Overview

- Office Update

- Portfolio and Market Performance

- Portfolio Update

- Recap of 2023 Predictions

- Last Year’s Portfolio Outliers

- 2024 Predictions

Administrative Updates

The TFSA limit is now $7,000. We are in the process of topping up accounts. Francesco is working on it every day and as we experienced last year, it usually takes a few months to get everyone’s accounts adjusted, so please be patient. If, however, you would like it done immediately or have a special request, e.g., you have funds you would like to send us from elsewhere, please don’t hesitate to give us a call.

The 2023 RRSP deadline is February 29, which is just around the corner. Please reach out to us if you would like to make a contribution. And as a reminder, we don’t have to wait until the deadline – we can also contribute for 2024 right now if you know your contribution room.

Asset allocation: As equities have risen more than bonds last year, we will be reviewing the asset allocation for individual households and accounts. 2022 was a bear market, and 2023 was a recovery year and the beginning of a new bull market, so we held off on selling equities for any cash needs over the past 2 years. Now that markets have recovered, we need to review clients’ future cash needs and risk profile to make sure the asset allocation is in line, i.e., do we have the proper ratio of fixed income to equities.

Portfolio and Market Performance

Year-to-Date Performance as at December 31, 2023

- S&P/TSX 60 Total Net Return, C$: 12.1%

- S&P 500 Total Net Return, US$: 26.3%

- S&P Canada All Bond Index Total Return, C$: 6.3%

- NASDAQ Composite Price Return, US$: 43.4%

- Dow Jones Industrial Average Total Net Return, US$: 16.2%

For context, Canada’s largest mutual fund is the RBC Select Balanced Portfolio, at about $50 billion in assets and a fee of 2% approx. Its year-to-date return was 10.2%, 2.0% over 3 years, and 5.9% over 5 years.

The Conservative Equity Portfolio returned 27.3% year-to-date, 5.6% over 3 years, 12.0% over 5 years, and 12.2% since inception (October 2015).

The Diversified Income Portfolio, which is our balanced portfolio used for many of our clients’ registered accounts, returned 8.8% year-to-date, 4.8% over 3 years, 9.9% over 5 years, and 8.6% since inception (July 2017).

The Focused Total Return Portfolio returned 40.0% year-to-date, 9.2% over 3 years, and 18.1% since inception (April 2020).

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

Over the month, we increased the fixed income allocation in both balanced mandates.

In the Diversified Income Portfolio, we increased the fixed income allocation by 7%, from 31% to 38%. The Portfolio now stands at 62% equity and 38% fixed income. We did this by trimming a 0.5-1% weighting for most equity positions.

In the North American Yield Portfolio, we increased the fixed income allocation by 6%, from 39% to 45%. The Portfolio now stands at 55% equity and 45% fixed income. We are also taking measures to align the equity portion of the North American Yield Portfolio with that of the Conservative Equity Portfolio.

In the Focused Total Return Portfolio, TFSA strategy, we trimmed some Canadian holdings, in particular Canadian Pacific Railway, TD Bank and Royal Bank of Canada, while adding to Berkshire Hathaway and Advanced Micro Devices. We had great timing on these trades, as well.

In the Conservative Equity Portfolio, we did something similar, trimming Canadian Pacific Railway, Royal Bank of Canada, Fortis and Johnson & Johnson for Berkshire Hathaway and NVIDIA.

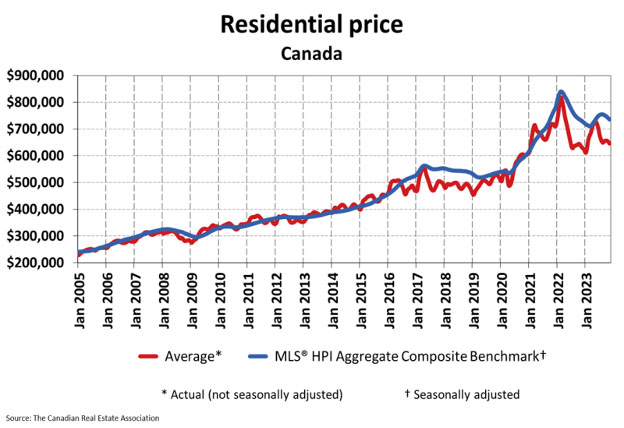

We added a new holding to our income portfolios: Canadian Apartment Properties REIT, Canada’s largest publicly traded, multi-family, residential property real estate investment trust. CAPREIT has 64,500 residential apartment suites, townhomes and manufactured home community sides well-located across Canada and the Netherlands, with a 98.9% occupancy rate and average monthly rent of $1,490/residence.

