Overview

- Office Update

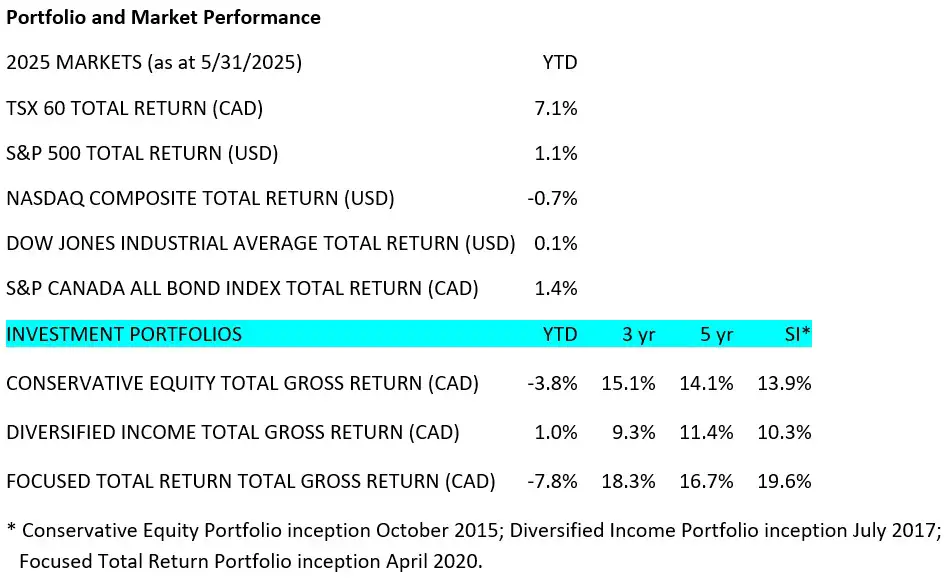

- Portfolio and Market Performance

- Portfolio Update

- Company Update

- Rapid-Fire Earnings

- S. Debt Downgrade and Bond Yields

- S. Budget Bill (“Big, Beautiful Bill”)

- Market Outlook

Office Update

We hope everyone’s enjoying these early days of summer. Tax season’s wrapping up and vacations are starting, but we’re always here should you need our assistance.

Your own returns will vary depending on the amount of fixed income you hold, cash flows in and out, and management fees.

Portfolio Update

In May, we trimmed 2% from Tesla (TSLA) and added to Goldman Sachs (GS) and Advanced Semiconductor Materials Lithography (ASML).

TSLA has performed well over the last few years and we believe it will continue to do so; however, our position had become too large, so we trimmed some profits and used the proceeds to add to GS and ASML. Goldman should do well as the Trump administration aims to deregulate the financial sector and stimulate growth.

ASML was at a less than 1% weighting in our portfolio, and the stock is down since we took our initial position last year. It’s now trading at the low end of its valuation range, with the business returning to growth this year.

We also trimmed 2% from Alphabet and initiated a 2% weighting in Louis Vuitton Moët Hennessy (LVMH).

We are becoming more and more concerned with respect to Google’s ad revenue business. For a long time, Google had a virtual monopoly on searching, but now, with the rapid advancements of artificial intelligence (AI), their future revenue is less certain. We are still in the early stages of large language model (LLM) development, and unlike , there are many players with deep pockets competing in the space, including Google Gemini, Meta AI Llama, Apple Intelligence, OpenAI ChatGPT, xAI Grok and Claude (Anthropic).

We rarely use Google Search anymore. We don’t need to search for links to find the right information. The reasoning within these AI models is becoming exceptional. We are not sure who is going to win this AI race, but the future of Google and its advertising is at risk, similar to how Yellow Pages got disrupted by Google Search 20 years ago.

We’ve been interested in LVMH for many years, but the stock was always too expensive for our liking. Over the last two years, though, the stock is down almost 50% from its all-time high.

