Overview

- Office Update

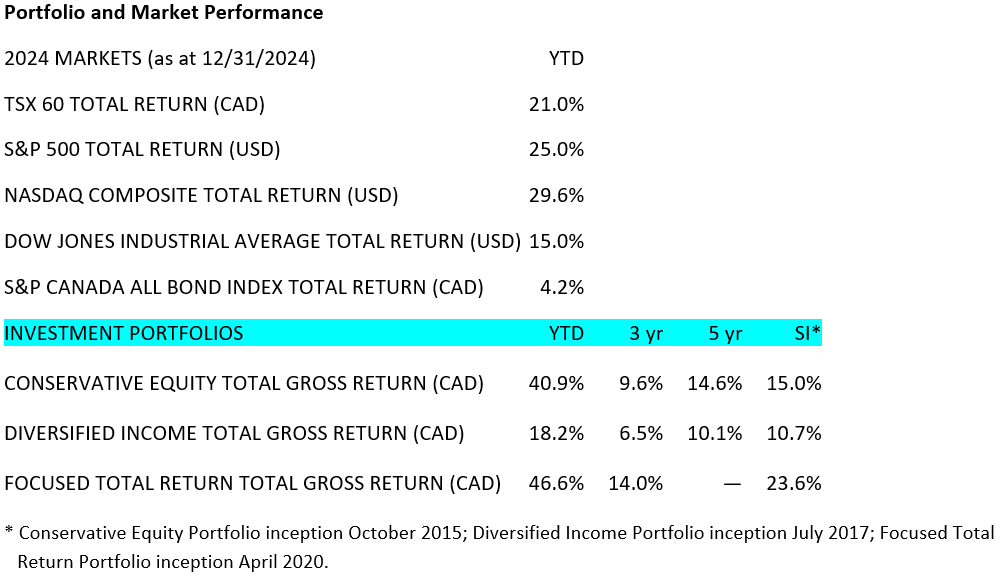

- Portfolio and Market Performance

- What We Got Right in 2024, and What We Didn’t

- Portfolio Update

- Recap of 2024 Predictions

- 2025 Predictions

- Market Outlook

Office Update

The new client portal is available! If you need any help with it, please reach out.

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

What We Got Right in 2024, and What We Didn’t

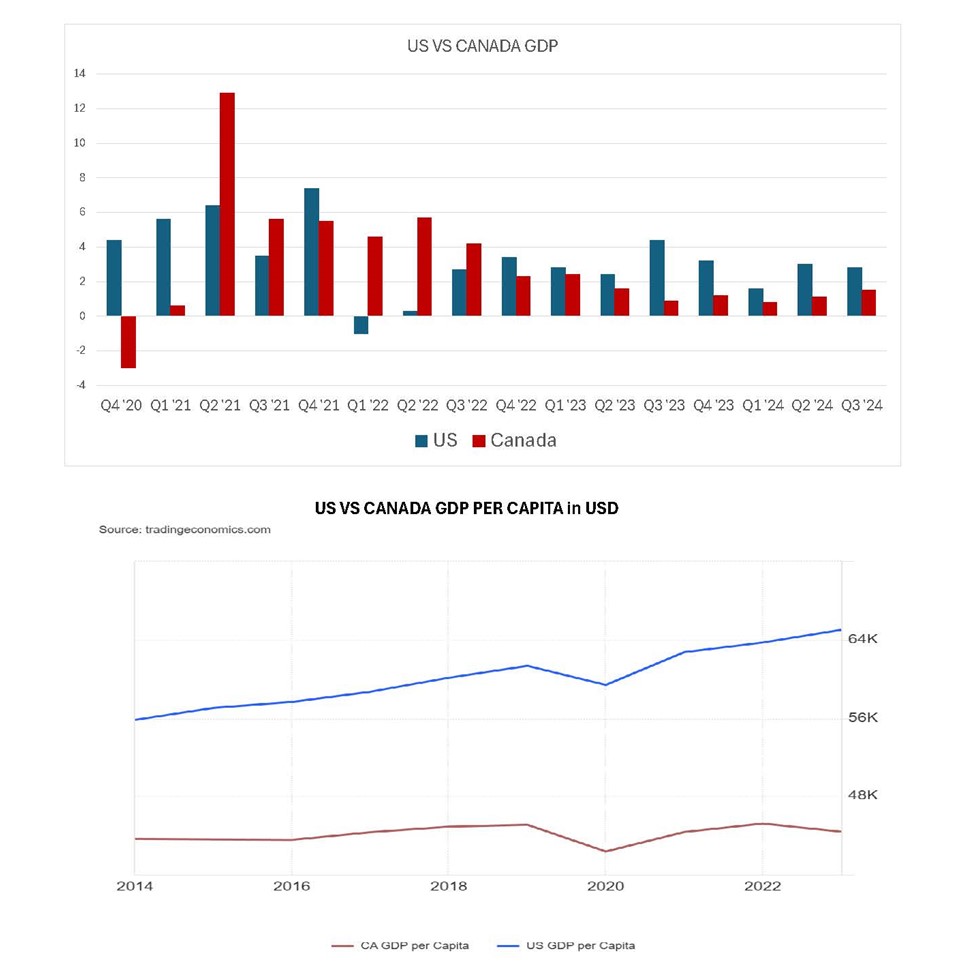

This past year was our largest single year outperformance on record. This came as a surprise to us as many of the previous market outperformances came in down years as we tend to try to protect capital on the downside.

