Overview

- Team Update

- Portfolio and Market Performance

- Portfolio Update

- Market Commentary

- Global Outlook

- Market Outlook

Team Update

The renovations at our office are complete and the furniture is arriving. However, as we approach year-end, we have decided to postpone our welcome party to early next year. After speaking with the team, we decided that it would be too rushed to plan and host the party before the holidays in December. We will keep you posted.

Portfolio and Market Performance[i]

Year-to-Date Performance as of October 31, 2023

- TSX 60 Total Net Return, C$: -0.2%

- S&P 500 Total Net Return, US$: 10.7%

- NASDAQ Composite Total Return, US$: 23.6%

- Dow Jones Industrial Average Total Net Return, US$: 1.4%

- S&P Canada All Bond Index Total Return, C$: -0.9%

Doing a traditional 60/40 portfolio with the three indexes, on average you would end up with 2.8% year-to-date, 4.5% over 3 years, and 5.9% over 5 years.

For context, Canada’s largest mutual fund is the RBC Select Balanced Portfolio, at about $50 billion in assets and a fee of about 2%. Its year-to-date return is 1.5%, 1.9% annualized over 3 years, and about 4% over 5 years.

The Conservative Equity Portfolio returned 15.1% year-to-date, 6.2% over 3 years, 8.7% over 5 years, and 11.1% since inception (October 2015).

The Diversified Income Portfolio, which is our balanced portfolio used for many of our clients’ registered accounts, returned 1.0% year-to-date, 5.7% over 3 years, 7.6% over 5 years, and 7.6% since inception (July 2017).

The Focused Total Return Portfolio returned 23.9% year-to-date, 8.3% over 3 years, and 15.1% since inception (April 2020).

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

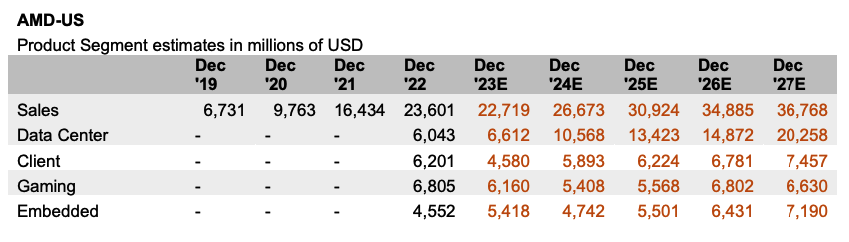

Advanced Micro Devices (AMD) reported at the end of October and their numbers were on track. It was good to hear about the development of their new generative artificial intelligence chip, which starts shipping this quarter.

Until now we were not sure when and how fast AMD could get these to market. The appetite for AI chips from large tech firms is limitless right now, so the speed at which they can produce and get these chips to market is key. Until now, Nvidia was the only game in town when it came to generative AI chips, but we had confidence that AMD’s Lisa Su would be quick to make the pivot. She’s done a tremendous job with this company since taking over as CEO in 2014.

Another surprise this quarter was the results of Amazon. Andy Jassy became CEO in 2021 and has been laser focused on profitability. It’s starting to show. In Q3 last year, the company did $18 billion in EBITDA (earnings before interest, taxes, depreciation, and amortization), and this quarter it’s $29 billion. We’ve been watching Amazon grow its top line for years and expected that one day they would start to turn on the tap to profitability: that’s one of the major reasons we’ve been investing in the company. Historically the company trades in a range of 20-30X EBITDA, but last year when the stock bottomed it went as low as 10X EBITDA.

If Amazon continues on this path, they could easily reach $200 billion in EBITDA in the next 2-3 years. If the market puts a 20X multiple on that, that would put the stock price closer to $400, while today the stock is at $135.

New Add: Costco

Costco is a simple-to-understand business, which we like.

Costco’s value proposition is substantial: focus on quality and value, negotiate large discounts from suppliers, then pass those savings on to consumers and charge a membership fee for access to those savings. Whereas most retailers focus on low quality and cheap or high quality and expensive, Costco is laser focused on high quality at a low price.

Costco is known for its disciplined growth. They only open a Costco warehouse within a population of 500,000, so no Costco in PEI. My father needs to drive to Moncton just to shop at Costco – but every month or so he makes the trip.

The prices they are able to offer for some products are sometimes lower than what other stores would purchase wholesale. Employees are motivated – well paid. They hustle on the job and in return they are paid 50-60% more than the average grocery store employee and receive health care benefits and paid leave.

We have six mouths to feed at home and we can’t find a better value proposition than Costco. I’m always shocked at the prices when we stop at a regular grocery store.