Company Update

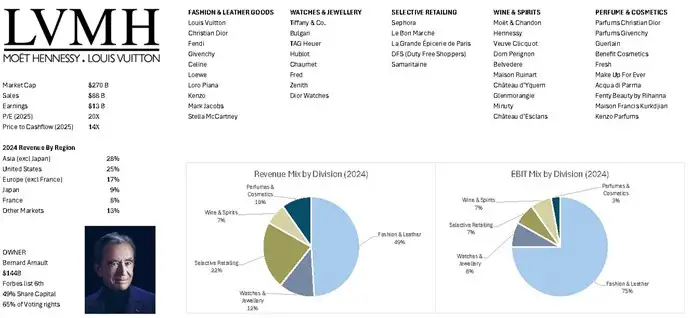

LVMH: The Pinnacle of Luxury for Your Portfolio

Overview

LVMH is the world’s leading luxury goods conglomerate, managing a portfolio of over 70 prestigious brands across fashion, wines, perfumes, jewellery, and retail. LVMH represents a stable, high-value investment in the growing luxury market.

Today, LVMH has 215,000 employees across 81 countries and 6,300 stores.

Its current largest competitor would be Hermès, with a market cap of USD in 2024 sales and trading at 53x earnings and 51x cash flow.

History & Foundation

Formed in 1987 through the merger of Louis Vuitton (est. 1854, iconic leather goods), Moët & Chandon (est. 1743, premier champagne), and Hennessy (est. 1765, leading cognac), LVMH was transformed under CEO Bernard Arnault into a luxury titan. Arnault’s strategic acquisitions expanded the company’s reach, cementing LVMH as the gold standard in prestige branding.

Key Brands & Segments

LVMH operates in six core areas, each housing globally recognized brands:

- Fashion and Leather Goods (49% of revenue): Louis Vuitton drives massive sales with its monogrammed bags, while Christian Dior and Fendi offer haute couture and accessories that define luxury fashion.

- Wines and Spirits (7% of revenue): Moët & Chandon and Dom Pérignon lead in champagne; Hennessy dominates premium cognac.

- Perfumes and Cosmetics (10% of revenue): Parfums such as Christian Dior, Givenchy and Guerlain create iconic fragrances and beauty products.

- Watches and Jewellery (12% of revenue): Tiffany & Co. (acquired in 2021 for $15.8 billion) and Bulgari deliver timeless luxury in diamonds and timepieces.

- Selective Retailing (22% of revenue): Sephora is a global leader in beauty retail, alongside DFS duty-free stores.

- Other Activities: Includes Celine, Loro Piana and hospitality ventures like Cheval Blanc hotels.

Why We Believe LVMH Is a Good Long-Term Investment

- Brand power: LVMH’s brands are synonymous with exclusivity, commanding premium pricing and customer loyalty, even in economic downturns.

- Global reach: With 6300, LVMH capitalizes on the growing wealth of the middle class in emerging markets, particularly China and India.

- Leadership: Bernard Arnault, one of the world’s richest individuals, ensures disciplined growth and innovation, maintaining LVMH’s edge in a competitive market. We look for CEOs that have a track record of success and delivering shareholder value.

Investment Appeal

LVMH’s stock (LVMUY) has delivered consistent returns, with a 5-year compound annual growth rate (CAGR) of ~15% through 2024, outperforming many consumer goods peers. Its focus on heritage brands, digital innovation (e.g., e-commerce via 24S), and strategic acquisitions (like Tiffany) positions it for long-term growth. For clients, LVMH offers exposure to the luxury sector’s stability and the rising spending power of affluent consumers.

Rapid-Fire Earnings

Royal Bank of Canada (RBC) – We prefer U.S. banks over Canadian right now, but if we have to own one in Canada, it would be RBC (RY), the largest and safest. RBC has a higher amount set aside for credit losses going forward. Although shares traded down for RBC, they had previously been less penalized for potential credit losses than other Canadian banks.

