Overview

- Office Update

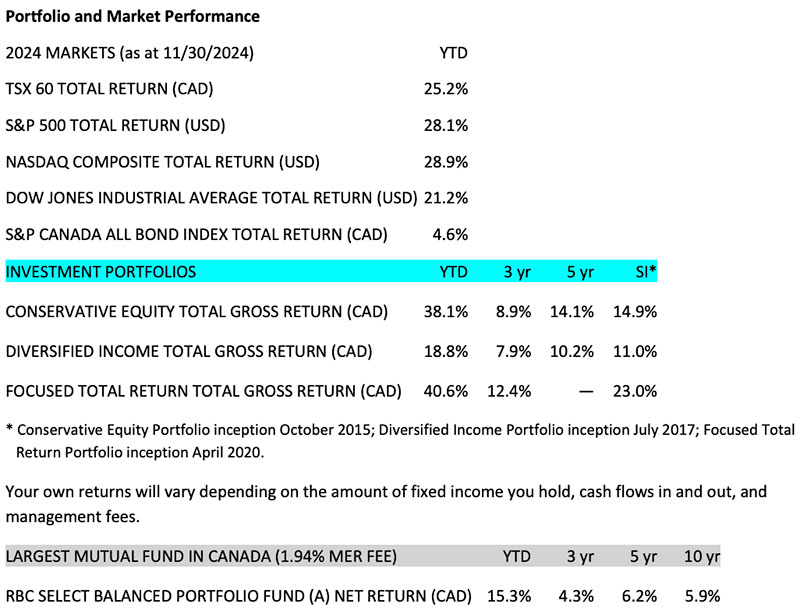

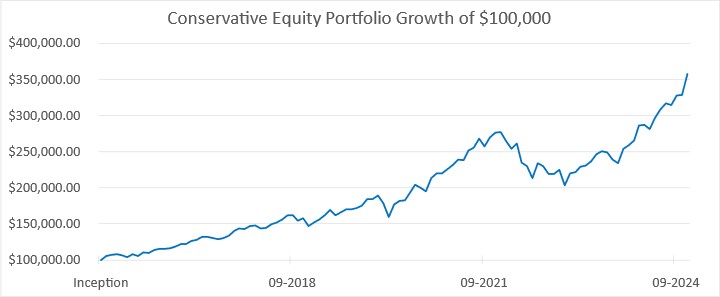

- Portfolio and Market Performance

- Portfolio Update

- Holdings Highlight: Brookfield

- Rapid-Fire Earnings

- Market Outlook

Office Update

We are rolling out our new client portal and will have everyone connected soon. We think you’ll be pleased with how intuitive it is.

Portfolio Update

We sold half of our position in Eli Lilly & Co. in November. We have no clarity on whether LLY will be affected by Robert F. Kennedy Jr.’s new policies, so we trimmed our LLY holdings and purchased Goldman Sachs (GS) with the proceeds. We are looking outward over the next four years and believe that mergers and acquisitions (M&A), and international investment banking will do well.

We’ve owned GS in the past and did well with it. It’s run by David Solomon, who has an excellent track record of success. We sold out of GS as interest rates increased to levels we felt would be negative for the M&A market. We were right; however, GS found other ways to increase shareholder value through that period of higher interest rates.

Going forward, with the tenure of Lina Khan as the head of the U.S. Federal Trade Commission coming to an end, interest rates coming down, and deregulation in the pipeline, it’s becoming increasingly clear who the beneficiaries will be in this environment.

We are also selling out of NFI, a North American bus manufacturer. We have not been impressed with their execution and therefore they don’t fit into our portfolio of best-in-class companies. We used the proceeds to add to our Intact Financial holdings.

We’ve owned Intact Financial Corporation (IFC) for roughly 10 years and it’s been a good compounder. Its 10-year annualized compound return has been 14% per year, almost double the S&P/TSX Composite return of 8% over that time. When we initiated the position back in 2014, IFC was a much smaller company with a market cap of roughly $10 billion. Today their market cap is almost $50 billion. It’s been a great story.

