Overview

- Team Update

- Portfolio and Market Performance

- Portfolio Update

- Market Commentary

- Global Outlook

Team Update

Last month we moved to our newly renovated offices, and we think they look great! We’re still waiting for some furniture, but once it all arrives, we’ll be hosting a welcome party for our clients.

We are beginning to work on a list of clients who should open First Home Savings Accounts (FHSAs) and plan to have the accounts open before year-end. As a reminder, there is an annual investment limit in FHSAs of $8,000 per year, to a maximum of $40,000 over 5 years.

FHSAs are available only to people between the ages of 18 and 71 that have not lived in a home they own in the current year or in the previous 4 calendar years. They are tax-sheltered investment accounts that carry a tax deduction for contributions, so we recommend them to anyone who has not lived in a property they own in the last 4 years.

Market Performance

Year-to-Date Performance as of August 31, 2023

- TSX 60 Total Return, C$: 6.4%

- S&P 500 Total Return, US$: 18.7%

- S&P Canada All Bond Index Total Return, C$: 1.2%

Doing a traditional 60/40 portfolio with the three indexes, on average you would end up with 8% year-to-date, 4.8% over 3 years, and 6% over 5 years.

For context, Canada’s largest mutual fund is the RBC Select Balanced Portfolio, at about $50 billion in assets and a fee of about 2%. Its year-to-date return is 6.0%, 2.7% over 3 years, and 3.8% over 5 years.

It’s interesting to note, if you back out the 2% fee, the average return of the RBC Select Balanced Portfolio is very close to our benchmark.

Portfolio performance [i]

The Conservative Equity Portfolio returned 22.6% year-to-date, 6.9% over 3 years, 9.0% over 5 years, and 12.2% since inception (October 2015).

The Diversified Income Portfolio, which is our balanced portfolio used for many of our clients’ registered accounts, returned 5.3% year-to-date, 6.9% over 3 years, 7.8% over 5 years, and 8.6% since inception (July 2017).

The Focused Total Return Portfolio returned 36.8% year-to-date, 10.5% over 3 years, and 19.3% since inception (April 2020).

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

In the Focused Total Return Portfolio, we sold 3% of our Nvidia position and purchased Advanced Micro Devices (AMD) with the proceeds.

Nvidia is up over 240% since we purchased it around 2 years ago. It’s gone from 5% to 13% of the portfolio. As 10% is our limit, it was necessary to trim. By investing in AMD, we kept with the artificial intelligence and chip theme. We hold AMD in other portfolios and have discussed this holding at length in the past. We believe we are in the early stages of an AI-driven advanced microchip boom.

Thesis: There is disruption taking place in the energy space, and the cost of renewable energy is going down. Today the cost to generate power from solar or wind is lower than coal, natural gas, or oil.

Energy demand is increasing, from home connected devices, to Cloud computing to EVs. Most of us will use more energy, not less, in the future.

Our entire grid is in the process of being modernized – from how we capture and store energy, to how it is distributed.

Let’s look at how we’ve done things for the past 100 years. The old way, which has not changed significantly over time, is to search, locate, and then extract fossil fuel, which is either coal, oil, or natural gas. We then transport it via pipeline, trucks, rail or boat. Then it needs to be processed before it is burned, which releases energy that we then capture and convert into electricity. Most fossil fuel plants are between 30-40% efficient, which means 60-70% of the energy is lost in the process.

We also, until recently, have had no way to stabilize the grid. Power plants keep running 24/7 just to satisfy peak demand. There was no way to store the excess power, and no option to turn on and off the power plants. To take it a step further, during peak seasons like summer in California, they would need to fire up what they call “peaker plants” for a month or so when the demand on the grid was too much during heat waves.

In short, we find the deposits, extract and refine the fossil fuel, transport it, and burn it, and then most of the energy is lost before we consume the electricity.

Now thanks to innovation and decreasing costs, we can capture the energy on our planet at a low cost, whether that be the energy from the displacement of water, sun, or wind. All these methods are more efficient and now more cost effective. We also have the ability to store the excess energy in batteries for later use, such as during peak hours. All of this is made possible through advancements in technology and cost efficiencies.

Today it is cheaper to build and operate a solar or wind farm than it would be to operate a gas-powered peaker plant, so governments are mothballing fossil fuel plants and transitioning to renewables.