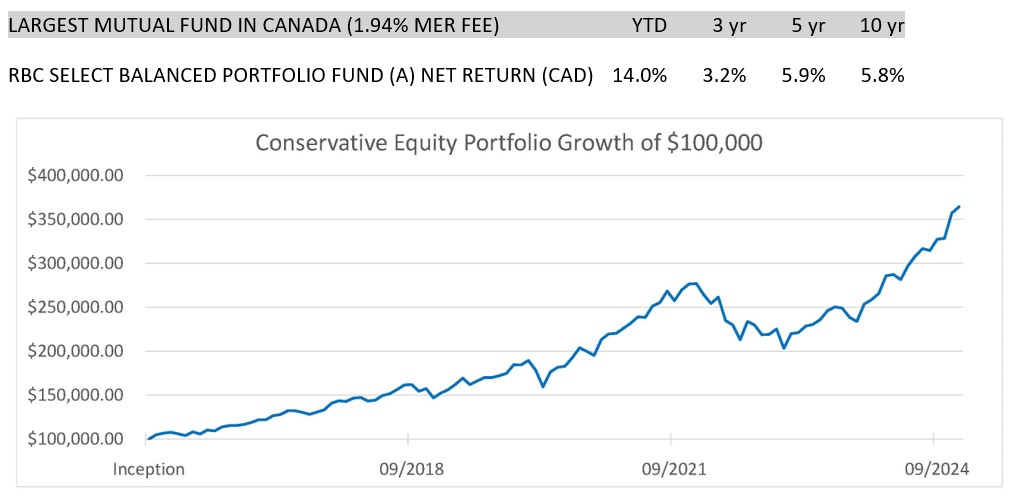

Below is a list of our top 5 winners and losers for 2024, ranked by how much they contributed or detracted towards that 40.9% 2024 return in our main equity strategy.

In reviewing which companies contributed the most to our performance and the least, one thing stands out to us; the names with the highest annual returns were significantly larger weighted positions in our portfolio throughout the year while we did a good job in limiting the size of our losing positions. Our convictions were certainly well placed for 2024.

One other item of note, in reviewing our biggest losing positions for the year, many were used to hedge our higher conviction names in case we were wrong about some factors. For example ASML and AMD were both hedges to some risks to Nvidia’s business. Nutrien was a hedge against inflation being worse than we thought, and Northland Power and Canadian National are both hard infrastructure assets that can hold value in a poor economy. Overall, we were ok with our decision looking back to hold both our top 5 winning and losing names.

Best & Worst Trades of 2024

Our best trade of the year was trimming our Nvidia position near its peak in June, then adding to our Tesla position with the proceeds before it went up 250% from that point. These trades contributed an extra 3% towards the year’s performance.

Our worst trade was buying BCE on what we thought was a smart turn-around debt story 2 weeks before they announced they were going to go on a spending spree and buy a U.S. fiber company. Thankfully, we were cautious, so while it lost 13% in 2 weeks it was a small trade and we moved quickly. It only contributed about a 0.1% loss on the year.

Tax update

There’s been a change to the capital gains inclusion rules. The increased capital gains inclusion has not been passed into law and will remain up in the air until after the March 24 prorogation of Parliament. It is possible, if the new government does not re-introduce this bill, that it may not be implemented.

For now, the CRA will be administering the new rule as if it is law. If the new government does not pass the legislation, you will be reimbursed the tax difference.

We won’t know how this will play out until later this year.