NVIDIA – The company beat expectations for the 10th consecutive quarter. This was even while taking a $4.5 billion write down on H20 chips, which were restricted from being shipped to China during the quarter. We don’t see AI spending slowing down anytime soon. At 24x forward earnings and an expected 20% growth rate, the stock is cheap in our opinion.

Costco – At 52x forward earnings, the stock is not cheap. With its expected EPS growth rate of 10%, its fair value is probably closer to 35-40x forward earnings, but since the position is only 2.4% of the portfolio, there’s not much to trim. Years ago, we sold our entire position in Costco on valuation concerns—that was a mistake. Most of its profits come from membership fees. They’ve talked about using their Kirkland branded items to reroute sales of items from other countries to reduce the effect of tariffs, which could contribute to their bottom line over the next 12 months.

U.S. Debt Downgrade and Bond Yields

On May 16, Moody’s downgraded the U.S. credit rating from AAA to Aa1, citing the national debt, persistent deficits and rising interest costs. Standard & Poor’s had already downgraded U.S. debt in 2011 and Fitch Ratings in 2023.

Scott Bessent, the U.S. Treasury Secretary, made the comment that Moody’s was a lagging indicator, similar to a comment from the Treasury Secretary Larry Summers in 2011 on the previous downgrade. The market agreed and shrugged it off.

While there is a purpose of credit rating agencies to keep borrowers in check with their behaviour, major investors understand they lag behind reality and do their own work on credit risks.

U.S. Budget Bill (“Big, Beautiful Bill)

Inside the bill is an increase to the withholding rate on dividends of U.S. stocks paid to international owners from a list they will create of “discriminatory countries.”

We had previously mentioned that the digital services taxes would be a target, and it looks like they are now trying to apply pressure against digital service taxes with taxes of their own, clawing back taxes on dividends through withholding taxes.

The countries that have enacted so-called “digital services taxes” against the U.S.’s largest companies include Canada and almost all European countries as well as South American countries.

Currently, outside of registered accounts, we have a treaty rate of 15% withholding tax on U.S. dividends, for which we are given a Canadian tax credit. If Canada were to be put on the list of “discriminatory countries” we could see the withholding rate increase to 35% in 2026, increasing by 5% per year up to 50% in 2029.

As a reminder, we receive a tax credit from the Canada Revenue Agency (CRA) on amounts withheld, so the effect may be negligible to individuals.

In short, nothing has occurred yet and the bill is still being worked on, and Canada will likely need to negotiate their way off the “discriminatory countries” list.

In terms of portfolio effects, in our case our portfolio has a very low effective U.S. dividend yield of 0.30% per year as we are extremely tax efficient. Most of our major U.S. positions have little to no dividend, so the effect would be minimal.

If this threat is carried through, the effects toward year-end would be a selloff in U.S. dividend-paying companies and a likely purchase of non-dividend-paying U.S. companies. We still view this as a threat in trade negotiations against digital services taxes being removed.

The policy would be a net positive to many of our largest holdings, either through a decrease in foreign taxes paid (some companies paying less digital services taxes), or through a movement of foreign capital to non-dividend-paying U.S. companies.

Market Outlook

We still have a year-end S&P 500 price target of 7,000 by end of 2025 and 14,000 by 2028. Today, the S&P 500 is trading around 5,900. That being said, tariffs and supply chain issues are still a real concern. We believe, though, that once the new tariffs are negotiated and set into policy, businesses will make the necessary adjustments and move forward.

~~~

Happy Father’s Day!

Simon & Michael

Simon Hale, CIM®, CSWP, FCSI®

Senior Wealth Advisor,

Portfolio Manager,

Wellington-Altus Private Wealth

Michael Hale, CIM®

Portfolio Manager

Senior Wealth Advisor,

Wellington-Altus Private Wealth

Hale Investment Group

1250 René-Lévesque Blvd. West, Suite 4200

Montreal, QC H3B 4W8

Tel: 514 819-0045