Overview

- Office Update

- Portfolio and Market Performance

- Portfolio Update

- Holding Highlight

- Rapid-Fire Earnings

- Market Outlook

Office Update

RRSP season is upon us and the deadline to contribute for the 2023 tax year is the end of February. Reach out if we can help you make a contribution to your account.

Tax documents will start to arrive at the end of this month and into the next.

We’ve set a date for our long-awaited grand opening event! We’ll be inviting you to our new office on April 18 for a special client event to welcome you to our new offices in Montreal. More details to follow but save the date. Invitations will go out soon.

Portfolio and Market Performance

Year-to-Date Performance as at January 31, 2024

- TSX 60 Total Return, C$: 0.5%

- S&P 500 Total Return, US$: 1.7%

- S&P Canada All Bond Index Total Return, C$: -1.2%

- NASDAQ Composite Total Return, US$: 1.0%

- Dow Jones Industrial Average Total Return, US$: 1.3%

For context, Canada’s largest mutual fund is the RBC Select Balanced Portfolio, at about $50 billion in assets and a fee of 2%. Its year-to-date return was 0.4%, 2.3% over 3 years, and about 5.3% over 5 years.

The Conservative Equity Portfolio returned 2.7% year-to-date, 6.4% over 3 years, 11.8% over 5 years, and 12.4% since inception (October 2015).

The Diversified Income Portfolio, which is our balanced portfolio used for many of our clients’ registered accounts, returned 1.7% year-to-date, 4.8% over 3 years, 9.3% over 5 years, and 8.8% since inception (July 2017).

The Focused Total Return Portfolio returned 3.5% year-to-date, 10.3% over 3 years, and 18.8% since inception (April 2020).

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

We continued selling more Johnson & Johnson this month, using the proceeds to purchase additional units of Home Depot. We’ve spoken before about the negative overhang on Johnson & Johnson stock, so we are using the position as a source of capital in order to purchase more Home Depot. Home Depot looks like it is finally breaking out, so we are making moves to build our position.

We trimmed 1% of Alphabet to add to Apple. Apple stock pulled back after the earnings because of weak China sales; however, we believe the street is missing the forest for the trees. Apple is on the cusp of introducing their own upgraded AI tool, which no one is talking about. We view Apple as a service platform business and service business and their iPhone and other hardware products as simply delivery mechanisms. This is to say, they control the pipe for most of the technology services we use today. It’s a great business!

Holding Highlight

This month we’ll take a deeper look at Home Depot.

CEO: Ted Decker worked at Home Depot for 20 years before becoming President and COO in 2020. He went on to become CEO in 2022. In our opinion, under his leadership, Home Depot has managed the complexities of the COVID pandemic better than any company we follow. Even today they continue to innovate (e.g., order online and get same-day curbside pickup).

Financial strength: Since Decker became President in 2020, HD has bought back $29 billion of their own stock, while managing to grow sales to $157 billion from $110 billion. Dividends have grown by 12% per year, while earnings per share have grown by 8% per year.

Business model: Best locations, largest scope of inventory and services. Growing demand. No one can compete on their scale.

We see Home Depot as the best-in-class supplier of building materials and home improvement products.

On a high level, they own 2,322 stores across the United Sates, Canada, and Mexico and have around half a million employees.

Home Depot is the 5th largest online retailer in the U.S. On paper, 15% of their sales are done online, but bigger picture, they have far more depth digitally in the remaining 85% of the business where the website and phone apps play a part in the process.

