Overview

- Office Update

- Portfolio and Market Performance

- Portfolio Update

- Holdings Highlight

- Rapid-Fire Earnings

- Economy and Market Outlook

Office Update

As we return from summer break, Mary continues to reach out to set up review meetings. As always, should you need to meet ahead of time, please feel free to reach out to her and schedule something sooner.

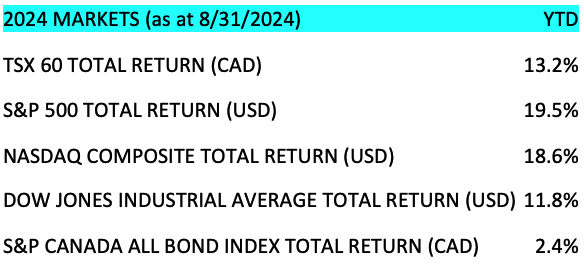

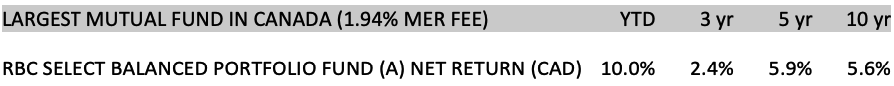

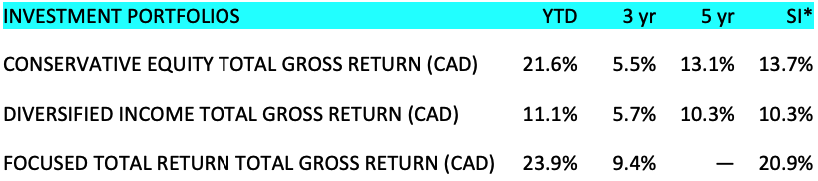

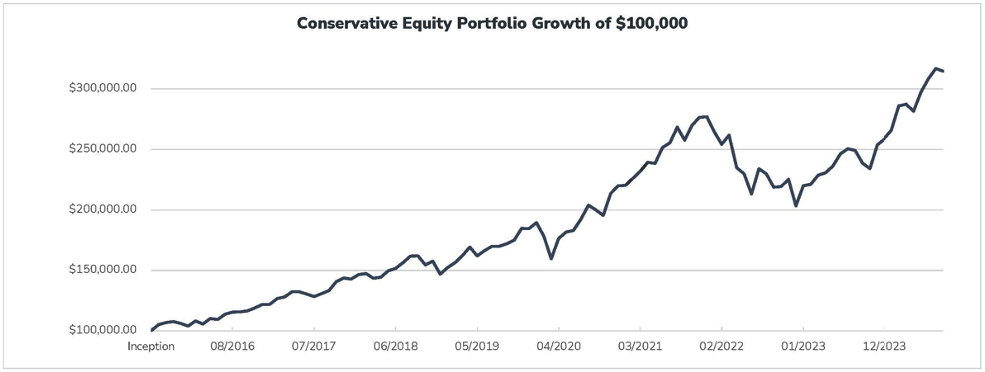

Portfolio and Market Performance

* Conservative Equity Portfolio inception October 2015; Diversified Income Portfolio inception July 2017; Focused Total Return Portfolio inception April 2020.

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

We made no changes to the portfolio in August, as markets have begun to correct.

Holdings Highlight

Royal Bank of Canada

Royal Bank, like Simon and Mike, actually comes from the Maritime provinces. It was founded in 1864 in Halifax, Nova Scotia, as the Merchants’ Bank of Halifax with the original purpose of facilitating trade between the maritime provinces and the West Indies.

Five years later, it received its federal charter and became a public company with initial capital of $300,000. It grew, opening offices all over the Maritimes, and opened its first office in Montréal in 1907. The major trade was through sugar and rum imports.

Its first international branches were opened in Bermuda in 1882 and Havana, Cuba, in 1899. In 1901, to reflect its growing scale, sitting at 64 branches at the time, the bank was rebranded to Royal Bank of Canada (RBC).

For the next 10 years, the bank tried expanding by opening branches in every major city in Canada and moved its headquarters to Montréal. The strategy was slow moving and difficult, so in 1910 they opted to expand through acquisition, merging with Union Bank of Halifax in 1910, Traders Bank of Canada in 1912 (giving them access to the Ontario market), Québec Bank in 1917 for access to Québec, and Northern Crown Bank in 1918, giving them a presence in Western Canada.

The largest growth was yet to come. In 1925, RBC took over the troubled Union Bank of Canada, adding 327 branches in a single deal. This was the largest banking transaction ever in the country and made RBC the largest bank in Canada overnight by assets. By 1929, RBC became the first bank to surpass $1 billion in assets.

Before 1954, banks in Canada were restricted from issuing mortgages directly. Through the Bank Act of 1871, banks could provide short-term lending rights for commercial and trade financing, while life insurance and trust companies provided longer-term lending such as mortgages. With the amendments to the Bank Act in 1954, chartered banks were allowed to issue mortgages, and by 1967 RBC had written more than half of all residential mortgages written by banks.