We owned Costco from 2014 to 2018 and did well with the investment. We sold our entire position on concerns the valuation was too high at 38X earnings. We regret going to 0 on the stock, but learned a valuable lesson: if we are concerned about the valuation, but the business is sound, then simply trim. Don’t go to 0 if it’s a wonderful business. Wonderful businesses are hard to find, and when you find one you like, hold onto it and possibly trade around the position on valuation fluctuations.

New Add: Eli Lilly

First, we want to remind everyone that we are not medical professionals so we will do our best on the topic, but pharmaceutical and medical fields are not areas where we have a lot of expertise. For a more detailed discussion on the topic there are some very interesting video series on YouTube published by Harvard Medical School, which we found extremely helpful when doing research on the topic.

So, what are these discussions around a new weight loss drug?

We’re going to start with this nice picture from the San Diego Zoo of a Gila monster, which is 1 of only 3 species of venomous lizards. In 1986, a diabetes researcher discovered that the venom of these lizards was a rich source of incretin hormones including glucagon-like peptide-1 that could be used to treat type 2 diabetes. GLP-1 is a hormone that is also produced by the intestine naturally in our body.

Three decades later, in 2005, after a long process of development, the first GLP-1 agonist drug was approved for diabetes treatment in the U.S. In the trials of this drug, called Byetta, it was shown to slow the emptying of food in the stomach and increase the feeling of fullness, suppressing appetite. Both have the effect of lowering blood sugar spikes in the body as well as a side-effect of weight loss.

The first product approved for weight loss arrived in 2014 when the FDA approved the Novo Nordisk drug Saxenda for weight loss of obese patients. Saxenda is a daily injection, with the further development of a more effective weekly injection under the name of Wegovy developed and finally approved for weight loss in 2021.

Producing a complex hormone is a difficult process and takes very specialized equipment. The production of these drugs has been increasing at a very rapid rate but not enough to keep up with the demand. There are currently shortages around the world and the suppliers have had to limit supply with an aim to keep supply for the more urgent diabetes patients.

There are two main players in this space, Novo Nordisk and Eli Lilly, who combined will sell about $34 billion worth of GLP-1 drugs this year.

Novo Nordisk is bigger in the space as they got approval for a weight loss variant in the U.S. in 2021. They sell about two-thirds of all GLP-1 drugs; however, they have historically earned most of their revenue from diabetes drugs and insulin sales, meaning the more people they treat with GLP-1, the fewer of their other products they are able to sell. Eli Lilly, on the other hand, has a healthy drug portfolio mostly in cancer treatment so they cannibalize less of their sales while diversifying the risk of being exposed to one area of treatment. This is part of the reason we prefer to invest in Eli Lilly: less risk, more diversification, and a more attractive growth profile.

Analysts generally see sales in these drugs doubling or tripling over the next few years. We think the sales could grow exponentially, potentially in the hundreds of billions due to the substantial addressable market of obese and morbidly obese Americans.

For context, the CDC estimates that about 42% of Americans are obese with a BMI over 30, or around 140 million people in the U.S. alone. The drugs are approved for type 2 diabetes treatment under many insurers and Medicaid; however, for weight loss it is generally not. Annual cost is around $10,000-15,000 for treatment, which puts our estimate at about 2.5 million patients currently under treatment. We think that number could easily increase more than ten-fold over the next few years and appears to be limited by production capacity.

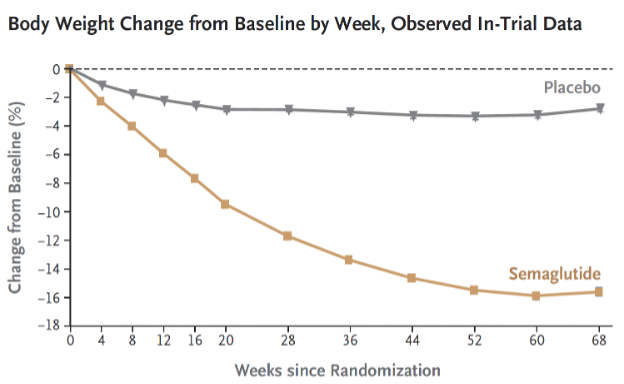

We reviewed a number of trial results and there were a few things that were apparent. GLP-1 prescribed with dietary changes and exercise causes significant weight loss in an overwhelming number of cases. The new versions of these drugs are more than twice as effective as the older GLP-1 drugs. In a trial published in 2015 in the New England Journal of Medicine, participants taking the older Saxenda GLP-1 drug had a mean weight loss of 6.4% after 68 weeks. The more recently developed Wegovy GLP-1 drug had a study published in 2021 in the New England Journal of Medicine that showed a mean weight loss of 14.9% after 68 weeks, with 51% of participants showing at least 15% body weight reduction.