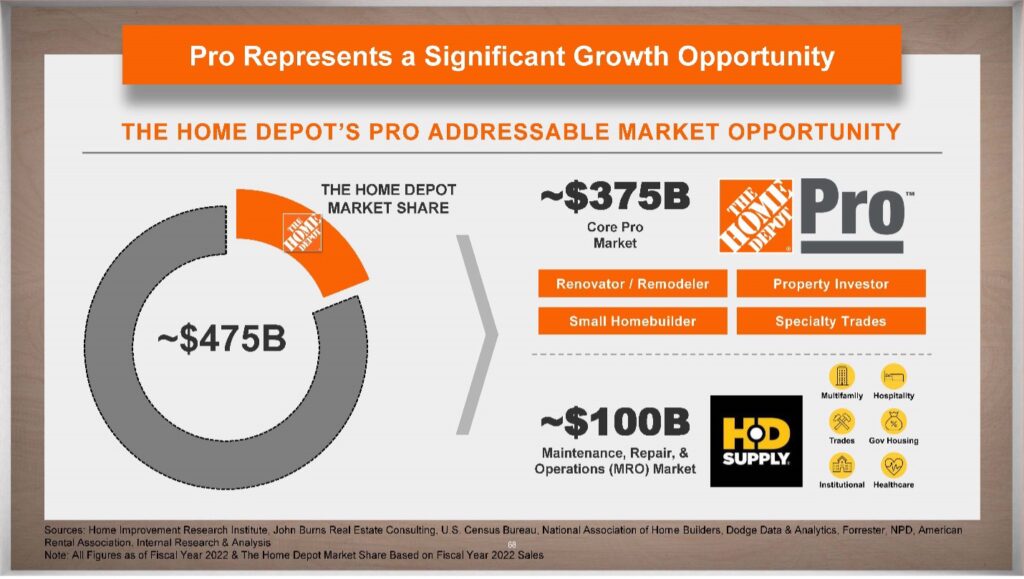

While most of us see Home Depot as a place to pick up items for our homes, the consumer only makes up about half of their sales; the other half is what they call pro or business-to-business sales. This category has been much stronger and a source of growth the last 2 years as the massive consumer spending in home improvements that spiked in 2021 has trailed off. This is divided into 2 distinct offerings: Home Depot Pro and HD Supply.

Home Depot Pro supplies renovators/remodelers, property investors, small homebuilders, and specialty tradespeople. HD Supply works with the maintenance, repair, and operations departments of institutions, from hospitals to apartment buildings.

Each requires a very special offering that is tailored to the way they do business. Most need quick delivery to a job site, and many require purchase financing terms. It’s a different type of customer and business and Home Depot has been rapidly expanding in this space.

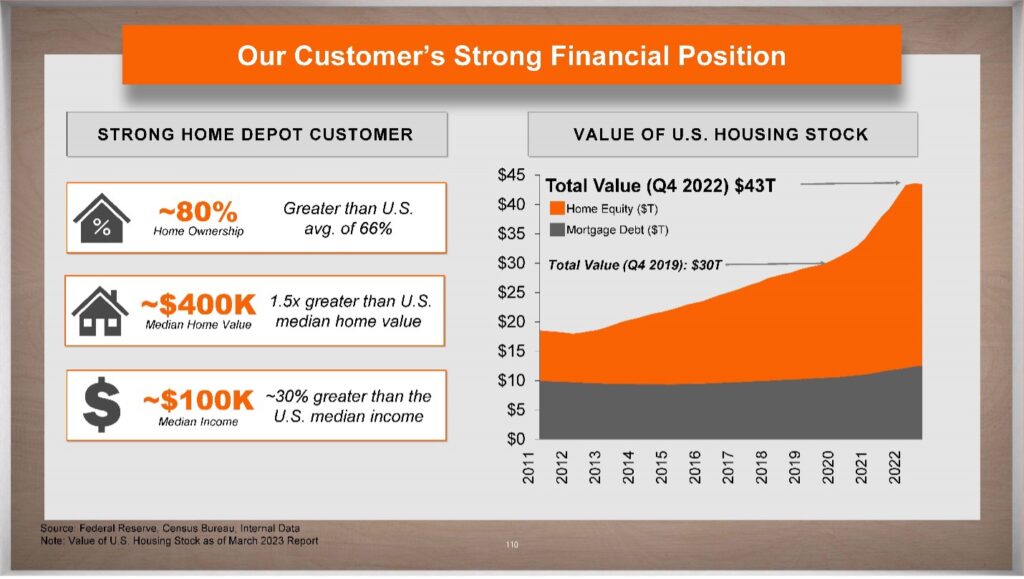

Now let’s talk about why we want to invest in the DIY, home improvement, and construction materials space. There are 4 underlying trends in this space: we have a strong consumer, we have appreciating home prices, we have an aging housing stock, and we have more people choosing to improve a property than build a new one.