In 1976, RBC moved its head office to Toronto from Montréal in response to the increasing separatist threat from the Parti Québecois.

The next major wave of expansion through deregulation came when it purchased investment dealer Dominion Securities in 1988. Then, with an amendment to the Bank Act again in 1992, banks were allowed to own trust companies, and the bank purchased Canada’s largest Trust company Royal Trustco Ltd.

The bank further tried to push regulations, moving into the realm of life insurance in the mid-1990s, first fighting over London Life, which they lost to Great-West Life, but then purchasing smaller Voyager, Westbury, and Liberty Life.

In 1998, RBC announced its intentions to merge with the Bank of Montreal (BMO). This move, however, was blocked by the Minister of Finance, saying it would reduce competition. This began the trend of Canadian banks that were blocked from domestic acquisitions starting to look south of the border, where in 2001 RBC purchased Centura Banks Inc. for $2.3 billion. The bank further tucked in acquisitions for the next 10 years south of the border, expanding its presence in the U.S.

The next moves in Canada were in asset management. In 2008, they purchased Phillips, Hager & North with $105 billion of assets, and internationally purchased London’s BlueBay Asset Management in 2010 with $50 billion in assets, making RBC Mutual Funds the largest mutual fund company in Canada.

After a long drought in Canadian banking acquisitions and mergers, the last one with BMO being blocked, Royal Bank was allowed to purchase HSBC Canada for $13.5 billion. In terms of relative scale, this purchase increased its total assets by about 7%.

Rapid-Fire Earnings

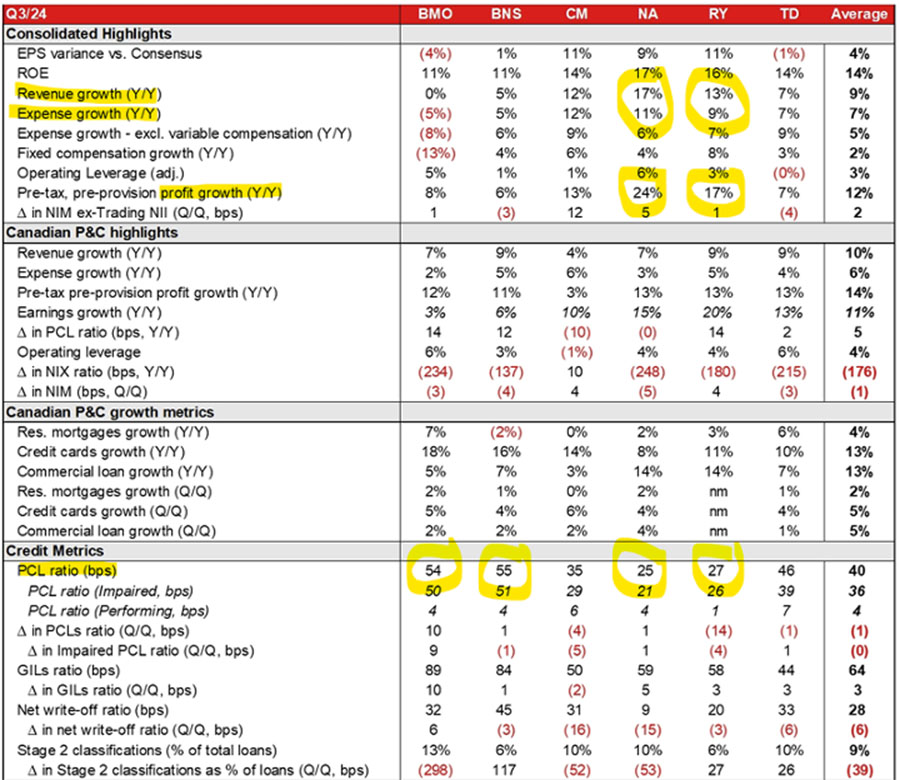

Canadian bank earnings – RBC and National Bank both surprised expectations and are reaching new all-time highs, while BNS, BMO, CM, and TD were all closer to expected results.

Source: National Bank research report

Home Depot – Home Depot reported a revenue increase, beating expectations with sales reaching $43.2 billion in the second quarter of 2024, marking a slight increase of 0.6% from the same period the previous year. This growth was partly supported by strategic acquisitions like SRS Distribution, which is expected to contribute significantly to sales. HD is on track to do over $150 billion in sales this year, but has warned about slower sales going forward—a 3-4% decline over next year. They’re seeing the effect of high interest rates on homeowners.

Eli Lilly – Revenue growth: Eli Lilly reported a significant revenue increase, with worldwide revenue rising by 36% to $11.3 billion in the second quarter. This growth was primarily driven by strong sales performances of key drugs like Mounjaro, Zepbound, and Verzenio. Guidance update: Reflecting the strong performance, Eli Lilly raised its full-year revenue guidance to be between $45.4 billion and $46.6 billion. The earnings per share (EPS) forecast was also increased, with the new range for reported EPS set at $15.10–$15.60, and for adjusted EPS at $16.10–$16.60. It’s interesting to understand what’s important and why new incumbents would have difficulty taking market share: established sales network (doctors)—$4 billion Indiana factory to increase production, unique direct-to-consumer distribution and partnering with Amazon all make Eli Lilly a tough one to beat.