The shares are trading at $47.56 approx., pay about 3% tax-efficient dividend and funds from operations increased in the 1-4% over the past couple of years. CAPREIT is arguably one of the most stable REITs in Canada. It’s boring and safe, and we like that combination for our income portfolios.

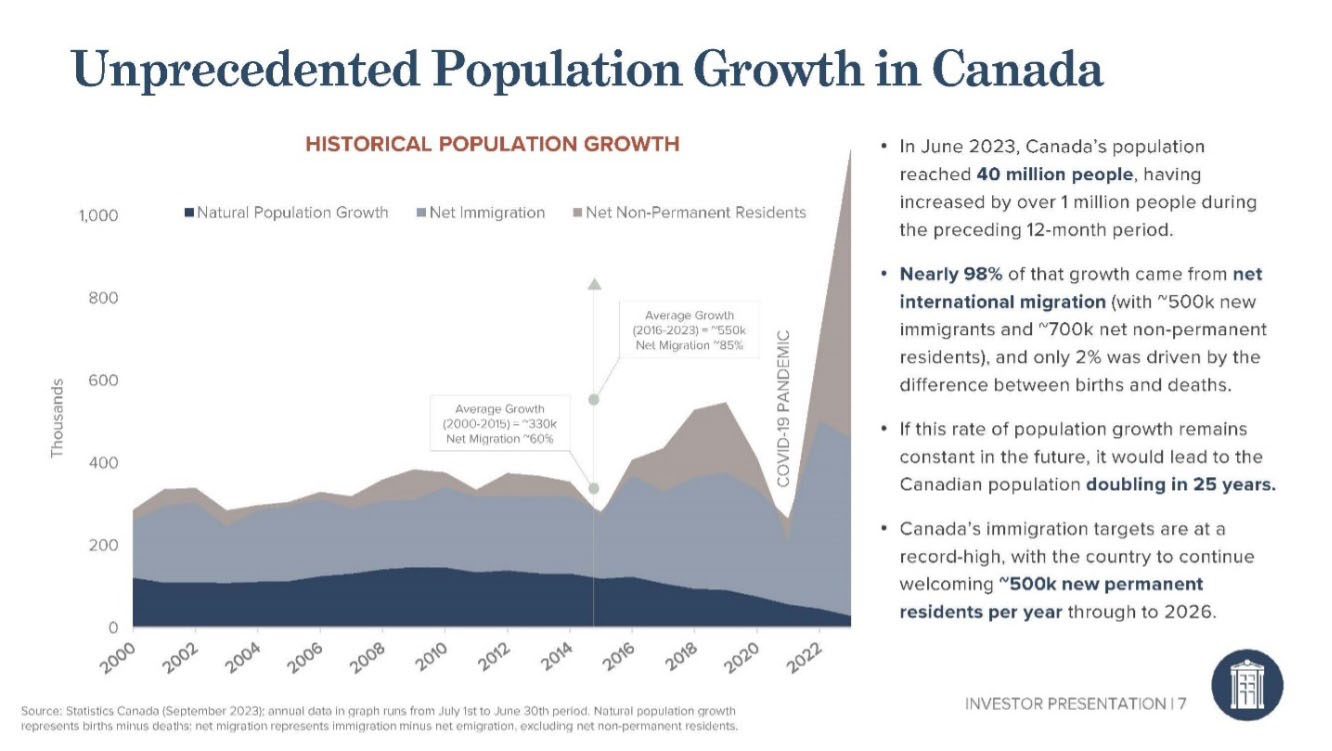

We will get into the fundamentals of the Canadian housing market later, but what we are seeing is that due to immigration, our population is growing faster than housing supply is being built. This environment creates strong fundamentals for affordable apartments in metropolitan areas.