It’s a huge transition and it will take time. Many governments are looking to make the transition over the next 20-30 years.

Some of the investment themes we are looking at are:

- Generation: wind, solar, hydro

- Transportation: utility and grid modernization, smart grids.

- Storage: battery mega packs

- Distribution channels: smart homes, virtual power plants, and EV charging networks

In the energy space, we already own shares of:

- Fortis, which is Canada’s largest publicly traded utility company.

- Brookfield Renewable’s US operation alone owns and operates 229 hydroelectric generation facilities, 125 wind farms, and 4,000 MW of solar farms.

- Tesla, which is the largest industrial energy storage system supplier in the world. Tesla also has the most reliable EV charging network in the world, and through its acquisition of SolarCity is now in the business of large-scale solar panel technology.

Northland Power Corporation: We initiated a small position in all of our portfolios over the last month.

NPI: As governments focus on decarbonization and energy independence – getting off foreign oil and gas – there is tremendous demand for localized, clean renewable energy.

This energy company, diversified by geography and business, is in Canada, the Netherlands, and Germany, and is in the process of expanding into Poland, Taiwan, Japan, and Korea, providing onshore and offshore wind, solar, storage, and distribution.

They are currently in the process of building the largest energy storage facility in Canada in Ontario. See image below.

Company News:

On August 25, Elon Musk demonstrated Tesla’s new self-driving technology run almost entirely on neural networks. In our opinion, this was a watershed moment that for the first time demonstrated the immense capability of Tesla’s AI. This was the equivalent of Chatbot GPT but for real world AI instead of text. We believe this will have enormous ramifications as Tesla ramps up its computing capabilities. Most of the mainstream media and Wall Street analysts have yet to comprehend what took place on August 25, 2023.

Market Commentary

Through this summer, financial markets continued to be heavily driven by inflation, interest rates, and bond yields.

While this has caused some moves up and back down in investment values, the reasoning behind these moves is not always apparent.

Over the last two months we saw longer-term lending rates rise, but the reason behind this rise was actually quite healthy.

Bonds and Inflation

It appears that all those people who got on the television last year talking about an impending economic crash caused by rising interest rates have had to change their tune, as our economy has remained healthy while inflation has been coming down.

The longer-term interest rates have been lower because there was an expectation that an economic crash would force central banks to drop rates back down to zero to avoid disaster after crushing the economy. What we’ve seen is that the economy was not crushed, and people now believe that the central bank will not need to drop rates back towards zero to stimulate the economy out of a deep recession.

This is essentially good news and in line with our view that central banks were competent and would be able to lower inflation without overshooting and causing a deep recession.

This does, however, dampen stock valuations a little bit as the cost of capital is higher.

On the interest rate front, the Bank of Canada held overnight rates at 5% in the first week of September as most people expected.

All the inflation numbers we are looking at continue to trend downward – employment data, Consumer Price Index, commodity prices, shipping volumes, and costs. Everything seems to be moving in the right direction.