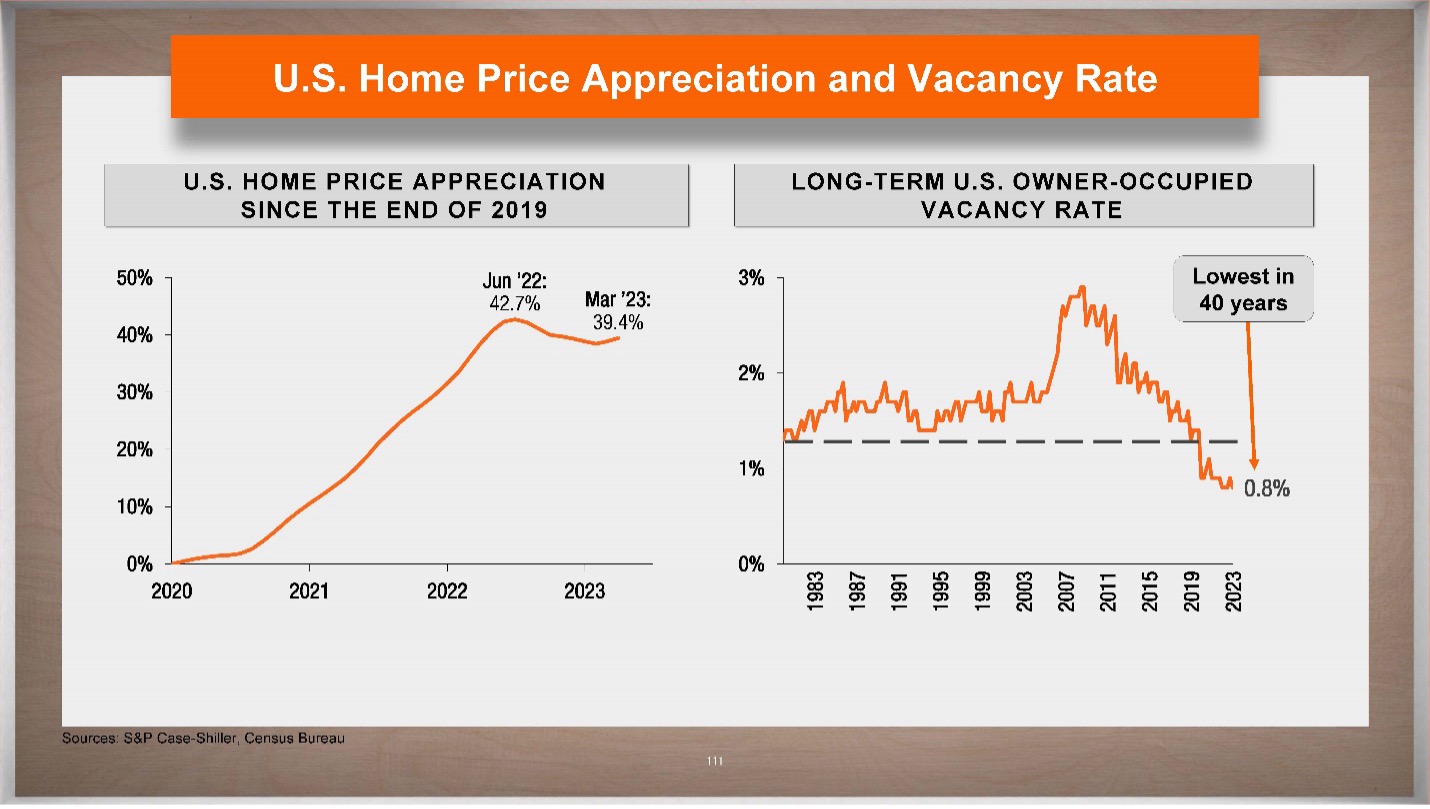

We have the lowest long-term owner-occupied vacancy rate we’ve had in 40 years at 0.8%, which is a measure of the tight housing market and a 40% home price appreciation since the end of 2019.