Recap of 2023 Predictions

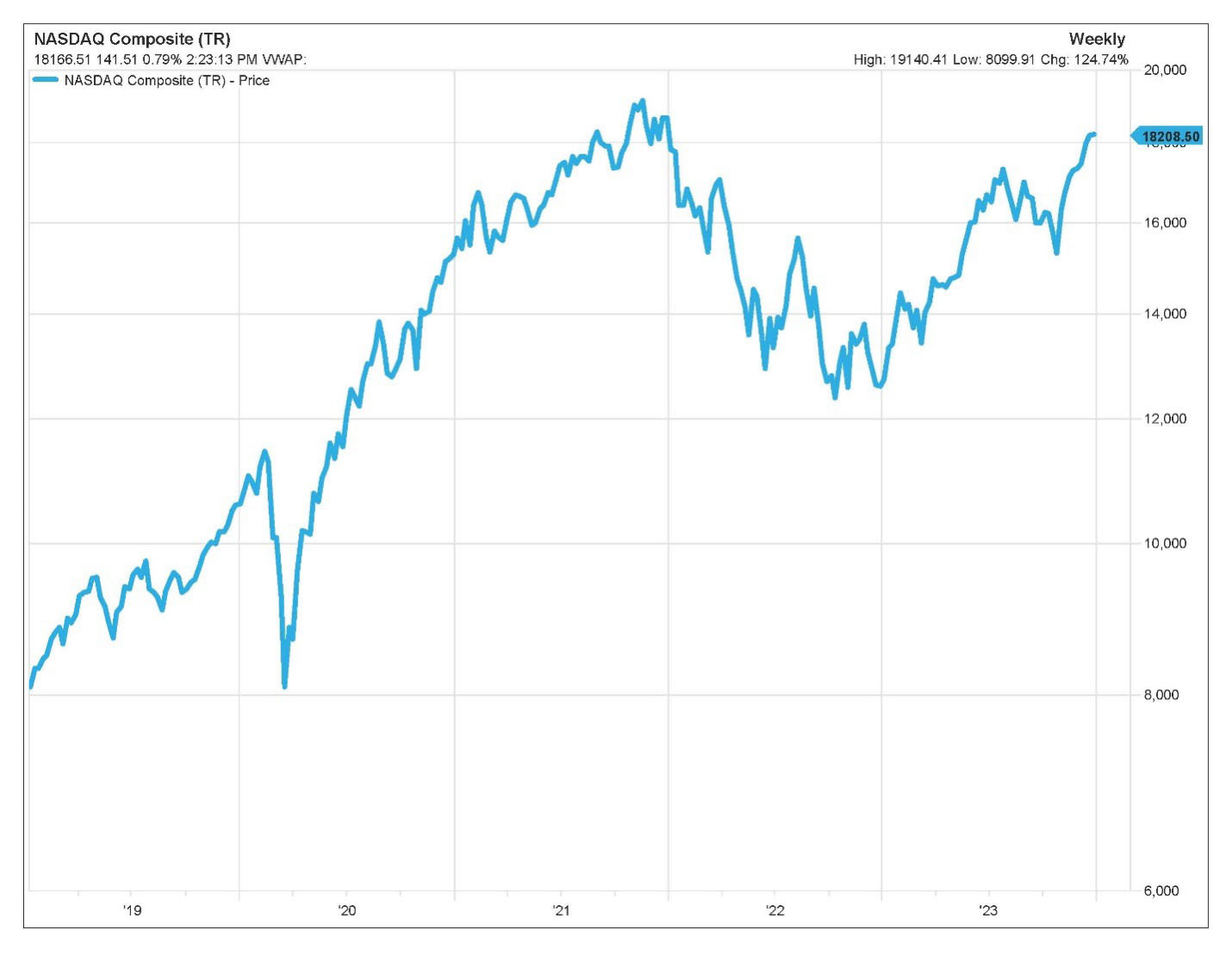

The market, particularly the NASDAQ, will rebound much in the way it crashed in 2022.

Source: FactSet

NASDAQ Composite was -33.10% in 2022, then provided a 43.42% return in 2023. (Percentages are $USD price returns)

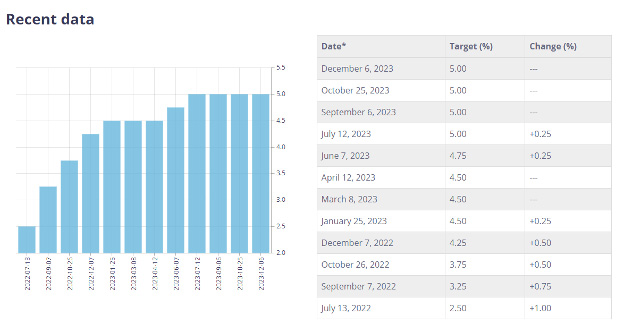

Rates will come down by 2024.