NVIDIA – Has great numbers. We’re seeing growth picking back up in graphics cards, beating all expectations. $4 billion in sales in networking equipment. The market was expecting unrealistic unconstrained growth.

- Revenue growth: NVIDIA reported a significant revenue increase, with quarterly revenue reaching $30.04 billion, marking a 122% increase from the previous year. Expectations were for $28 billion. This growth was largely driven by demand in the data centre segment, which includes chips for AI applications.

- Data centre revenue: The data centre business segment saw record revenue of $26.3 billion, showcasing a 154% increase from the previous year, underscoring NVIDIA’s dominance in providing hardware for AI and data processing.

- Future guidance: NVIDIA provided a revenue forecast for the current quarter (Q3 fiscal 2025) of about $32.5 billion, plus or minus 2%, which was above the analysts’ expectations at the time.

- Stock market reaction: Despite beating expectations, NVIDIA’s stock experienced a decline in after-hours trading, dropping by around 3.5% to as much as 6% immediately after the earnings release. We believe short-term traders were waiting for the earnings release before selling the stock and rotating into something else. Buy the rumour, sell the news.

- Blackwell chips: NVIDIA mentioned that it began shipping samples of its next-generation Blackwell chips in the second quarter and expects to ship several billion dollars’ worth in the fourth quarter, indicating confidence in continued demand for its AI-focused hardware.

Is the U.S. Department of Justice going after NVIDIA for being too successful? It’s becoming a badge of honor when you get in the crosshair of the DOJ.

When it comes to investing, we are always looking a few years out. As Wayne Gretzky would say, go to where the puck is going, not where it is.

That being said, mainstream media is usually concerned with matters of today and has a horrible track record forecasting the future.

Be careful what you read in the mainstream media. We always approach the majority of mainstream financial news with caution, and then look at the facts to prove our thesis.

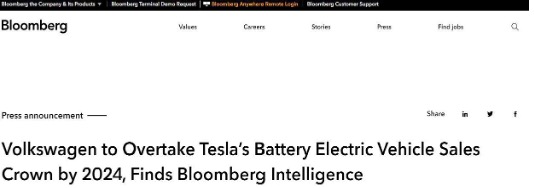

We came across this article yesterday in Bloomberg discussing how Volkswagen is planning to close factories in Germany, citing difficulties competing in the EV landscape and China.

Here is the headline.

It made me think of an article Bloomberg wrote back in 2022 on how Volkswagen was going to pass Tesla in the EV space and dominate the market by 2024. So, I looked back and found the article. The internet never forgets.

It also made me realize how mainstream media is so focused on today’s headline grabber and is never held accountable when their predictions don’t materialize.

Here’s what the media said about NVIDIA in September of last year and June of this year. Complete 180° turn.

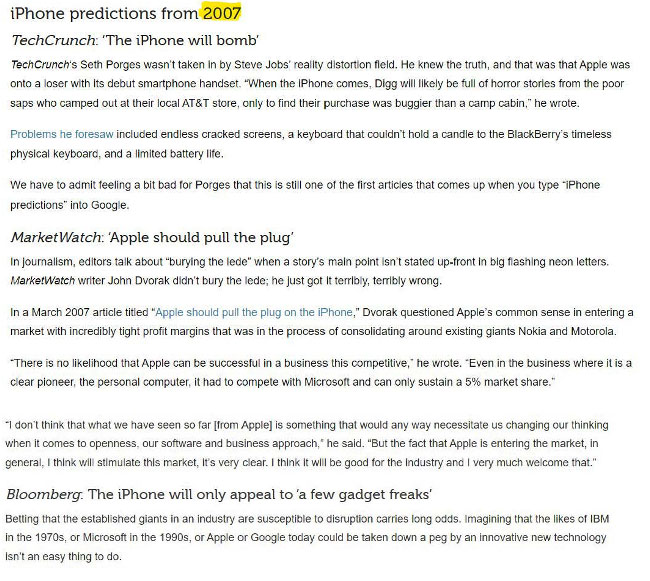

And look at what the media said about Apple when it first hit the market:

Economy and Market Outlook

The Bank of Canada cut interest rates by another 25 basis points, to 4.25%, in early September. The Canadian private sector is not doing well and rates need to come down much faster, in our opinion. The U.S. Federal Reserve Board is expected to make its first cut this month.

September historically is the worst month for markets, and we expect this September to be no different, especially during an election year. We need to be reminded that market corrections are normal and healthy, and they occur almost every year, although mainstream media pundits will point to this or that as reason for the correction. Our belief is that markets correct all the time for no particular reason. Our long-term view has not changed. We see higher markets by the end of the year and into the next. We could see the effects of high interest rates in the U.S. by the middle of next year. Longer term, we feel confident that markets and our investments will do very well into the next decade.

~~~

We leave you with this YouTube video, which gave us a chuckle: https://www.youtube.com/watch?v=qycUOENFIBs. Have a great rest of September!

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045