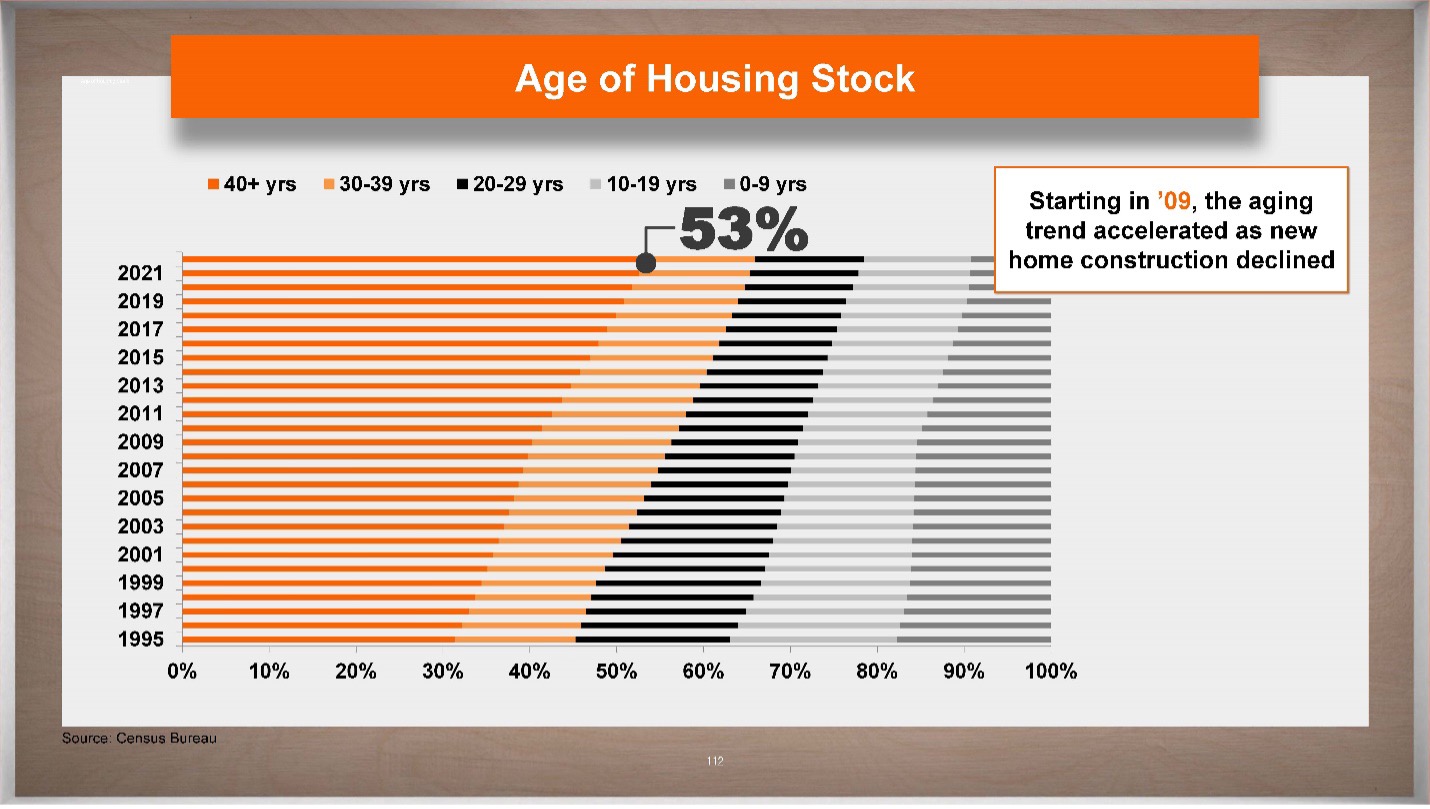

Why home improvement? In 1995, 31% of the housing stock was over 40 years old. Today, 53% of the housing stock is over 40 years old. These older properties require a growing amount of maintenance and improvement, making for a fantastic environment for Home Depot.