Holdings Highlight: Brookfield

Brookfield was founded in 1899, as the São Paulo Tramway, Light and Power Company. It was created by William Mackenzie and Frederick Stark Pearson to develop electricity and transportation infrastructure in Brazil. Incorporated in Toronto in 1912, the company changed its name to Brascan, reflecting its operations in Brazil and Canada, and then in 2005 changed its name to Brookfield Asset Management to reflect its global footprint.

Two brothers from Montreal had a significant role to play. Brothers Peter and Edward Bronfman were nephews to Seagram founder Samuel Bronfman. After being excluded from Seagram’s leadership, they used a $15 million inheritance to invest in various ventures, including acquiring Brascan in the 1960s. The brothers then diversified Brascan’s portfolio, investing in industries like mining, breweries, real estate, and financial services. Their investments and restructuring efforts helped transform Brascan into one of Canada’s largest conglomerates by the 1980s. The Bronfman brothers eventually sold their stakes in the early 1990s, with the company evolving under new leadership into what is now Brookfield Corp. The proceeds of the sale are not disclosed in public records, but we estimate it was in the billions.

Three interesting facts about Brookfield Corp.:

- Senior management owns 20% of the company, with CEO Bruce Flatt owning 5%.

- Like Berkshire Hathaway, the insurance business that Brookfield owns gives them about $110 billion worth of insurance float that they invest and make a profit on.

- Brookfield Corp. owns $119 billion worth of public securities; the intrinsic value of the privately held assets is about $126 billion with debt and preferred shares of about $27 billion. That makes the value of the assets per share $144 whereas the shares trade for $85, a 40% discount.

Brookfield Corp. has been one of the best performing stocks in Canada over the last 30 years. Annual returns are 17% over the last 10 years, 19% annually over the last 20 years, and 18% over the last 30 years. Management has that magic touch we look for. They know how to make money and add value to shareholders over time. For this reason, it’s always been a core holding in our portfolios.

We would rather own Brookfield Corp. over any private equity firm and consider our ownership in Brookfield a great replacement for alternative investments, private equity, or private debt

Rapid-Fire Earnings

iA Financial Corporation (IA): Finally getting the valuation that it deserves, IA is another great Canadian story. IA posted quarterly earnings that were 11% higher than people were expecting, and 17% growth over the same quarter last year. They also announced an additional $700 million in capital being unlocked by lighter capital requirements in Quebec, raised their dividend by 10%, and renewed their stock buyback at 5% of outstanding value this year. This gives a combined 7.7% capital return to shareholders in yield and buybacks.

We were buyers of IA in 2022 at 9 x price-to-earnings (PE), and now, with it trading at 11 x forward and a future projected growth rate of 12%, it’s still undervalued, in our opinion.

Tesla: Up 40% over the last several weeks. Why? Wall Street is waking up to the fact that Tesla is an artificial intelligence (AI) and robotics play.

Interestingly, Craig Irwin with Roth Capital has been a vocal bear on the stock for the last number of years. His tagline has been “Tesla is egregiously overvalued” and “Tesla doesn’t have anything that Toyota doesn’t have.”

He had a price target of $85 on the stock. This week he changed his tune, raising his price target to $380, and now says Tesla is an AI, robotics, and autonomous driving play. I suspect he will not be the last Wall Street analyst to raise their price target.

Tesla’s stock price surged 40% since the last call, in a post-election rally. Also benefiting the stock is the improving U.S. legal framework for self-driving. Tesla is no longer dealing with a hostile regulatory environment.

Economy and Market Outlook

At the risk of sounding like a broken record, we are in the early innings of a bull market led by AI and technology. November and December historically are two of the best months of the year for stocks. We are targeting 6,200 on the S&P 500 by year-end, 7,000 by the end of 2025, and 15,000 by 2029. Keep in mind that we will have market pullbacks every year, but these pullbacks are necessary to keep the markets healthy and shake out speculators.

~~~

From our family to yours, we wish you a very Merry Christmas and Happy Hanukkah.

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045