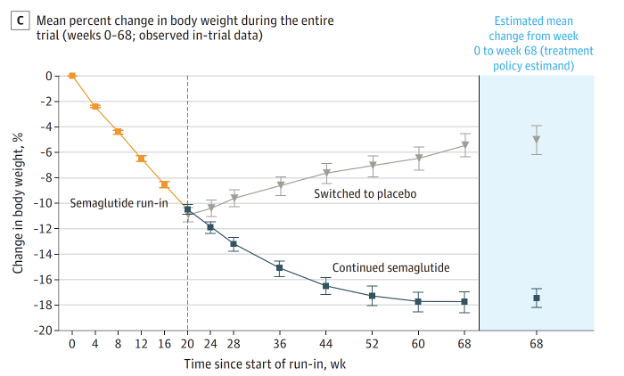

While looking at the financials of the drug, we also wanted to understand how long the average patient would be taking it and what happens when they stop taking it. In a study published in 2021 by The Journal of the American Medical Association, people who reverted to placebo from Wegovy after being treated for 20 weeks and lost around 10% of their weight up to that point, put weight back on and finished with only losing 5% of their weight average at week 68, whereas those people that kept taking Wegovy lost around 17% of their weight by week 68.

The 2021 study results are pretty compelling. In fact, the news is so compelling that over the last few months we have seen a wave of analysts in other industries start to warn of the scale of its effects on the commercial landscape.

Med tech and surgical sectors have traded down on the expectation of lowered procedures and revenues but better patient outcomes.

A Walmart executive mentioned they saw patients of GLP-1 buying slightly less food; in the following days, shares in Kraft, Coke, Pepsi, Hershey, and others fell in response.

Barclays analysts discussed the threat to fast food, which has put McDonalds shares under pressure even after beating earnings expectations and having a very strong year.

A Jefferies analyst theorized that if enough people took the medicine, it would reduce the average weight of airplanes for airlines, affecting fuel usage and reducing costs.

A retail analyst called for record clothing sales as people losing weight would need to replace their entire wardrobes.

JP Morgan put their estimate at 7% of the American population taking the drug or around 24 million people, by 2035.

Market Commentary

Bonds and GICs

As interest rates have risen drastically over the past year, mortgage demand has been collapsing. This past year has been difficult for bankers to make their sales targets. The one silver lining has been the increase in GIC rates. Most bankers have pivoted from attempting to sell credit, to GICs. We on the other hand believe that government bonds are a superior investment in this environment.

Here are 5 reasons to purchase a bond ETF today versus a GIC.

- Almost half the return on a bond today is capital gain. On a 5% GIC, 100% of the return is taxed as interest income, whereas on a 5% bond under par – on the assumption that 50% is taxed as interest income and 50% as capital gain – the result is much more tax efficient. As a comparable, you would need to have a GIC that pays 6.25% interest for the same after-tax return as the bond ETFs we are purchasing.

- GICs are guaranteed by the bank that issues them, and up to $100,000 is insured by the CDIC. Government bonds are guaranteed by the government – no limits.

- Most typical GICs are locked in for the term of the GIC. It’s next to impossible to redeem ahead of time if you need the funds. Bonds can be sold at any time without penalty.

- Bonds usually act as a natural hedge and protection in an equity portfolio. When equity markets sell off because of uncertainties, government bonds usually rally, whereas a GIC simply holds its value and will never go up in price.

- Inverse relationship with interest rates. When interest rates go down, bond prices go up, so if rates go down next year, we could make 10% on our bonds in 12 months versus 5% on a GIC.

In short, if we are right on our call and rates go down, we could make 10% on some of our bond ETFs. If we are wrong, we just locked in the interest equivalent of 7.5% for the next few years until the ETFs mature.

Global Outlook

Globally, the biggest concern is the Israel-Hamas war.

Historically, war can have varied impacts on the markets both in the short and long term. For example, should the war in the Middle East escalate, it could certainly affect oil prices. However, we don’t believe it would have the scale we saw from the war in Ukraine as the region is not a major exporter of grains or fertilizers, which was a major effect on global food prices last year.

In a recent note from our Chief Market Strategist, Dr. Jim Thorne, he showed that since the Second World War, U.S. markets have gone up an average of over 10% in the 12 months after a war breaks out.

Market Outlook

We are entering what have historically been the strongest months for growth stocks. And once the market gets a whiff that the U.S. Federal Reserve Board has stopped tightening, growth stocks should rally. We believe we are well positioned for the environment that is unfolding.

We expect that this time next year, interest rates will be lower, and bonds will be higher along with other bond proxies like utilities, infrastructure and growth stocks.

~~~

Get those snow tires on. We’ll talk again in early December.

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Boulevard West, Suite 4200

Montreal, QC, H3B 4W8

Tel: 514 819 0045