Recap of 2024 Predictions

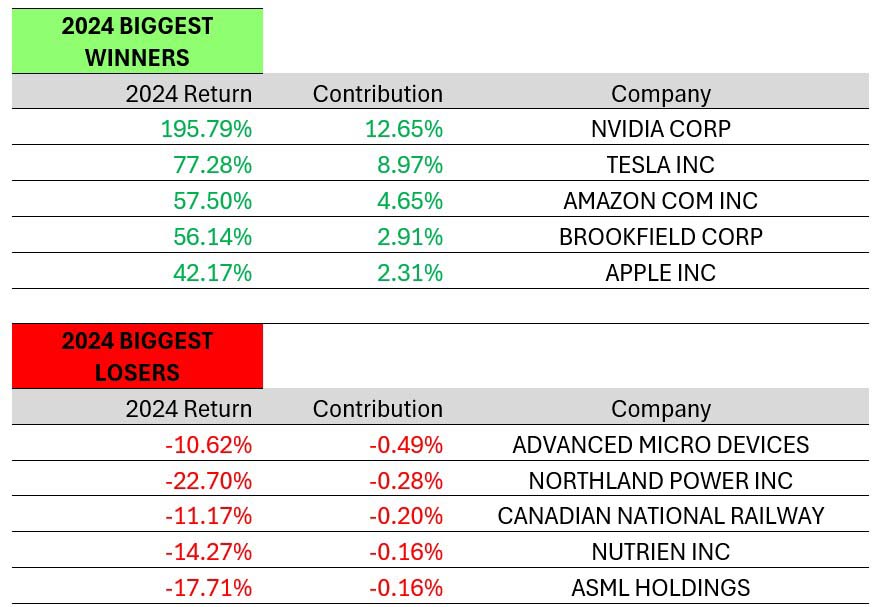

- The Canadian economy will slow in 2024, keeping growth subdued. The U.S. will be healthier, with a soft landing being confirmed.

Unfortunately, we were correct. The Canadian economy has been flat. In fact, the only reason our GDP has been positive is because of the extreme immigration. If you look at GDP per capita we have actually turned negative.

- Markets will be positive in 2024, but we expect volatility as a steady stream of global events and risks stoke 5%-10% corrections as the economy bottoms and prepares to return to growth.

Markets were indeed positive in 2024, perhaps even more positive than we had expected. The max correction in the S&P 500 was July to August at 8.5%.

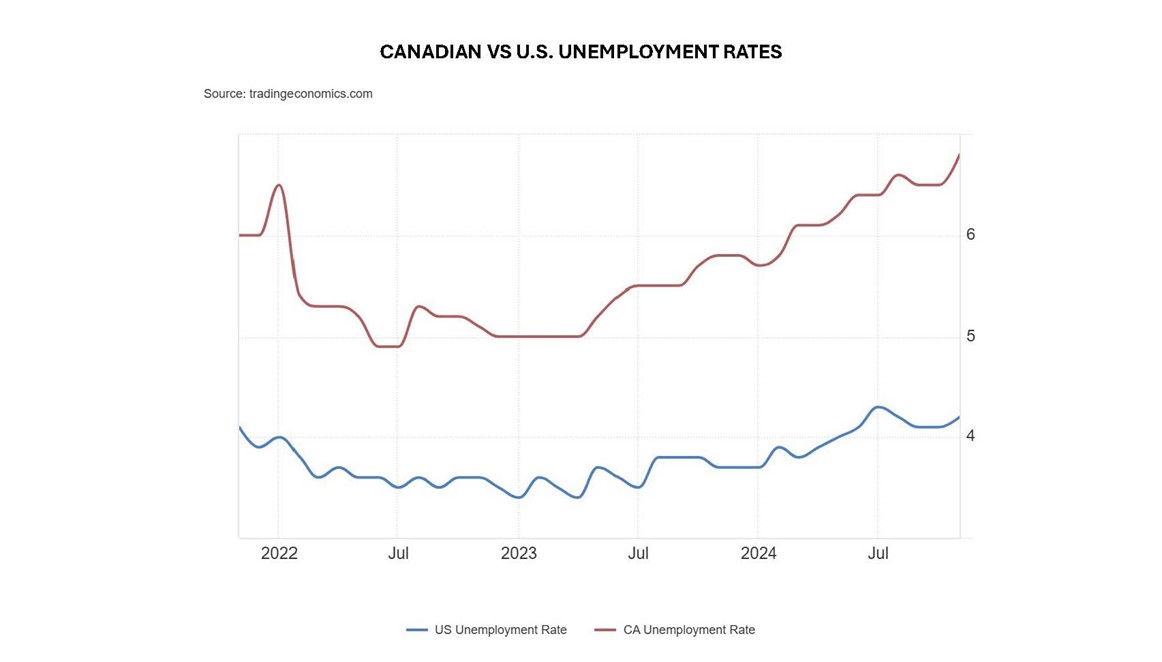

- Labour remains strong, but we expect unemployment in Canada to trend up while U.S. labour remains stronger.

Canadian unemployment reached 6.8% in November and has increased at a faster pace than the U.S. through 2024. We should add that about 25% of our workforce is directly employed by federal, provincial, or municipal governments, versus only about 12% in the U.S. workforce. If you factored in how many government jobs were created over the past few years to keep this number lower, the effects to our economy are even worse than they appear. Ten years ago, we had 20% of the workforce employed in the public sector, so it has trended up dramatically.

- The tech rally will extend into select companies as a combination of cost savings with productivity increases propel the most innovative companies.