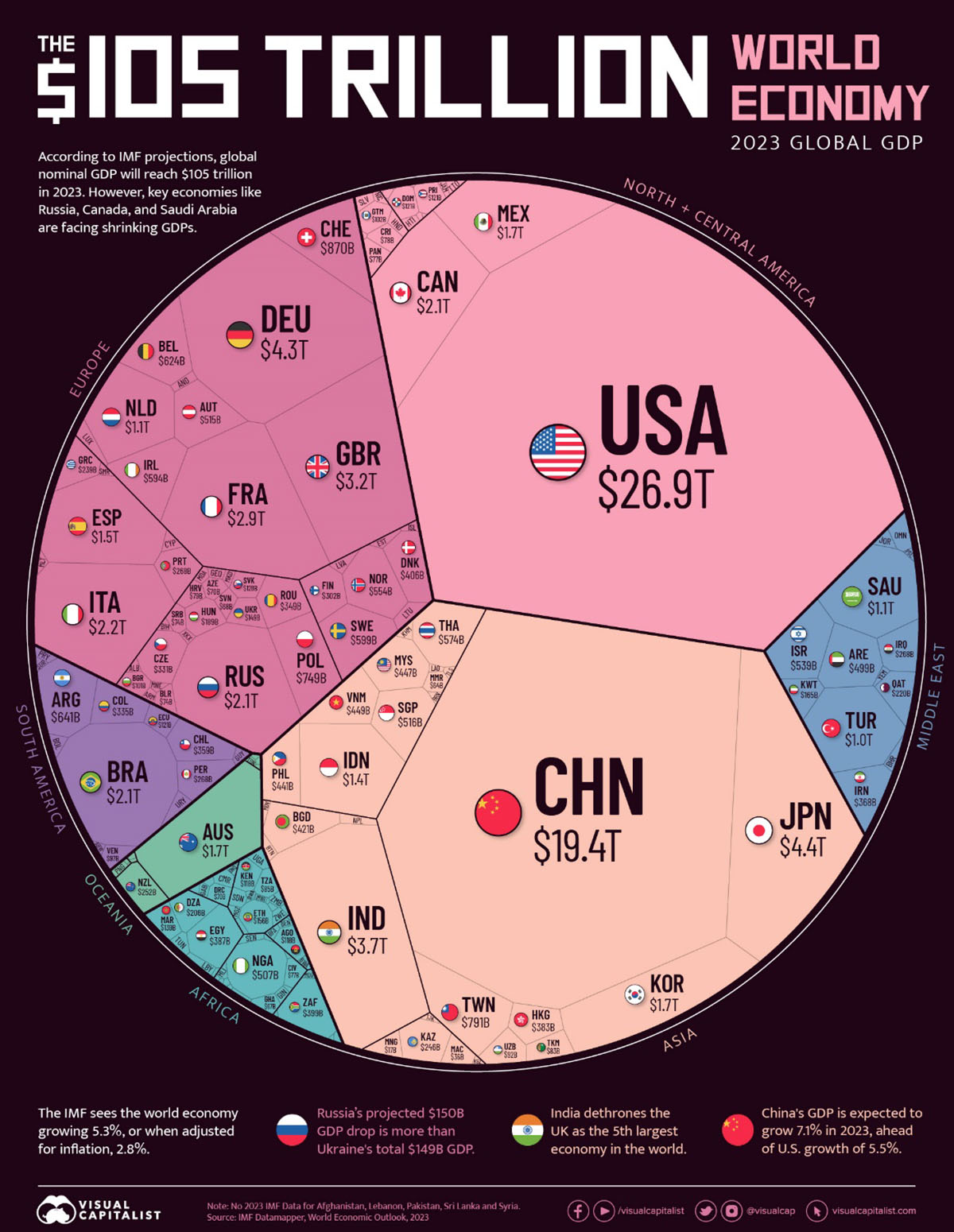

China

One major item of economic concern has been China. While many, including us, had been hopeful that the re-opening of China post-COVID-19 would provide a boost to the global economy, there have been cracks through the re-opening process like many economies around the world.

China is experiencing slow growth, real estate problems, de-coupling, and lower exports to Europe.

With most western countries raising interest rates to slow inflation, this has dramatically curbed their consumption of goods from China to the tune of around a 20% decline from last year.

China has had a large portion of their economy, and in particular growth in their economy, driven by real estate and infrastructure. Real estate is estimated to account for around 30% of their GDP. The real estate sector has had growing pains, which have culminated in some of their largest property developers going bankrupt. Evergrande, one of China’s largest developers, filed for bankruptcy protection 3 weeks ago.

People have known this was coming for years now, so it’s not coming as a sudden shock. We had been reading about the potential default of Evergrande 2 years ago. There is definitely some pressure on the country’s extremely large real estate market.

So, does this mean that the Chinese economy is likely growing at around 4-5% rather than the 6+% we are all used to?

Canada is more affected by commodity exports like lumber, metals, and oil. All of these are significantly affected by China, as China is one of the largest consumers if not the largest consumer in many categories, such as copper.

We expect that the Canadian economy will be slower to recover, while the U.S. will be faster to bounce back after rates normalize as they have a smaller share of their economy tied to commodities and real estate than Canada does.

This leads us to our outlook.