As a shareholder your average return over the last 5 years has been 16.5% compounded or 19% compounded over the last 10 years. They return about 2.5% in a dividend and 2.3% in share buybacks every year.

We are very excited to own a part of this best-in-class home improvement and construction material supply company that sells into what we see as a growing market over the next 10 years.

On top of that, we’ve had a unique purchasing environment the last year as the massive home improvement spend from 2021 gave us a narrow window of declining revenue to buy into before we move back into a normal growth cycle.

See Appendix 1 for more information about Home Depot.

Rapid-Fire Earnings

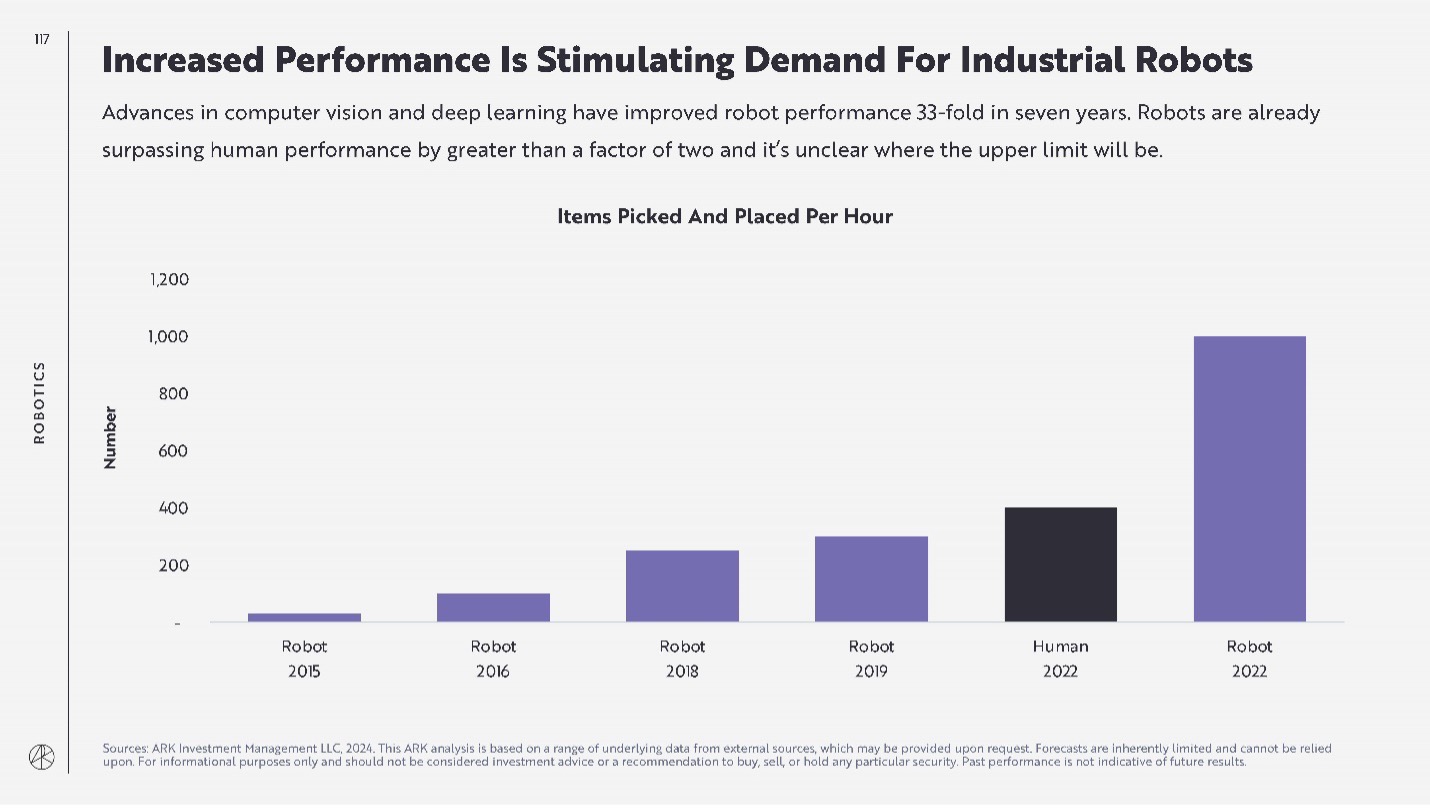

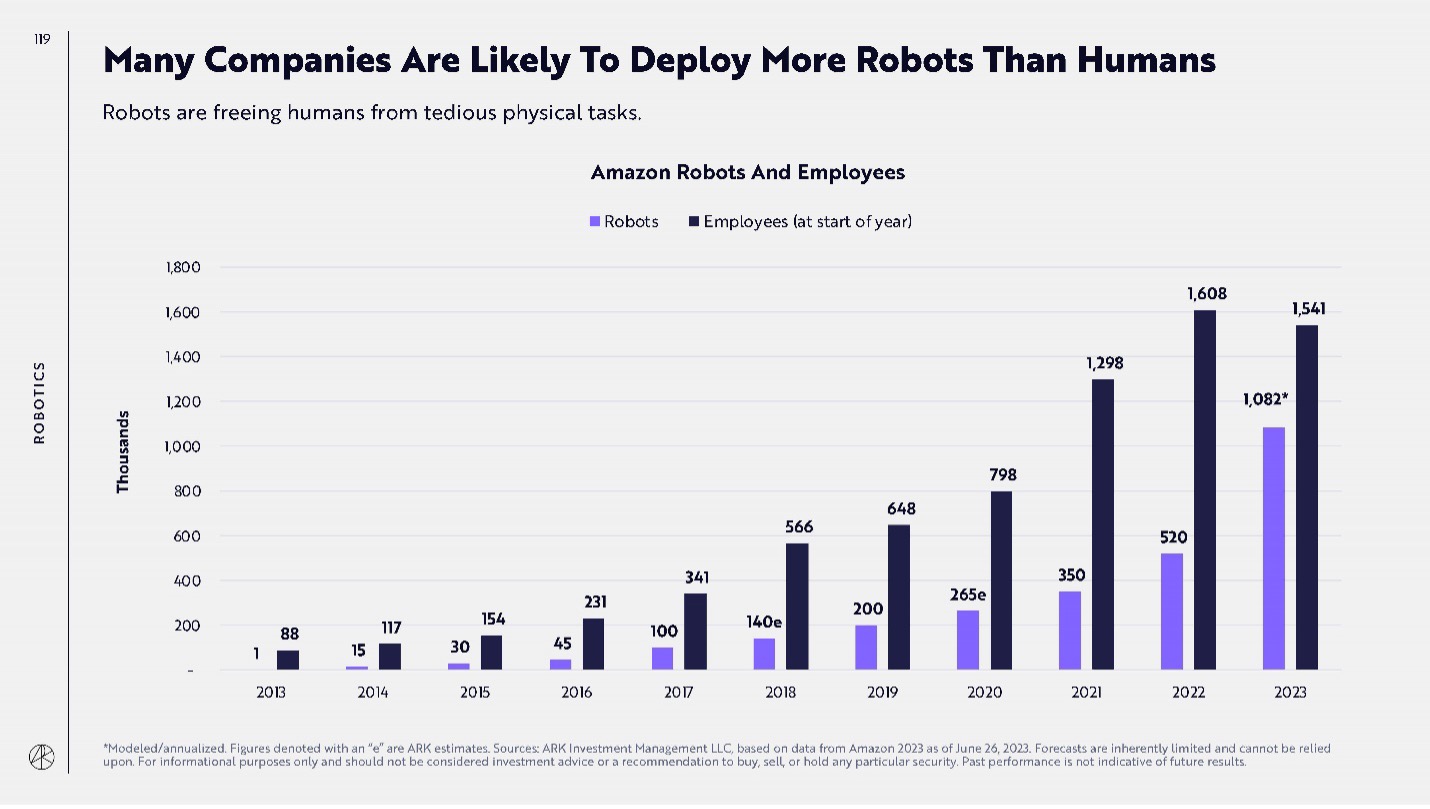

Amazon – Huge cash flow growth. $29 billion in free cash flow for the quarter and $36 billion in free cash flow for 2023 with an estimate of $66 billion of free cash flow for 2024. That’s an 80% increase in free cash flow looking forward. Improving efficiency – Amazon robots are now picking more than twice as many items as humans. Amazon doubled the number of robots in fulfilment centers last year to over 1 million, while lowering the number of employees to 1.5 million. See Appendix 2 for more information about robotics.

AMD – Incredibly high expectations, performed amazingly, while providing a cautious outlook. Overall the PC market is cyclical and still a bit slower to recover. We expect it to come back, which will help to drive growth. The shares rallied ahead of earnings and are up around 15% so far this year.