Many of the factors that drove markets in 2023 extended further into 2024 and we saw many of the same trends. The NASDAQ returning twice as much as the Dow is a prime example of the continued dominance of innovators.

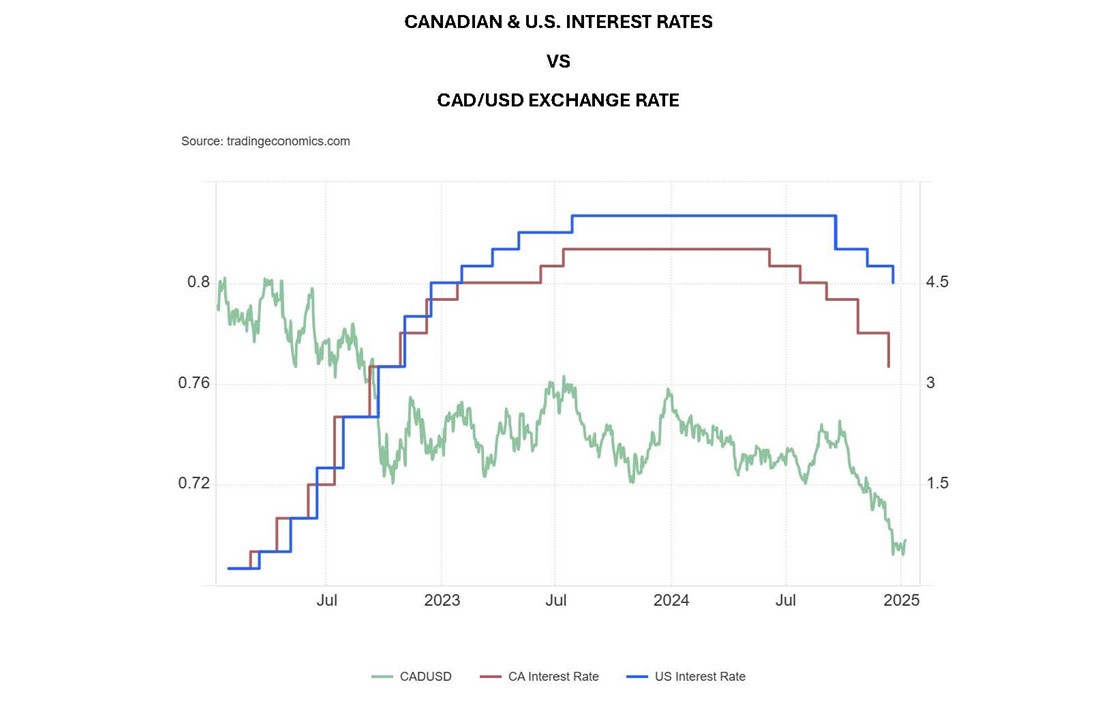

- Canada will drop interest rates faster and harder than the U.S. The Canadian dollar will trade from $1.32 to $1.38.

This was surprisingly close to reality while we underestimated the total drop in the dollar, which went to $1.44 instead of $1.38. The tariff threat certainly did not help.

- Inflation will decrease, and interest rates will decline between 1% to 2% in 2024.

Inflation now sits at 1.9% in Canada and 2.7% in the U.S., with a rate decrease of 1.75% for the year in Canada.

2025 Predictions

- The greatest re-organization of government and shift in the public sector in 50 years will begin in the U.S. and follow through to Canada and the U.K. before the end of the year.

- There will be a record level of strikes and service disruptions as public employees and unions try to push back against reduced spending and increased automation.

- Discussions will move from inflation to deflation as people question the spending decreases, tighter consumer spending, and efficiency gains in the economy.

- The U.S. will not impose a 25% tariff on all goods coming in from Canada.

- Relations between China and the U.S. will normalize for the positive and reach a more balanced state while globalization continues to reverse.

- The Canadian economy will continue to worsen at a slow pace. Policy will be grid-locked with the Liberals holding power as long as possible, we will likely not see a change from a Liberal federal government until July to November.

- The Canadian economy will officially enter recession.

- Rates in Canada will fall another 1-1.5%; prediction: overnight rate below 2% by this time next year.

- The Canadian dollar will remain weak throughout the first half of the year but will begin to strengthen as a future reversal in tax and trade policies becomes more evident.

- The biggest surprises of 2025 will be autonomous driving and robotics—both AI driven.

- Demand for energy will increase dramatically.

Economy and Market Outlook

We are quite optimistic about the future. Our 2025 price target on the S&P 500 is 7,200, and 15,000 by 2029. We still believe we are in the early stages of an AI-driven cyclical bull market that should last into the next decade.

The AI party is just getting started. It’s 10 p.m. and the party will go to 4 a.m.

~~~

Happy New Year, folks!

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045