Global Outlook

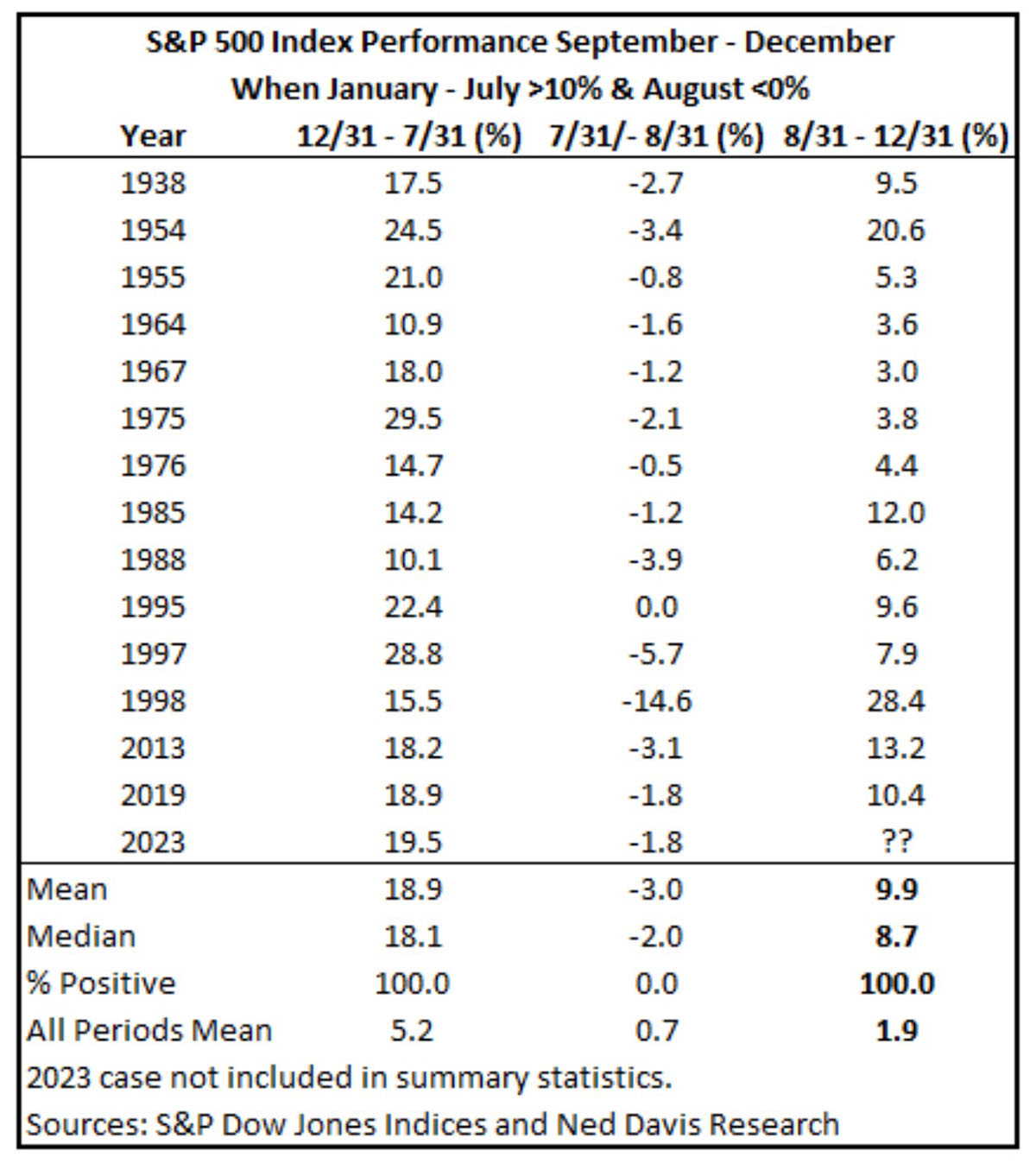

History says that years in which the market is up more than 10% during the first half of the year, followed by a pullback in August, are up another 9% on average through December. This has been the case 100% of the time since 1938.

Disclaimer: Past performance is not indicative of future performance, but history usually rhymes.

[i] These returns represent the returns of model portfolios only and do not represent the returns of any client. Individual account performance may differ materially from the representative performance history in this chart, due to factors including but not limited to an account’s size, the length of time the strategy has been held, the timing and amount of deposits and withdrawals, the timing and amount of dividends and other income, trade execution timing and pricing, foreign exchange rates, and fees and other costs. This is not an official statement from Wellington-Altus Private Wealth (“WAPW”). WAPW cannot verify the accuracy of these performance numbers. Please refer to your official WAPW statement for your specific performance numbers.

~~~

Enjoy the start of fall and we’ll reconnect with you again in the first week of October.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Boulevard West, Suite 4200

Montreal, QC, H3B 4W8

Tel: 514 819 0045