Policy interest rate – Bank of Canada

The overnight rate has not changed, and long-term rates actually spiked midway through 2023 before coming back down to where they were at the start of last year. The central banks started talking about taking rates down recently, so we may have been 6 months early on our call here.

The construction and housing sector in Canada will be the largest negative in 2023.

While rates did put pressure on housing, record immigration has caused housing prices not to decline as much as expected. With current immigration around double our longer-term average, there has been downward pressure especially on lower-end real estate and rental units. The construction industry faced some challenges in 2023 which led to a contraction, but not as pronounced as we had feared.

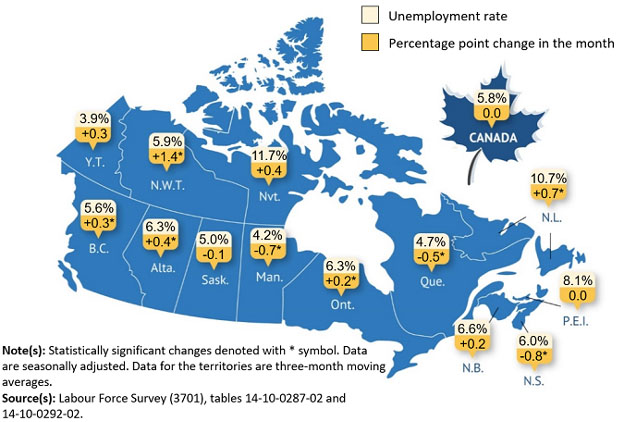

The labour market will remain tight as inflation comes down.

Source: Unemployment in Canada from Stats Can.

We were dead-on here with the unemployment rate in the U.S. remaining very stable while inflation came down, a large part of why the market did so well.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/240105/mc-a001-eng.htm

China’s economic recovery will be a positive contributor to avoiding global recession.

Despite media reports and a weak stock market, China had 5.2% growth in 2023, which certainly kept the global economy out of recession. While we weren’t wrong in our prediction, it did not surprise in any large way to the upside.

Last Year’s Portfolio Outliers

Nutrien Ltd. was down 24% approximately but has been executing very well – bet you couldn’t tell that from the stock price.

Johnson & Johnson was down nearly 12% on the year. We misjudged the overhang on the stock due to the talc lawsuits.

Despite what we got wrong, our big call was to lean into big tech and AI chip manufacturers while trimming financials. This worked out rather well and far outweighed poor performers.

2024 Predictions

- The Canadian economy will continue to slow. The U.S. will as well, but to a lesser degree. All economies will see slower growth this year as a soft landing has been widely predicted. We believe we are already in a very mild recession in Canada, which will keep growth subdued into 2025.

- Markets will be positive in 2024, but we can expect a 5-10% correction in a bull market. We will not be free of volatility as a steady stream of global events and risks continue to stoke investor fears. Just a reminder: markets are forward looking, so they likely will remain positive as the economy bottoms ahead of an expected return to growth.

- Labour remains tight, however we see unemployment continuing to increase in Canada, while the U.S. will increase more slowly. Although labour is tight it is not immune to a recession, and we will continue to see unemployment increase through 2024.

- The tech rally will extend in select companies as a combination of cost cutting, along with growing sales from cost-saving or productivity-increasing services, will propel the most innovative companies. AI-driven tools are just one example; they will start to hit markets in 2024.

- While Canada will be weaker than the U.S. economy, and may likely drop interest rates faster and harder, risk on sentiment will drive the dollar back up in value. We see the Canadian dollar as range bound for 2024, between 1.32 and 1.38.

- We continue to see inflation coming down and expect to see interest rates decreasing between 1% and 2% in 2024, followed by further cuts in 2025, in both Canada and the U.S. We expect to see the overnight rate mid-2025 around 2.5%.

~~~

We look forward to seeing what 2024 holds for us. Have a great month.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045