion on U.S. manufacturing since 2020 so they will likely be most resilient on this.

Tesla – As we had been expecting, Tesla reported the worst numbers we’ve seen in terms of quarterly revenue and earnings in some time. Shutting down Model Y production lines for 6 weeks to retool for new model Y is the biggest reason, as it represents about 2/3 of Tesla’s production. Their focus remains on launching a fully autonomous taxi service in June, and they’re still on track on version 3 of their humanoid robot and starting mass production at the end of the year. Shares traded up despite bad numbers, with the market increasingly focused on autonomous driving technology and the robotics side. The general belief is that political heat will decrease going forward.

Canadian National and Canadian Pacific – Both rails reported better-than-expected numbers. The key highlight, though, is a pull-forward of shipments before tariffs hit, making their numbers look good. CN talked about a coming “air bubble” in shipping channels. There was also a note about increasing metallurgical coal shipments, which could point to a coming surge in industrial activity. We suspect that connects to the $8 trillion announced investment in the U.S. to build production. Metallurgical coal is needed to make steel, while thermal coal is used for power generation.

Fortis – Reported strong numbers and shares are up, reminding us that regulated power utilities have become a growth area. We are no longer in an energy transition – we are just in an energy expansion. Looking back, we realize Fortis, which is a very conservative business, has returned an average of 9% per year for the last 10 years compounded while having very little risk. In our minds this is why we would rather own this than bonds. The stock is up 15% year-to-date as the markets have pulled back due to its defensive nature.

The Canadian Election

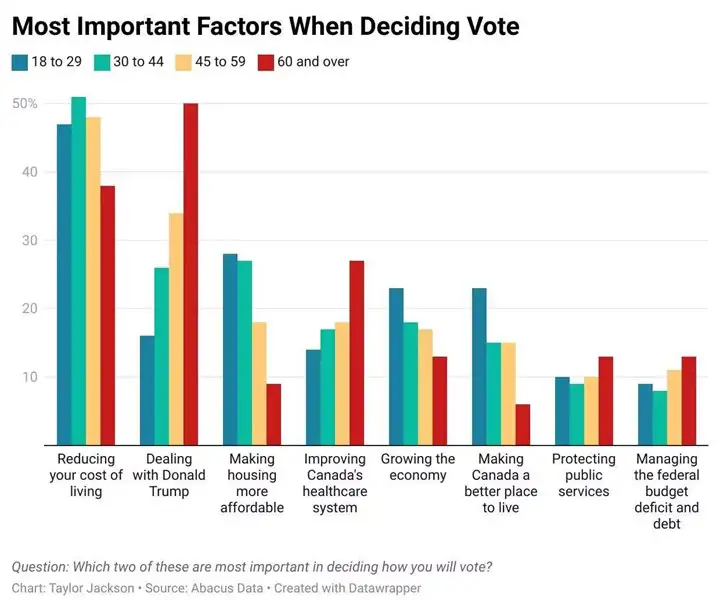

I think we realized during this election that we are truly in the minority when it comes to our priorities during elections. We spend so much of our days reviewing the financial health of companies that we can’t help but worry about the financial health of economies during elections. The voting public has a very wide variety of issues that matter most to them, often being very personal in nature. Our view tends to be less personal and more broad.

Interestingly, while managing the federal budget deficit and debt was a major issue for us, for 90% of Canadians it was not a core issue in this election. According to data from Abacus, younger Canadians were most concerned with the cost of living and making housing more affordable, while older Canadians were most concerned with Donald Trump.

There is also a clear flip developing as younger Canadians voted overwhelmingly Conservative while older Canadians voted overwhelmingly Liberal. In decades past this was not the case.

As longer-term investors, we also tend to take a longer-term lens when it comes to politics, looking through party terms.

Economic Policy

In terms of tax policy, the major effects will be a 1% decrease in the lowest tax bracket along with a return to the 50% capital gains tax rate.

For further policy, much of the talk has been towards social supports if the economy weakens, which bodes well to support the Canadian market should things turn south. We will have to wait for the broader strokes in terms of specifics for when Carney tables his first budget.

Housing Policy

Government involvement in housing has a long track record, from the post-war housing councils in Britain to rebuild.

In Sweden from 1965 to 1974, the Social Democratic Party embarked on “The Million Homes Programme,” which successfully built 1 million new homes.

On the negative side, government-led housing has often suffered from being too ambitious and led to ghost cities with empty housing that no one wanted to live in.

Hopefully the Canadian initiative will be successful, but it certainly comes with dangers.

Currency

The U.S. dollar has been weakening, but we believe strength will come back once certainty is given to trade.

Market Outlook

Right now, financial markets are being driven more by global trade policies than any other force. We just had a great set of earnings from all companies and the economy remains strong. We are in a very fluid state and the market hates uncertainty; however, it is starting to get used to it. There is a building consensus that we are in the middle of a negotiation and the situation is improving.

The market feels like it’s looking for any reason to go up; it bounces on every rumour of trade talks or trade deals.

The natural tendency for the market is to go up over time, the same as water flows down a river. We do not see this changing in our lifetime. We will have corrections and pullbacks along the way, but over time its natural state of movement is up.

~~~

Wishing everyone a pleasant Summer.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045