Apple – Reached 2.2 billion installed devices, is gradually increasing market share of devices, then selling services and software through those devices. Reported solid numbers, beat expectations, but got beaten up on weak China sales. China accounts for 19% of their revenue. Economic cycles in China do not scare us as we are long-term investors. We think people are looking too short term. The big story for us is Services. Apple is now making over 35% of their gross income through Services, which is a hugely profitable, amazing business going forward and why this company is such high quality. Next up: AI.

Eli Lilly – Another amazing quarter. The launch of their GLP-1 weight loss drug blew past expectations by 25%. They are targeting $40 billion of sales for 2024 and we think their sales could explode in the next few years, reaching 60-100 billion by 2026. On the earnings call, there was an important point about one of their competitors: they mentioned the single monthly shot Amgen was trying to launch made people very ill as the monthly dose was large, which pointed to less competition than people anticipated.

Google – Continues to grow its top and bottom line at double-digit growth. They however had disappointing ad revenue which missed expectations, and guidance was weak. Good business but weaker execution than competitors. Lots of room to trim costs. Competition on the horizon from Microsoft.

Tesla – 1.8 million vehicles delivered as expected, which is a 40% increase in deliveries from 1.3 million in 2022. Model Y became the best-selling car in the world. Margins are improving as cost of goods sold continues to decrease, from $39.5k per vehicle last year to $36k now. Planning first deliveries of low-cost, high-volume vehicles in Q2 2025. Big headline was expected delivery of Optimus humanoid robots in 2025.

Microsoft – Big expectations and they didn’t disappoint, with 30% growth in Azure and other cloud. services, 18% revenue growth and 33% EPS growth in fiscal Q2 2024 vs. last year. This is a $3 trillion company that can still grow like a start-up. AI products are starting to roll out through Copilot at $30/month. Great execution.

Market Outlook

Up!

We continue to believe that we are in the early stages of a multi-year bull market fueled by innovation and technology. We believe this bull market could last well into the next decade. Expect distractions from the mainstream media. Expect corrections of 10-15% along the way. Keep it simple: own quality. The best-run companies will always outperform over the long term.

~~~

We hope you enjoy the new format of our monthly update. If you have a few minutes, we encourage you to take some time to visit https://www.youtube.com/watch?v=fJoEPRQMBuY and watch one of the most talked about economic speeches this year – an interesting perspective by the newly elected president of Argentina, Javier Milei, who is also a former economic professor.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Michael Hale, CIM®

Senior Wealth Advisor,

Portfolio Manager

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045

Appendix 1

Appendix 2